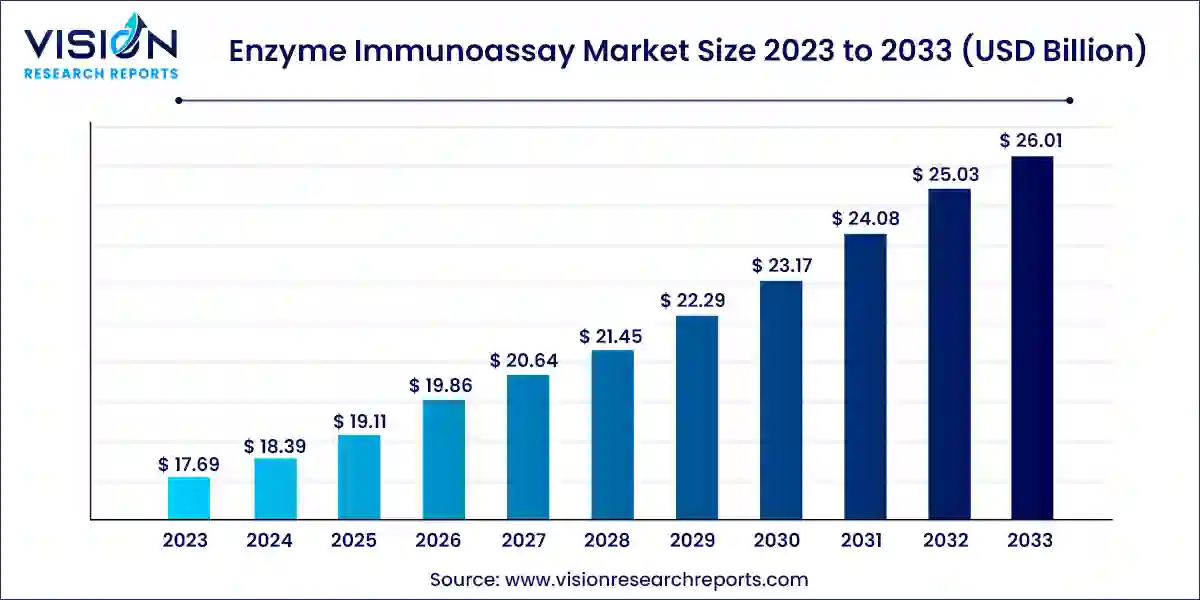

The global enzyme immunoassay market size was estimated at around USD 17.69 billion in 2023 and it is projected to hit around USD 26.01 billion by 2033, growing at a CAGR of 3.93% from 2024 to 2033.

Enzyme immunoassay (EIA), also known as enzyme-linked immunosorbent assay (ELISA), is a widely utilized biochemical technique employed for the detection of various analytes in clinical diagnostics, pharmaceuticals, and research applications. With its versatility and high sensitivity, the enzyme immunoassay market has experienced significant growth in recent years.

The growth of the enzyme immunoassay market growth is driven by an increasing prevalence of chronic and infectious diseases worldwide has fueled the demand for diagnostic assays capable of accurate and timely detection. Additionally, advancements in assay technologies, such as enhanced sensitivity and specificity, have contributed to the market's growth by enabling the development of more reliable and efficient immunoassays. Moreover, rising healthcare expenditure, coupled with the growing focus on preventive healthcare measures, has led to greater adoption of enzyme immunoassays in clinical diagnostics.

