The global fipronil pyrazole market size was estimated at USD 289.73 million in 2023 and it is expected to surpass around USD 402.81 million by 2033, poised to grow at a CAGR of 3.35% from 2024 to 2033.

The fipronil pyrazole market is experiencing significant growth due to its broad application in agriculture and pest control sectors. Fipronil Pyrazole, a potent insecticide known for its effectiveness against a wide range of pests, has garnered substantial attention in recent years. This growth is driven by increasing demand for crop protection solutions that enhance agricultural productivity while ensuring environmental sustainability.

The growth of the fipronil pyrazole market is fueled by an effectiveness as a broad-spectrum insecticide in agriculture has spurred demand among farmers aiming to enhance crop yields. Secondly, stringent regulations promoting sustainable agricultural practices have encouraged the adoption of Fipronil Pyrazole due to its lower environmental impact compared to traditional pesticides. Moreover, technological advancements in formulation techniques have improved product efficacy, further boosting market growth. Additionally, increasing awareness about integrated pest management strategies and rising concerns over food security globally contribute to expanding market opportunities for fipronil pyrazole-based products.

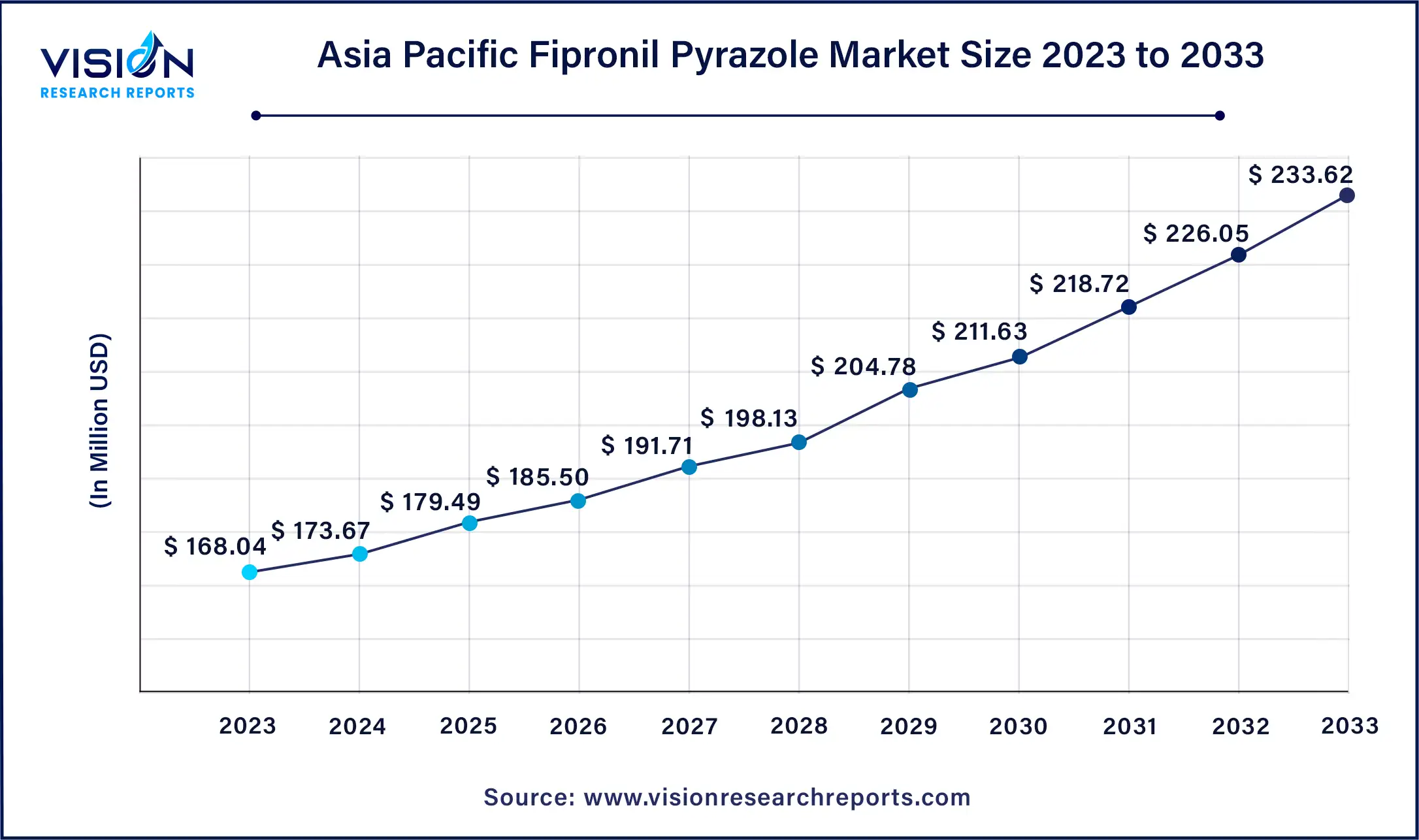

The Asia Pacific fipronil pyrazole market size was estimated at around USD 168.04 million in 2023 and it is projected to hit around USD 233.62 million by 2033, growing at a CAGR of 3.34% from 2024 to 2033.

