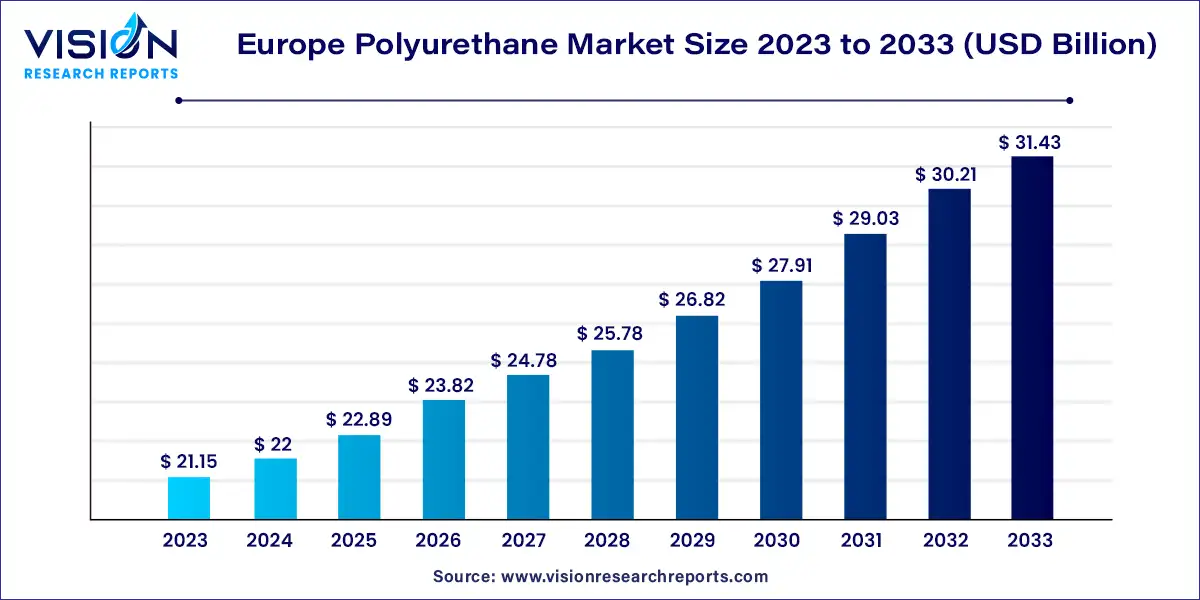

The Europe polyurethane market size was estimated at around USD 21.15 billion in 2023 and it is projected to hit around USD 31.43 billion by 2033, growing at a CAGR of 4.04% from 2024 to 2033. Polyurethane (PU) is one of the most versatile materials used in various industries across Europe, driven by its adaptability, durability, and wide range of applications. The Europe polyurethane market has experienced steady growth due to increasing demand in key sectors such as construction, automotive, furniture, and footwear. With the rising focus on sustainable and energy-efficient materials, polyurethane continues to evolve in terms of product innovation and environmental impact.

The Europe polyurethane market is driven by an increasing demand for energy-efficient materials in construction and automotive applications. Polyurethane's excellent insulation properties make it ideal for enhancing energy efficiency in buildings, aligning with Europe's stringent environmental regulations. Additionally, the automotive industry's push for lightweight materials to improve fuel efficiency has led to increased use of polyurethane in vehicle interiors and components. The growing focus on sustainability has also spurred the development of bio-based polyurethane alternatives, further supporting market growth.

In 2023, rigid polyurethane (PU) dominated the market, capturing a 34% share, largely due to its superior thermal insulation properties. The increasing demand for energy efficiency, particularly in the construction industry, drove the growth of this segment. Rigid PU is widely used to improve insulation, reduce energy consumption, and reinforce building structures. It is also a preferred material for insulation in appliances like refrigerators and freezers. Furthermore, the automotive industry has adopted rigid PU in various components, leveraging its strength-to-weight ratio, especially in fuel-efficient vehicles.

Flexible PU is expected to be the fastest-growing segment during the forecast period. The European automotive sector’s focus on innovation for comfort and safety has led to the extensive use of flexible PU foam in seating, interiors, and cushioning. The furniture industry also contributed to the growth of this segment, utilizing PU in sofas, chairs, and mattresses for its comfort and durability. Additionally, ongoing research and development have resulted in advanced formulations that improve foam density, resilience, and fire resistance, thereby enhancing performance.

In 2023, the construction industry held the largest market share. This growth was driven by rising residential demand in metropolitan areas, spurred by urbanization, population growth, and migration. Polyurethane materials are increasingly used for insulation, flooring, and coatings to improve energy efficiency in buildings. PU adhesives, sealants, and coatings were employed in building renovations, and their use extended to hospital flooring and wall panels. Moreover, European governments’ investment in infrastructure, including roads, bridges, and public facilities, bolstered the demand for PU materials in road surfacing, sound barriers, and waterproofing.

The electronics and appliances sector is expected to grow at the fastest rate, with a CAGR of 5.03% during the forecast period. This growth can be attributed to the region’s expanding population and rising disposable income. As European consumers seek high-performance, convenient products, the use of PU materials in this sector has increased. PU is also used in wearable devices, fitness trackers, and smart health gadgets due to its lightweight, comfortable, and durable characteristics.

Germany accounted for a leading share of 17% in the region, driven by the construction sector's focus on sustainability and energy efficiency, which increased demand for thermal insulation. The automotive industry, especially in the production of electric and hybrid vehicles, also significantly contributed to market growth, with PU being used in interior components, coatings, and adhesives. Additionally, Germany’s booming e-commerce sector has fueled the need for efficient packaging solutions, with PU materials offering protective cushioning for shipments.

France's polyurethane market is expected to grow significantly, with a projected CAGR of 4.63% during the forecast period. The market's growth is largely driven by the thermal properties of PU, which enhance energy efficiency. Furthermore, France’s stringent environmental regulations have encouraged the adoption of eco-friendly materials, including PU. This has prompted manufacturers to develop bio-based and recyclable products while prioritizing sustainability. Companies are also investing heavily in research and development to improve PU formulations, incorporating new additives, flame retardants, and advanced processing techniques.

By Product

By End-use

By Country

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others