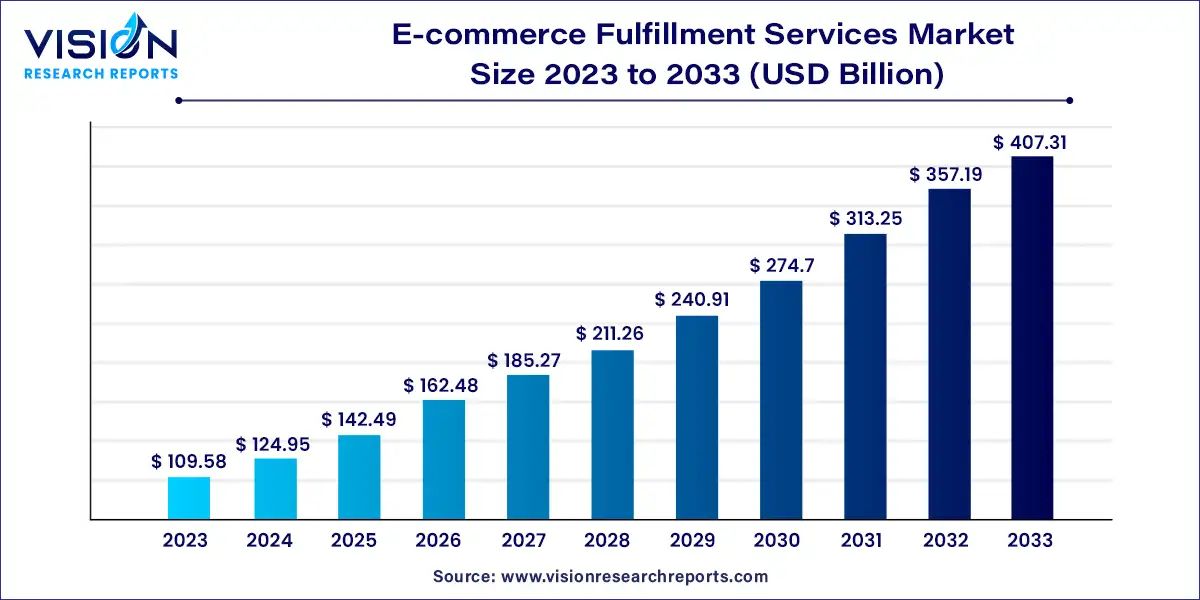

The global e-commerce fulfillment services market size was surpassed at USD 109.58 billion in 2023 and is expected to hit around USD 407.31 billion by 2033, growing at a CAGR of 14.03% from 2024 to 2033.

The e-commerce fulfillment services market is experiencing significant growth driven by the rapid expansion of online retail. This sector encompasses a wide range of services aimed at facilitating the storage, packaging, and shipping of products ordered online. Key players in this market include third-party logistics providers (3PLs) and fulfillment centers that specialize in efficiently managing inventory and order fulfillment processes. The increasing demand for quick and reliable delivery services, coupled with advancements in technology such as automation and robotics, are reshaping the landscape of e-commerce fulfillment.

The growth of the e-commerce fulfillment services market is propelled by the exponential rise in online shopping has necessitated efficient and scalable fulfillment solutions. This surge is driven by changing consumer behaviors favoring convenience and the accessibility of a wide range of products online. Additionally, advancements in logistics technology, such as automation, AI-driven analytics, and robotics, have significantly enhanced operational efficiencies within fulfillment centers. These technologies streamline order processing, reduce turnaround times, and optimize inventory management, thereby meeting the growing demand for fast and reliable delivery services. Moreover, the globalization of e-commerce has expanded market reach, prompting businesses to seek reliable fulfillment partners capable of managing international logistics seamlessly.

