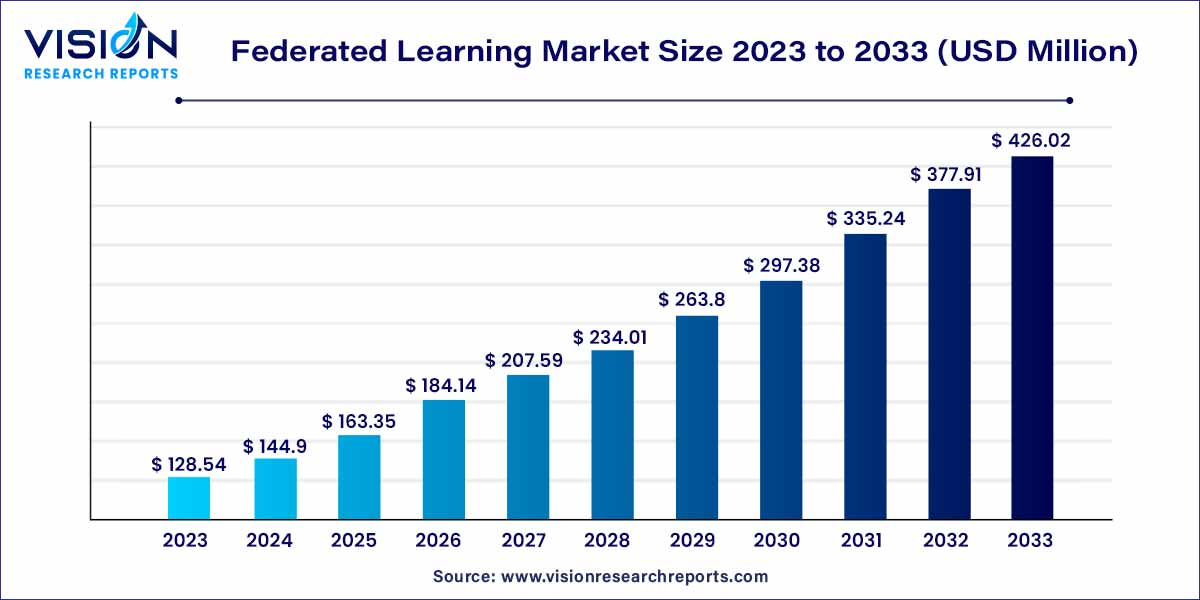

The global federated learning market size was estimated at around USD 128.54 million in 2023 and it is projected to hit around USD 426.02 million by 2033, growing at a CAGR of 12.73% from 2024 to 2033.

Federated Learning, an innovative approach in the realm of machine learning, is reshaping the dynamics of collaborative model training. This decentralized learning paradigm has garnered substantial attention due to its ability to address privacy concerns while harnessing the collective intelligence of diverse datasets.

The federated learning market is experiencing robust growth propelled by several key factors. Foremost among these is the escalating demand for privacy-preserving machine learning solutions across diverse industries. As data privacy concerns become increasingly paramount, federated learning emerges as a compelling solution by enabling collaborative model training without centralizing sensitive information. This approach not only adheres to stringent data protection regulations but also fosters trust among users and stakeholders. Additionally, the proliferation of connected devices and the advent of 5G technology have contributed significantly to the market's expansion. The ability of federated learning to harness insights from decentralized sources aligns seamlessly with the distributed nature of connected devices, making it an ideal choice for industries ranging from healthcare to finance. Furthermore, the ongoing investments in research and development, coupled with strategic collaborations between technology providers and enterprises, underscore the market's resilience and potential for continuous growth. In essence, the confluence of heightened privacy awareness, technological advancements, and collaborative industry efforts positions federated learning as a catalyst for innovation and sustained market expansion.