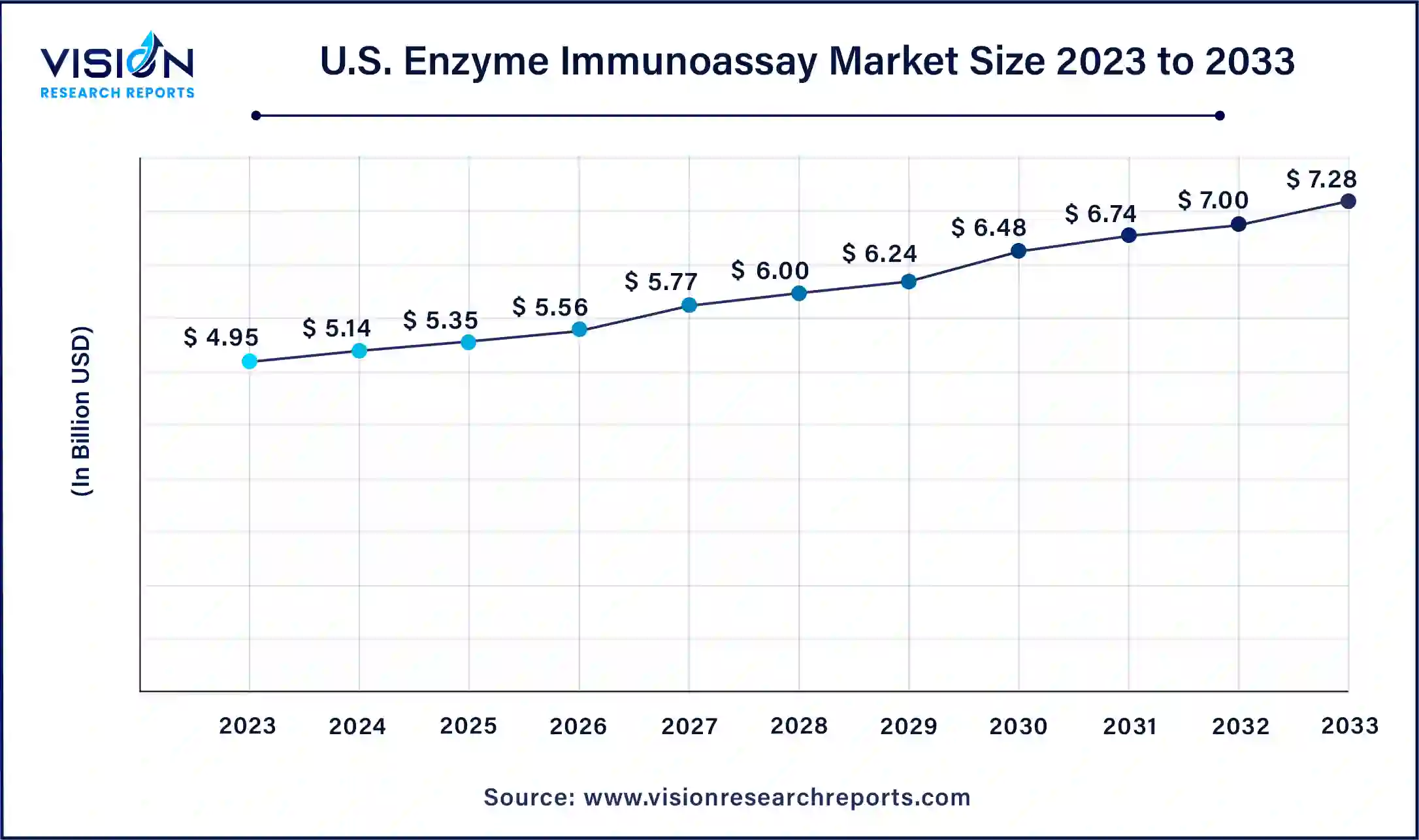

The U.S. enzyme immunoassay market size was valued at USD 4.95 billion in 2023 and it is predicted to surpass around USD 7.28 billion by 2033 with a CAGR of 3.93% from 2024 to 2033.

The enzyme immunoassay market in the U.S. is anticipated to thrive over the forecast period, driven by the presence of numerous market players undertaking diverse strategic initiatives such as collaborations and product launches. Moreover, the escalating prevalence of cardiovascular diseases in the U.S. serves as a major catalyst for market growth. EIAs play a pivotal role in detecting cardiac markers crucial for diagnosing heart-related ailments.

In 2023, North America claimed the largest market share, accounting for 40% of the enzyme immunoassay market. The region, chiefly the U.S., is renowned for its advanced healthcare infrastructure and robust biotechnology research sectors. Continuous investments and advancements in these domains have propelled innovations in EIA technologies, enhancing their efficiency and reliability. Government initiatives aimed at enhancing healthcare quality and accessibility, alongside substantial funding for diagnostics-related research and development endeavors, have notably contributed to the market's growth trajectory.

