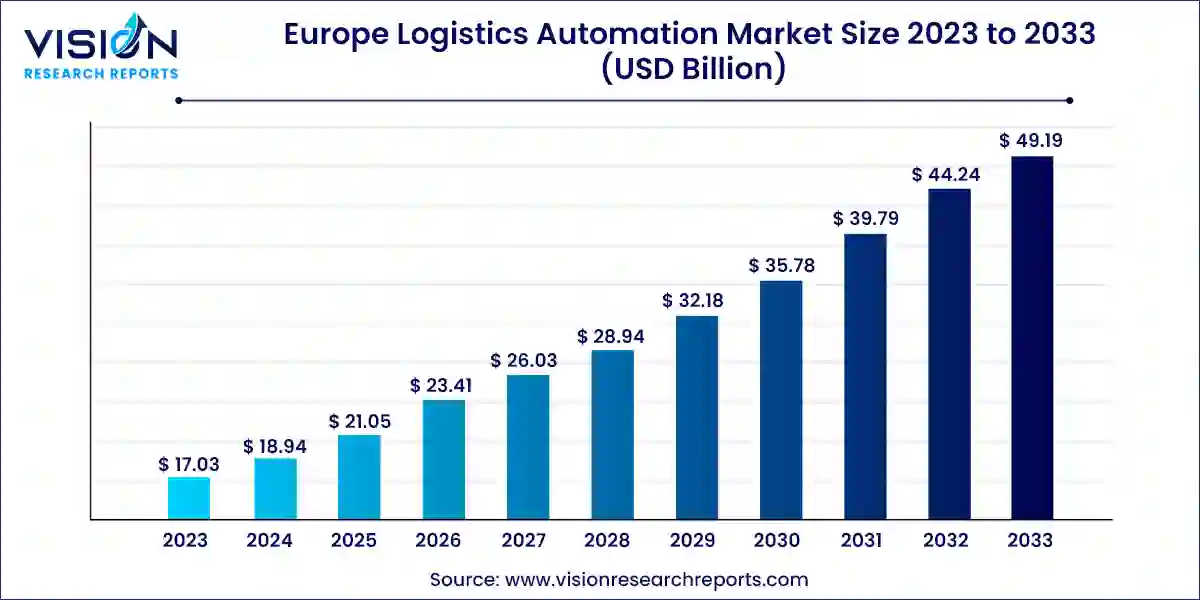

The Europe logistics automation market size was estimated at around USD 17.03 billion in 2023 and it is projected to hit around USD 49.19 billion by 2033, growing at a CAGR of 11.19% from 2024 to 2033.

The Europe logistics automation market is experiencing significant growth propelled by advancements in technology and increasing adoption of automated solutions across various industries. With the aim of streamlining operations, reducing costs, and enhancing efficiency, businesses are increasingly investing in automation technologies such as warehouse management systems, automated guided vehicles, and robotics. Factors such as the expansion of e-commerce, rising demand for faster delivery, and the need for improved supply chain visibility are driving the demand for logistics automation solutions in the region.

The growth of the Europe logistics automation market is attributed to the burgeoning e-commerce sector has intensified the need for efficient logistics operations to meet increasing consumer demands for fast and reliable delivery services. Additionally, the rising emphasis on cost reduction and operational efficiency across industries has prompted companies to adopt automation solutions to streamline their supply chain processes. Furthermore, advancements in technology, such as robotics, artificial intelligence, and machine learning, have enabled more sophisticated and agile automation systems, further driving market growth.

The production logistics segment held the largest revenue share of 51% 2023. Production logistics focuses on the management of materials, parts, and components within manufacturing facilities, ensuring smooth and uninterrupted production processes. Automation technologies such as conveyor systems, automated storage and retrieval systems (AS/RS), and robotic arms are widely utilized in production logistics to streamline material handling, minimize idle time, and maximize throughput. These automation solutions not only accelerate the pace of production but also improve inventory management, reduce errors, and enhance overall productivity.

