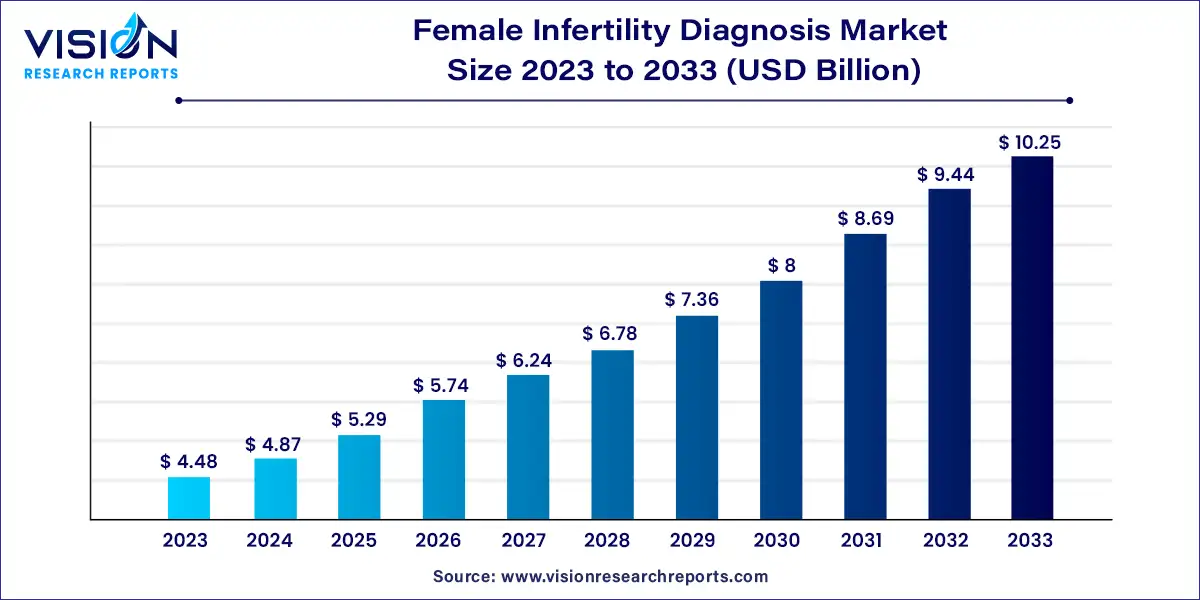

The global female infertility diagnosis market size was estimated at USD 4.48 billion in 2023 and it is expected to surpass around USD 10.25 billion by 2033, poised to grow at a CAGR of 8.63% from 2024 to 2033. The female infertility diagnosis market is a vital segment within the broader reproductive health industry, focusing on the identification and assessment of factors contributing to female infertility.

The growth of the female infertility diagnosis market is primarily driven by the technological advancements play a crucial role, as innovations such as high-resolution imaging techniques, sophisticated genetic testing, and advanced hormonal assays have significantly improved diagnostic accuracy and efficiency. Additionally, the rising prevalence of infertility, influenced by lifestyle changes, delayed childbearing, and various medical conditions, has led to an increased demand for diagnostic services. Increased awareness and education about reproductive health have also contributed to market expansion, as more women seek early diagnosis and treatment. Furthermore, improved healthcare access and the proliferation of specialized fertility clinics have made diagnostic procedures more widely available, further fueling market growth.