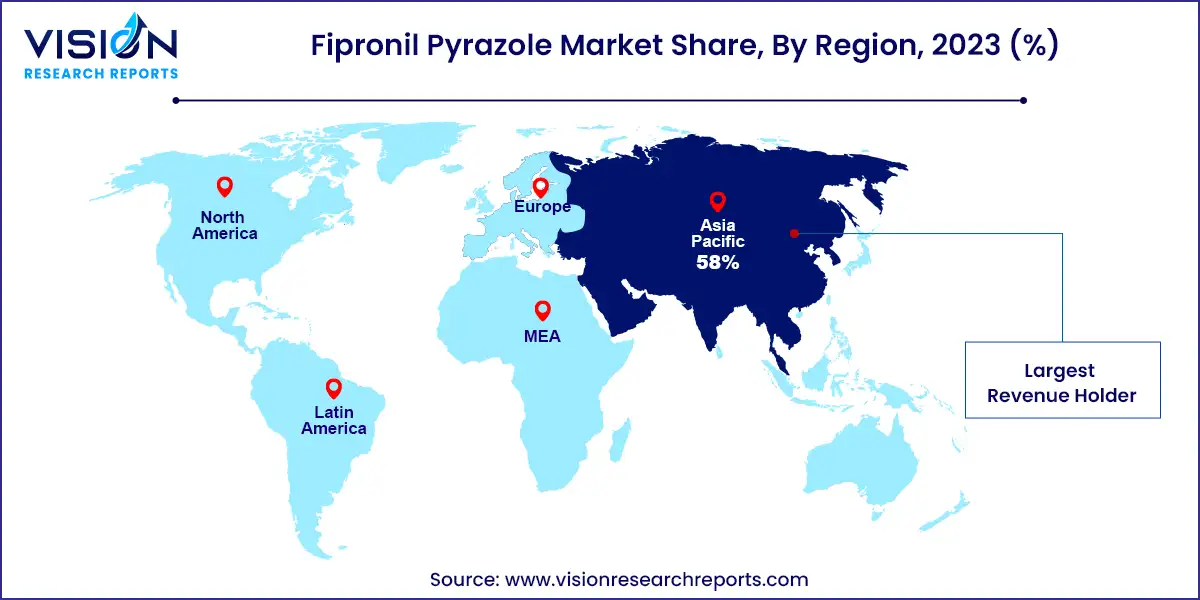

In 2023, the Asia Pacific region dominated the fipronil pyrazole market with a 58% revenue share. This growth is attributed to a growing population and shrinking arable land, which has intensified the need to boost overall crop yields.

China's fipronil pyrazole market is forecasted to grow significantly, supported by increased crop production efforts. Fipronil pyrazole plays a critical role in enhancing crop yields and ensuring crop protection. China has ramped up production of key crops such as wheat, rice, corn, and roses, with cereal production reaching 633.7 million tons in 2022, predominantly from wheat, rice, and coarse grains.

The North America region is poised for significant growth during the forecast period, driven by increasing demand for crop protection chemicals and expanding agricultural production. According to the U.S. Agricultural, Economic, and Foreign Trade outlook, the total wheat production area is projected to reach 49.5 million acres, marking a 3.8 million-acre increase from the previous year, the highest since 2016/17.

The U.S. fipronil pyrazole market is expected to expand over the forecast period, bolstered by a burgeoning agricultural sector and rising demand for crop protection chemicals to enhance production and safeguard crops.

The liquid segment emerged as the dominant force in the global market during 2023, capturing a substantial 48% revenue share. This growth is primarily attributed to the superior ability of liquid formulations to evenly distribute active ingredients across treated surfaces, ensuring effective performance. Liquid carriers facilitate uniform dispersion of active ingredients, making them ideal for large-area applications and delivering quick pest control.

On the other hand, the particle form of fipronil pyrazole exists in solid states like powder or granules. This formulation offers advantages in handling, storage, and application efficiency. It enables targeted application to specific areas, minimizing non-target exposure and reducing wastage. Particle formulations also excel in surface coverage and adhesion, enhancing efficacy in agriculture, forestry, public health, and household pest control applications.

The agriculture segment held sway over the global market in 2023, commanding a substantial 75% revenue share. Fipronil pyrazole's effectiveness against diverse insect pests underscores its pivotal role in crop protection. It is widely used in agriculture through liquid sprays, granules, and seed treatments.

In agricultural settings, fipronil pyrazole adapts to various forms such as liquid sprays, granules, or seed treatments based on specific pest types, crop varieties, and application methods. As a foliar spray, it is diluted in water and applied directly to plants, targeting insects on contact with the sprayed solution

Fipronil pyrazole serves as a crucial intermediate in the synthesis of diverse organic compounds, facilitating the creation of complex molecules through organic reactions like substitution, addition, and condensation. Its chemical properties make it particularly suitable for incorporation into molecular frameworks, enabling the development of new pharmaceuticals, agrochemicals, or materials tailored to specific properties. Its role in chemical synthesis varies based on desired end products and the specific reactions and transformations involved in the synthesis process.

By Form

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others