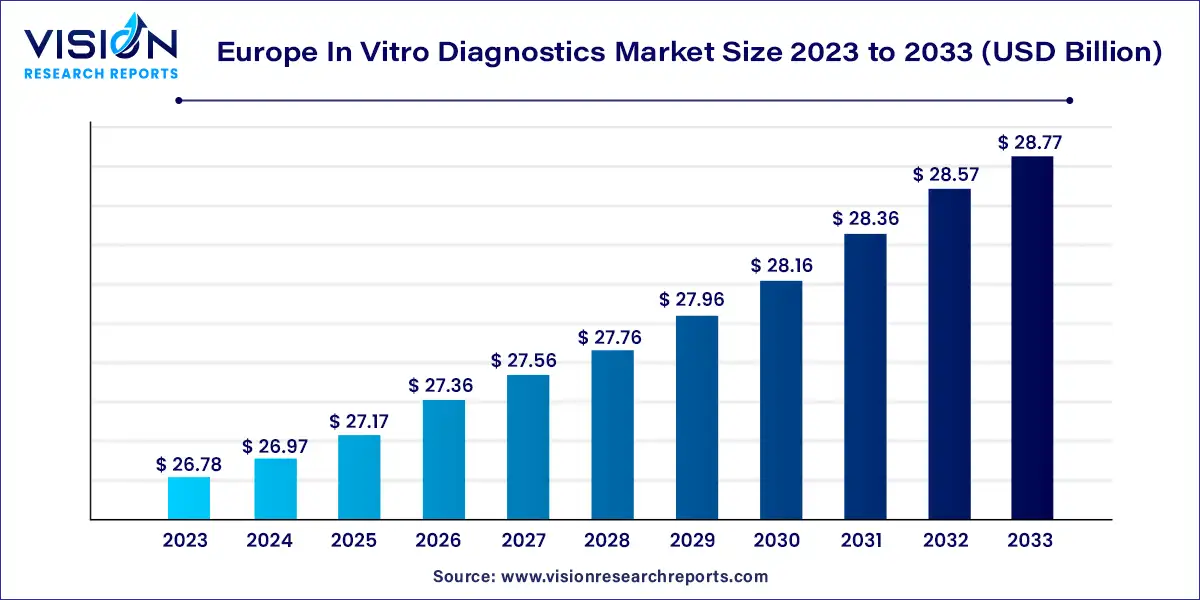

The Europe in vitro diagnostics market size was estimated at USD 26.78 billion in 2023 and it is expected to surpass around USD 28.77 billion by 2033, poised to grow at a CAGR of 0.72% from 2024 to 2033. The in vitro diagnostics (IVD) market in Europe stands as a crucial pillar within the broader healthcare landscape, facilitating accurate and timely disease diagnosis, prognosis, and therapeutic monitoring. This sector is characterized by dynamic advancements in technology, a rising prevalence of chronic diseases, and a concerted effort to enhance healthcare infrastructure.

The growth of the Europe in vitro diagnostics (IVD) market is propelled by an advancements in diagnostic technologies, such as molecular diagnostics and immunoassays, contribute to heightened accuracy and efficiency in disease detection. Secondly, the increasing prevalence of chronic diseases, including cardiovascular disorders and diabetes, accentuates the demand for reliable diagnostic solutions, fostering market expansion. Additionally, the aging demographic in Europe further amplifies the need for precise diagnostic tools to address a higher incidence of age-related diseases. Supportive government policies and initiatives aimed at enhancing healthcare infrastructure and research and development also play a pivotal role in driving market growth. Overall, the convergence of technological innovation, rising disease prevalence, demographic shifts, and governmental support collectively underpin the robust growth of the in vitro diagnostics market in Europe.

| Report Coverage | Details |

| Market Size in 2023 | USD 26.78 billion |

| Revenue Forecast by 2033 | USD 28.77 billion |

| Growth rate from 2024 to 2033 | CAGR of 0.72% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

On the basis of product, the market is segmented into instruments, reagents, and software. The reagents segment dominated the market with a revenue share of around 66% in 2023, owing to a spike in the utilization of POC tests, self-testing kits, and various other cutting-edge items in in-vitro diagnosis. The rising volume of research and development efforts for detecting acute diseases is one of the primary reasons fueling the need for reagents and consumables. Furthermore, the growing priority placed on timely diagnosis in established and developing nations is increasing the proportion of patients getting routine tests, adding to the high growth of the category.

