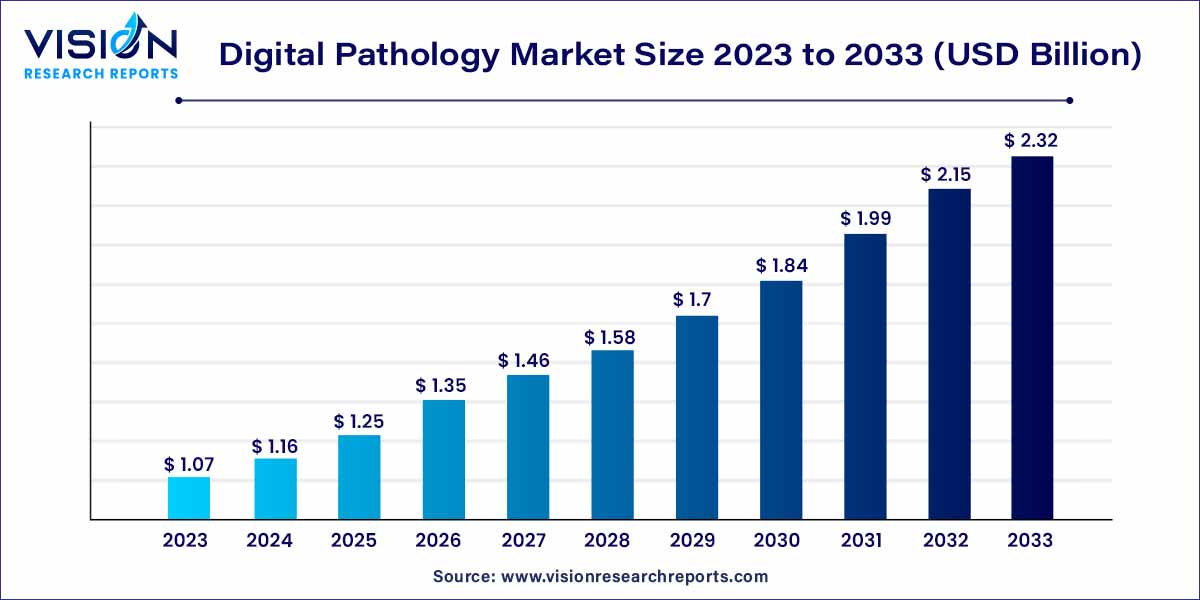

The global digital pathology market size was estimated at around USD 1.07 billion in 2023 and it is projected to hit around USD 2.32 billion by 2033, growing at a CAGR of 8.06% from 2024 to 2033.

The digital pathology market has emerged as a transformative force within the healthcare industry, revolutionizing the way pathology services are conducted. This comprehensive overview delves into the key facets of the digital pathology market, exploring its growth drivers, technological advancements, market trends, and potential challenges.

The digital pathology market is experiencing robust growth, propelled by several key factors. One significant driver is the escalating adoption of digital platforms, which are reshaping conventional pathology practices across healthcare institutions. The integration of technological advancements, such as whole-slide imaging, artificial intelligence (AI), and cloud-based solutions, is further fueling this expansion. These innovations empower pathologists with tools that enhance efficiency, streamline workflows, and contribute to improved diagnostic accuracy. The growing demand for telepathology, facilitated by digital pathology, is breaking down geographical barriers, allowing for remote pathology consultations and fostering accessibility to expert opinions. As the industry witnesses an increased integration of AI for pattern recognition and precise diagnostics, collaborations and partnerships between digital pathology solution providers and healthcare institutions are becoming more prevalent, driving the development of innovative and customized pathology solutions.

In 2023, the device segment secured the largest market share at 52%, with expectations of continued robust growth throughout the projected period. This segment comprises slide management systems and scanners, and its expansion is driven by the growing adoption of digital pathology in academic research activities, benefitting from enhanced resolution capabilities.

Anticipated to showcase the fastest growth rate from 2024 to 2033, the software segment is propelled by an increasing number of cancer cases. Key industry players are actively engaged in developing novel digital pathology systems, driving the demand for software solutions. For example, Xybion Corp. introduced Pristima XD Digital Pathology in August 2021, enhancing lab throughput and streamlining workflows. Additionally, F. Hoffmann-La Roche Ltd. contributed to this trend by launching uPath enterprise software in January 2019, aimed at improving performance, speed, and overall usability in the field of digital pathology.

In 2023, the device segment dominated the market with a substantial share of 52% and is poised for lucrative growth throughout the projected period. This segment, encompassing slide management systems and scanners, is experiencing a surge in demand attributed to the expanding adoption of digital pathology in academic research activities, particularly benefiting from enhanced resolution capabilities. An illustrative example is the CE marking received by F. Hoffmann-La Roche Ltd. in June 2022 for its VENTANA DP 600 slide scanner. This next-generation, high-capacity scanner generates precise, high-resolution digital images of stained tissue samples, proving instrumental in cancer diagnosis and treatment planning.

Concurrently, the software segment is projected to exhibit the fastest growth rate from 2024 to 2033. This upswing is linked to the escalating number of cancer cases, prompting key industry players to concentrate on developing innovative digital pathology systems. For instance, in August 2021, Xybion Corp. introduced Pristima XD Digital Pathology, a solution designed to enhance lab throughput and streamline workflows. Furthermore, F. Hoffmann-La Roche Ltd. contributed to this trend with the launch of uPath enterprise software in January 2019. This software is geared towards enhancing performance, speed, and usability in the realm of digital pathology.

