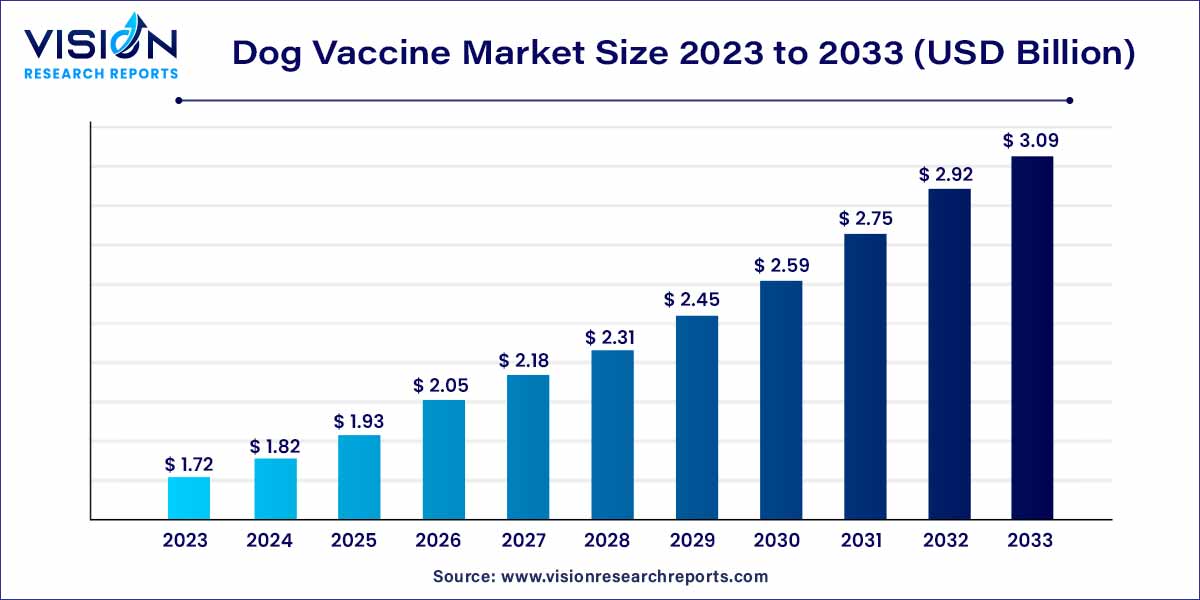

The global dog vaccine market size was estimated at around USD 1.72 million in 2023 and it is projected to hit around USD 3.09 million by 2033, growing at a CAGR of 6.05% from 2024 to 2033.

The dog vaccine market represents a critical segment within the broader landscape of veterinary pharmaceuticals, driven by the imperative to ensure the health and well-being of canine companions. This overview provides a comprehensive glimpse into the key facets defining the current state and trajectory of the dog vaccine market.

The growth of the dog vaccine market is propelled by a confluence of factors that collectively contribute to its expansion. Increased pet ownership, coupled with a heightened awareness of responsible pet care, has driven a surge in demand for canine vaccinations. Advancements in veterinary science, characterized by ongoing research and development initiatives, play a pivotal role in the introduction of new and improved vaccines. The industry's commitment to addressing both existing and emerging threats to canine health through innovative immunization solutions further fuels market growth. Additionally, evolving trends in personalized vaccine plans, tailored to individual dogs, reflect the market's responsiveness to the changing preferences of pet owners. This dynamic landscape, supported by technological advancements in vaccine delivery and genetic engineering, underscores a commitment to enhancing vaccine efficacy.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 3.09 million |

| Growth Rate from 2024 to 2033 | CAGR of 6.05% |

| Revenue Share of North America in 2023 | 39% |

| CAGR of Asia Pacific from 2024 to 2033 | 7.05% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Growing Awareness of Preventive Healthcare:

A heightened awareness among pet owners about the importance of preventive healthcare measures for dogs is a significant driver for the market. The realization that vaccinations are crucial in safeguarding canine companions from a spectrum of infectious diseases has led to a proactive approach to veterinary care, boosting the market for dog vaccines.

Advancements in Veterinary Science:

The relentless pursuit of scientific innovation in veterinary medicine, marked by ongoing research and development activities, serves as a major driver for the dog vaccine market. The introduction of novel vaccines, improvements in existing formulations, and the application of cutting-edge technologies contribute to the overall growth and dynamism of the market.

Limited Accessibility in Developing Regions:

Accessibility to canine vaccines remains a significant restraint, particularly in developing regions. Challenges related to distribution networks, infrastructure limitations, and economic constraints in these areas contribute to an uneven distribution of vaccines, hindering comprehensive canine healthcare.

Cost-Related Concerns:

The cost of canine vaccines, including production, distribution, and administration, poses a restraint to market growth. Some pet owners may be deterred by the perceived high cost of comprehensive vaccination programs, impacting the widespread adoption of immunization measures.

Customized Vaccination Plans:

Responding to the growing demand for personalized healthcare, there is an opportunity to develop and promote customized vaccination plans for dogs. Tailoring vaccine regimens to individual health profiles, lifestyles, and regional risks can enhance the market's appeal and efficacy.

Emerging Zoonotic Threats:

The recognition of zoonotic diseases and their potential transmission between animals and humans opens doors for advancements in canine vaccines. Developing vaccines that not only protect dogs but also contribute to public health initiatives can position the market as a crucial component in the prevention of cross-species transmission.

The market is segmented based on the vaccine type into modified/attenuated live, inactivated (killed), and others. The modified/attenuated live segment accounted for the largest revenue share of 53% in 2023. The attenuated live vaccine can protect against disease and infection and provide long-term immunity, driving their market. All canine adenovirus-2 and parvoviruses, such as canine adenovirus type 2 (CAV-2), are attenuated live vaccines. The CAV-2 vaccine helps in the protection of infectious hepatitis.

