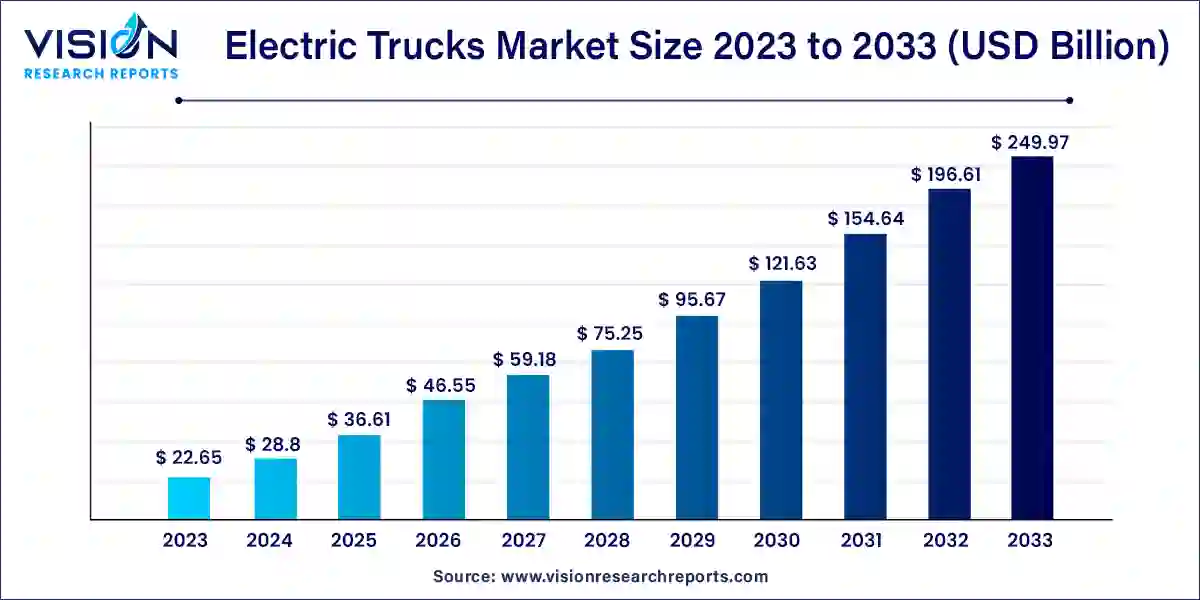

The global electric trucks market size was estimated at around USD 22.65 billion in 2023 and it is projected to hit around USD 249.97 billion by 2033, growing at a CAGR of 27.14% from 2024 to 2033. The electric trucks market is experiencing significant growth due to increasing environmental regulations, advancements in battery technology, and the growing push for sustainable transportation. Electric trucks, which include light, medium, and heavy-duty vehicles, are seen as a key solution for reducing carbon emissions in the transportation sector. These trucks are powered by electricity rather than conventional fossil fuels, providing a cleaner alternative with lower operational costs over time.

The electric trucks market is driven by an increasing emphasis on reducing carbon emissions and combating climate change. Governments worldwide are implementing stringent regulations and offering incentives to promote the adoption of electric vehicles, including trucks. Additionally, advancements in battery technology are improving the range and efficiency of electric trucks, making them more viable for long-distance transportation. The rising fuel prices and the lower total cost of ownership of electric trucks compared to diesel-powered trucks are further encouraging fleet operators to transition towards electric alternatives. Moreover, growing awareness among consumers and businesses about the environmental benefits of electric vehicles is accelerating the market's expansion.