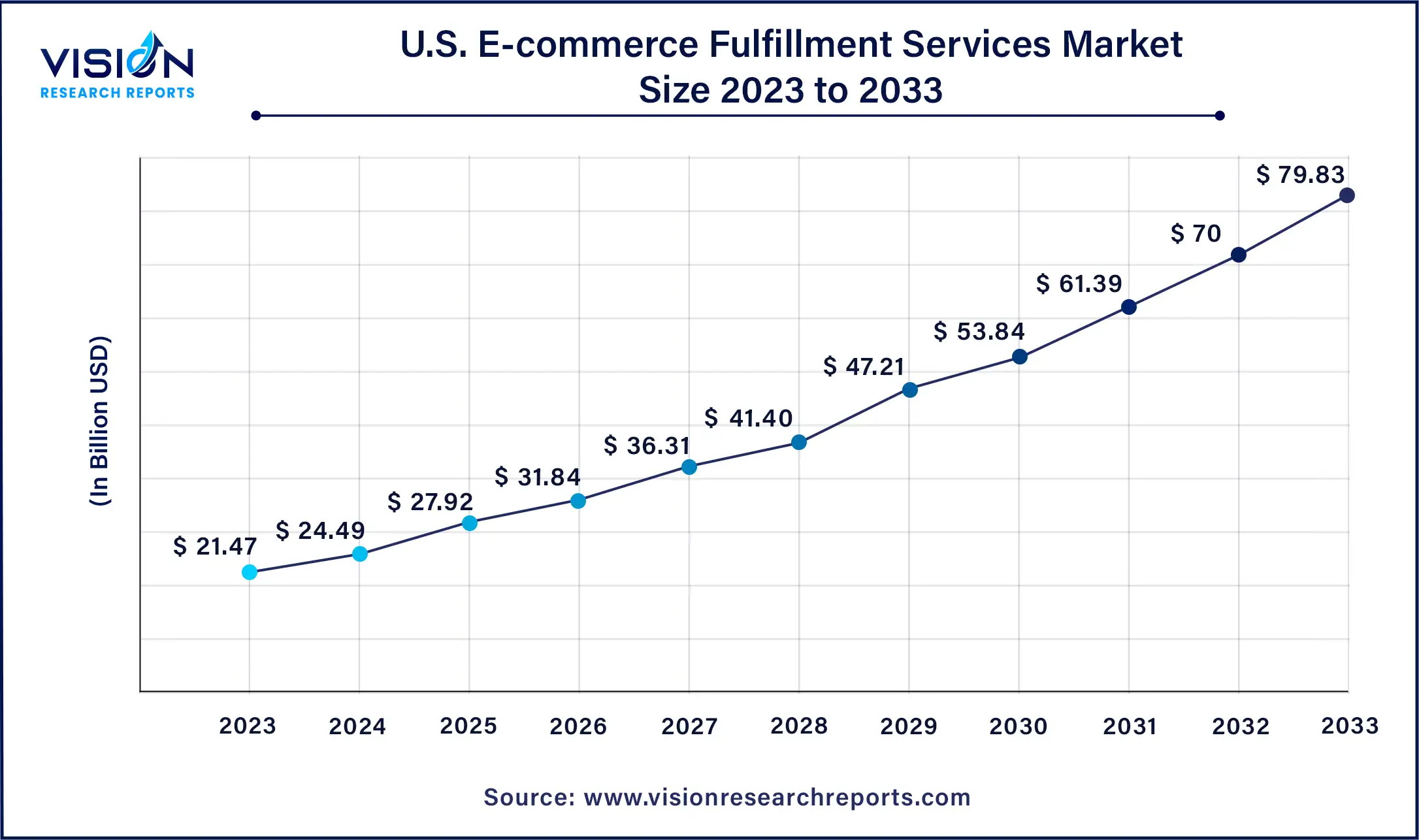

The U.S. e-commerce fulfillment services market size was estimated at around USD 21.47 billion in 2023 and it is projected to hit around USD 79.83 billion by 2033, growing at a CAGR of 14.03% from 2024 to 2033.