On the other hand, sales logistics encompasses the distribution, warehousing, and delivery of finished products to customers, retailers, or distribution centers. Automation plays a critical role in sales logistics by automating order fulfillment processes, inventory management, and transportation operations. Automated order picking systems, sorting systems, and warehouse management software streamline the picking, packing, and shipping processes, resulting in faster order processing, reduced labor costs, and improved accuracy.

The hardware segment dominated in 2023 with a 56% revenue share in the Europe logistics automation revenue. Technological advancements have dramatically propelled the revenue for logistics automation in Europe. Automated guided vehicles (AGVs), robotic arms, conveyor systems, and automated storage and retrieval systems (AS/RS) are examples of hardware components that are becoming essential for improving labor costs and operating efficiency. These technologies' ongoing advancement and widespread use have been crucial to preserving the hardware segment's leadership position.

The software segment is observed to be the fastest growing in the Europe logistics automation revenue during the forecast period. In today's fast-paced corporate world, having access to real-time data and insights is essential for making wise decisions. Businesses may monitor their operations in real-time with the help of logistics software, which offers extensive analytics features. This includes monitoring inventory levels, tracking shipment statuses, and calculating transportation expenses. Logistics companies may better serve their customers, react swiftly to shifting revenue conditions, and increase efficiency and profitability by using real-time data analytics to make proactive decisions. The adoption of logistics software is significantly influenced by the capacity to derive meaningful insights from data.

The large enterprises segment dominated in 2023 with a 66% revenue share in the Europe logistics automation revenue. Large enterprises, with their extensive resources, infrastructure, and established market presence, often lead the adoption of logistics automation technologies to streamline operations, improve efficiency, and gain competitive advantages. These enterprises leverage their scale and financial capabilities to invest in advanced automation solutions, such as robotics, artificial intelligence, and integrated software platforms, to optimize their supply chain processes, reduce costs, and enhance customer satisfaction.

On the other hand, SMEs in Europe are increasingly recognizing the importance of logistics automation in driving business growth, enhancing operational efficiency, and remaining competitive in today's digital economy. While SMEs may have limited resources and budgets compared to their larger counterparts, they are often more agile, adaptable, and responsive to change, making them well-positioned to leverage automation technologies to their advantage. SMEs can selectively adopt automation solutions tailored to their specific needs and budget constraints, such as cloud-based logistics management systems, modular automation components, and scalable robotics solutions.

The road segment dominated in 2023 with a 56% revenue share in the Europe logistics automation revenue. Road transport, characterized by its flexibility, accessibility, and door-to-door delivery capabilities, is a preferred choice for transporting goods over short to medium distances within Europe's vast network of roadways. Automation technologies such as GPS tracking, fleet management systems, and route optimization software enhance the efficiency and reliability of road transport operations, enabling logistics providers to optimize delivery routes, minimize fuel consumption, and reduce transit times. Additionally, advancements in vehicle automation, such as autonomous trucks and platooning systems, hold the potential to further revolutionize road transport by increasing safety, reducing labor costs, and improving overall productivity.

The sea segment is observed to be the fastest growing in the Europe logistics automation revenue during the forecast period. Automation technologies play a crucial role in enhancing the efficiency, safety, and environmental sustainability of sea transport operations. Port automation solutions, such as automated container terminals, crane systems, and cargo handling equipment, streamline loading and unloading processes, optimize berth utilization, and minimize turnaround times for vessels.

The transportation management segment dominated in 2023 with a 70% revenue share in the Europe logistics automation revenue. Transportation management applications encompass a range of software solutions and technologies designed to streamline the planning, execution, and monitoring of transportation activities, including route optimization, carrier selection, freight tracking, and fleet management. By leveraging transportation management systems (TMS), logistics providers can optimize delivery routes, minimize transportation costs, and improve delivery reliability through real-time visibility and control over transportation assets and operations.

Warehouse and storage management applications are equally critical in the Europe logistics automation market, facilitating the efficient handling, storage, and retrieval of goods within warehouses, distribution centers, and fulfillment centers. Warehouse management systems (WMS) play a central role in automating and optimizing warehouse operations, including inventory management, order picking, packing, and shipping processes. By integrating barcode scanning, RFID technology, and automation equipment such as conveyors and automated guided vehicles (AGVs), WMS enables real-time inventory tracking, accurate order fulfillment, and efficient use of warehouse space, leading to improved productivity, reduced labor costs, and enhanced customer satisfaction.

