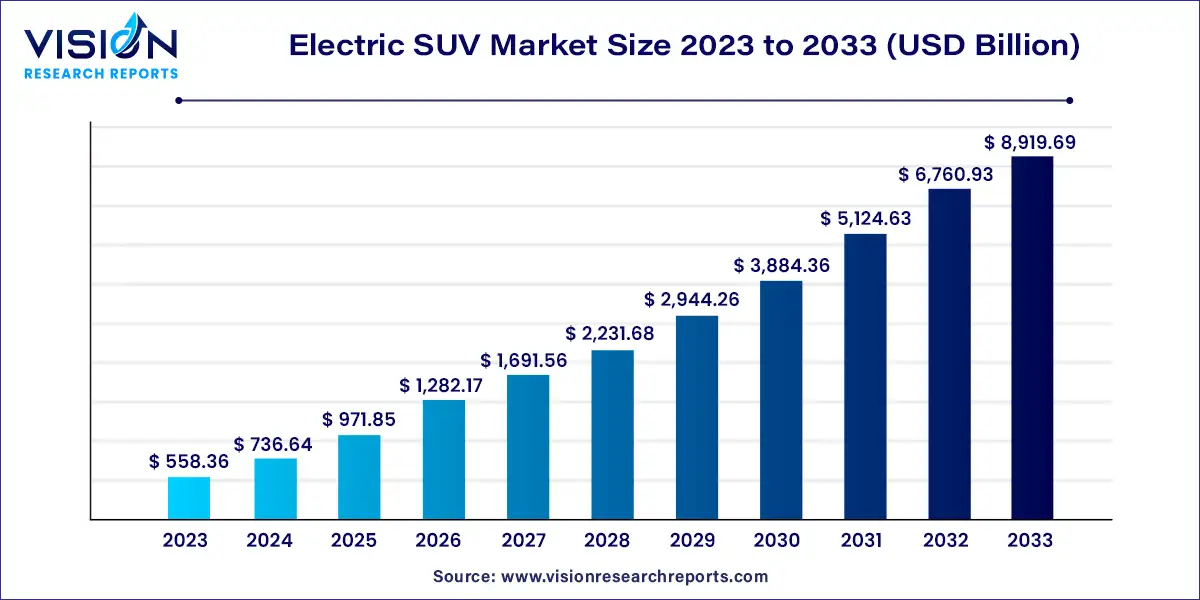

The global electric SUV market size was estimated at around USD 558.36 billion in 2023 and it is projected to hit around USD 8,919.69 billion by 2033, growing at a CAGR of 31.93% from 2024 to 2033.

Electric SUVs have emerged as a pivotal segment within the electric vehicle (EV) industry, combining the growing demand for SUVs with the environmental benefits of electric propulsion. These vehicles offer significant advantages in terms of reduced emissions, lower operational costs, and enhanced driving experience, catering to both consumer preferences and regulatory pressures towards sustainability.

The growth of the electric SUV market is driven by the stringent emissions regulations worldwide compel automakers to expand their electric vehicle (EV) offerings, including SUVs, to meet environmental standards. Secondly, rising consumer awareness of environmental issues and the desire for high-performance, spacious vehicles are increasing the demand for electric SUVs. Technological advancements in battery technology, extending driving ranges, and improving charging infrastructure further bolster consumer confidence in electric vehicles. These factors collectively propel the electric SUV market forward, promising continued growth and innovation in the coming years.

In 2023, the compact SUV segment emerged as the market leader, commanding 54% of global revenue. The rise of electric SUVs (e-SUVs) in this category has been fueled by their attractive designs and improved fuel efficiency, resulting in increased consumer preference for practical and eco-friendly commuting options. Models like the Hyundai IONIQ 5, Kia EV6, and Ford Mustang Mach-E exemplify the growing demand and availability of compact e-SUVs, driving robust segment growth.

The mid-size segment is poised for significant expansion from 2024 to 2033. Mid-size e-SUVs are gaining popularity among electric vehicle buyers for their versatility, spaciousness, and upscale appeal. Larger than compact models, they offer ample cargo and passenger space, making them ideal for families and travelers needing room for gear. This size advantage ensures a comfortable and practical driving experience, enhancing their appeal across diverse consumer demographics.

In 2023, Battery Electric Vehicles (BEVs) dominated the market. These vehicles operate solely on electric power derived from rechargeable battery packs, offering emissions-free transportation. The growing adoption of battery-powered SUVs is driven by their cost-effectiveness, environmental benefits, and quieter driving experience, contributing to the segment’s growth.

The Plug-In Hybrid Electric Vehicle (PHEV) segment is expected to experience substantial growth from 2024 to 2033. PHEVs offer flexibility by running on electricity or switching to gasoline as needed, providing extended range and reducing emissions during short trips. Their capability to operate in electric mode for local journeys appeals to eco-conscious consumers seeking fuel efficiency and environmental benefits.

In 2023, the up to 250-mile range segment dominated the market. The popularity of smaller, more affordable e-SUVs with simpler designs and smaller battery packs has fueled growth in this category. These vehicles are well-suited for urban commuting and local errands, offering maneuverability and convenience in city settings.

The 250-500-mile range segment is forecasted to grow significantly from 2024 to 2033. E-SUVs within this range offer practicality and environmental advantages, catering to consumers’ increasing preference for long-distance electric vehicles. Models like the 2024 Audi Q4 e-tron, with an estimated range of up to 258 miles, exemplify the expanding options available in this segment.

