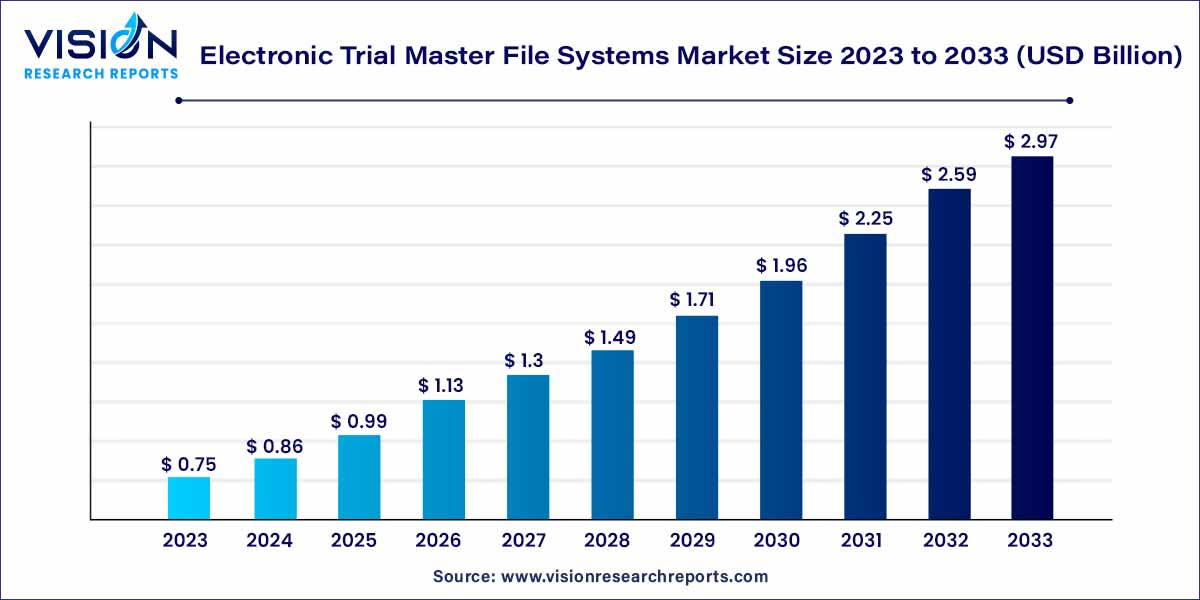

The global electronic trial master file systems market size was estimated at USD 0.75 billion in 2023 and it is expected to surpass around USD 2.97 billion by 2033, poised to grow at a CAGR of 14.75% from 2024 to 2033. The rising number of clinical studies and the expanding use of eTMF devices are credited with driving the market expansion.

The Electronic Trial Master File (eTMF) systems market has witnessed significant growth in recent years due to the increasing adoption of electronic document management solutions in the pharmaceutical and biotechnology industries. eTMF systems play a crucial role in streamlining clinical trial processes, enhancing regulatory compliance, and improving collaboration among stakeholders.

The growth of the electronic trial master file (eTMF) systems market is fueled by several key factors. Firstly, the increasing adoption of paperless solutions within the pharmaceutical and biotechnology industries is driving demand for eTMF systems, as organizations seek more efficient data management and document control processes. Secondly, stringent regulatory compliance requirements imposed by agencies such as the FDA and EMA necessitate the implementation of eTMF systems to ensure data integrity and audit readiness. Additionally, the rising number of clinical trials worldwide, spurred by advancements in healthcare technology and the demand for innovative therapies, is boosting the need for eTMF solutions to manage trial documentation effectively. Furthermore, continuous technological advancements in eTMF software, including cloud-based solutions and mobile accessibility, are enhancing system efficiency and scalability, further driving market growth. Overall, these growth factors underscore the increasing importance of eTMF systems in streamlining clinical trial processes and supporting regulatory compliance efforts within the life sciences industry.

