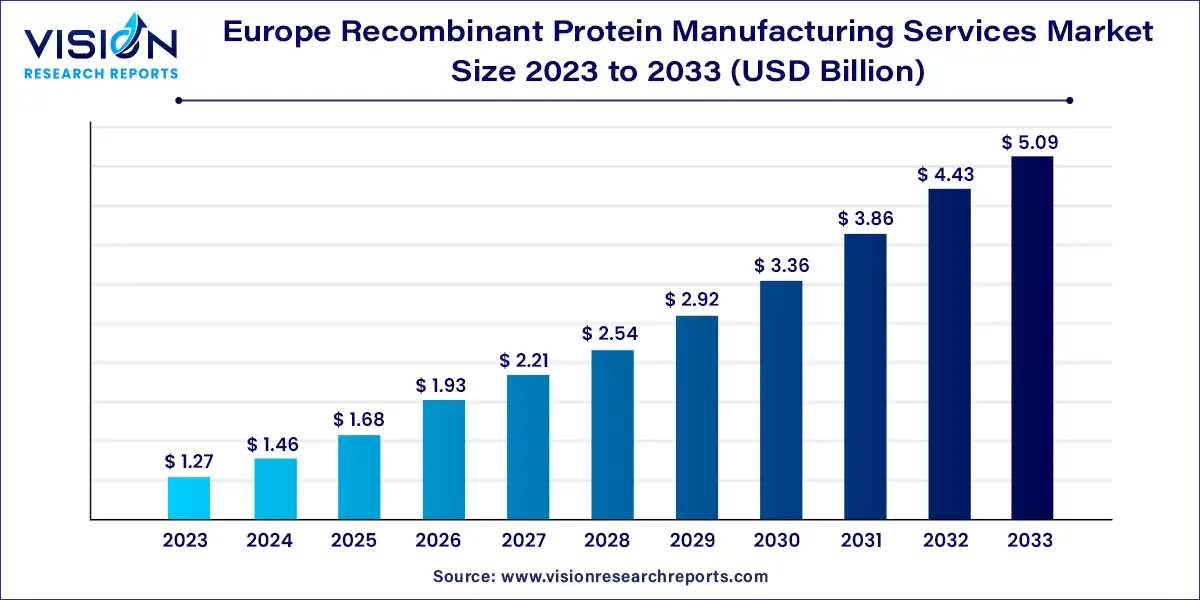

The Europe recombinant protein manufacturing services market size was estimated at USD 1.27 billion in 2023 and it is expected to surpass around USD 5.09 billion by 2033, poised to grow at a CAGR of 14.89% from 2024 to 2033.

The Europe recombinant protein manufacturing services market is experiencing significant growth driven by an increasing demand for biologics and personalized medicines has accelerated the need for efficient and scalable protein production services across the region. Advances in biotechnology and bioprocessing techniques have enhanced production capabilities, improving yield and reducing costs, thereby attracting more pharmaceutical and biotech companies to outsource these services. Additionally, supportive government initiatives and funding aimed at promoting healthcare innovation, along with a rising prevalence of chronic diseases requiring advanced therapeutic solutions, are further propelling market expansion. The presence of a robust healthcare infrastructure and a strong network of research institutions in Europe also contribute to the sustained growth and development of the recombinant protein manufacturing services market.

| Report Coverage | Details |

| Market Size in 2023 | USD 1.27 billion |

| Revenue Forecast by 2033 | USD 5.09 billion |

| Growth rate from 2024 to 2033 | CAGR of 14.89% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Lonza; Boehringer Ingelheim International GmbH; FUJIFILM Diosynth Biotechnologies; Merck KGaA; Bruker (InVivo BioTech Services GmbH); Sino Biological, Inc.; GenScript; Kaneka corporation (Kaneka Eurogentec S.A); Polyplus Transfection (Xpress Biologics); Boster Biological Technology; Trenzyme GmbH |

Commercial production services was the largest revenue-generating segment with the dominant market share of 60% in 2023. The development of recombinant DNA technology, cell culture methods, protein expression systems, and growing accessibility of high-yield expression systems like mammalian cell lines, yeast, and bacteria, which can boost production productivity & efficiency, are some of the factors driving the commercial production services market.