The automotive segment dominated with a 31% revenue share in 2023 in the Europe logistics automation revenue. The automotive industry, characterized by complex supply chains, just-in-time manufacturing, and stringent quality requirements, relies heavily on logistics automation to ensure efficient and reliable transportation of parts, components, and finished vehicles. Automation technologies such as robotic assembly lines, automated guided vehicles (AGVs), and material handling systems enable automotive manufacturers to optimize production processes, reduce lead times, and enhance manufacturing flexibility. Moreover, advanced logistics automation solutions facilitate seamless coordination and synchronization of logistics activities among suppliers, manufacturers, and distributors, enabling automotive companies to achieve operational excellence, cost savings, and competitive advantages in the global market.

The retail and e-commerce segment significantly growing in the Europe logistics automation revenue during the forecast period. Retailers and e-commerce companies face the challenge of managing complex and dynamic supply chains, fulfilling orders accurately and quickly, and meeting customer expectations for fast delivery and seamless shopping experiences. Logistics automation plays a crucial role in addressing these challenges by automating order fulfillment processes, optimizing warehouse operations, and improving last-mile delivery efficiency. Automated order picking systems, sorting systems, and robotic warehouses enable retailers and e-commerce companies to handle large volumes of orders with speed and precision, reducing order processing times and improving order accuracy.

By Type

By Component

By Organization Size

By Mode of Freight Transport

By Application

By End-user

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. End-user Procurement Analysis

4.3.2. Sales and Distribution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Europe Logistics Automation Market

5.1. COVID-19 Landscape: Europe Logistics Automation Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Europe Logistics Automation Market, By Type

8.1. Europe Logistics Automation Market, by Type, 2024-2033

8.1.1. Sales Logistics

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Production Logistics

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Recovery Logistics

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Europe Logistics Automation Market, By Component

9.1. Europe Logistics Automation Market, by Component, 2024-2033

9.1.1. Hardware

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Software

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Services

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Europe Logistics Automation Market, By Organization Size

10.1. Europe Logistics Automation Market, by Organization Size, 2024-2033

10.1.1. Small and Medium Enterprises

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Large Enterprises

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Europe Logistics Automation Market, By Mode of Freight Transport

11.1. Europe Logistics Automation Market, by Mode of Freight Transport, 2024-2033

11.1.1. Air

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Road

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Sea

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Europe Logistics Automation Market, By Application

12.1. Europe Logistics Automation Market, by Application, 2024-2033

12.1.1. Transportation Management

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Warehouse and Storage Management

12.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Europe Logistics Automation Market, By End-user

13.1. Europe Logistics Automation Market, by End-user, 2024-2033

13.1.1. Manufacturing

13.1.1.1. Market Revenue and Forecast (2021-2033)

13.1.2. Healthcare and Pharmaceuticals

13.1.2.1. Market Revenue and Forecast (2021-2033)

13.1.3. Fast Moving Consumer Goods

13.1.3.1. Market Revenue and Forecast (2021-2033)

13.1.4. Retail and E-commerce

13.1.4.1. Market Revenue and Forecast (2021-2033)

13.1.5. Automotive

13.1.5.1. Market Revenue and Forecast (2021-2033)

13.1.6. Others

13.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 14. Europe Logistics Automation Market, Regional Estimates and Trend Forecast

14.1. Europe

14.1.1. Market Revenue and Forecast, by Type (2021-2033)

14.1.2. Market Revenue and Forecast, by Component (2021-2033)

14.1.3. Market Revenue and Forecast, by Organization Size (2021-2033)

14.1.4. Market Revenue and Forecast, by Mode of Freight Transport (2021-2033)

14.1.5. Market Revenue and Forecast, by Application (2021-2033)

14.1.6. Market Revenue and Forecast, by End-user (2021-2033)

Chapter 15. Company Profiles

15.1. E&K Automation

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. Jungheinrich

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. Knapp

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. SSI Schaefer

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. Swisslog

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. System Logistics

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. TGW Logistics Group

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. SAP

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others