The other segment is expected to grow at the fastest CAGR of 8.16% over the forecast period. The innovation in the dog vaccine has led to the development of new and more effective canine vaccines, such as recombinant vaccines, which insert a pathogen gene into the virus in combination with other antigens. For instance, Recombitek is a recombinant vaccine developed by Boehringer Ingelheim International GmbH to protect against distemper, leptospirosis, and other diseases.

Based on disease type, the market is segmented into canine infectious respiratory disease complex (CIRDC), canine distemper, canine rabies, canine leptospirosis, canine Lyme disease, infectious canine hepatitis, canine parvovirus/parvovirus disease, and other diseases. The CIRDC segment accounted for the highest revenue share of 28% in 2023. The existence of several causal agents for CIRDC has encouraged the development of new vaccines. For instance, in November 2019, Zoetis launched the first of its kind, Plus Bb Oral, in Europe to protect against one of the primary causal agents of CIRDC, Bordetella bronchiectasis. The vaccine is expected to provide a comfortable route of administration for one year.

The canine rabies segment is estimated to register the fastest CAGR of 6.96% over the forecast period. This growth can be attributed to the prevalence of canine rabies, its zoonotic potential, and efforts by public and private players to create awareness and prevent rabies. For instance, in September 2021, jbfsociety.org launched an anti-rabies vaccination program for dogs in Northeast India intending to make society rabies-free until 2030. Such initiatives are likely to foster the demand for canine rabies vaccines over the forecast period.

Based on the route of administration, the market is segmented into injectable, intranasal, and oral vaccines. The injectable segment held the largest revenue share of 77% in 2023. Injectable vaccines are the most popular among veterinarians and pet owners due to their ability to facilitate accurate dosage. In March 2021, MSD Animal Health (Merck & Co., Inc.) launched an injectable vaccine to protect against Bordetella bronchieseptica, Nobivac(r) Respira Bb. The single-dose administration of the vaccine can protect dogs against disease for seven months after the primary course and 12 months after the booster dose.

The oral vaccine segment is anticipated to grow at the fastest CAGR of 7.15% over the forecast period. Oral vaccines are considered more convenient as the pet owners can administer them. In addition, oral vaccines are also easy to supply since they require less stringent cold chain storage. This is likely to encourage the development and increase the adoption rate for these vaccines.

Based on the components, the market is segmented into combined vaccines and mono vaccines. The combined vaccine segment contributed the largest market share of 66% in 2023 and is expected to grow at the fastest CAGR of 6.26% over the forecast period.

Administration of combined vaccines helps protect against more than one disease and reduce the requirement for several injections a dog needs for different diseases. This makes the vaccine procedures more convenient and less stressful which is expected to drive their demand in the dog vaccine industry. For instance, Nobivac Puppy DP by Merck & Co, Inc. is a combined vaccine to protect against canine distemper and canine parvovirus.

North America accounted for the largest revenue share of 39% in 2023. The region has a presence of several key players in the dog vaccines market. In addition, the rising awareness regarding preventive healthcare for pets and increasing pet ownership rates are major growth drivers for this market. For instance, the combined efforts by Merck & Co., Inc., Petco Love, and NGO helped distribute one million free pet vaccines by October 2022.

Asia Pacific is expected to grow at the fastest CAGR of 7.05% during the forecast period. The region has the presence of several emerging economies, such as India and China. The growing income levels, changing demographics, and improvement in the standard of living are expected to foster the growth of the market in this region. According to an article published by CNBC in October 2022, India is expected to experience the biggest hike of 4.6% in real wages, whereas 3.6% growth is expected in China. This rise in income levels is expected to encourage more spending on pets.

By Vaccine Type

By Disease Type

By Route of Administration

By Component

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Dog Vaccine Market

5.1. COVID-19 Landscape: Dog Vaccine Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Dog Vaccine Market, By Vaccine Type

8.1. Dog Vaccine Market, by Vaccine Type, 2024-2033

8.1.1. Modified/ Attenuated Live

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Inactivated (Killed)

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Dog Vaccine Market, By Disease Type

9.1. Dog Vaccine Market, by Disease Type, 2024-2033

9.1.1. Canine Distemper

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Canine Infectious Respiratory Disease Complex (CIRDC)

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Canine Parvovirosis/ Parvovirus Disease

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Canine Leptospirosis

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Canine Lyme Disease

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Infectious Canine Hepatitis

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Canine Rabies

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Other Diseases

9.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Dog Vaccine Market, By Route of Administration

10.1. Dog Vaccine Market, by Route of Administration, 2024-2033

10.1.1. Injectable

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Intranasal

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Oral

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Dog Vaccine Market, By Component

11.1. Dog Vaccine Market, by Component, 2024-2033

11.1.1. Combined Vaccines

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Mono Vaccines

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Dog Vaccine Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.1.4. Market Revenue and Forecast, by Component (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Component (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Component (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.2.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.2.4. Market Revenue and Forecast, by Component (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Component (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Component (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Component (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Component (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.3.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.3.4. Market Revenue and Forecast, by Component (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Component (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Component (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Component (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Component (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.4.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.4.4. Market Revenue and Forecast, by Component (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Component (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Component (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Component (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Component (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.5.4. Market Revenue and Forecast, by Component (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Component (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Disease Type (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Route of Administration (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Component (2021-2033)

Chapter 13. Company Profiles

13.1. Bioveta a.s

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Hester Biosciences Limited

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Boehringer Ingelheim International GmbH

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Brilliant Bio Pharma

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Heska Corporation

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Merck & Co., Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Virbac

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Zendal Group

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Elanco

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Zoetis Services LLC.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others