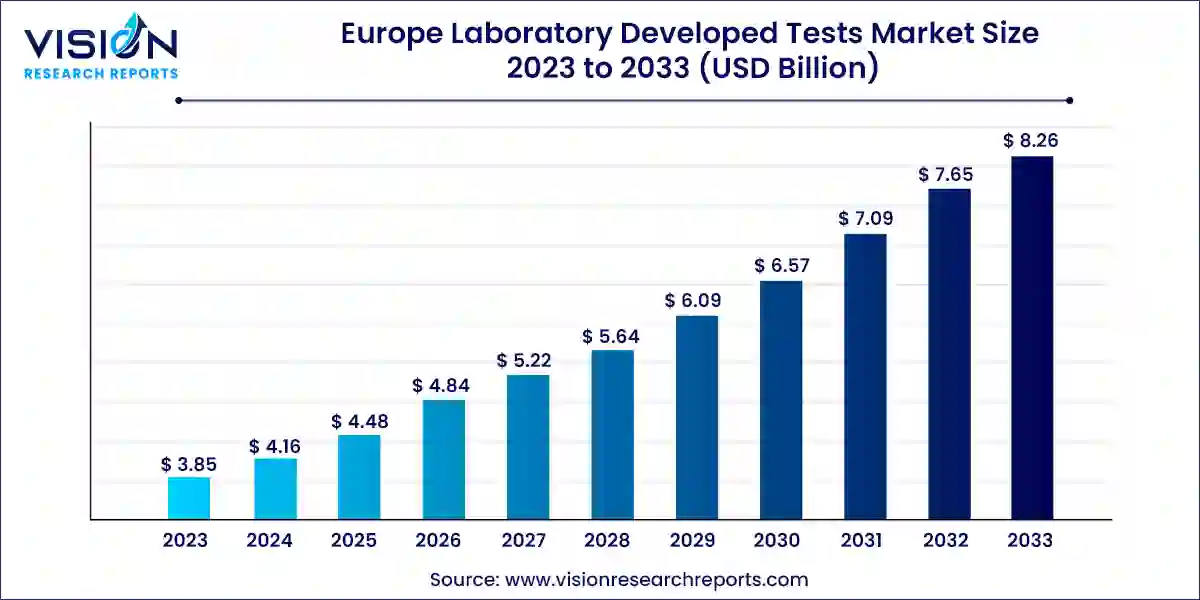

The Europe laboratory developed tests market size was valued at USD 3.85 billion in 2023 and is predicted to surpass around USD 8.26 billion by 2033 with a CAGR of 7.93% from 2024 to 2033. The laboratory developed tests (LDTs) market in Europe is witnessing significant growth and evolution, driven by advancements in diagnostic technologies and increasing demand for personalized medicine.

The growth of the laboratory developed tests (LDTs) market in Europe is propelled by an advancements in diagnostic technologies, such as molecular diagnostics and next-generation sequencing, are driving the development of innovative LDTs with enhanced accuracy and sensitivity. Additionally, the increasing demand for personalized medicine is fueling the adoption of LDTs that can provide tailored diagnostic and therapeutic approaches based on individual patient characteristics. Furthermore, collaborations between academic institutions, research organizations, and diagnostic companies are facilitating the commercialization of novel LDTs, fostering innovation and growth in the market. Moreover, the rising prevalence of chronic diseases and the growing emphasis on early diagnosis and treatment are driving the demand for LDTs, particularly in emerging markets within Europe.

The oncology segment emerged as the market leader in 2023, commanding the largest revenue share of 22%. The LDTs market is categorized into various segments, including oncology, genetic disorders/inherited diseases, infectious and parasitic diseases, immunology, endocrine, nutritional and metabolic diseases, cardiology, mental/behavioral disorders, pediatrics-specific tests, hematology/general blood tests, body fluid analysis, toxicology, and other diseases. According to data from the EU Science Hub, the number of new cancer cases rose by 2.3% in 2022 compared to 2020, reaching a total of 2.74 million. While Western and Northern EU countries exhibit higher incidence rates, Eastern EU countries experience elevated mortality rates due to cancer.

Pancreatic cancer, one of the top four deadliest cancers, presents a significant healthcare challenge due to late diagnosis and treatment. A report published in The Lancet highlights Western Europe's heightened risk of pancreatic cancer infection. The European PANCAID project (pancreatic cancer initial detection via liquid biopsy) aims to identify biomarkers for early screening of at-risk groups through a blood test.

The nutritional and metabolic disease segment is projected to achieve the fastest CAGR of 10.53% during the forecast period. In Germany, neonatal screening encompasses 19 congenital diseases, including 13 metabolic disorders. According to the German Federal Statistical Office, Germany recorded a total of 738,819 live births in 2022, with 2,345 deaths of children under one year. Approximately one in 1,300 newborns is affected by these target diseases. ZenTech LaCAR offers a range of screening tests for rare neonatal diseases. Additionally, ARUP Laboratories' pharma services group developed AAV5 DetectCDx, a blood test aiding in the identification of patients with Hemophilia A. In December 2023, ARUP Laboratories partnered with Medicover, a Europe-based diagnostics and healthcare service provider, to provide companion diagnostics for Hemophilia A gene therapy.

The molecular diagnostics segment dominated the market in 2023, capturing the largest revenue share of 27%. The LDT market comprises segments such as immunoassays, hematology and coagulation, molecular diagnostics, microbiology, clinical chemistry, histology/cytology, flow cytometry, mass spectrometry, and others. Molecular diagnosis has proven instrumental in detecting various genetic, inherited, viral, and bacterial diseases.

The surge in lifestyle-associated diseases has heightened the demand for early detection methods. Cancer, a prime example of a genetic disorder, ranked as the second leading cause of death in Europe in 2020, claiming 1.2 million lives. In November 2023, F. Hoffmann-La Roche Ltd launched the next-generation qPCR system LightCycler PRO, expected to facilitate testing for cancer, infectious diseases, and other public health challenges.

The rising prevalence of autoimmune disorders has spurred demand for rapid disease detection, driving the development of laboratory-developed tests, including immunoassay kits. Multi-parametric flow cytometry remains a laboratory-developed test for leukemia and lymphoma diagnosis due to lack of FDA approval. In October 2023, Synlab GmbH introduced myEDIT-B, the world's first blood-based diagnostic test for bipolar disorder diagnosis. IBDSENSE, a non-invasive fluorescence-based technology developed by the University of Edinburgh, aids in the diagnosis of inflammatory bowel disease.

The UK laboratory developed tests market is expected to grow at the fastest CAGR over the forecast period, due to an increase in long-term physical health conditions across the country's working population. These long-term physical health conditions anticipate economic inactivity. According to NHS, about 90% of the adult population is infected with type 2 diabetes in the UK.

The laboratory developed tests market in France is expected to grow at the fastest CAGR over the forecast period, due to the increasing number of deaths caused by non-communicable diseases (NCDs), thus highlighting the need for early disease detection. According to data published by WHO, Alzheimer's disease and other dementia, and ischemic heart disease accounted for the highest deaths in 2019.

By Technology

By Application

By Country

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others