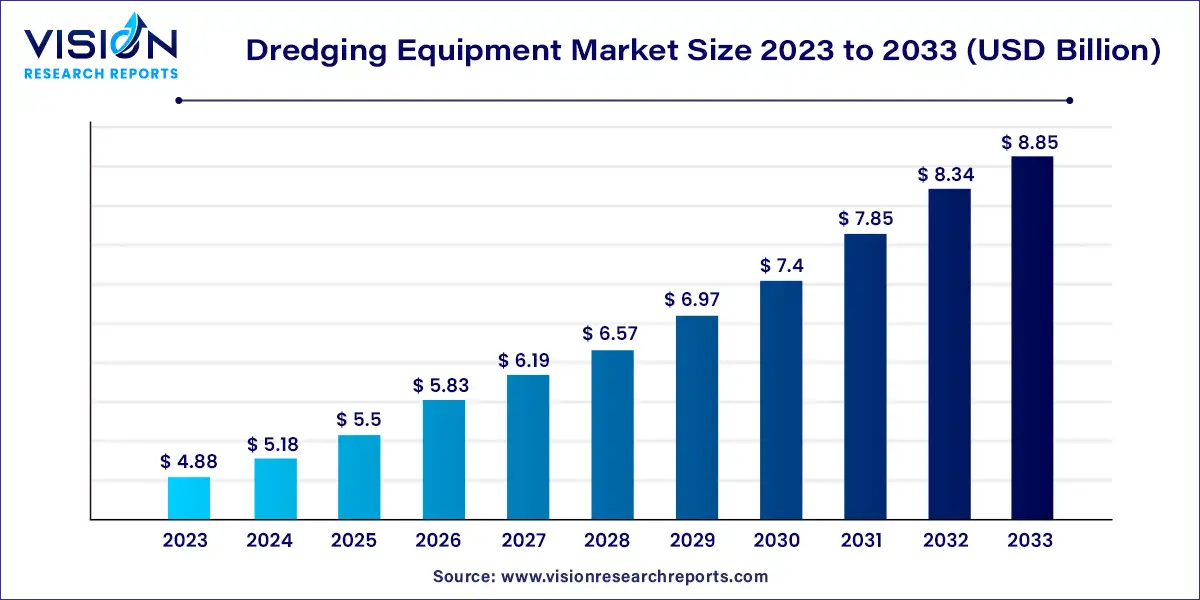

The global dredging equipment market size was estimated at USD 4.88 billion in 2023 and it is expected to surpass around USD 8.85 billion by 2033, poised to grow at a CAGR of 6.13% from 2024 to 2033.

The dredging equipment market encompasses a diverse range of machinery and tools crucial for excavation, sediment removal, and maintenance of waterways, ports, and coastal areas. This sector plays a pivotal role in supporting global trade, environmental conservation, and infrastructure development.

The growth of the dredging equipment market is propelled by an increasing maritime trade activity, coupled with the expansion of port infrastructure worldwide, drive the demand for dredging equipment to maintain navigational channels and accommodate larger vessels. Urbanization and industrialization lead to heightened construction activities, necessitating dredging for land reclamation and waterfront development. Moreover, rising concerns over climate change and sea-level rise bolster investments in coastal protection projects, further boosting the market. Technological advancements, such as automation and efficiency improvements in dredging equipment, enhance operational capabilities and fuel market growth. Government initiatives aimed at enhancing waterway infrastructure and promoting sustainable development also contribute to the market's expansion, particularly in emerging economies.

