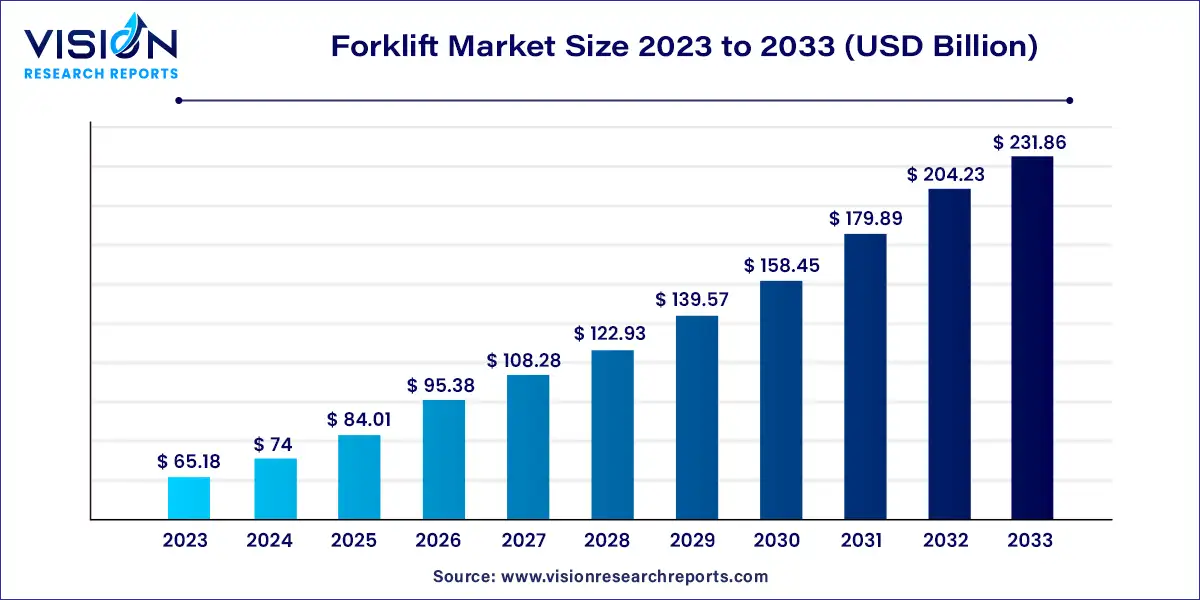

The global forklift market size was estimated at USD 65.18 billion in 2023 and it is expected to surpass around USD 231.86 billion by 2033, poised to grow at a CAGR of 13.53% from 2024 to 2033.

The forklift market encompasses a diverse range of industrial vehicles crucial for material handling operations across various sectors. This market segment is characterized by a variety of forklift types, including electric, diesel, and LPG-powered models, each tailored to specific operational needs. Key drivers influencing market growth include technological advancements, increasing automation in logistics and manufacturing, and stringent safety regulations.

The forklift market is experiencing robust growth driven by several key factors. Technological advancements play a pivotal role, with innovations such as electric forklifts gaining prominence due to their eco-friendly operation and lower maintenance costs. Increasing automation in logistics and manufacturing sectors is another significant driver, as businesses seek efficient material handling solutions to enhance productivity. Stringent safety regulations also contribute to market growth, encouraging the adoption of safer and more advanced forklift models.