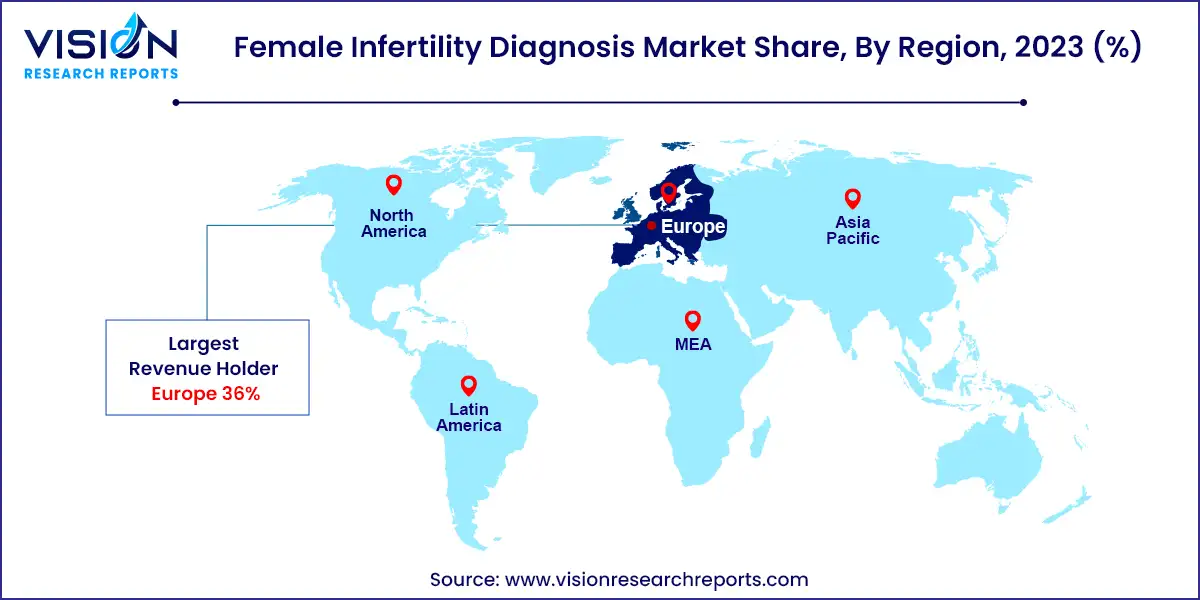

The female infertility diagnosis market in Europe held the largest share of 36%, fueled by growing demand for infertility diagnosis and treatments. A July 2024 report by the European Society of Human Reproduction and Embryology (ESHRE) revealed an increase in IVF cycles among European women, indicating a trend towards greater utilization of assisted reproductive technologies to address infertility.

| Attribute | Europe |

| Market Value | USD 1.61 Billion |

| Growth Rate | 8.63% CAGR |

| Projected Value | USD 3.69 Billion |

In the UK, the market is experiencing notable growth, driven by lifestyle factors contributing to fertility issues. Smoking, excessive alcohol consumption, poor diet, lack of exercise, and high stress levels negatively impact fertility by disrupting hormone levels, sperm quality, ovulation, and overall reproductive health.

North America

In 2023, the female infertility diagnosis market in North America is expected to hold a significant share. The market growth in this region is driven by rising infertility rates and the increasing need for external support. The decline in fertility rates, particularly in Canada, has notably influenced market expansion. According to Statistics Canada, published in September 2022, the fertility rate in Canada decreased to 1.43 children per woman in 2021, well below the replacement level of 2.1 children per woman.

Asia Pacific

The female infertility diagnosis market in the Asia Pacific region is witnessing significant growth due to heightened healthcare awareness and collaborative initiatives. A July 2023 expert meeting on population aging and low fertility addressed the implications of these demographic trends for sustainable development. This meeting, which involved experts, policymakers, and stakeholders, emphasized the impact of an aging population on societies, economies, and healthcare systems in the Asia-Pacific region.

In Japan, the female infertility diagnosis market is poised for rapid growth, driven by rising demand for fertility detection and treatments. Factors such as delayed marriages, career pressures, and declining birth rates have led to the emergence of fertility start-ups addressing the growing need for reproductive assistance.

In 2023, the ovarian reserve testing segment commanded the largest market share of 44% and is projected to experience the highest growth rate over the forecast period. This leading position is attributed to the rise in reproductive health concerns among women. Ovarian reserve testing is essential for evaluating a woman’s fertility potential by assessing the quantity and quality of her remaining eggs. It is particularly relevant for women contemplating delayed childbearing, those with a family history of early menopause, or individuals undergoing treatments like chemotherapy that could affect ovarian function.

Additionally, ovarian reserve testing is crucial for assisted reproductive technologies (ART), including in vitro fertilization (IVF). Evaluating ovarian reserve helps customize treatment plans and predict responses to stimulation. By analyzing markers such as anti-Müllerian hormone (AMH) levels, antral follicle count (AFC), and follicle-stimulating hormone (FSH) levels, healthcare providers can offer personalized advice, enabling women to make informed decisions about their reproductive options.

By Test

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Female Infertility Diagnosis Market

5.1. COVID-19 Landscape: Female Infertility Diagnosis Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Female Infertility Diagnosis Market, By Test

8.1. Female Infertility Diagnosis Market, by Test Type, 2024-2033

8.1.1. Ovarian Reserve Testing

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Hysterosalpingography

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Hormone testing

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Other Tests

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Female Infertility Diagnosis Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Test (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Test (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Test (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Test (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Test (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Test (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Test (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Test (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Test (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Test (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Test (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Test (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Test (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Test (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Test (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Test (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Test (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Test (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Test (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Test (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Test (2021-2033)

Chapter 10. Company Profiles

10.1. PFCLA

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Mayo Foundation for Medical Education and Research (MFMER)

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Cleveland Clinic

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Apricity Fertility UK Limited

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. King’s Fertility Limited

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Dallas IVF

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Midwest Fertility Specialists

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Europe IVF

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. Care Fertility

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Aspire Fertility

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others