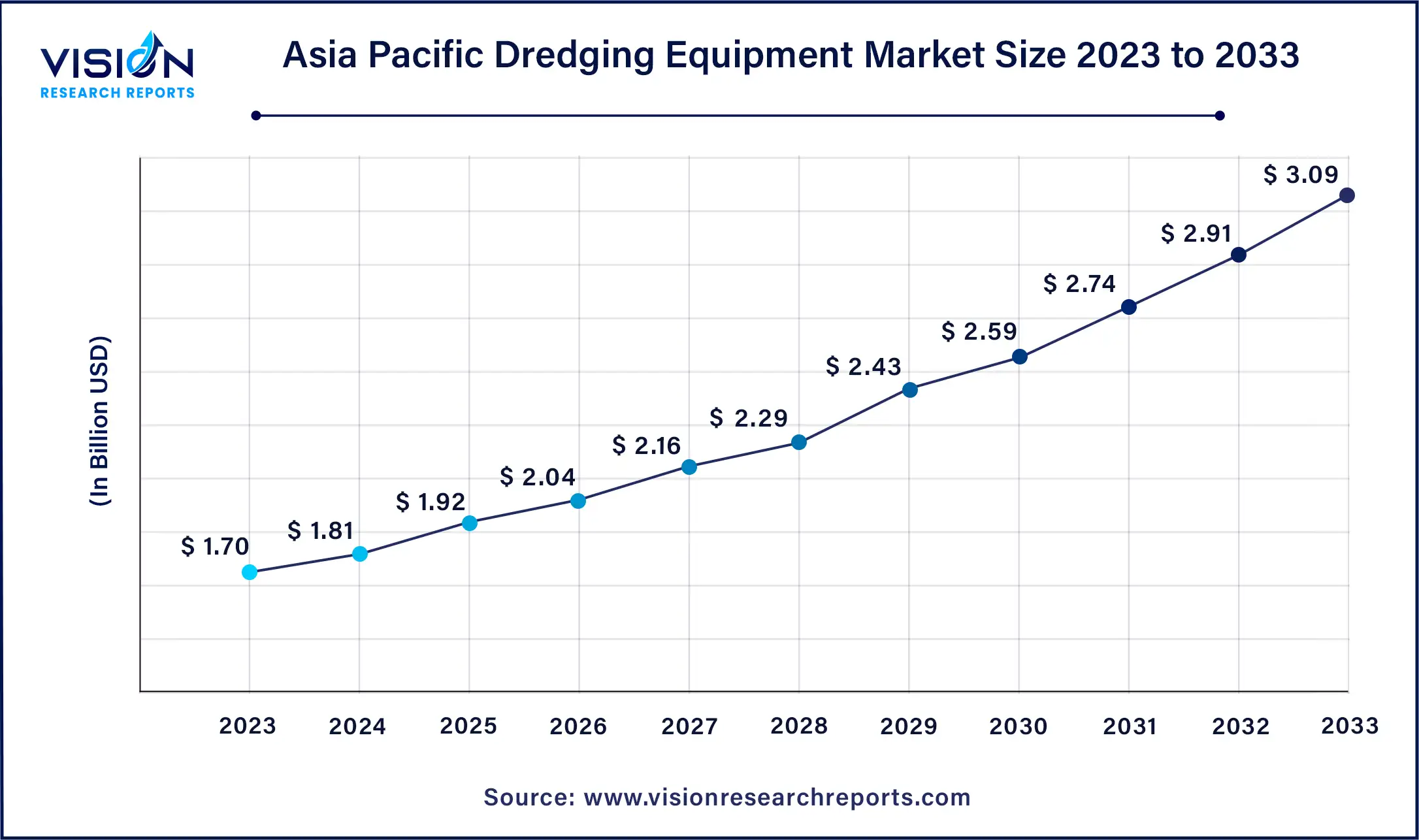

The Asia Pacific dredging equipment market size was estimated at around USD 1.70 billion in 2023 and it is projected to hit around USD 3.09 billion by 2033, growing at a CAGR of 6.15% from 2024 to 2033.

