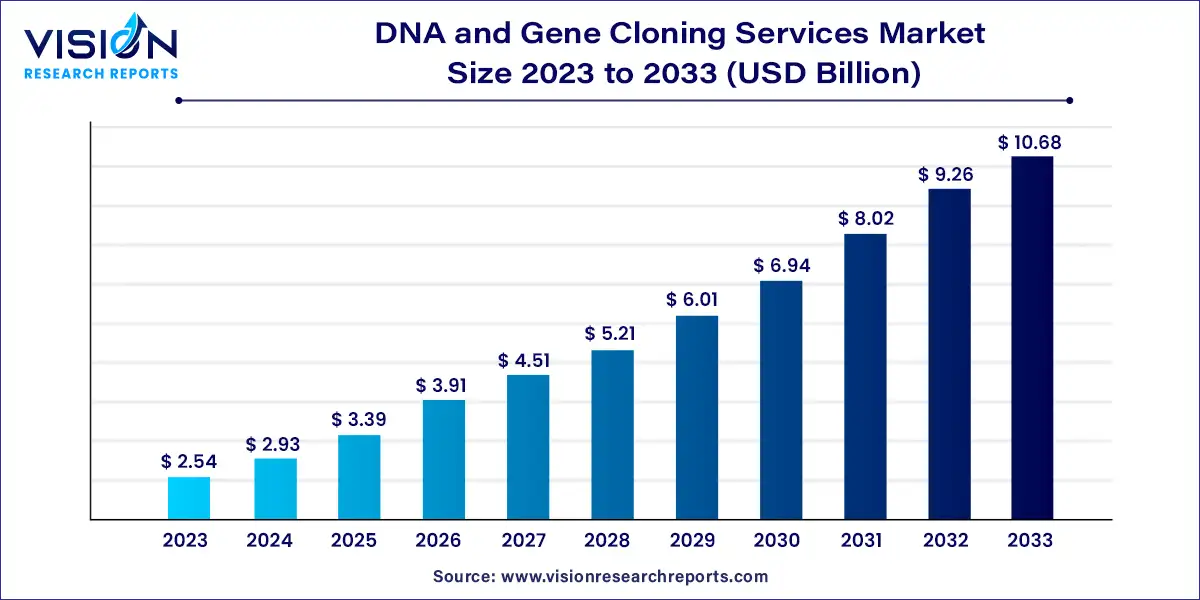

The global DNA and gene cloning services market size was estimated at around USD 2.54 billion in 2023 and it is projected to hit around USD 10.68 billion by 2033, growing at a CAGR of 15.45% from 2024 to 2033.

The DNA and gene cloning services market has experienced significant growth driven by advancements in biotechnology, increasing demand for personalized medicine, and the rise in genetic research. These services are crucial for various applications, including drug development, gene therapy, and agricultural biotechnology

The DNA and gene cloning services market is propelled by an advancements in biotechnology, particularly in gene-editing technologies like CRISPR-Cas9, have significantly enhanced the precision and efficiency of cloning processes, driving market expansion. The rising demand for personalized medicine, which necessitates precise genetic modifications, is another critical driver. Additionally, the increasing volume of genetic research, supported by substantial investments from both public and private sectors, contributes to the market's growth. The expanding applications of DNA and gene cloning in pharmaceuticals, agriculture, and academic research further fuel demand. Moreover, the emergence of automated cloning systems has improved throughput and reduced operational costs, making these services more accessible and attractive to a broader range of end-users.