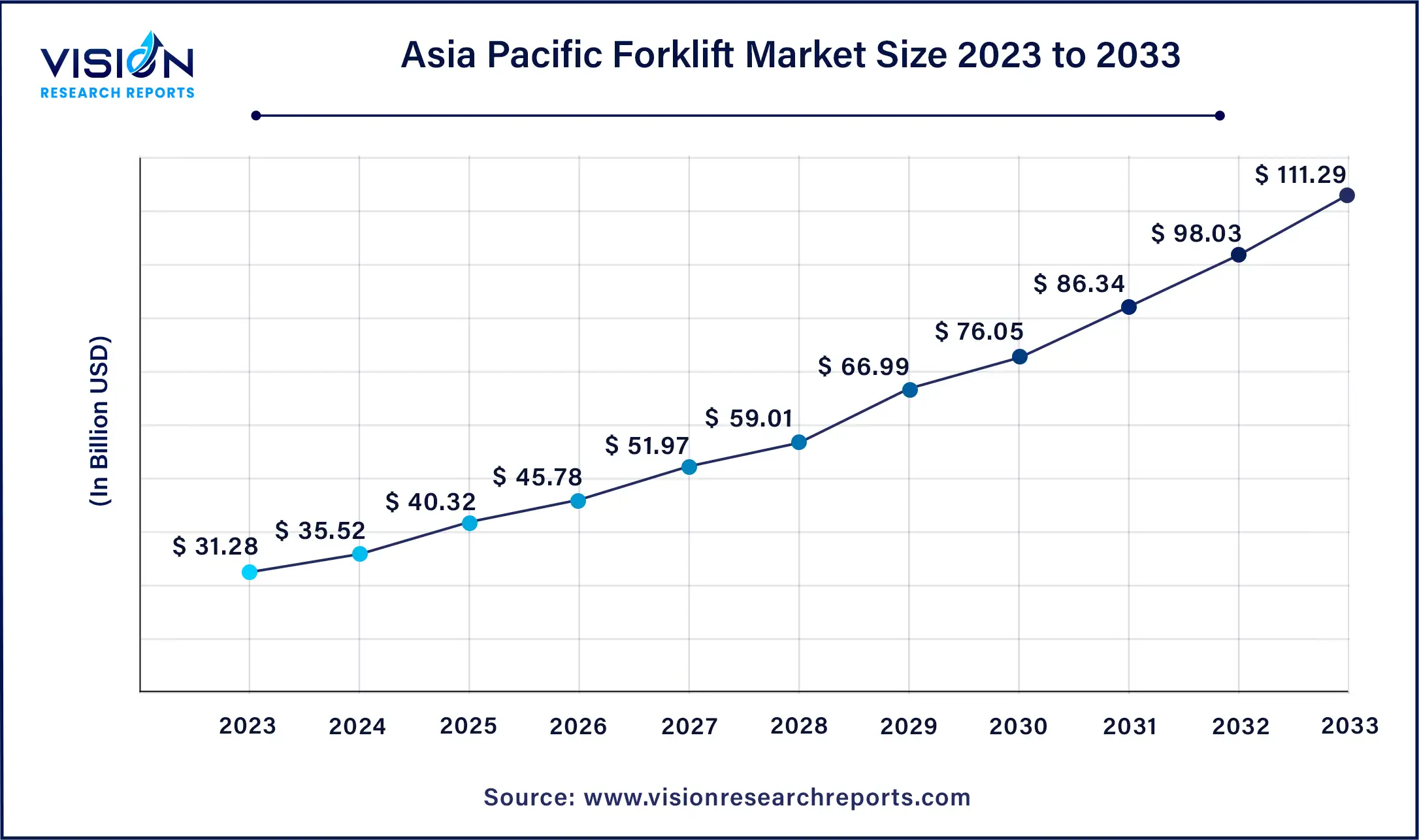

The Asia Pacific forklift market size was estimated at around USD 31.28 billion in 2023 and is projected to hit around USD 111.29 billion by 2033, growing at a CAGR of 13.53% from 2024 to 2033.