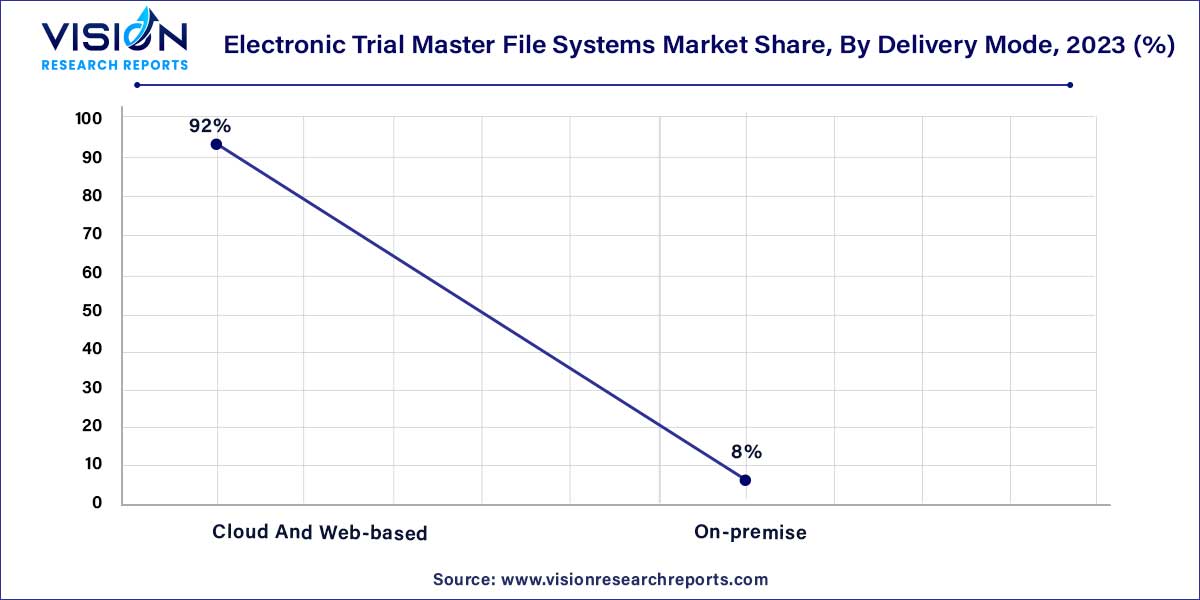

The cloud and web-based segment held the dominant position in the market, accounting for the largest revenue share of 92% in 2023. This was attributed to the various benefits it offers, including easy accessibility, usability, and lower investments. Cloud and web-based products also provide easy customization options, enabling providers to tailor information presentations for different user groups effectively. Additionally, these products demonstrate higher interoperability, further enhancing their appeal. It is anticipated that this segment will maintain its leading position throughout the forecast period.

On the other hand, the on-premise delivery mode involves the installation of services and solutions on computers located within the organization. Despite requiring the software to be installed within the organization's premises, it can still be accessed from remote locations, offering the advantage of reduced costs associated with power consumption and system maintenance. The on-premise eTMF solution is highly preferred due to its benefits, such as enhanced security and ease of access. The preference for these services primarily stems from the complete access to information and the sense of full control maintained within the organization's premises.

In 2023, the Phase III segment emerged as the market leader, capturing the largest revenue share of 54%. This dominance is attributed to the remarkable growth within the drug development sector, driven by an increasing number of drugs successfully progressing to Phase III trials. Phase III trials typically involve studying drug efficacy in a patient group exceeding 1,000 individuals. As the patient cohort grows, the complexity of studies escalates, thereby creating a heightened demand for technologically advanced data management systems. Consequently, computer-based solutions such as eTMF (Electronic Trial Master File) systems are witnessing a steady rise in adoption.

Moreover, the Phase I segment is projected to experience the swiftest growth, with CAGR of 15.63% from 2024 to 2033. This growth trajectory is primarily fueled by the substantial number of Phase I trials conducted and the intricate management and analysis of data collected across these studies. Notably, as of June 2021, the American clinical trial database reported approximately 20,182 registered clinical trials in the UK alone. Advances in biological modeling systems and personalized medicine technologies have further catalyzed the development of new drugs, thereby propelling market expansion.

The Contract Research Organizations (CROs) segment emerged as the market leader in 2023, capturing the largest revenue share of 38%. Furthermore, this segment is projected to experience the highest Compound Annual Growth Rate (CAGR) of 15.05% during the forecast period. A key driver behind this growth is the increasing emphasis among pharmaceutical companies on reducing overall expenditure, prompting a surge in the adoption of eTMF (Electronic Trial Master File) solutions within research operations.

The notable benefits associated with outsourcing clinical trials to CROs have significantly fueled the expansion of this segment. For instance, in January 2021, ICON plc provided clinical trial services to BioNTech SE and Pfizer, exemplifying the advantages of a strong partnership between sponsors and CROs. This collaborative effort has set new industry standards in terms of trial management efficiency and speed, showcasing the transformative impact of such alliances.