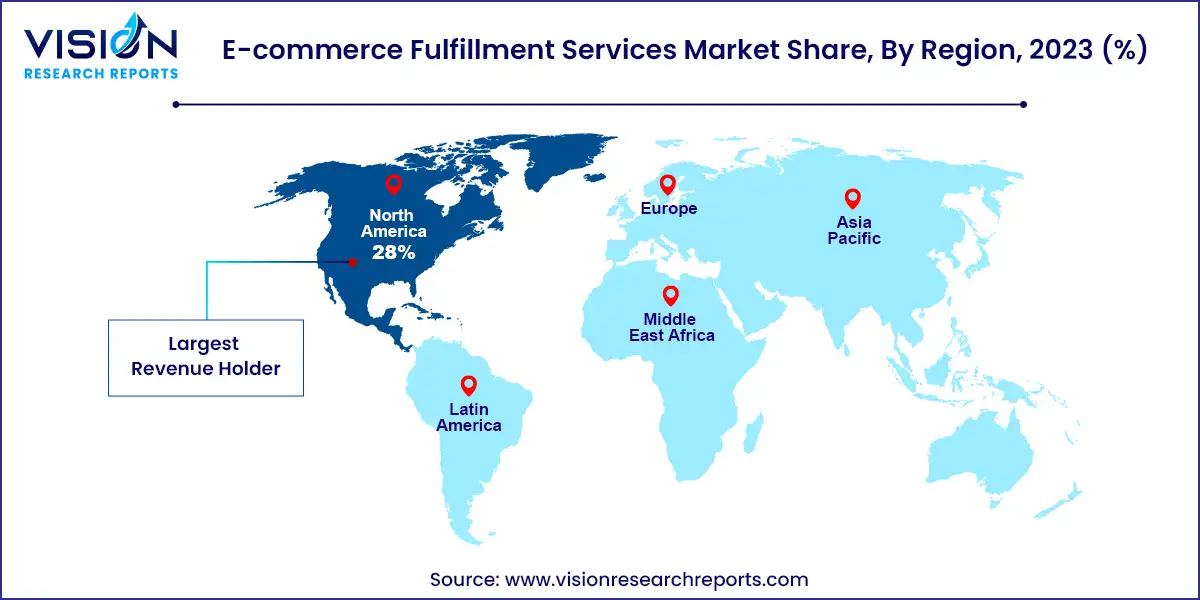

North America dominated the e-commerce fulfillment services market in 2023, capturing the largest revenue share of 28%. The surge in e-commerce is propelling market growth as consumers confidently purchase a wider range of goods online. This is enhanced by the growth of omnichannel retail, where brick-and-mortar stores integrate online elements, allowing for seamless browsing, purchasing, and delivery options. The demand for efficient last-mile delivery solutions, such as same-day delivery and flexible pick-up locations, further drives the market. Additionally, the emergence of social commerce, where social media platforms facilitate direct product discovery and purchase, creates new opportunities. The confluence of rising e-commerce adoption, omnichannel expansion, last-mile delivery demands, and social commerce growth is creating a boom in the North American e-commerce fulfillment services market.

The e-commerce fulfillment services market in the Asia Pacific region recorded the fastest CAGR of 15.13% from 2024 to 2033. Government initiatives, such as infrastructure development and streamlined regulations, actively support e-commerce growth and create a favorable market environment. Further, the surge in e-commerce adoption across the region, particularly among the expanding middle class, is a primary driver. This trend is further supported by the increasing demand for last-mile delivery options as consumers seek faster and more convenient ways to receive their online purchases. Additionally, a growing focus on sustainability is shaping the market, with businesses and consumers prioritizing eco-friendly packaging and fulfillment solutions. These combined forces are driving the Asia Pacific e-commerce fulfillment services market to new heights, necessitating innovative and sustainable solutions to meet the evolving needs of the region's dynamic online economy.

In 2023, shipping fulfillment services led the market with a significant revenue share of 41%. These services, integral to e-commerce operations, manage crucial stages from inventory receipt to the last mile delivery. They are pivotal in ensuring prompt and secure delivery, essential for bolstering customer satisfaction and loyalty amidst intense online retail competition. As e-commerce continues to expand, the demand for efficient shipping fulfillment services is expected to sustain robust market growth.

The bundling fulfillment services segment is anticipated to achieve a notable CAGR of 14.83% during the forecast period. This growth is driven by increasing demand for comprehensive solutions that encompass storage, packaging, and value-added services such as kitting and custom packaging. With the rise of omnichannel retail and personalized product bundles, these services offer cost-effective strategies to manage diverse inventory across platforms, ensuring consistent customer presentation. The segment's expansion reflects its pivotal role in enhancing operational efficiency and customer experience in the evolving e-commerce landscape.

The business-to-business (B2B) segment dominated in 2023, attributed to complex supply chain needs and high-volume transactions. E-commerce fulfillment services cater to these requirements by optimizing warehousing, inventory management, and order fulfillment processes. Specialized services address industry-specific demands, including compliance and labeling for commercial goods. As B2B e-commerce continues to grow, the demand for scalable and efficient fulfillment solutions remains robust, securing the segment's market position.