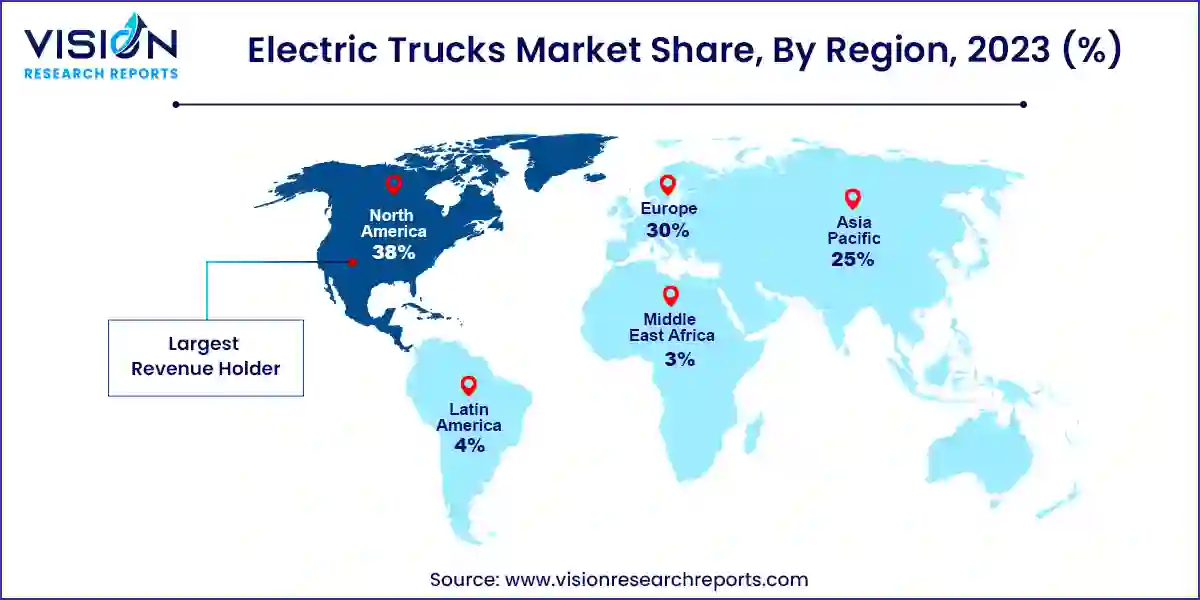

North America dominated the global electric truck market with a 38% revenue share in 2023. Strong government policies and incentives aimed at cutting carbon emissions have accelerated the shift toward electric mobility. Both federal and state governments in the U.S. are offering tax credits, grants, and subsidies to encourage investment in electric trucks. Additionally, new product offerings and services by manufacturers have spurred demand for electric vehicles. For example, in July 2024, Isuzu launched connected services for its BEV trucks using the GATEX platform to support uptime and charging management. This coincided with the launch of its N-Series light-duty BEV trucks in August 2024.

In 2023, the U.S. accounted for the largest share of the North American market, driven by stringent environmental regulations and supportive policies such as the EPA's Clean Truck Plan. Partnerships between manufacturers have accelerated the development of advanced features like autonomous driving and smart logistics solutions. In January 2024, Accelera, Daimler Truck, and PACCAR selected Marshall County, Mississippi, for their new battery cell manufacturing plant to localize production for commercial electric vehicles, with plans to expand capacity to meet growing demand by 2027.

Europe held a significant share of the global market in 2023, spurred by stringent emissions regulations set by the European Union. The region's well-established vehicle engineering ecosystem, particularly in Germany, the UK, and France, has led to innovative solutions from electric truck manufacturers. For example, in June 2024, Daimler Truck launched its TruckCharge brand, offering comprehensive electric truck charging infrastructure solutions across Europe, including consulting, hardware, and digital services.

The Asia Pacific region is expected to grow at the fastest rate during the forecast period, driven by favorable government initiatives like China's NEV mandate and India's FAME scheme. The expanding e-commerce and logistics sectors, alongside regional manufacturers like BYD, FAW Group, and Dongfeng Motor, are driving electric truck innovation and adoption. India’s growing automotive sector, supported by rising income levels and government efforts to promote EV adoption, is also contributing to the region's market growth. Domestic manufacturers such as Tata Motors and Ashok Leyland are heavily investing in electric vehicle technology to meet the increasing demand for sustainable transportation solutions.

