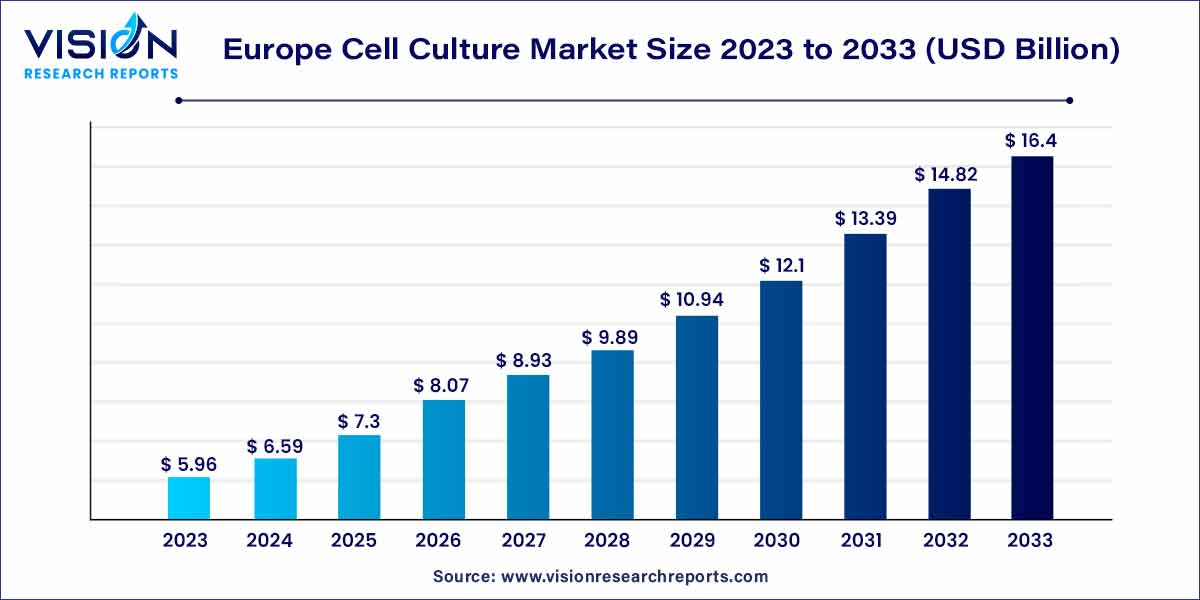

The Europe cell culture market size was estimated at around USD 5.96 billion in 2023 and it is projected to hit around USD 16.4 billion by 2033, growing at a CAGR of 10.65% from 2024 to 2033. The rising incidence of infectious and chronic diseases, such as COVID-19, and the quick uptake of cell culture methods in the production of vaccines are the main reasons behind the expansion of the European cell culture market. Furthermore, during the course of the forecast period, the market demand is anticipated to increase due to the growing need for improved therapeutic pharmaceuticals.

The Europe cell culture market is a dynamic and rapidly evolving sector within the broader life sciences industry. Cell culture, a foundational technique in biomedical research and biopharmaceutical production, involves the cultivation of cells outside their natural environment for various scientific and commercial purposes. This overview provides a snapshot of the key facets shaping the landscape of the cell culture market in Europe.

The growth of the Europe cell culture market is propelled by several key factors. Firstly, the increasing emphasis on biopharmaceuticals, such as monoclonal antibodies and therapeutic proteins, is a significant driver. The demand for advanced cell culture techniques has surged in tandem with the rising prominence of biopharmaceutical research and production. Additionally, continuous innovation and technological advancements, including 3D cell culture systems and automation, contribute to the market's expansion by enhancing precision and scalability in cell culture processes. The region's heightened focus on research and development across academic, pharmaceutical, and research institutions further fuels the demand for diverse cell culture applications. Moreover, the exploration of regenerative medicine and breakthroughs in stem cell research plays a pivotal role, creating additional avenues for growth. In summary, the Europe cell culture market is thriving due to the increasing relevance of biopharmaceuticals, ongoing technological innovations, a robust research environment, and the exploration of regenerative medicine applications.