Report Scope of the Federated Learning Market

| Report Coverage | Details |

| Market Revenue by 2033 | USD 426.02 million |

| Growth Rate from 2024 to 2033 | CAGR of 12.73% |

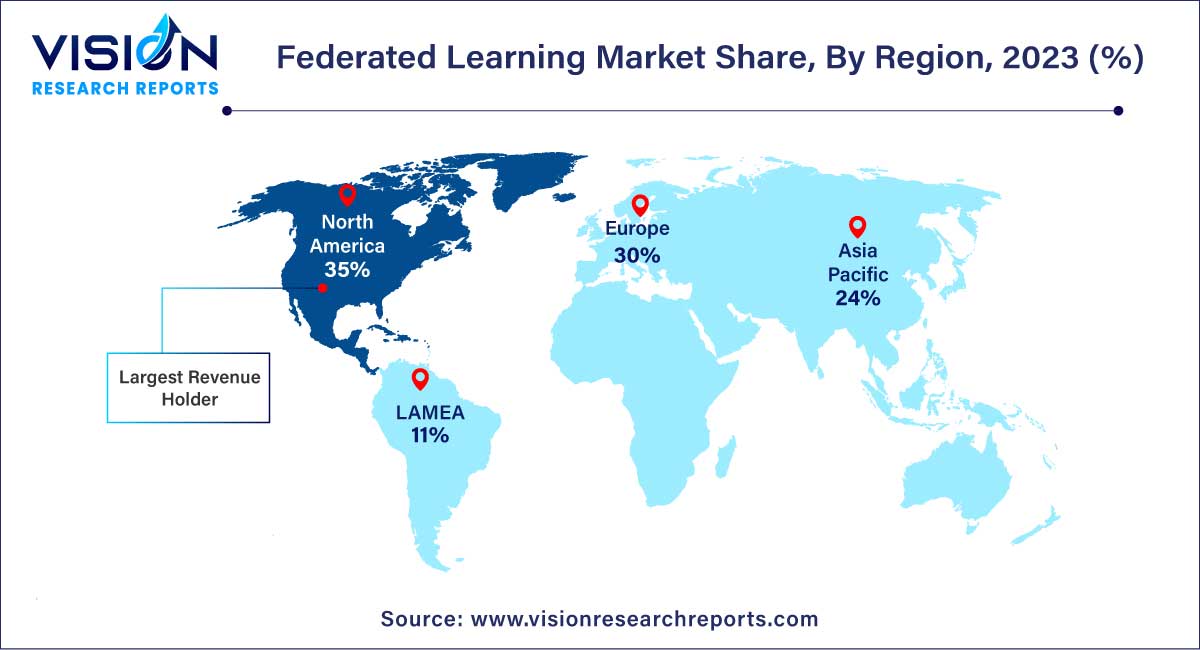

| Revenue Share of North America in 2023 | 35% |

| CAGR of Asia Pacific from 2024 to 2033 | 14.28% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The Industrial Internet of Things (IIOT) segment dominated the market with a revenue share of 25% in 2023. The demand growth for federated learning is propelled by its natural alignment with the decentralized structure of IIoT environments. Federated learning’s capacity to train models across distributed devices without centralizing data strongly resonates with the inherently decentralized nature of IIoT. This compatibility fosters adoption within industries reliant on IIoT, driving the expansion of the market. Moreover, its continual enhancement of AI models across various devices within IIoT environments, optimizing operations, serves as a driving force for broader implementation and market growth.

The drug discovery segment is expected to register a significant CAGR over the forecast period. Federated learning’s ability to help different groups collaborate on model training without sharing sensitive information is a big reason why it is growing in the market. By allowing various organizations to work together on drug development without sharing private data, it speeds up the process. This approach gains trust among pharmaceutical companies, research labs, and healthcare groups that want secure ways to work together efficiently. As federated learning proves it can speed up analysis while keeping data safe, more industries are becoming interested in using it, which is driving industry growth.