The direct-to-consumer (D2C) and business-to-consumer (B2C) segment is poised for significant growth, driven by increasing consumer preference for online shopping. E-commerce fulfillment services facilitate streamlined inventory management, order processing, and delivery for individual customer orders. Integration with e-commerce platforms enhances operational efficiency, meeting demands for personalized and expedited shipping options. As consumer expectations evolve, these services are pivotal in supporting the dynamic growth of the D2C/B2C segment.

In 2023, large enterprises commanded the largest market share, leveraging e-commerce fulfillment services to manage high-volume operations and complex supply chains efficiently. Outsourcing fulfillment enables focus on core business functions while ensuring prompt customer delivery, amidst the global surge in online shopping. This trend is anticipated to continue as businesses prioritize operational efficiency and customer satisfaction in an increasingly competitive market environment.

Small and medium enterprises (SMEs) are expected to register significant growth over the forecast period, propelled by the burgeoning online retail sector. E-commerce fulfillment services offer SMEs scalable solutions to compete effectively, optimizing resource allocation for innovation and marketing initiatives. The flexibility and cost-effectiveness of these services make them particularly attractive to expanding enterprises, driving widespread adoption amidst increasing online transactions.

The clothing & footwear segment dominated in 2023, reflecting growing consumer preference for online apparel purchases. E-commerce fulfillment services cater to specific needs such as size variations and presentation-worthy packaging, essential for enhancing customer satisfaction. As online apparel shopping continues to rise, these services are poised to sustain the segment's growth within the market.

The consumer electronics segment is projected to achieve the highest CAGR, fueled by expanding online sales and the convenience of home delivery. E-commerce fulfillment services play a crucial role in ensuring timely and secure delivery of electronics, addressing unique packaging and handling requirements. With increasing adoption by manufacturers and retailers, these services are pivotal in supporting the segment's growth trajectory.

By Service

By Sales Channel

By Organization Size

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on E-commerce Fulfillment Services Market

5.1. COVID-19 Landscape: E-commerce Fulfillment Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global E-commerce Fulfillment Services Market, By Service

8.1. E-commerce Fulfillment Services Market, by Service, 2024-2033

8.1.1. Shipping Fulfillment Services

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Warehousing and Storage Fulfillment Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Bundling Fulfillment Services

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global E-commerce Fulfillment Services Market, By Sales Channel

9.1. E-commerce Fulfillment Services Market, by Sales Channel, 2024-2033

9.1.1. Business to Business

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Direct to Customer/ Business to Customer

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global E-commerce Fulfillment Services Market, By Organization Size

10.1. E-commerce Fulfillment Services Market, by Organization Size, 2024-2033

10.1.1. Large Enterprises

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Small and Medium Enterprises (SMEs)

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global E-commerce Fulfillment Services Market, By Application

11.1. E-commerce Fulfillment Services Market, by Application, 2024-2033

11.1.1. Clothing & Footwear

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Consumer Electronics

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Home & Kitchen Application

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Beauty & Personal Care

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Sports & Leisure

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Automotive

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Books & Stationery

11.1.7.1. Market Revenue and Forecast (2021-2033)

11.1.8. Healthcare

11.1.8.1. Market Revenue and Forecast (2021-2033)

11.1.9. Others

11.1.9.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global E-commerce Fulfillment Services Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Service (2021-2033)

12.1.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.1.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.1.4. Market Revenue and Forecast, by Application (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Service (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Service (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Service (2021-2033)

12.2.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.2.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.2.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Service (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Service (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Service (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Service (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Service (2021-2033)

12.3.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.3.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.3.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Service (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Service (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Service (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Service (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Service (2021-2033)

12.4.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.4.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.4.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Service (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Service (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Service (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Application (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Service (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Application (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Service (2021-2033)

12.5.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.5.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Service (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Application (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Service (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Application (2021-2033)

Chapter 13. Company Profiles

13.1. Amazon.com, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. eFulfillment Service

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Ingram Micro, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Rakuten Super Logistics

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Red Stag Fulfillment

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. ShipBob, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Shipfusion Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Xpert Fulfillment

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Sprocket Express

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. FedEx

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others