| Report Coverage | Details |

| Market Size in 2023 | USD 5.96 billion |

| Revenue Forecast by 2033 | USD 16.4 billion |

| Growth rate from 2024 to 2033 | CAGR of 10.65% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

On the basis of product, the market is segmented into instruments and consumables. The consumables segment accounted for the largest market share of 58% in 2023 and is expected to witness the fastest growth during the forecast period. The consumables segment includes reagents, sera, and media. The segment dominance is primarily due to recurring demand and purchase of consumables. Moreover, the increasing R&D expenditure by biopharmaceuticals and biotechnology firms to develop sophisticated biologics, such as monoclonal antibodies & vaccines, is expected to propel the segment growth. In addition, industry participants are increasing the offerings in this segment. For instance, in May 2023, Lonza, a key industry player, introduced TheraPEAK T-VIVO Cell Culture Medium for developing cell therapies.

The instruments segment is expected to exhibit significant growth over the forecast period due to the increasing launches of innovative systems like cryostorage instruments, biosafety instruments, and pipetting equipment. Companies are constantly innovating to introduce novel instruments. For instance, in October 2023, Sartorius announced the launch of Picus 2 Electronic Pipette, the newest addition to its electronic pipette portfolio.

On the basis of application, the market is segmented into biopharmaceutical production, diagnostics, drug development, tissue culture & engineering, toxicity testing, cell & gene therapy, and other applications. The biopharmaceutical production segment held the largest revenue share in 2023. Cell culture technology is heavily utilized in the biotechnology sector for a variety of purposes, including bioprocessing, drug development, and biomanufacturing. Mammalian cell cultures are primarily used in the production of biopharmaceuticals, and the growing demand for nonconventional therapeutic options has led to a substantial increase in the bioproduction of genetically enhanced drugs. Thus, the demand for various cell culture consumables, such as cell culture media, is expected to increase. Furthermore, increasing availability of a variety of media types in serum-free and animal component-free forms has led to increased adoption of cell culture media in bioprocessing operations. These factors are expected to significantly boost segment growth over the forecast period.

On the contrary, the diagnostics segment is predicted to grow at the remarkable CAGR over the forecast period. Cell cultures can be used in metabolomics to identify biomarkers of pathologically relevant conditions. Moreover, metabolic pathways that lead to the production of such biomarkers can also be identified to determine underlying metabolic disorders. In addition, metabolites also play a vital role in diagnosing cancer and its recurrence, which increases the scope of applications for cell culture media products. Thus, with the rising prevalence of cancer across the region coupled with the increasing application of cell culture products for disease diagnosis, the segment is expected to witness growth over the forecast period.

By Product

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Europe Cell Culture Market

5.1. COVID-19 Landscape: Europe Cell Culture Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Europe Cell Culture Market, By Product

8.1. Europe Cell Culture Market, by Product, 2024-2033

8.1.1. Consumables

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Instruments

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Culture Systems

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Incubators

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Centrifuges

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Cryostorage Equipment

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Biosafety Equipment

8.1.7.1. Market Revenue and Forecast (2021-2033)

8.1.8. Pipetting Instruments

8.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Europe Cell Culture Market, By Application

9.1. Europe Cell Culture Market, by Application, 2024-2033

9.1.1. Biopharmaceutical Production

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Drug Development

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Diagnostics

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Tissue Culture & Engineering

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Cell & Gene Therapy

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Toxicity Testing

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Other Applications

9.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Europe Cell Culture Market, Regional Estimates and Trend Forecast

10.1. Europe

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Danaher Corporation

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Thermo Fisher Scientific Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Merck KGaA

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Sartorius AG

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Corning Incorporated

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. BD

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Avantor, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Eppendorf SE

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. PromoCell GmbH

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Bio-Techne

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others