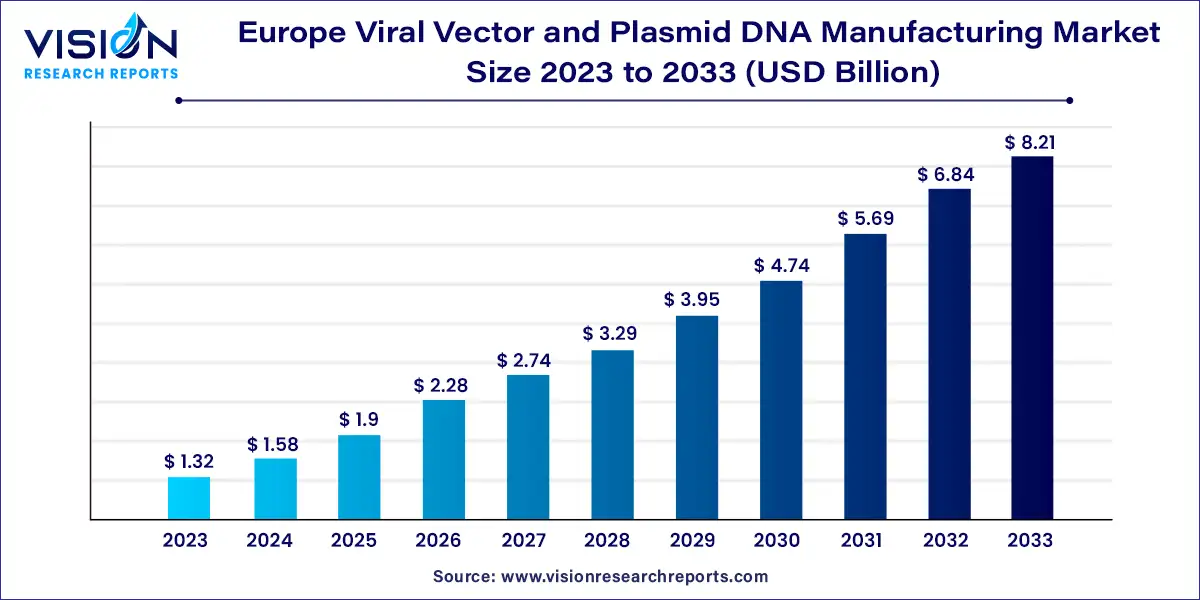

The Europe viral vector and plasmid DNA manufacturing market size was estimated at around USD 1.32 billion in 2023 and it is projected to hit around USD 8.21 billion by 2033, growing at a CAGR of 20.05% from 2024 to 2033.

The Europe viral vector and plasmid DNA manufacturing market presents a dynamic landscape characterized by burgeoning research and development activities, propelled by the increasing demand for advanced gene therapies and vaccines. With a growing emphasis on personalized medicine and innovative biotechnological solutions, the region's market is witnessing significant investments in manufacturing capabilities and infrastructure. Key players are strategically focusing on expanding their production capacities and enhancing technological capabilities to cater to the escalating requirements of the healthcare sector.

The growth of the Europe viral vector and plasmid DNA manufacturing market is propelled by an increasing prevalence of chronic diseases and genetic disorders has spurred the demand for advanced gene therapies, driving the need for viral vectors and plasmid DNA. Additionally, the rising investments in research and development activities, coupled with supportive government initiatives and funding, are fueling innovation and technological advancements in manufacturing processes. Moreover, the growing adoption of personalized medicine and the emergence of new applications in areas such as cancer treatment and rare diseases are further driving market growth.

The adenovirus segment established significant prominence in 2023. Adenoviral Vectors (AdV) are increasingly utilized across various research applications in gene therapy due to their ability to achieve high titers, integrate large transgenes, and transduce both quiescent and dividing cells. For instance, researchers are actively investigating adenovirus-mediated gene therapy as a potential treatment for HIV infection, offering promising avenues for improved disease management. AdV also play a pivotal role in vaccine development, eliciting robust humoral and T cell responses. Numerous studies have assessed the efficacy of AdV in diverse applications, including vaccinology and gene editing, with notable successes observed in using AdV as a delivery tool for CRISPR/Cas9, resulting in efficient gene disruption within the human cell genome.

The lentivirus segment is anticipated to exhibit the fastest CAGR of 20.23% throughout the forecast period. With the escalating utilization of lentiviral vectors in ongoing research endeavors, the scientific community is actively exploring advancements in these vectors. Notably, researchers are investigating the potential of non-integrating lentiviral vectors (NILVs) as a means to mitigate insertional mutagenesis risks. NILVs demonstrate the capability to transduce both dividing and non-dividing cells, presenting promising applications in CAR-T cell therapy research. Additionally, recent studies highlight the utilization of lentiviral vectors in developing vaccines targeting dendritic cells, stimulating potent T-cell immune responses.