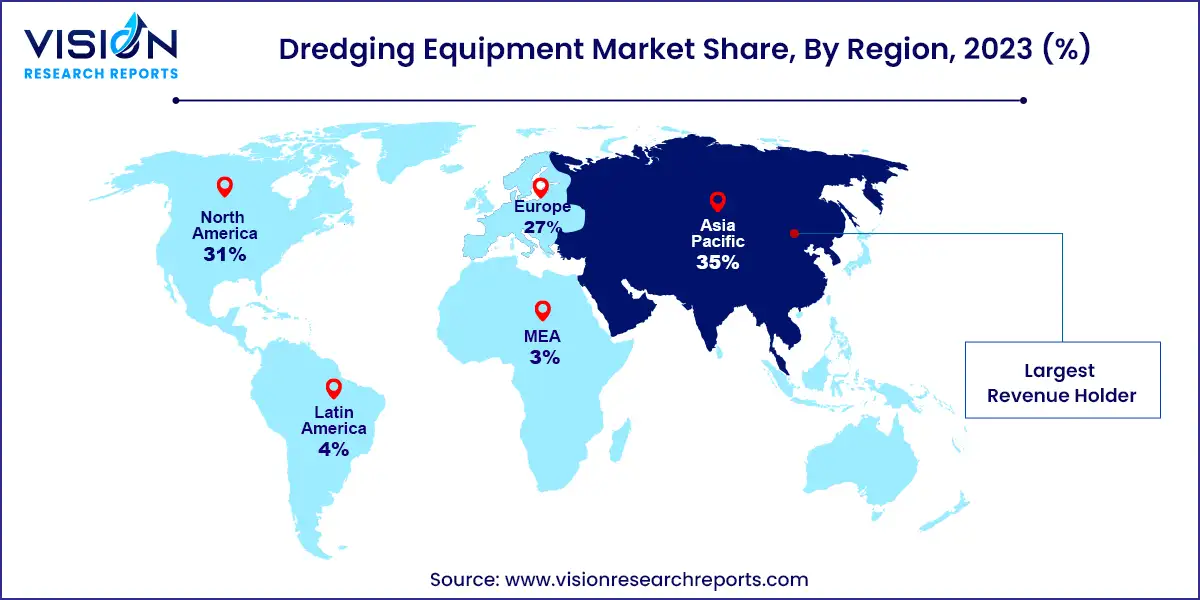

Asia Pacific dominated the global dredging equipment market in 2023, accounting for 35% of the total revenue. The region's growth is driven by robust investments in infrastructure, environmental conservation initiatives, and economic development. These factors are creating lucrative opportunities for both domestic and international manufacturers in the dredging equipment sector.

North America is projected to witness significant growth during the forecast period, supported by established market players and increasing investments in infrastructure projects. Companies like DSC Dredge, LLC, American Marine Corporation, and GeoForm International Inc. are pivotal in driving market expansion across the region.

The U.S. dredging equipment market is expected to grow at a notable CAGR of 6.3% from 2024 to 2030. This growth is attributed to substantial investments in infrastructure, particularly harbor and port improvements funded by the federal government. Such initiatives are boosting demand for dredging equipment nationwide, highlighting a promising outlook for market expansion in the coming years.

The hydraulic dredger segment emerged as the market leader in 2023, capturing the largest revenue share of 47%. Hydraulic dredging has become pivotal in environmental management and civil engineering, playing a crucial role in maintaining navigation channels, reshaping waterways, and reclaiming sediments. Its popularity stems from attributes like mobility, cost-effectiveness, versatility, reliability, and adaptability to challenging conditions. The increasing demand for hydraulic dredging equipment across applications such as deepening ports, flood control, and environmental restoration is driving segment growth.

The mechanical dredger segment is anticipated to exhibit a significant CAGR during the forecast period. Mechanical dredging involves physically removing sediment using equipment like backhoes, clamshells, and excavators. This method is favored for its capability to handle large debris and sediment of varying sizes, efficiently clear vegetation, and facilitate shoreline maintenance. Consequently, the segment is poised for growth from 2024 to 2030 due to these operational advantages.

Navigational channels led the market in 2023, commanding the largest revenue share of 39%. Dredging equipment is extensively employed in harbors, ports, and shipping channels to maintain navigable waterways. This activity is essential for ensuring safe passage for vessels transporting goods crucial to international trade and economic growth. The rising demand for dredging equipment to enhance navigation safety, maintain water channel depth, and support maritime activities is fueling segment expansion.

The construction segment is expected to experience substantial growth at a compound annual growth rate (CAGR) during the forecast period. Dredging equipment used in construction plays a critical role at the outset of projects by relocating and removing sediments. This process facilitates the creation of new land for various purposes such as artificial islands, industrial and residential areas, airports, causeways, and highways. Additionally, it supports the construction of infrastructure like dikes, dams, and wildlife habitats by preparing land through sediment removal and relocation.

By Type

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others