The global disaster preparedness system market size was valued at USD 173.99 billion in 2023 and it is predicted to surpass around USD 395.21 billion by 2033 with a CAGR of 8.55% from 2024 to 2033.

The disaster preparedness system market encompasses a wide array of solutions and technologies designed to mitigate the impact of natural and man-made disasters. From early warning systems and emergency communication platforms to disaster recovery and response mechanisms, these systems play a crucial role in enhancing resilience and safeguarding lives and infrastructure.

The growth of the disaster preparedness system market is propelled by an increasing frequency and severity of natural disasters worldwide drive the demand for advanced preparedness solutions. Additionally, stringent regulatory mandates and standards imposed by governments and international organizations compel organizations to invest in robust disaster preparedness measures. Technological advancements, such as the integration of IoT devices and predictive analytics, enhance the capabilities of preparedness systems, enabling real-time monitoring and early detection of potential hazards. Furthermore, the emphasis on building resilient infrastructure and fostering public-private partnerships presents significant growth opportunities for market players. As organizations prioritize resilience and invest in innovative solutions, the disaster preparedness system market is expected to witness sustained growth in the coming years.

| Report Coverage | Details |

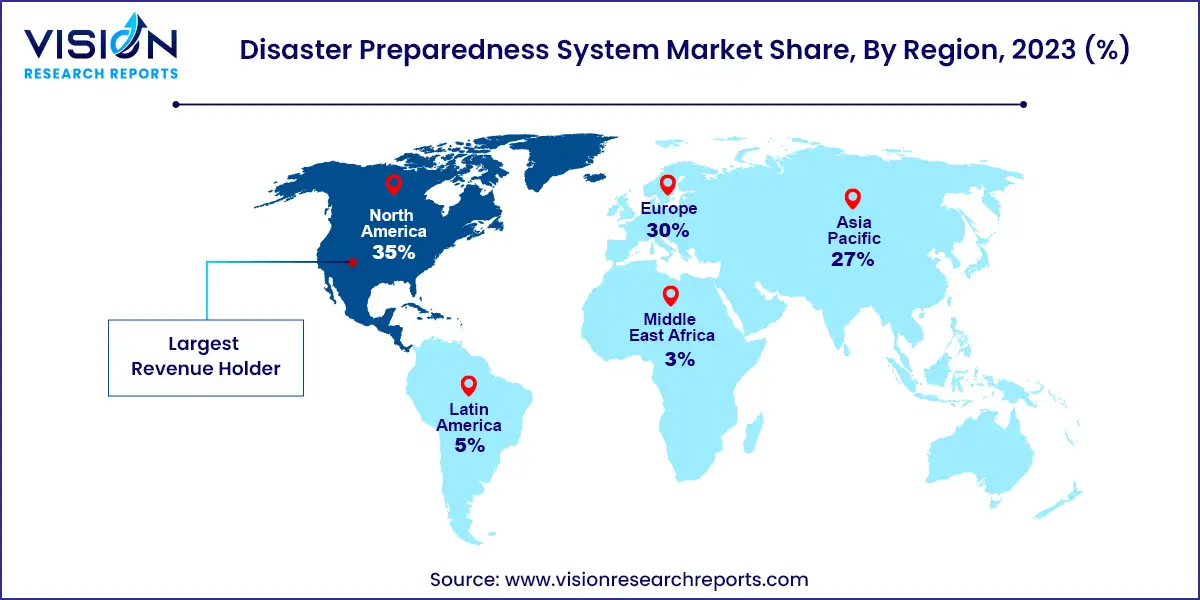

| Revenue Share of North America in 2023 | 35% |

| CAGR of Asia Pacific from 2024 to 2033 | 9.96% |

| Revenue Forecast by 2033 | USD 395.21 billion |

| Growth Rate from 2024 to 2033 | CAGR of 8.55% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The surveillance system segment dominated the market with a revenue share of more than 37% in 2023. Various factors, including the escalating occurrence of natural disasters, unpredictable climatic conditions, the prevalence of domestic violence, and government emphasis on safety policies, have prompted emergency management agencies to adopt and enhance surveillance systems in urban areas.