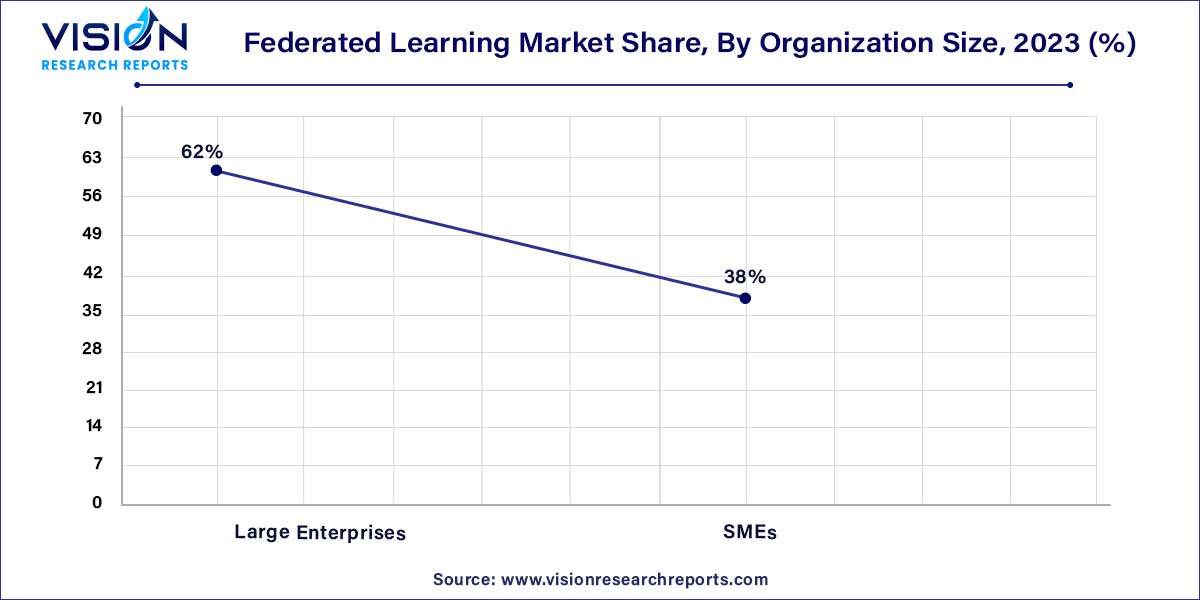

The large enterprises segment led the market with a revenue share of 62% in 2023. Large enterprises are increasingly gravitating toward federated learning due to its adaptability to their distributed structure and scale. This approach enables diverse branches or units within these organizations to collaborate on AI model training without centralizing sensitive data, ensuring compliance with stringent privacy regulations. Federated learning accommodates the vast and diverse datasets characteristic of large enterprises, optimizing resource allocation and accelerating model training across different divisions. Its decentralized data handling minimizes the risk of data breaches, aligning with the risk management strategies of these enterprises and fostering a culture of compliance.

The facilitation of collaborative AI model training by federated learning, even for SMEs with limited computational resources, is a key factor propelling market growth. This inclusive approach empowers smaller businesses to collectively refine models using diverse data sources without hefty infrastructure requirements. By enabling SMEs to participate in advanced AI model training without the need for substantial investments, federated learning democratizes access to cutting-edge technology, fostering broader adoption within SMEs. This democratization and resource-efficient nature of federated learning fuel its expansion, driving forward the market for AI solutions among smaller enterprises.

The IT & telecommunications segment held a dominant market share of over 28% in 2023. The IT & telecommunications industry possesses vast and diverse datasets dispersed across various systems and networks. Federated learning aligns with their distributed nature, enabling collaborative model training without compromising sensitive data. The sector’s emphasis on data privacy and security dovetails perfectly with federated learning’s decentralized approach. Moreover, the constant need for innovation and optimization within IT and telecom necessitates efficient utilization of data without centralizing it, a demand met effectively by federated learning. The need for real-time data analysis and processing in IT & telecommunications is met by federated learning's ability to perform on-device training, minimize latency, and enhance network performance.

The healthcare & life sciences segment is expected to register a CAGR of 14.35% over the forecast period. The personalized nature of healthcare often requires customized treatments based on individual patient data. Federated learning enables the creation of more accurate and personalized AI models, enabling advancements in precision medicine without compromising patient confidentiality. Federated learning optimizes the utilization of diverse and extensive datasets available across healthcare institutions. It enables the collective analysis of this data while preserving data privacy, leading to enhanced disease prediction, treatment optimization, and overall healthcare innovation.

North America held the highest market share of over 35% in 2023. Key industries, such as healthcare, finance, and technology in North America are early adopters of advanced AI technologies. Federated learning's ability to address data privacy concerns while enabling collaborative model training resonates well with these sectors, leading to widespread adoption and market dominance in the region. The region fosters strong collaborative networks among academia, research institutions, and industries. This collaboration encourages the sharing of expertise, resources, and data, ideal for federated learning's collaborative model training without compromising data privacy.

Asia Pacific is anticipated to witness a CAGR of 14.28% from 2024 to 2033. Countries, such as China, Japan, South Korea, and Singapore, are witnessing significant advancements in AI technologies. These nations are investing heavily in R&D, fostering a thriving ecosystem for AI innovation, including federated learning. Industries in the Asia Pacific are increasingly recognizing the potential of AI solutions for various applications. Federated learning's ability to address data privacy concerns while enabling collaboration resonates with sectors, such as healthcare, finance, and automotive, in this region.

By Application

By Organization Size

By Industry Vertical

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Application Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Federated Learning Market

5.1. COVID-19 Landscape: Federated Learning Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Federated Learning Market, By Application

8.1. Federated Learning Market, by Application, 2024-2033

8.1.1 Industrial Internet of Things

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Drug Discovery

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Risk Management

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Augmented & Virtual Reality

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Data Privacy Management

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Federated Learning Market, By Organization Size

9.1. Federated Learning Market, by Organization Size, 2024-2033

9.1.1. Large Enterprises

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. SMEs

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Federated Learning Market, By Industry Vertical

10.1. Federated Learning Market, by Industry Vertical, 2024-2033

10.1.1. It & Telecommunications

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Healthcare & Life Sciences

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. BFSI

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Retail & E-commerce

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Automotive

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Federated Learning Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Application (2021-2033)

11.1.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.1.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Application (2021-2033)

11.2.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.2.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Application (2021-2033)

11.3.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.3.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.4.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.4.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.5.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.5.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Organization Size (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

Chapter 12. Company Profiles

12.1. Acuratio, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Cloudera, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Edge Delta.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Enveil.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. FedML.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Google LLC

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. IBM Corporation.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Intel Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Lifebit.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. NVIDIA Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others