Front-wheel drive (FWD) dominated the market in 2023, reflecting its widespread adoption across various vehicle types. Many e-SUV manufacturers place the electric motor at the front to power the front wheels, enhancing efficiency and performance. Examples include the Hyundai Kona Electric and Nissan Leaf.

The all-wheel drive (AWD) segment is expected to grow significantly from 2024 to 2033. AWD e-SUVs utilize dual electric motors to power both front and rear wheels, improving traction and capability in diverse driving conditions such as snow and rough terrain. Models like the Tesla Model Y, equipped with dual-motor AWD systems, underscore the increasing availability and appeal of AWD e-SUVs.

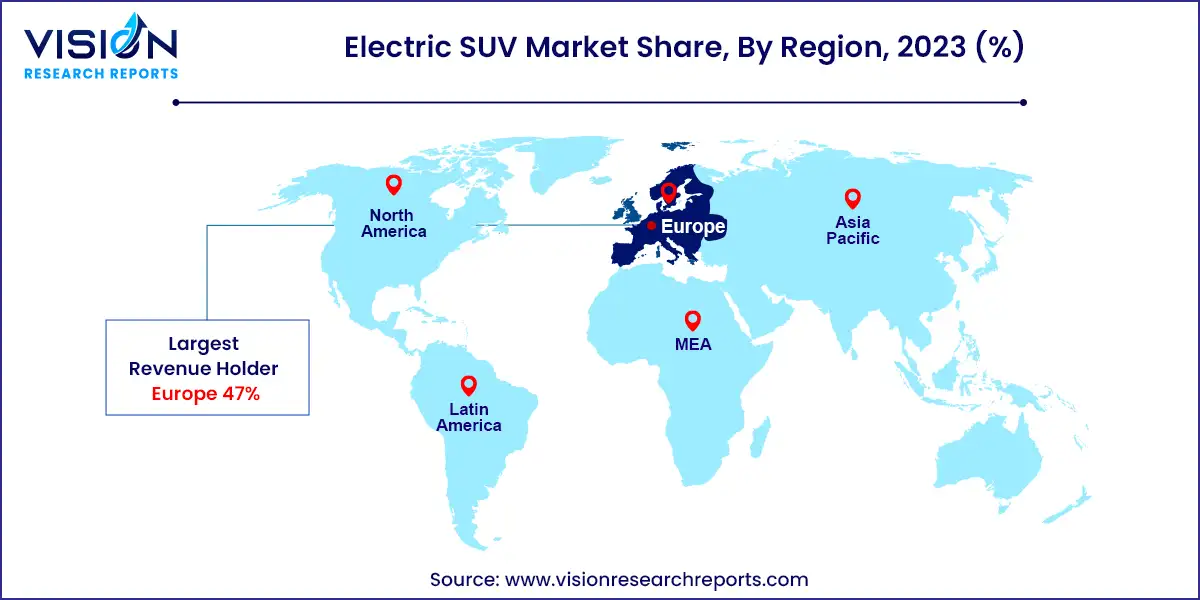

In 2023, the electric SUV market in Europe led globally with a 47% share of total revenue. The market's growth is driven by increasing consumer demand for electric vehicles, particularly e-SUVs, fueled by environmental concerns and a preference for advanced, high-performance vehicles. According to the European Environment Agency, the adoption of electric vehicles in Europe is steadily rising, with electric cars accounting for 23.6% of all new car registrations in 2023.

North America’s electric SUV market is poised for notable growth from 2024 to 2033, driven by ongoing efforts to expand electric vehicle charging infrastructure in the United States and Canada. Technological advancements, a focus on sustainable transport, and initiatives to reduce carbon emissions are expected to support steady market expansion in the region.

By Vehicle Type

By Propulsion Type

By Vehicle Range

By Drive Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Electric SUV Market

5.1. COVID-19 Landscape: Electric SUV Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Electric SUV Market, By Vehicle Type

8.1. Electric SUV Market, by Vehicle Type, 2024-2033

8.1.1. Compact

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Mid-size

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Full-size

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Electric SUV Market, By Propulsion Type

9.1. Electric SUV Market, by Propulsion Type, 2024-2033

9.1.1. Battery Electric Vehicle (BEV)

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Plug-in Hybrid Electric Vehicle (PHEV)

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Electric SUV Market, By Vehicle Range

10.1. Electric SUV Market, by Vehicle Range, 2024-2033

10.1.1. Up to 250 Miles

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. 250-500 Mile

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Above 500 Miles

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Electric SUV Market, By Drive Type

11.1. Electric SUV Market, by Drive Type, 2024-2033

11.1.1. FWD

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. RWD

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. AWD

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Electric SUV Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.1.4. Market Revenue and Forecast, by Drive Type (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Drive Type (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Drive Type (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.2.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.2.4. Market Revenue and Forecast, by Drive Type (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Drive Type (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Drive Type (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Drive Type (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Drive Type (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.3.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.3.4. Market Revenue and Forecast, by Drive Type (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Drive Type (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Drive Type (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Drive Type (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Drive Type (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.4.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.4.4. Market Revenue and Forecast, by Drive Type (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Drive Type (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Drive Type (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Drive Type (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Drive Type (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.5.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.5.4. Market Revenue and Forecast, by Drive Type (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Drive Type (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Vehicle Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Propulsion Type (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Vehicle Range (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Drive Type (2021-2033)

Chapter 13. Company Profiles

13.1. Tesla Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. BYD Company Ltd.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Hyundai Motor Company

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Toyota Motor Corporation

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Nissan Motor Corporation

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Kia Corporation

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Ford Motor Company

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Volkswagen AG

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. AB Volvo

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Honda Motor Co., Ltd.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others