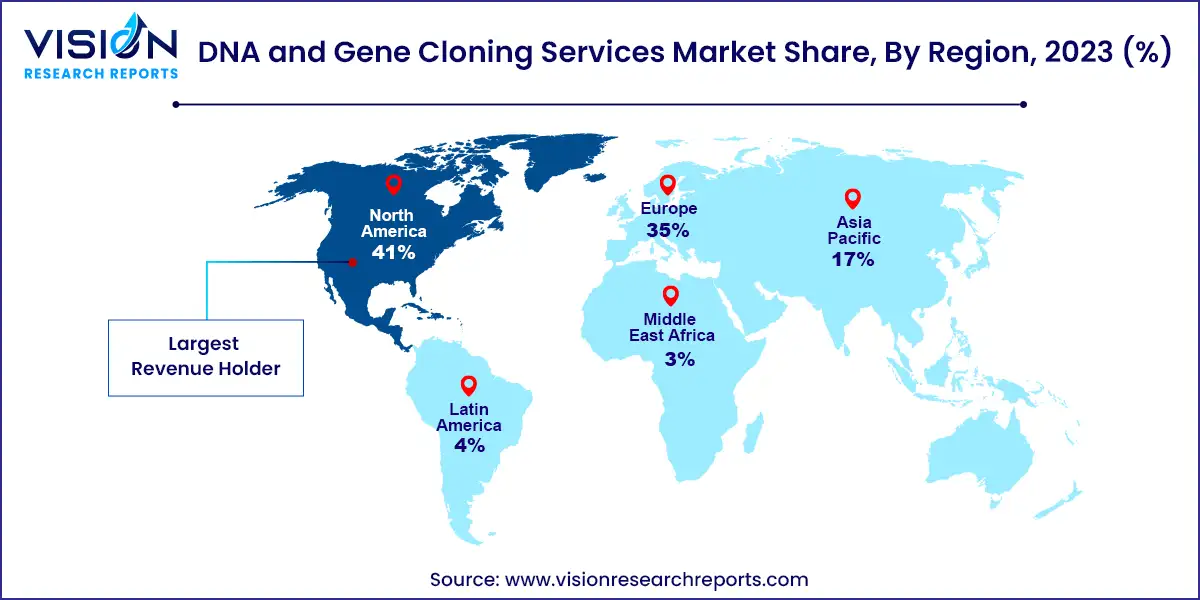

North America dominated the DNA and gene cloning services market, accounting for a 41% revenue share in 2023. This growth is attributed to advanced healthcare infrastructure, a strong presence of leading biotechnology firms, and significant funding for recombinant DNA (rDNA) technology research. The increasing demand for personalized medicine and the rising prevalence of chronic and hereditary diseases are expected to further drive the market.