The instruments segment held the second largest share in 2023. The advancement in instruments provided a great avenue for the segment's growth. For instance, in September 2022, Sysmex Corporation launched the UD-1500 Completely Automated Urine Particle Analyzer for urine sediment evaluation. The product inherits the excellent capability and ease of use of the UF-5000, an entirely automated urine particle analyzer. The most popular IVD tools include cell imaging and analysis systems, slide processing systems, urine test strips, pregnancy tests, blood sugar monitoring systems, coagulation test systems, and PCR testing platforms.

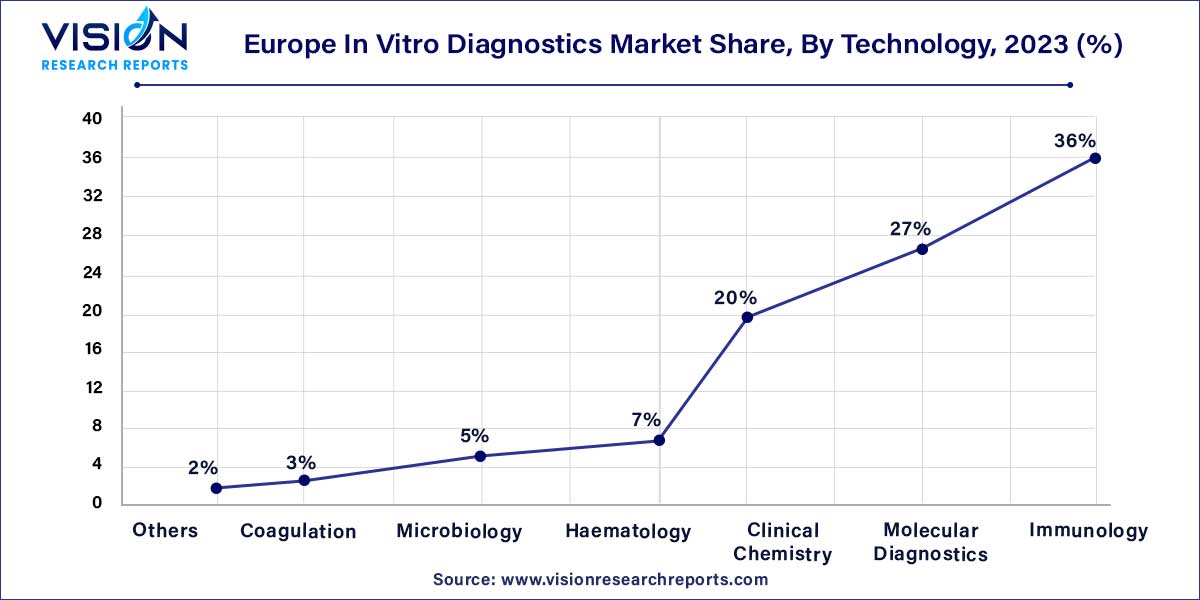

On the basis of technology, the market is segmented into immunoassay, hematology, clinical chemistry, molecular diagnostics, coagulation, microbiology, and others. The immunoassay segment held the largest revenue share of over 36% in 2023, as immunoassays are being utilized significantly in alcohol and drug testing as well as cancer. Immunoassays are being furnished with modern technology to aid medical practitioners in generating timely diagnosis, boosting their acceptance.

The microbiology and clinical chemistry segments are estimated to register the fastest CAGR of 4.45% over the forecast period of 2024 to 2033. A proportion of clinical chemistry is accomplished by utilizing high throughput apparatus with cutting-edge automation. However, point-of-care diagnostics continues to grow to address the need for quick diagnosis for chronic and contagious diseases. This factor is a crucial component influencing growth in clinical chemistry. Ongoing advancements in microbiology due to advancements in biotechnological research aimed at investigating the role of microbes in disease pathogenesis are also crucial factors driving the growth.

