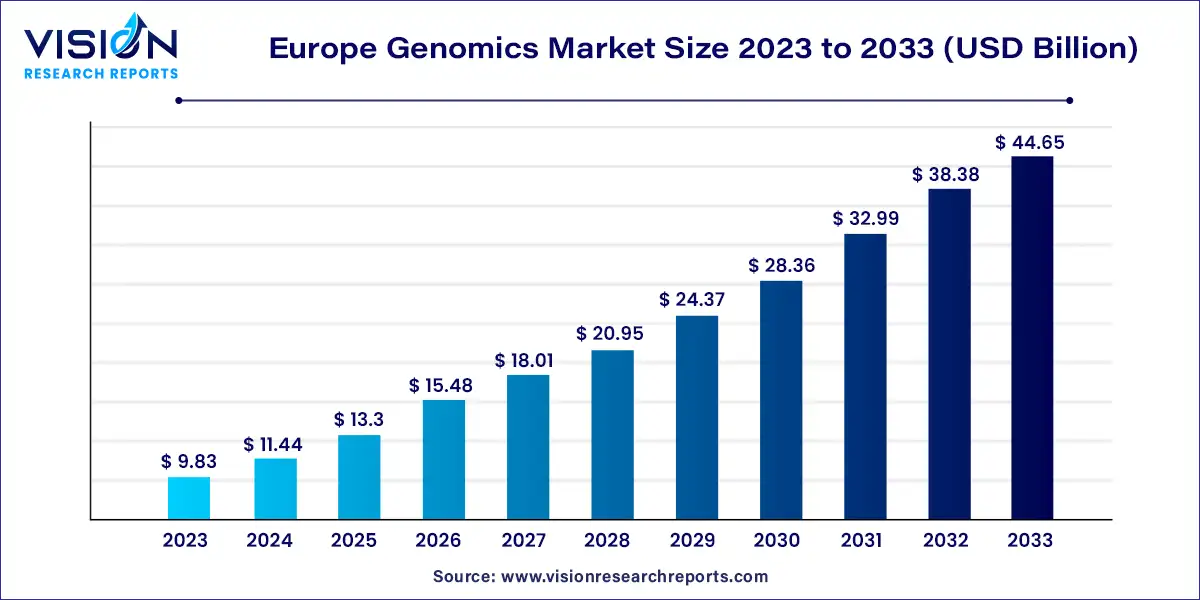

The Europe genomics market size was valued at USD 9.83 billion in 2023 and it is predicted to surpass around USD 44.65 billion by 2033 with a CAGR of 16.34% from 2024 to 2033.

The field of genomics in Europe has witnessed remarkable growth and innovation in recent years, propelled by advancements in technology, increasing research initiatives, and a growing understanding of the importance of genetic information in various sectors.

The growth of the genomics market in Europe can be attributed to several key factors driving its expansion. Firstly, advancements in technology, particularly in next-generation sequencing (NGS) and bioinformatics tools, have significantly enhanced the efficiency and accuracy of genomic analysis, thereby fueling demand for genomic services and products. Secondly, increasing research initiatives and collaborations between academic institutions, biotechnology companies, and government agencies have accelerated innovation in the field, leading to the development of novel therapies, diagnostic tools, and agricultural biotechnology solutions. Moreover, rising awareness of the potential applications of genomics in personalized medicine, disease prevention, and precision agriculture has spurred investment in genomic research and infrastructure. Additionally, supportive government policies, regulatory frameworks, and funding initiatives have created a conducive environment for growth and innovation in the genomics sector.

In 2023, the functional genomics segment seized the largest revenue share at 32%. This dominance underscores the pivotal role functional genomics plays in elucidating gene function and regulation. By employing diverse techniques, researchers delve into the inner workings of genes, unraveling their mechanisms in health and disease. This knowledge serves as a cornerstone in developing gene therapies, particularly for cancers, thereby paving the path for more precise treatments. Functional genomics equips researchers not only to pinpoint disease-causing genes but also to comprehend their interactions with cellular pathways.

Meanwhile, the pathway analysis segment is poised for rapid revenue growth, projected to achieve a CAGR of 17.03% from 2024 to 2033. This segment delves into unraveling the intricate networks of interacting genes and molecules within cells. Through pathway analysis, scientists attain a comprehensive understanding of biological processes. This knowledge holds immense promise, especially in drug discovery. By identifying key players within disease pathways, researchers can devise more efficacious therapeutics that target specific steps in the disease progression. The symbiotic relationship between functional genomics and pathway analysis is driving significant strides in personalized medicine, heralding a future of tailored treatments tailored to an individual's unique genetic makeup.

In 2023, the products segment dominated the total revenue share at 70%. This segment primarily encompasses the sale of genomics-related products like sequencing instruments, reagents, and consumables. The robust growth in this sector can be attributed to the expanding adoption of next-generation sequencing (NGS) technologies, enabling researchers and clinicians to analyze genetic data with increased efficiency and accuracy. Factors propelling the products segment include advancements in NGS platforms, escalating demand for personalized medicine, and the integration of genomics in drug discovery. With the dynamic evolution of genomics, companies are channeling investments into research and development to enrich product portfolios and extend their market reach.

Conversely, the services segment is poised to witness the second-highest revenue growth, with a projected CAGR of 14.42% from 2024 to 2033. These services encompass genomic testing, data analysis, and interpretation offered by specialized laboratories and service providers. The upsurge in the services segment is propelled by various factors, including the escalating demand for clinical genetic testing, large-scale genomics initiatives, and the imperative for precise diagnostic services. With an increasing number of individuals seeking genetic testing for disease risk assessment, personalized treatment insights, and ancestry elucidation, the services segment is anticipated to sustain substantial growth.

In 2023, pharmaceutical and biotechnology companies commanded a substantial 56% of the total revenue share. These entities hold a pivotal role in drug discovery, development, and the advancement of personalized medicine. Genomics data plays a critical role in identifying potential drug targets, comprehending disease mechanisms, and optimizing therapeutic strategies. The dominance of this segment is fueled by several factors, including increased investment in genomics research by pharmaceutical giants, collaborations with academic institutions, and the integration of genomics into clinical trials. As the prominence of precision medicine grows, pharmaceutical companies are harnessing genomics insights to craft targeted therapies tailored to individual patient requirements.

Concurrently, the clinical research segment is forecasted to exhibit the swiftest revenue growth, with a projected CAGR of 22.03% from 2024 to 2033. Clinical research encompasses studies conducted within healthcare settings, academic institutions, and research centers. Genomics serves as a cornerstone in understanding disease susceptibility, treatment response, and disease progression.

The Spain genomics market dominated the Europe genomics market, capturing the biggest revenue share of 26% in 2023. This dominance suggests a strong foundation for genomics research and development within Spain, potentially due to established infrastructure or government support. Further investigation into the reasons behind Spain's market share could be fruitful for understanding successful strategies in this field.

The Germany genomics market is expected to grow at a CAGR of 17.93% from 2024 to 2033. While not currently the market leader, Germany appears to be a rising star. This significant growth rate suggests a rapidly developing genomics market in Germany, possibly fueled by factors like increased investment or a growing focus on personalized medicine. By analyzing the drivers behind Germany's impressive growth rate, we can gain insights into potential future trends for the Europe market as a whole.

By Application & Technology

By Deliverables

By End-use

By Country

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others