| Attribute | North America |

| Market Value | USD 1.04 Billion |

| Growth Rate | 15.56% CAGR |

| Projected Value | USD 4.37 Billion |

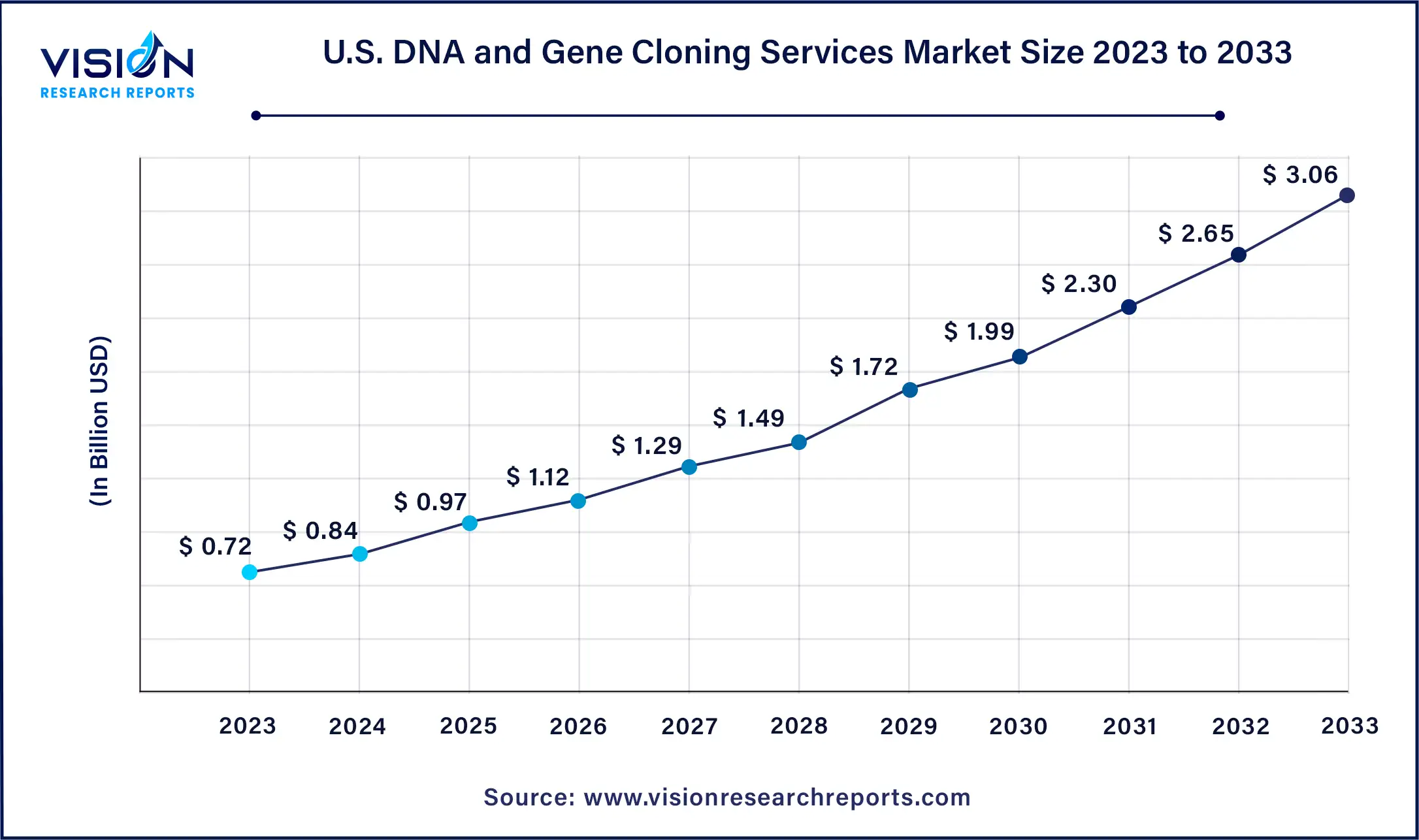

The U.S. DNA and gene cloning services market size was estimated at USD 0.72 billion in 2023 and it is expected to surpass around USD 3.06 billion by 2033, poised to grow at a CAGR of 15.56% from 2024 to 2033.

The U.S. DNA and gene cloning services market is anticipated to grow from 2024 to 2033 due to increasing government funding, a focus on targeted treatments, regenerative medicine, and the rising prevalence of diseases. Growing research in drug discovery and personalized medicine, along with the strong presence of biotechnology and biopharmaceutical companies, is expected to fuel market growth.

Europe

The Europe DNA and gene cloning services market is expected to grow over the forecast period, driven by the strong presence of biopharmaceutical companies producing recombinant vaccines and biologics. Increasing research and development activities, collaborations between pharmaceutical companies and research institutions, and a growing demand for novel antibiotics and enzymes further propel market growth. In the UK, the market is expected to grow at a CAGR of 17.2% due to the rising prevalence of cancer and growing demand for targeted therapies. Government laws regarding genetically modified crops are also likely to boost the market. For example, in March 2023, the Government of England legalized the commercial production of gene-edited food, enhancing agricultural outcomes and food production through rDNA technology.

Asia Pacific

The Asia Pacific DNA and gene cloning services market is expected to experience rapid growth, with a projected CAGR of 16.78% from 2024 to 2033. This growth is attributed to the rising prevalence of chronic diseases, increasing research activities, advancements in genetic engineering, rising adoption of gene therapies, and a strong presence of biotechnology and biopharmaceutical companies. In China, the market is anticipated to grow due to increasing investments in healthcare innovation and research. The country's focus on advancing biotechnology and immunotherapy, coupled with rising awareness of personalized medicine, is driving market expansion.