On the basis of application, the market is segmented into infectious diseases, diabetes, oncology/cancer, cardiology, nephrology, autoimmune diseases, drug testing, and others. The IVD-based infectious disease diagnostics market accounted for the largest market share owing to the rising prevalence of hospital-acquired infections and the high unmet medical needs pertaining to the effective diagnosis of infectious diseases. The substantial share of the market in this category is mainly related to the high frequency of infectious illnesses, the increasing number of elderly people, a growing need for early detection of diseases, and the government's attempt to increase the affordability of services geared towards infectious illness testing. In vitro diagnostics (IVD) is a widely prevalent diagnostic tool that complies with the minimum requirements. IVD kits have become popular and successful in diagnosing infectious illnesses.

The oncology segment is one of the fastest-growing segments due to the introduction of technologically advanced devices and the rising demand for companion diagnostics. The growing need for early disease identification and prevention stimulates development, improving diagnostic capabilities, and personalized medicine strategies, particularly in cancer diagnosis.

The European in vitro diagnostics market is segmented by end use into hospitals, laboratories, home care, and others. The hospital category dominated the overall segment, considering diagnostics are seamlessly integrated with other disciplines and comprehensive healthcare services are available. They have the facilities, resources, and qualified staff to run a successful IVD operation. Hospitals serve as primary places of care, primary points of referral, and providers of a wide range of medical services. Their range of clinical specialties guarantees precise diagnosis and analysis of IVD test findings. Furthermore, hospitals receive favorable funding and reimbursement policies and must follow strict regulatory guidelines to guarantee patient safety and test accuracy.

The home care segment is expected to grow at the fastest CAGR during forecast period due to the rising demand for rapid diagnostic services for patients at the time of care, the rising government initiatives aimed at lowering hospital stays to curb healthcare expenditure, and the increase in collaboration between the market players. Multiple partnerships between healthcare organizations and various MedTech firms offer a fantastic chance for the efficient implementation of healthcare services at the residence. For instance, Medtronic's Integrated Health Solutions (IHS) presently has 170 in-progress long-term relationships in 24 countries throughout Europe, adding value to healthcare organizations and assisting in the more cost-effective provision of high-quality services at home. As a result, this component spurs market expansion.

By Product

By Technology

By Application

By End Use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Europe In Vitro Diagnostics Market

5.1. COVID-19 Landscape: Europe In Vitro Diagnostics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Europe In Vitro Diagnostics Market, By Product

8.1. Europe In Vitro Diagnostics Market, by Product, 2024-2033

8.1.1. Instruments

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Reagents

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Europe In Vitro Diagnostics Market, By Technology

9.1. Europe In Vitro Diagnostics Market, by Technology, 2024-2033

9.1.1. Immunology

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Haematology

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Clinical Chemistry

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Molecular Diagnostics

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Coagulation

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Microbiology

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Europe In Vitro Diagnostics Market, By Application

10.1. Europe In Vitro Diagnostics Market, by Application, 2024-2033

10.1.1. Infectious Diseases

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Diabetes

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Oncology/Cancer

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Cardiology

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Nephrology

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Autoimmune Diseases

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Drug Testing

10.1.7.1. Market Revenue and Forecast (2021-2033)

10.1.8. Other

10.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Europe In Vitro Diagnostics Market, By End Use

11.1. Europe In Vitro Diagnostics Market, by End Use, 2024-2033

11.1.1. Hospitals

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Laboratories

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Home Care

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Europe In Vitro Diagnostics Market, Regional Estimates and Trend Forecast

12.1. Europe

12.1.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by End Use (2021-2033)

Chapter 13. Company Profiles

13.1. Bio-Rad Laboratories, Inc

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Abbott

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Sysmex Corporation

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. BD

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. BIOMÉRIEUX

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Danaher

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. F. Hoffmann-La Roche Ltd

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Siemens

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. QIAGEN

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Thermo Fisher Scientific Inc

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others