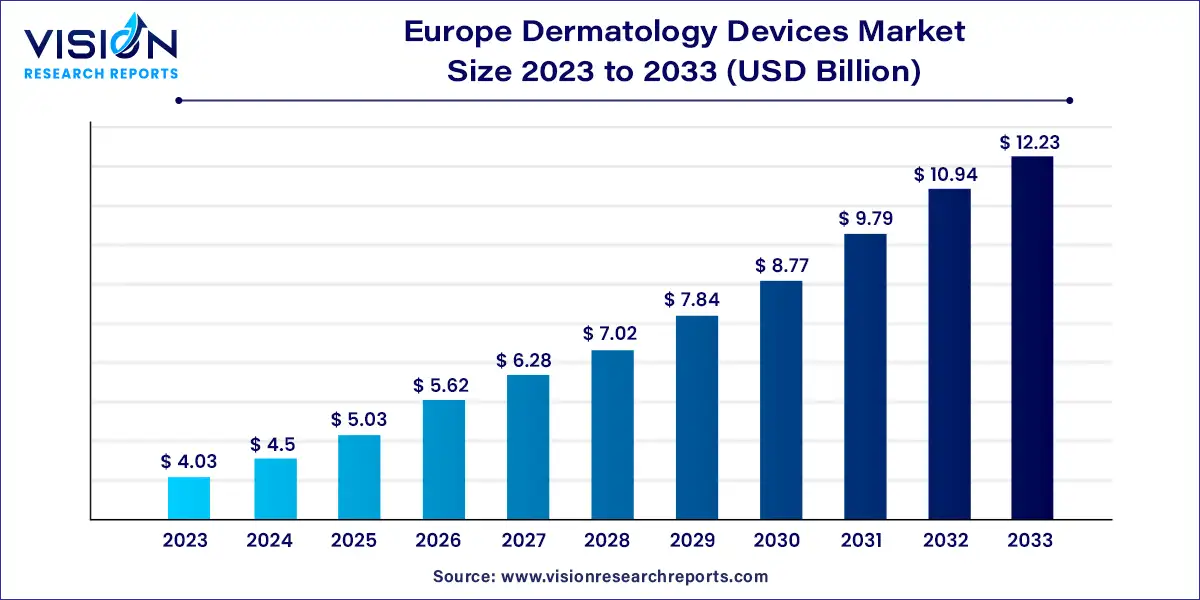

The Europe dermatology devices market size was valued at USD 4.03 billion in 2023 and it is predicted to surpass around USD 12.23 billion by 2033 with a CAGR of 11.74% from 2024 to 2033.

In recent years, the market has seen significant growth driven by advancements in technology, increasing prevalence of skin disorders, and rising awareness among both healthcare providers and patients. Key players in this market include major multinational corporations and innovative startups, each contributing to the development of new technologies and treatment modalities aimed at improving patient outcomes and enhancing efficiency in dermatological care.

Regulatory landscape and reimbursement policies also play a crucial role in shaping the market dynamics across different European countries. As the demand for minimally invasive procedures and non-surgical treatments continues to rise, the market is expected to witness further expansion, supported by ongoing research and development efforts in dermatology and related fields.

The growth of the Europe dermatology devices market is driven by the technological advancements in diagnostic and treatment devices have enhanced the precision and effectiveness of dermatological procedures. Increasing prevalence of skin disorders, coupled with aging populations, has heightened demand for advanced dermatology treatments. Moreover, rising consumer awareness about skincare and aesthetic treatments has spurred market growth. Regulatory support for medical devices and favorable reimbursement policies further contribute to market expansion. Additionally, innovations in non-invasive and minimally invasive procedures continue to attract both patients and healthcare providers, fostering continuous market growth in the dermatology devices sector across Europe.

The treatment devices segment dominated the market with a share of 80% in 2023, a position it is expected to maintain due to ongoing advancements in technologies such as lasers, radiofrequency devices, and other therapeutic equipment. These innovations enable a broader range of effective and minimally invasive dermatological procedures, enhancing accessibility and appeal across diverse patient demographics. This segment's leadership is anticipated to endure as technological progress continues to redefine the landscape of dermatological treatment.

The diagnostic devices segment is projected to experience a compound annual growth rate (CAGR) of 10.83% from 2024 to 2033, driven by increasing emphasis on early and precise detection of skin cancer. Adoption of advanced diagnostic technologies like confocal laser microscopy and digital mole mapping systems is further fueling growth in this segment.

Hospitals represented the largest revenue share at 55% in 2023, serving as pivotal hubs for diagnosing and treating various skin conditions, including skin cancers and dermatological disorders like psoriasis. Their comprehensive infrastructure, specialized medical personnel, and access to advanced diagnostic and treatment tools underscore their significance in the dermatology devices market.

Clinics are poised for rapid growth, supported by rising disposable incomes in Europe and a growing inclination towards aesthetic procedures. Increasing focus on preventive healthcare encourages early intervention for skin issues, driving patient visits to clinics for consultations and treatments.

Germany holds the largest market share in the dermatology devices market, accounting for 35% of total revenue in 2023. Renowned for precision and quality, German manufacturers excel in segments such as laser and cryosurgery devices, leveraging advanced technologies and a commitment to innovation to solidify their market position.

In the UK, the dermatology devices market is projected to grow at a CAGR of 12.83% from 2024 to 2033. Technological advancements in skincare instruments are driving adoption of dermatology devices, supported by increasing disposable incomes and demand for accurate diagnosis of skin disorders. The country's influence on the Europe regional market for dermatology devices is bolstered by its evolving role in skin health and aesthetics.

By Product

By End-use

By Country

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others