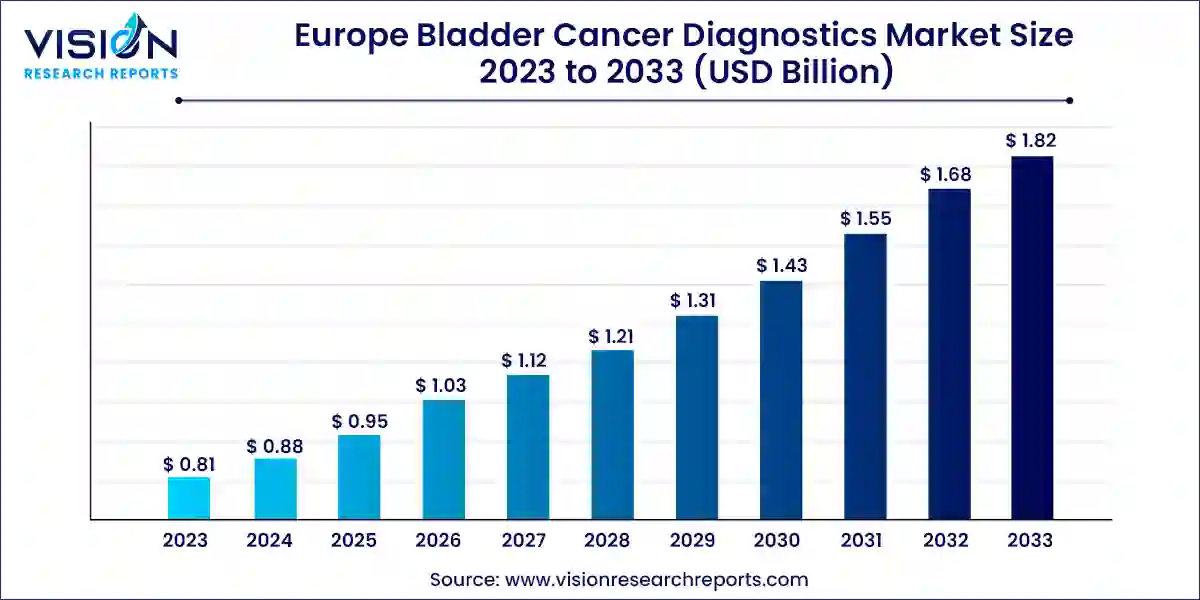

The Europe bladder cancer diagnostics market size was estimated at around USD 0.81 billion in 2023 and it is projected to hit around USD 1.82 billion by 2033, growing at a CAGR of 8.41% from 2024 to 2033. The bladder cancer diagnostics market in Europe has experienced substantial growth in recent years, driven by rising awareness of the disease, increasing prevalence of bladder cancer, and advancements in diagnostic technologies. Bladder cancer is one of the most common urological cancers, particularly affecting older populations, and Europe has witnessed a notable rise in its incidence.

The growth of the Europe bladder cancer diagnostics market is primarily driven by an increasing prevalence of bladder cancer, particularly among the aging population in Europe. As the population ages, the risk of bladder cancer rises, leading to a higher demand for diagnostic services. Additionally, advancements in diagnostic technologies, such as improved imaging techniques, biomarker-based tests, and non-invasive screening methods, are enhancing early detection and accuracy, fueling market expansion. Government initiatives and healthcare programs aimed at promoting cancer screening and prevention have also played a crucial role in driving the market. These programs focus on raising awareness, improving access to diagnostic tools, and encouraging early-stage diagnosis, which ultimately boosts the adoption of bladder cancer diagnostics across Europe.

In 2023, cystoscopy accounted for the largest revenue share of 48%. Cystoscopy is a critical diagnostic technique that allows direct visualization of the bladder, making it highly effective for early detection and monitoring of bladder cancer. Its integration with other diagnostic tools further enhances its utility, driving market growth. The increasing incidence of bladder cancer and the need for early detection and regular surveillance have led to the rising adoption of cystoscopy in Europe. The European Association of Urology (EAU) Clinical Guidelines also recognize cystoscopy as a key diagnostic tool for bladder cancer, adding to its significance in the region.

Moreover, growing product approvals contribute to the expansion of the bladder cancer diagnostics market. For example, in October 2023, Ambu received a European CE mark for its Ambu aScope 5 Cysto HD cystoscope, used in conjunction with the Ambu aView 2 Advance full-HD endoscopy system. This advanced cystoscope offers high-resolution imaging and complements their existing aScope 4 Cysto, providing diverse solutions for both standard and high-definition cystoscopy needs.

The other segment, which includes MRI, CT scans, AI-based diagnostics, and emerging technologies, is expected to witness the fastest growth, with a CAGR of 9.75% during the forecast period. MRI and CT scans play vital roles in imaging diagnostics by providing detailed anatomical images, crucial for bladder cancer staging and assessing treatment response. Additionally, AI-based diagnostics, which utilize machine learning algorithms to enhance imaging analysis, are becoming increasingly integrated into diagnostic processes, further accelerating the market’s growth.