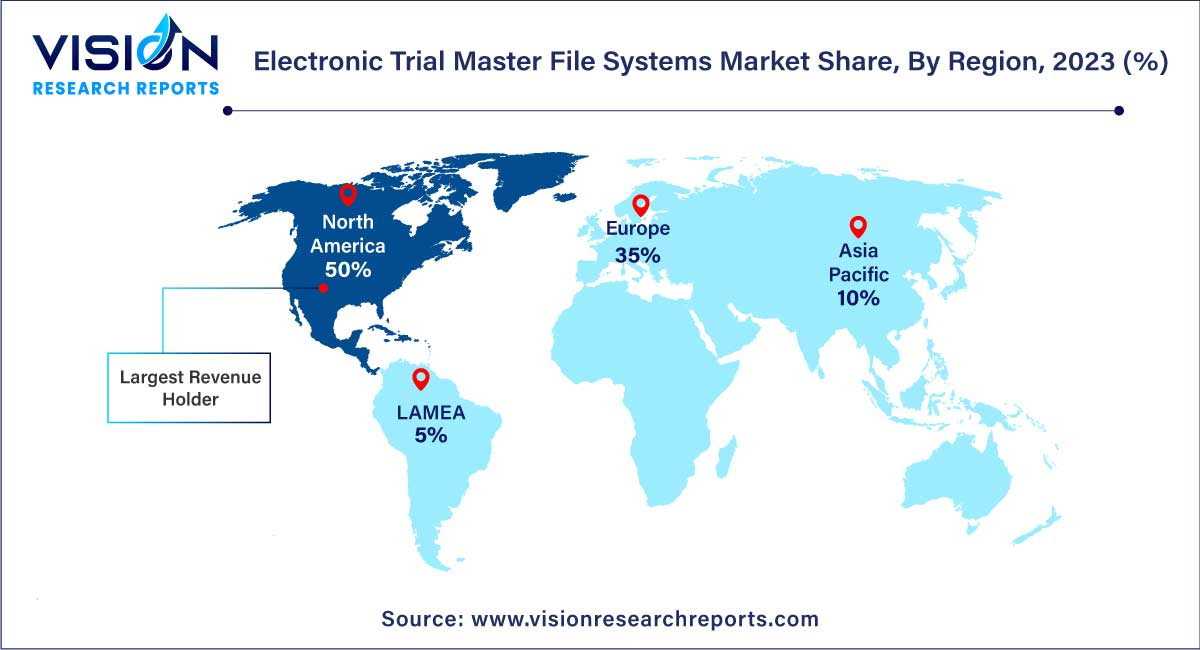

North America commanded the market in 2023, capturing the largest revenue share of 50%. The region's market growth can be attributed to several factors, including an expanding target population, a notable increase in lifestyle-related ailments such as diabetes and cardiovascular disorders, and the introduction of new products by key market players. Additionally, government grants have played a significant role in bolstering market growth within the region. Moreover, the presence of a well-established healthcare infrastructure is expected to further augment the regional market's growth trajectory.

U.S. Electronic Trial Master File (eTMF) Systems Market U.S. eTMF systems market is poised for growth, benefiting from a robust healthcare infrastructure and government support in the form of grants and funding for healthcare research and development.

Europe Electronic Trial Master File (eTMF) Systems Market Europe eTMF systems market is expected to experience significant growth, driven by increasing demand for cloud-based solutions in clinical trials and the necessity for improved data sharing and collaboration among stakeholders.

Germany Electronic Trial Master File (eTMF) Systems Market Germany eTMF systems market is anticipated to grow, reflecting a focus on patient-centric approaches in healthcare and clinical research within the country.

Denmark Electronic Trial Master File (eTMF) Systems Market Denmark eTMF systems market is projected to grow, influenced by a rising population and preventive initiatives by the healthcare system, leading to increased adoption of eTMF services.

Meanwhile, in the Asia-Pacific region, the eTMF systems market is poised for rapid expansion, boasting the highest CAGR of 16.53% over the forecast period. This surge is fueled by the region's substantial unmet medical needs, escalating prevalence of chronic diseases, and the outsourcing of clinical trials to countries such as China, India, Korea, and Japan. These nations offer large patient populations and cost advantages, making them increasingly attractive destinations for trial conduct, thereby propelling market growth in the Asia-Pacific region.

By Delivery Mode

By Clinical Trials

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Delivery Mode Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Electronic Trial Master File Systems Market

5.1. COVID-19 Landscape: Electronic Trial Master File Systems Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Electronic Trial Master File Systems Market, By Delivery Mode

8.1. Electronic Trial Master File Systems Market, by Delivery Mode, 2024-2033

8.1.1 Cloud And Web-based

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. On-premise

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Electronic Trial Master File Systems Market, By Clinical Trials

9.1. Electronic Trial Master File Systems Market, by Clinical Trials, 2024-2033

9.1.1. Phase I

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Phase II

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Phase III

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Phase IV

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Electronic Trial Master File Systems Market, By End-use

10.1. Electronic Trial Master File Systems Market, by End-use, 2024-2033

10.1.1. Hospitals/Healthcare providers

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Contract Research Organizations (CROs)

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Academic Institutes

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Pharma & Biotech Organizations

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Medical Device Manufacturers

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Electronic Trial Master File Systems Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.1.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.2.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.3.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.4.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.5.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Delivery Mode (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Clinical Trials (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Oracle.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Clinevo Technologies.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. MasterControl Solutions, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Veeva Systems.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Aris Global LLC.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. PHARMALEX GMBH

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. TransPerfect.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Aurea, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. ePharmaSolutions (WCG Clinical).

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. SureClinical Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others