Deploying surveillance systems enables organizations to effectively identify potential risks and formulate appropriate action plans. In addition, IP-based video surveillance systems empower municipalities and organizations to remotely detect incidents such as flooding, fires, theft, or even acts of terrorism. These favorable circumstances collectively contribute to the growth of this segment.

For instance, in February 2023, Researchers at Dokuz Eylül University (DEÜ) developed earthquake early warning systems that would issue alerts before the earthquake hits. The Earthquake Early Warning Systems (DEUSÄ°S) is currently undergoing testing, having been developed through extensive research conducted at Dokuz Eylül University’s Earthquake Research and Application Center (DAUM).

According to DAUM Director Hasan Sözbilir, the system is designed to provide early notifications before the actual perception of an earthquake, detecting the movement of fault lines. Depending on the proximity to the seismic source, the warning can be issued 10, 15, or 20 seconds in advance of the tremor's impact on the surface.

The disaster recovery solutions segment dominated the disaster preparedness system market in 2023 with a revenue share of more than 42%. Organizations, regardless of their size, adopt disaster recovery solutions to swiftly recover their crucial data, hardware, and applications, essential for uninterrupted business operations.

Through the implementation of disaster recovery solutions, organizations and municipal authorities can effectively strategize and prepare for disruptive events such as floods, fires, power outages, and human-caused disasters. Cloud-based data recovery offerings have gained popularity among numerous organizations worldwide as they significantly reduce the substantial capital investment needed for infrastructure and the expenses associated with environmental management. These factors are anticipated to propel the growth of this segment.

The situational awareness solutions segment is anticipated to register the fastest CAGR of 8.74% over the forecast period. The increasing demand for surveillance and security systems to promptly identify issues, government prioritization of public safety during disasters, and the advancement of smart infrastructure are motivating organizations and emergency management agencies to embrace situational awareness solutions.

The consulting services segment dominated the market with a revenue share of more than 41% in 2023. Consulting firms are moving away from traditional siloed approaches and adopting a broader perspective that considers multiple hazards, vulnerabilities, and interdependencies. This shift enables organizations to develop more robust and integrated disaster preparedness strategies that address a wide range of potential risks.

In addition, there is a growing emphasis on leveraging advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and big data analytics in consulting services, further contributing to the growth of the segment. These technologies enable the analysis of vast amounts of data, the identification of patterns, and the generation of valuable insights for proactive decision-making.

The training & education services segment is anticipated to register a significant CAGR over the forecast period. The widespread adoption of disaster preparedness systems in organizations and municipalities has sparked a demand for professional services, specifically training and education services, catering to first responders, disaster response teams, and disaster management volunteers. These services involve immersive training scenarios that simulate real-time emergencies, enabling disaster response teams to enhance their preparedness and response capabilities.

In addition, organizations provide training for the utilization of simulation tools, such as hazard propagation simulation tools and incident and evacuation simulation tools. The implementation of these simulation tools within the training modules contributes to improving the response capabilities, preparedness levels, and property damage mitigation during emergencies. Therefore, these factors are projected to generate growth opportunities for the training and education services segment throughout the forecast period.

The emergency response radars segment held the largest revenue share of more than 31% in 2023. Emergency response radars play a crucial role in detecting natural disasters and unfavorable weather conditions, enabling early warnings and aiding the preparedness of first responders and government organizations. These radars are instrumental in managing traffic during emergencies by providing real-time simulations of the current traffic situation and assisting in identifying evacuation routes to ensure smooth traffic flow.

In addition, radar technology detects surface displacements during earthquakes, facilitating the assessment of seismic activity. Furthermore, these radars have become indispensable tools for short-term weather forecasting, particularly in the case of natural disasters and severe weather events such as windstorms, thunderstorms, and tornadoes. The significance of these applications is anticipated to drive the growth of the emergency response radar segment.

The first responder tools segment is anticipated to register the fastest CAGR of 9.85% over the forecast period. The growth of the segment is being driven by increased utilization of first responder tools among various emergency response teams, such as fire departments, security personnel, medical teams, and police personnel. These tools encompass a range of technology devices that assist these teams and departments in providing prompt aid during emergencies. Specifically designed communication devices are used by first responders in disaster-stricken situations.