The gene synthesis services segment dominated the market with the largest revenue share of 41% in 2023. Gene synthesis services are vital in synthetic biology, enabling the creation of custom DNA sequences without a template. This allows researchers to design and construct genes with specific traits tailored to their research needs, optimizing gene expression levels through codon optimization. Companies provide gene synthesis services, including DNA synthesis, cloning, recombinant expression projects, and downstream services such as sub-cloning, mutagenesis, and plasmid preparation.

The custom cloning services segment is expected to grow at the fastest CAGR of 16.52% from 2024 to 2033. Custom cloning services offer benefits like saving time, ensuring accuracy, and providing access to specialized vectors and techniques not readily available in typical laboratory settings. These services include gene synthesis & mutagenesis, molecular cloning, and shRNA & RNAi cloning services.

The DNA sequencing segment held the largest revenue share of 40% in 2023 and is anticipated to grow at the fastest CAGR during the forecast period. Gene cloning is essential for DNA sequencing as it allows scientists to create copies of specific genes for further analysis. By inserting genes into vectors like plasmids or viral vectors and introducing them into host cells for replication, researchers can accurately determine the nucleotide sequences. This process is crucial for understanding the genetic makeup and function of genes.

The mutagenesis segment is also expected to see significant growth from 2024 to 2033. Gene cloning is critical in mutagenesis, allowing researchers to introduce specific mutations into genes for various studies and applications. Combining gene cloning and mutagenesis enables the creation of customized genetic constructs for applications in molecular biology, biotechnology, and genetics, revolutionizing genetic engineering and expanding possibilities for gene function and regulation studies.

The academic and research institutes segment led the market with a revenue share of 39% in 2023. Research institutes collaborate with service providers to accelerate research programs requiring gene fragment characterization and synthesis. For example, in January 2024, GSK and Elegen Corporation collaborated to develop cell-free DNA-based vaccines and medicines. DNA and gene cloning services bridge basic research with clinical applications in translational studies, helping scientists develop potential therapies, diagnostic tools, or biomarkers.

The CROs & CMOs segment is projected to grow at the fastest CAGR of 16.57% from 2024 to 2033. The high number of contract research organizations (CROs) providing gene synthesis services is expected to boost revenue in the region. Companies like GenScript have a significant presence across North America, offering a broad range of services, including antibody drug development and custom gene synthesis.

By Service

By Application

By End use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Service Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on DNA and Gene Cloning Services Market

5.1. COVID-19 Landscape: DNA and Gene Cloning Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global DNA and Gene Cloning Services Market, By Service

8.1. DNA and Gene Cloning Services Market, by Service, 2024-2033

8.1.1 Gene Synthesis

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Custom Cloning

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Sub-cloning

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global DNA and Gene Cloning Services Market, By Application

9.1. DNA and Gene Cloning Services Market, by Application, 2024-2033

9.1.1. DNA Sequencing

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Mutagenesis

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Genotyping

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global DNA and Gene Cloning Services Market, By End use

10.1. DNA and Gene Cloning Services Market, by End use, 2024-2033

10.1.1. Academic & Research Institutes

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Pharmaceutical & Biotechnology Companies

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. CMOs & CROs

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global DNA and Gene Cloning Services Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Service (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Service (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Service (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Service (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by End use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Service (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Service (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Service (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Service (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Service (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by End use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Service (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Service (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Service (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Service (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Service (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by End use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Service (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Service (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Service (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Service (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Service (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by End use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Service (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Service (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End use (2021-2033)

Chapter 12. Company Profiles

12.1. Sezzle.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Sezzle.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Sezzle.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Sezzle.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Sezzle.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Sezzle

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Sezzle.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Sezzle

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Sezzle.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Sezzle

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others