The commercial production services segment is expected to witness the fastest CAGR of 16.42% over the forecast period due to an increasing focus on precision medicine, targeted therapies, and the growing need for outsourcing clinical trial design, data collection, & analysis. Moreover, Europe is home to some of the world’s high research and development (R&D) focused countries, such as the UK, Germany, and Denmark. For instance, according to EuroDev, the pharmaceutical industry in Germany spends over USD 6.74 billion (EUR 6.2 billion) annually on R&D and conducted around 499 clinical trials funded by research-based pharmaceutical companies in 2019. This is expected to drive market expansion throughout the forecast period.

Mammalian host cell was the highest revenue-generating segment with the largest market share of 56% in 2023. For manufacturing complex proteins that need significant folding, subunit assembly, and/or posttranslational modifications, mammalian cells are fitting host cells. These features contribute to understanding the preference for mammalian cells utilized in the biotech and pharmaceutical sectors for manufacturing diagnostic and therapeutic proteins.

On the other hand, the yeast & fungi segment is estimated to witness a significant CAGR of 16.33% over the forecast period. Yeasts are now used in several healthcare fields, including the generation of therapeutic recombinant proteins and their traditional application in fermentation. Yeast cells are particularly captivating as hosts for biopharmaceutical synthesis as they are generally accepted as safe organisms. These factors are expected to drive market expansion throughout the forecast period.

The pharmaceutical & biotechnology company segment held the largest market share of 80% in 2023. Numerous major and small biotechnology businesses are driving innovation in these fields in terms of service and manufacturing capabilities, providing commercial potential for market expansion. For instance, the EIB approved a USD 19.65 million (€18 million) investment to Estonian biotech Icosagen for new Current Good Manufacturing Practice (cGMP) production facilities and novel Research & Development (R&D) technologies. Furthermore, rising demand for protein manufacturing services, growing competition among players, and increasing biologics pipeline are contributing to the development of the global market.

On the other hand, the academic & research institutes industry segment is estimated to witness a 17.38% CAGR during the forecast period. As recombinant technology advances, novel uses of recombinant proteins enabling the development of customized medicine, cell and gene therapies, and bioengineering products are expected to grow at a rapid rate. For example, the development of gene editing technologies such as CRISPR-Cas9 permitted precise modification of recombinant proteins to develop novel therapies. These factors are projected to significantly improve the demand for recombinant proteins in academic and research institutes, driving the segment’s growth in the manufacturing services industry.

By Service Type

By Host Cell

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Service Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Europe Recombinant Protein Manufacturing Services Market

5.1. COVID-19 Landscape: Europe Recombinant Protein Manufacturing Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Europe Recombinant Protein Manufacturing Services Market, By Service Type

8.1. Europe Recombinant Protein Manufacturing Services Market, by Service Type, 2024-2033

8.1.1 Pre-clinical & Clinical Services

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Commercial Production Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Europe Recombinant Protein Manufacturing Services Market, By Host Cell

9.1. Europe Recombinant Protein Manufacturing Services Market, by Host Cell, 2024-2033

9.1.1. Host Cell

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Bacterial Cells

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Insect Cells

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Yeast & Fungi

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Europe Recombinant Protein Manufacturing Services Market, By End-use

10.1. Europe Recombinant Protein Manufacturing Services Market, by End-use, 2024-2033

10.1.1. Pharmaceutical & Biotechnology Companies

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Academic & Research Institutes

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Europe Recombinant Protein Manufacturing Services Market, Regional Estimates and Trend Forecast

11.1. Europe

11.1.1. Market Revenue and Forecast, by Service Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Host Cell (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Lonza

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Boehringer Ingelheim International GmbH.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. FUJIFILM Diosynth Biotechnologies

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Merck KGaA.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Bruker (InVivo BioTech Services GmbH)

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Sino Biological, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. GenScript

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Kaneka corporation (Kaneka Eurogentec S.A)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Polyplus Transfection (Xpress Biologics)

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Boster Biological Technology

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others