These devices include wearable technologies such as smartwatches, smart glasses, and wearable cameras, as well as GIS-based tools, Ultra High Frequency (UHF), Very High Frequency (VHF) radios, and land mobile radios. While radios remain the most commonly employed first responder tools during emergencies, smartphones, and smart devices are also witnessing growing adoption. Smartphones offer enhanced access to mapping, navigation, street views, and satellite views, providing valuable support to first responders.

The BFSI segment dominated the market in 2023 with a revenue share of more than 22%. The increasing focus on business continuity and disaster recovery planning within the BFSI sector is a major factor contributing to the segment growth. With the criticality of their operations and the potential financial and reputational risks involved, banks, financial institutions, and insurance companies are investing in robust disaster preparedness systems to ensure uninterrupted service delivery during crises.

In addition, the increasing adoption of cloud-based solutions in the BFSI sector is also driving segment growth. Cloud-based disaster recovery and backup systems offer scalability, flexibility, and cost-efficiency, allowing BFSI organizations to store and retrieve critical data and applications seamlessly.

The healthcare segment is anticipated to register the fastest CAGR of 9.97% over the forecast period. Increasing recognition of the importance of healthcare infrastructure resilience and emergency response capabilities is contributing to the growth of the segment. Healthcare facilities, including hospitals, clinics, and medical centers, are focusing on implementing robust disaster preparedness systems to ensure the continuity of critical healthcare services during emergencies.

Moreover, the rising adoption of advanced technologies, such as telemedicine and remote patient monitoring, to enhance disaster response and patient care is also driving the segment’s growth. These technologies help healthcare providers to remotely assess and monitor patients, deliver virtual consultations, and manage healthcare services even amid a crisis.

The North America region dominated the market in 2023 with a revenue share of over 35%. The U.S. holds a significant market share due to the government's heightened emphasis on developing and implementing intelligent emergency management and mitigation plans. These initiatives aim to minimize response time and mitigate damages resulting from both natural and man-made disasters. A comprehensive disaster preparedness system is vital in expediting emergency planning and facilitating the recovery process. The region's increasing frequency and cost of disasters, attributed to climate change, further underscores the necessity for robust disaster preparedness systems.

Asia Pacific is anticipated to witness the fastest CAGR of 9.96% over the forecast period. Increasing awareness and recognition of the vulnerability of the region to natural disasters such as earthquakes, typhoons, floods, and tsunamis are the major reason contributing to regional growth. Therefore, governments and organizations in the Asia Pacific region are investing in comprehensive disaster preparedness systems to enhance their resilience and response capabilities. In addition, the growing adoption of innovative technologies, including remote sensing, satellite imagery, and geospatial data analysis, to improve disaster risk assessment and early warning systems is further contributing to the growth of the segment.

By Type

By Solution

By Services

By Communication Technology

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Disaster Preparedness System Market

5.1. COVID-19 Landscape: Disaster Preparedness System Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Disaster Preparedness System Market, By Type

8.1. Disaster Preparedness System Market, by Type, 2024-2033

8.1.1. Emergency/Mass Notification System

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Surveillance System

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Safety Management System

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Earthquake/Seismic Warning System

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Disaster Recovery and Backup Systems

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Disaster Preparedness System Market, By Others

9.1. Disaster Preparedness System Market, by Others, 2024-2033

9.1.1. Geospatial Solutions

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Disaster Recovery Solutions

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Situational Awareness Solutions

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Disaster Preparedness System Market, By Services

10.1. Disaster Preparedness System Market, by Services, 2024-2033

10.1.1. Training & Education Services

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Consulting Services

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Design & Integration Services

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Support & Maintenance Services

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Disaster Preparedness System Market, By Communication Technology

11.1. Disaster Preparedness System Market, by Communication Technology, 2024-2033

11.1.1. First Responder Tools

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Satellite Phones

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Emergency Response Radars

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Vehicle-Ready Gateways

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Others

11.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Disaster Preparedness System Market, By End-use