In 2023, transitional cell bladder cancer (TCBC) dominated the market, accounting for the largest share of 88%. TCBC represents over 90% of bladder cancer cases in Europe, driving the demand for advanced diagnostic methods aimed at improving early detection and treatment outcomes. Diagnostic techniques like cystoscopy, molecular testing, and imaging are critical for accurately detecting and staging TCBC, which is essential for optimal patient management in Europe. According to Cancer Research UK, around 90% of bladder cancers are urothelial cancers, also known as transitional cell cancers. A comprehensive diagnostic approach, including cystoscopy, urine cytology, and imaging tests, helps ensure accurate detection and staging of TCBC.

The squamous cell carcinoma (SCC) segment is expected to grow at a faster pace, driven by advances in molecular biology that enable early detection through biomarkers such as Psoriasin and Galectin 3. In regions where schistosomiasis is endemic, treatment with anti-bilharzia therapies has significantly reduced the incidence of SCC. Early detection techniques and surveillance programs, along with innovative diagnostic tools, are key drivers for the growth of the SCC segment in the bladder cancer diagnostics market.

In 2023, the hospital settings segment led the market, capturing a 76% share. Hospitals play a crucial role in diagnosing and managing bladder cancer, equipped with advanced diagnostic tools like cystoscopy, urine lab tests, and imaging technologies essential for accurate detection and treatment. The prevalence of bladder cancer in Europe has increased the demand for such sophisticated diagnostic tests in hospitals, where advanced technologies help in early detection and disease monitoring.

A significant challenge in Europe is the lack of awareness about bladder cancer. A 2022 survey by the European Association of Urology (EAU) revealed that 60% of adults are unaware of the seriousness of bladder cancer, and many do not recognize symptoms such as changes in urine color. As awareness grows through public health campaigns, the demand for diagnostic procedures in hospital settings is likely to increase, further boosting market growth.

The non-hospital settings segment, which includes specialty clinics, ambulatory surgical centers, and cancer treatment centers, is expected to grow at a faster rate. These facilities provide advanced diagnostic services outside traditional hospital settings, offering more accessible, cost-effective, and patient-centric care through technologies like ultrasound and urine cytology for bladder cancer diagnosis.

Germany Bladder Cancer Diagnostics Market Trends

Germany led the European bladder cancer diagnostics market in 2023, holding an 19% share. Bladder cancer is a serious health concern in the country, with significant statistics showcasing its impact. According to the World Cancer Research Fund International, Germany saw 29,035 new bladder cancer cases in 2022, highlighting the high prevalence of the disease. The mortality rate is also notable, with 9,180 deaths reported in the same year. These numbers underscore the severity of bladder cancer and the challenges in managing and treating the disease effectively.

The gap between the incidence and mortality rates points to the importance of improved treatment options, early detection, and enhanced healthcare strategies. To address this burden, several initiatives from key industry players and government bodies are underway, indicating significant market growth potential.

UK Bladder Cancer Diagnostics Market Trends

In the UK, advancements in bladder cancer diagnostics, particularly for squamous cell carcinoma (SCC), are notable. Innovations like the EarlyTect BCD test are improving diagnostic accuracy while reducing the need for invasive procedures. Non-invasive tests, such as UroAmp, are driving market growth, and trials like the BOXIT study highlight the economic burden of bladder cancer, further emphasizing the demand for more accurate and cost-effective diagnostic solutions.

France Bladder Cancer Diagnostics Market Trends

Bladder cancer was the fifth most common cancer in metropolitan France in 2022, with 19,733 new cases, representing 4.1% of all new cancer diagnoses. Although bladder cancer is less common than cancers like breast, prostate, colorectal, and lung cancer, it remains a significant health concern. Its high incidence rate, compared to other cancers such as thyroid and testicular cancer, underlines the need for effective diagnostic and treatment strategies.

Spain Bladder Cancer Diagnostics Market Trends

In Spain, around 18,247 new bladder cancer cases are expected in 2024, according to REDCAN forecasts. With an increasing disease burden, companies like Cepheid are advancing technologies for early detection. Cepheid's non-invasive Xpert Bladder Cancer Detection test is a key innovation, alongside traditional methods such as cystoscopy and imaging. The market is shifting towards early detection and precision medicine, with growing use of advanced cystoscopy techniques and artificial intelligence.

Denmark Bladder Cancer Diagnostics Market Trends

The Danish bladder cancer diagnostics market sees competition between traditional diagnostic approaches and innovative solutions. New urine biomarker tests are gaining popularity for reducing the need for cystoscopy, while regulatory and healthcare considerations shape the market dynamics.

In 2022, 2,501 bladder cancer cases were diagnosed in Denmark, representing 5.1% of all new cancer cases. The incidence was significantly higher among males, with 1,835 cases (7.1% of all male cancers) compared to 666 cases in females (2.9% of all female cancers). The disease led to 531 deaths, accounting for 3.1% of all cancer deaths in the country. The 5-year prevalence of bladder cancer was 8,819 cases, with 7,145 among males and 1,674 among females, demonstrating the considerable impact of the disease on both genders.

By Technology

By Cancer Type

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others