Within the workflow domain, the downstream processing segment emerged as the market leader, capturing the largest revenue share of 54% in 2023. Downstream processing encompasses a series of purification methods involving multiple steps, typically categorized into capture, intermediate purification, and polishing stages. Chromatography and ultrafiltration techniques are predominantly employed for intermediate purification and final polishing, with chromatography techniques utilizing ion exchange and affinity methods being the industry's preferred choice. However, these methods encounter challenges necessitating additional purification steps, potentially resulting in yield losses.

The upstream processing segment is poised to witness a robust CAGR of 19.13% over the forecast period. Representing the initial stage of processing, upstream processing involves cell introduction to the virus, cell cultivation, and subsequent virus extraction. Continuous innovation in product development, exemplified by technologies like the ambr 15 microbioreactor system, is anticipated to bolster this segment's growth, facilitating high-throughput upstream process development.

The vaccinology segment emerged as the dominant application segment, commanding the largest revenue share of 22% in 2023. Heightened demand for vaccines, particularly amid efforts to combat infectious diseases such as Coronavirus and cancer, is poised to propel market expansion. Viral vector-based vaccine manufacturing offers inherent ease and compatibility with traditional vaccine production, facilitating large-scale manufacturing in existing units while enabling straightforward assessment of safety profiles. Ongoing exploration of various viral vectors underscores their potential advantages, driving accelerated development of viral vector-based vaccines.

In contrast, the cell therapy segment is projected to exhibit a notable CAGR of 22.23% over the forecast period. The increasing adoption of advanced transfer vectors has catalyzed the popularity of cell therapy-based treatments. These vectors, renowned for their safety and efficacy, facilitate the modification of patient samples through gene therapy vectors, followed by re-implantation for therapeutic purposes.

Within the end-use landscape, research institutes emerged as the dominant segment, commanding a substantial revenue share of 58% in 2023. This growth trajectory is underpinned by rising demand for viral vectors and heightened engagement of scientific communities in gene and cell therapy research. Research entities' endeavors aimed at enhancing vector production further propel segmental growth.

Meanwhile, pharmaceutical and biotechnology companies are poised to witness a noteworthy CAGR of 20.53% over the forecast period. This growth is attributed to the continual introduction of advanced therapies and subsequent proliferation of gene therapy-based research initiatives by pharmaceutical firms. The increasing adoption of vectors for therapeutic production by biotech companies further augments market dynamics.

In terms of disease segmentation, cancer emerged as the dominant segment, capturing the largest revenue share of 39% in 2023. The segment's growth is fueled by a surge in cancer cases and extensive utilization of plasmid DNA and viral vectors in developing gene therapies targeting cancer. Lifestyle factors such as the adoption of Western lifestyles, poor dietary habits, and sedentary lifestyles contribute to the escalating incidence of cancer cases, underscoring the imperative for innovative therapeutic interventions.

Genetic disorders are projected to undergo rapid growth during the forecast period. Gene therapy, developed specifically for treating rare genetic disorders like hemophilia, Adenosine Deaminase-Severe Combined Immunodeficiency (ADA-SCID), and Lipoprotein Lipase Deficiency (LPLD), addresses conditions arising from genetic inconsistencies or missing genes expressing particular traits. While most genetic diseases are congenital, some can result from random mutations. Common examples include sickle cell anemia and hemophilia, characterized by blood clot formation and impaired hemoglobin production, which compromises blood oxygen-carrying capacity.

In 2023, the viral vector and plasmid DNA manufacturing market in Germany claimed a revenue share of 25%. Germany stands as a leading country in Europe for gene therapy clinical trials, with numerous companies establishing their facilities, fostering the rapid commercialization of drugs. Notably, Germany became the first country to employ recently approved gene therapy treatments. With an increasing number of companies establishing themselves and government support for viable treatment options for genetic disorders and various cancers, Germany anticipates significant growth in trial numbers and drug approvals in the forthcoming years.

Italy's viral vector and plasmid DNA manufacturing market are poised to witness a remarkable CAGR of 19.43% over the forecast period, driven by significant advancements in biomanufacturing and industrial research. The country hosts several biotechnology and biopharmaceutical hubs, accommodating key players in viral vectors and plasmid DNA manufacturing. Milan, in particular, serves as a prominent biotechnology sector hub in Italy, housing approximately 35% of all biotech companies.

By Vector Type

By Workflow

By Application

By End-use

By Disease

By Country

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others