12.1. Disaster Preparedness System Market, by End-use, 2024-2033

12.1.1. BFSI

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Energy and Utilities

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Aerospace and Defense

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Manufacturing

12.1.4.1. Market Revenue and Forecast (2021-2033)

12.1.5. IT and Telecom

12.1.5.1. Market Revenue and Forecast (2021-2033)

12.1.6. Public Sector

12.1.6.1. Market Revenue and Forecast (2021-2033)

12.1.7. Transportation and Logistics

12.1.7.1. Market Revenue and Forecast (2021-2033)

12.1.8. Healthcare

12.1.8.1. Market Revenue and Forecast (2021-2033)

12.1.9. Others

12.1.9.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Disaster Preparedness System Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Type (2021-2033)

13.1.2. Market Revenue and Forecast, by Others (2021-2033)

13.1.3. Market Revenue and Forecast, by Services (2021-2033)

13.1.4. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.1.5. Market Revenue and Forecast, by End-use (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Type (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Others (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Services (2021-2033)

13.1.6.4. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.1.7. Market Revenue and Forecast, by End-use (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Type (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Others (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Services (2021-2033)

13.1.8.4. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.1.8.5. Market Revenue and Forecast, by End-use (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Type (2021-2033)

13.2.2. Market Revenue and Forecast, by Others (2021-2033)

13.2.3. Market Revenue and Forecast, by Services (2021-2033)

13.2.4. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.2.5. Market Revenue and Forecast, by End-use (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Others (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Services (2021-2033)

13.2.7. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.2.8. Market Revenue and Forecast, by End-use (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Type (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Others (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Services (2021-2033)

13.2.10. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.2.11. Market Revenue and Forecast, by End-use (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Type (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Others (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Services (2021-2033)

13.2.12.4. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.2.13. Market Revenue and Forecast, by End-use (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Type (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Others (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Services (2021-2033)

13.2.14.4. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.2.15. Market Revenue and Forecast, by End-use (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Type (2021-2033)

13.3.2. Market Revenue and Forecast, by Others (2021-2033)

13.3.3. Market Revenue and Forecast, by Services (2021-2033)

13.3.4. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.3.5. Market Revenue and Forecast, by End-use (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Others (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Services (2021-2033)

13.3.6.4. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.3.7. Market Revenue and Forecast, by End-use (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Type (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Others (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Services (2021-2033)

13.3.8.4. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.3.9. Market Revenue and Forecast, by End-use (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Type (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Others (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Services (2021-2033)

13.3.10.4. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.3.10.5. Market Revenue and Forecast, by End-use (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Type (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Others (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Services (2021-2033)

13.3.11.4. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.3.11.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Type (2021-2033)

13.4.2. Market Revenue and Forecast, by Others (2021-2033)

13.4.3. Market Revenue and Forecast, by Services (2021-2033)

13.4.4. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.4.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Others (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Services (2021-2033)

13.4.6.4. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.4.7. Market Revenue and Forecast, by End-use (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Type (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Others (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Services (2021-2033)

13.4.8.4. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.4.9. Market Revenue and Forecast, by End-use (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Type (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Others (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Services (2021-2033)

13.4.10.4. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.4.10.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Type (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Others (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Services (2021-2033)

13.4.11.4. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.4.11.5. Market Revenue and Forecast, by End-use (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Type (2021-2033)

13.5.2. Market Revenue and Forecast, by Others (2021-2033)

13.5.3. Market Revenue and Forecast, by Services (2021-2033)

13.5.4. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.5.5. Market Revenue and Forecast, by End-use (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Type (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Others (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Services (2021-2033)

13.5.6.4. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.5.7. Market Revenue and Forecast, by End-use (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Type (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Others (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Services (2021-2033)

13.5.8.4. Market Revenue and Forecast, by Communication Technology (2021-2033)

13.5.8.5. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 14. Company Profiles

14.1. Honeywell International Inc.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Lockheed Martin

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Motorola Solutions, Inc.

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Siemens

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. NEC Corporation

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. IBM

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Alertus Technologies LLC

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. OnSolve

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Juvare, LLC

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Singlewire Software, LLC

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others