Light-duty trucks dominated the market with a revenue share of 65% in 2023, largely due to their widespread use in urban delivery and logistics applications where electric vehicle advantages are most apparent. These trucks are ideal for short- to medium-haul routes, offering reduced operational costs, zero to low emissions, and enhanced performance. The rising demand for sustainable last-mile delivery, driven by e-commerce growth and urbanization, has boosted the adoption of light-duty electric trucks. Additionally, these vehicles consume less energy, making them cost-efficient and appealing to fleet operators focused on reducing their environmental impact.

Medium-duty trucks are projected to grow at the fastest CAGR during the forecast period. This growth is driven by factors such as falling battery prices, advancements in technology, and the expanding charging infrastructure, which are making these trucks a feasible option for various applications. Their ability to meet the evolving needs of commercial fleets and support the transition to sustainable transportation has spurred demand. Moreover, medium-duty electric trucks are positioned to capitalize on the increasing need for sustainable logistics, fueled by regulatory demands and consumer pressure.

Battery Electric Vehicles (BEV) held the largest market share in 2023 due to their superior performance, reduced operating costs, and growing acceptance as alternatives to internal combustion engine (IC) trucks. BEVs rely solely on batteries and electric motors, offering a strong value proposition for fleet operators aiming to cut environmental impact, reduce fuel expenses, and lower maintenance costs. The increasing availability of BEV models across different weight categories, coupled with advancements in battery technology and falling costs, has made them more competitive with diesel trucks. For example, in March 2024, Scania expanded its BEV lineup, introducing new axle configurations, electric machines, and improved batteries for its electric trucks.

Hybrid Electric Vehicles (HEV) are expected to grow significantly from 2024 to 2033. Positioned as a transitional technology, HEVs bridge the gap between traditional IC trucks and BEVs, providing a gradual transition to electric propulsion. HEVs balance environmental sustainability with practical operation, particularly in long-haul and heavy-duty scenarios. Additionally, ongoing HEV technology improvements, including better fuel efficiency and lower emissions, are enhancing their market competitiveness.

Electric trucks with a range of up to 300 miles held the highest market share in 2023. This range aligns well with the daily requirements of commercial fleets, particularly in urban and regional transportation. Trucks in this range offer a good balance between adequate range for daily operations and minimized battery capacity, which helps reduce initial costs and improve total ownership costs. They are ideal for applications like parcel delivery, food distribution, and municipal services, where routes are predictable and charging infrastructure is readily available. These factors have led to the dominance of this segment.

The 300-600 miles range segment is anticipated to grow at the fastest CAGR during the forecast period. This growth is driven by the increasing adoption of vehicles in this range by fleets looking to electrify long-haul operations. Trucks in this range allow fleets to transition to electric vehicles for regional and interstate applications while minimizing range anxiety and downtime for charging. Innovations in battery technology, cost reductions, and expanding charging networks have further increased demand for extended-range trucks.

The logistics and delivery segment captured the largest market share in 2023, driven by the rising need for sustainable and efficient last-mile delivery solutions. The growth of e-commerce and increasing consumer expectations for fast and reliable deliveries have bolstered demand for electric trucks, particularly in urban logistics where routes are shorter and more predictable. Logistics companies are also under pressure to reduce their environmental impact, making electric trucks an attractive solution to meet sustainability targets. For instance, in June 2024, IKEA partnered with KLOG to use Scania electric trucks for transporting products from its Paços de Ferreira factory to Porto Harbour and IKEA stores, highlighting the strong growth potential of this market.

The waste management sector is expected to see notable growth from 2024 to 2033. The adoption of electric vehicles in waste management is growing as companies seek to reduce emissions, lower operational costs, and lessen environmental impact. Electric trucks are well-suited for waste management applications, where routes are predictable and involve frequent stops, allowing for regenerative braking and energy recovery. The sector is benefiting from advancements in electric vehicle technology, such as increased range and payload capacity, making electric trucks a practical option for a wider variety of tasks.

By Vehicle

By Propulsion

By Vehicle Range

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others