In 2023, the academic research segment took center stage, commanding a substantial market share of 46%. This dominance is expected to persist from 2024 to 2033, driven by ongoing research endeavors in cancer therapy development and a widespread adoption of digital pathology in diverse research studies. Numerous academic research institutes are actively collaborating with digital pathology providers to integrate this technology into their research activities. A noteworthy example is the November 2022 partnership between the University Medical Center Utrecht and Paige.

The disease diagnosis segment is poised to exhibit the fastest growth rate from 2024 to 2033. This acceleration is attributed to the escalating prevalence of chronic diseases and manufacturers' increasing focus on developing rapid and novel diagnostic techniques to facilitate seamless circulation of information within and between departments. The digital adoption of technologies plays a crucial role in enhancing the efficiency of disease diagnosis, consequently improving therapeutic outcomes.

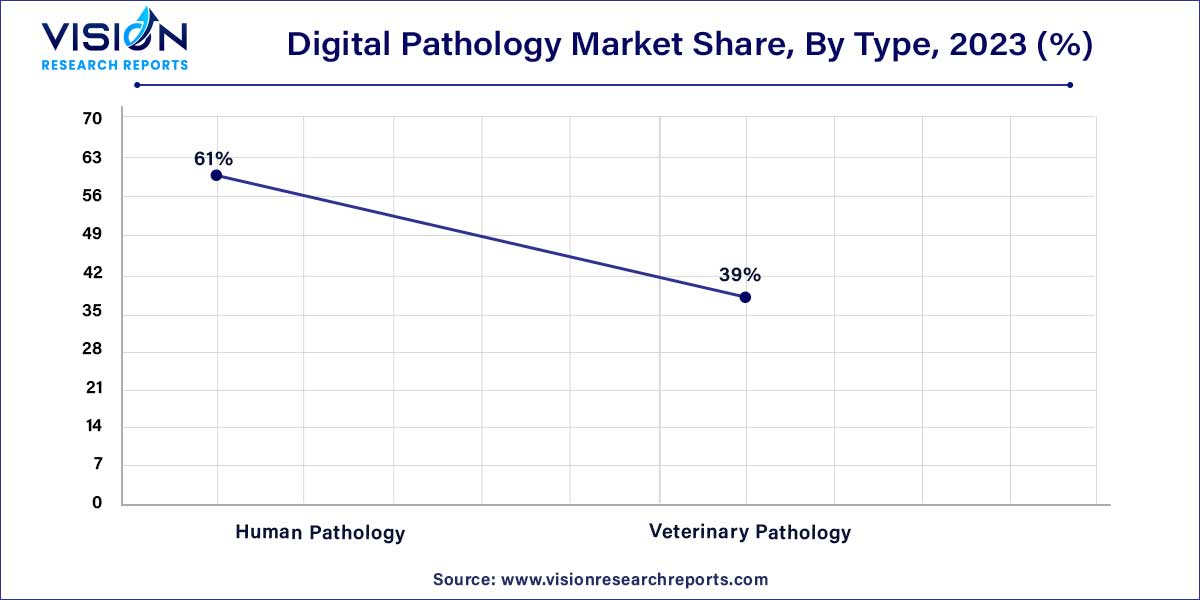

The human pathology segment claimed the majority share, accounting for approximately 61% in 2023. The growth of this segment is propelled by the increasing adoption of digital pathology, aimed at reducing the turnaround time for disease diagnosis and enhancing laboratory productivity. Additionally, the surge in the prevalence of chronic diseases in humans has elevated the demand for digital pathology solutions within this segment.

Forecasts indicate substantial growth for veterinary digital pathology in the coming years. The implementation of digital pathology in the veterinary sector is facilitated by fewer restrictions on virtual scanned slides for veterinary diagnoses. Moreover, a proactive push for automation within the veterinary field is contributing to the increased demand for digital pathology solutions, showcasing its potential impact and growth opportunities in the veterinary diagnostics domain.

In 2023, North America asserted its dominance over the overall market, commanding a substantial share of 41%. This leadership is attributed to several factors, including increasing government initiatives fostering the development of technologically advanced pathologies, continuous investments in research and development (R&D), a growing adoption of digital imaging, and the presence of key market players focusing on delivering advanced solutions. Notably, in March 2023, PathAI launched AISight, a digital pathology platform across 13 leading health systems, reference laboratories, medical centers, and independent pathology organizations in the U.S. This initiative was part of an Early Access Program aimed at providing enhanced solutions to the population. The burgeoning usage of digital pathology in academic research and disease diagnosis further propels the market growth in the region.

On the other hand, the Asia Pacific region is poised to exhibit the fastest CAGR from 2024 to 2033. This growth is driven by factors such as rapid digitalization, increased investments in the medical field, and the expanding penetration of digital imaging in developing economies. The region is witnessing a rising prevalence of cancer, necessitating novel treatment options, which in turn contributes to the accelerated growth of the digital pathology market. Noteworthy collaborations, such as the one in March 2023 between Qritive and Corista for the integration of artificial intelligence (AI) using DP3, a DICOM-compliant pathology software in digital pathology, demonstrate initiatives aimed at providing improved patient care, novel treatment options, and concurrently reducing laboratory cost expenses.

By Product

By Type

By Application

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others