The enzyme immunoassay market in the Asia Pacific region is poised to exhibit the highest CAGR of 6.53% over the forecast period. Countries such as China, India, Japan, South Korea, and Singapore are witnessing rapid industrialization and economic expansion. This growth trajectory fuels demand across various sectors, including pharmaceuticals and biotechnologies, all of which rely on enzyme immunoassays. Noteworthy investments by governments and private entities in healthcare infrastructure, pharmaceutical research, and life sciences further drive the demand for EIAs, particularly in combating infectious diseases.

In 2023, the reagents and kits segment asserted its dominance in the market, capturing a substantial revenue share of 68%. These reagents and kits, tailored for enzyme immunoassays, are extensively applied across diverse sectors such as clinical diagnostics, pharmaceutical analysis, and food safety testing. Their widespread utility stems from their ability to meet varied needs and requirements within these fields.

Expectedly, the software and services segment is poised to register a significant compound annual growth rate (CAGR) from 2024 to 2033. The increasing complexity of immunoassay tests and the imperative for accurate, reliable results are compelling laboratories and healthcare facilities to adopt sophisticated software solutions. These solutions facilitate efficient data management and ensure result precision through advanced algorithms and data analysis techniques. Moreover, the growing demand for laboratory automation to handle high volumes of tests efficiently is propelling the growth of this segment.

The infectious diseases testing segment dominated the market in 2023 and is anticipated to maintain the fastest CAGR over the forecast period. The segment's dominance is attributed to the high prevalence and incidence rates of infectious diseases globally, particularly in developing nations. This drives the demand for effective and efficient diagnostic methods, with enzyme immunoassays being highly preferred due to their sensitivity and specificity. Additionally, public health initiatives and global health programs aimed at controlling infectious diseases rely extensively on serological assays, including enzyme immunoassays, for disease screening and monitoring purposes.

Over the forecast period, the oncology segment is projected to experience significant growth owing to the rising prevalence of cancer worldwide and the imperative for early detection and disease monitoring. With approximately 1.96 million new cancer cases diagnosed in 2023, enzyme immunoassays emerge as a preferred method for detecting biomarkers associated with various cancer types due to their high sensitivity and specificity. These assays play a crucial role in early diagnosis and treatment planning, facilitated by technological advancements leading to the development of more efficient and cost-effective EIA tests.

In 2023, the blood specimen segment emerged as the dominant revenue contributor. Blood-based enzyme immunoassays are highly sensitive and specific, making them invaluable for early disease detection and accurate diagnosis. Given the comprehensive circulation of blood throughout the body, it serves as an ideal specimen for broad-spectrum disease screening and monitoring, encompassing infections, chronic diseases, and hormonal imbalances.

Expectedly, the urine specimen segment is poised to register the fastest CAGR over the forecast period. Urine sampling, being non-invasive, is favored by patients and healthcare providers alike. The ease of collection encourages its preference, particularly for routine monitoring and screening purposes. With the growing demand for point-of-care testing and preventive healthcare, urine-based enzyme immunoassay kits are increasingly utilized, given their ability to deliver rapid results with minimal equipment.

The hospital segment emerged as the leading revenue contributor in 2023. Hospitals, being primary healthcare institutions, handle a diverse array of diseases and patient samples, necessitating extensive utilization of enzyme immunoassay technologies. Timely and accurate diagnostic methods are imperative for effective patient care management, with enzyme immunoassays fulfilling these requirements by providing precise results crucial for informed treatment decisions. The adoption of advanced EIA platforms is particularly prevalent in hospitals in developed countries, driven by the imperative for enhanced diagnostic accuracy, improved patient outcomes, and operational efficiency.

The clinical laboratories segment is projected to witness the fastest CAGR during the forecast period. This growth is spurred by the escalating demand for diagnostic services, driven by the increasing prevalence of chronic and infectious diseases, and the imperative for early disease detection. Clinical laboratories play a pivotal role in diagnosing and managing these conditions through a multitude of tests, including enzyme immunoassays. Heightened awareness among the general populace regarding the significance of preventive healthcare and early diagnosis, coupled with augmented healthcare expenditure by both governments and individuals, further bolsters the expansion of diagnostic services, particularly those offered by clinical laboratories.

By Product

By Application

By Specimen

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others