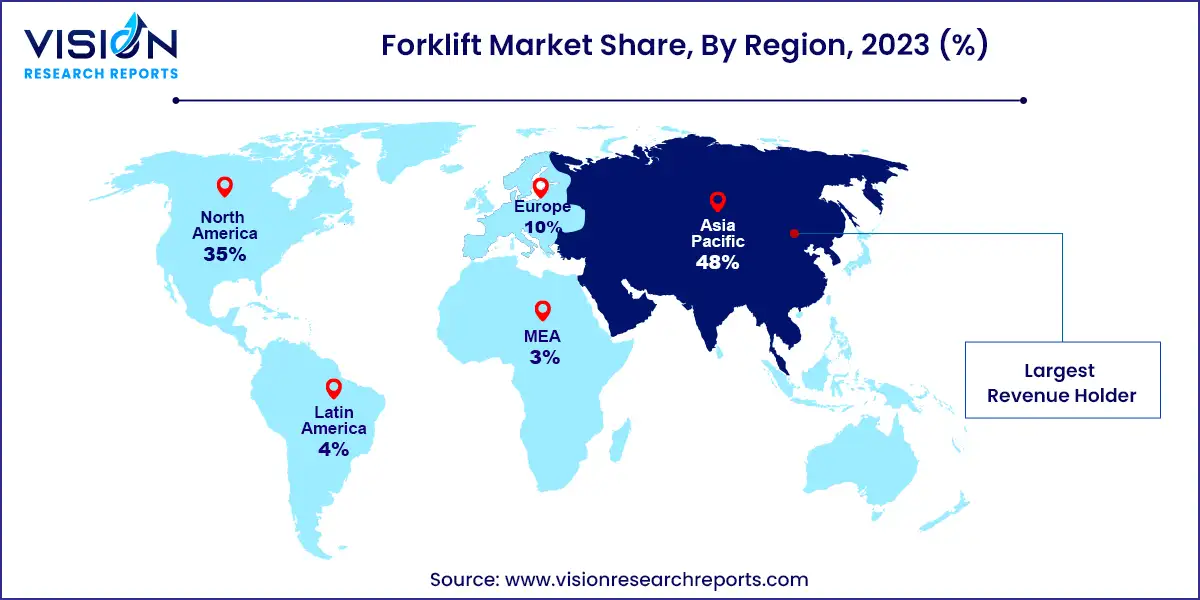

In 2023, Asia Pacific dominated the forklift market with a share of 48%. The region hosts several leading forklift manufacturers like Doosan Corporation and Hangcha Forklift, driving technological advancements and enhancing industry competitiveness. Continuous development of advanced electric forklift models with improved performance and features prompts industries to upgrade their fleets for enhanced efficiency and competitiveness. Collaborations among governments, manufacturers, and businesses are expected to further drive innovation and widespread adoption of forklifts across Asia Pacific.

Europe is poised to experience significant growth in the forklift market during the forecast period. The region's forklift industry is set to expand rapidly, driven by increasing demand for sustainable supply chain solutions and heightened global awareness of climate change. Businesses in Europe are increasingly focused on reducing their carbon footprints and adopting eco-friendly practices throughout their operations, bolstering the demand for environmentally sustainable forklift technologies.

In 2023, the Class 3 segment dominated the market with a share of 44%. This segment includes electric motorized hand trucks, which are controlled by a tiller at the front of the vehicle. These forklifts are commonly used for moving low-height items across warehouse floors, eliminating the need for high shelving.

The Class 1 segment is expected to experience significant growth during the forecast period. Increased demand for electric rider trucks in sectors such as retail, manufacturing, food service, and chemicals is driving this growth. Class 1 forklifts are known for their minimal maintenance due to fewer moving parts, as well as their quiet and maneuverable operations, making them suitable for various workplace environments.

In 2023, the electric segment held the largest market share. Electric forklifts are preferred for their environmental benefits over gasoline and diesel alternatives. As concerns grow over environmental impact and fossil fuel depletion, electric forklifts provide a sustainable solution, contributing to a cleaner workplace environment without emissions. Advancements in battery technology are expected to further propel the growth of electric forklifts, with manufacturers like AB Volvo Penta and FTMH Fantuzzi Team Material Handling Spa developing high-capacity electric models to meet market demand.

In 2023, the 5-15 ton segment dominated the market. Forklifts with capacities ranging from 5 tons to 15 tons are widely used for handling diverse materials such as pallets, steel, and bricks. These forklifts are essential for efficient mechanized loading and short-distance transport, suitable for both indoor and outdoor operations. Powered by natural gas, liquid propane, or gasoline, these sit-down models are versatile and commonly employed for precise and swift handling of heavy objects, presenting lucrative growth opportunities for this segment.

The below 5 ton segment is projected to exhibit the highest growth rate during the forecast period. These compact forklifts offer exceptional versatility, enabling businesses to efficiently handle varying load sizes. Ideal for navigating limited floor space, they facilitate safe and easy movement of products in applications spanning manufacturing, warehousing, logistics, and freight handling. Their compact design also enhances workplace safety when transporting hazardous materials within confined warehouse environments.

In 2023, the lead-acid segment captured the largest revenue share at 67%. Known for their reliable power surge capabilities, lead-acid batteries are favored for electric forklifts. These batteries deliver high current outputs necessary for heavy lifting and maneuvering tasks, ensuring consistent performance without significant voltage drops or power fluctuations.

The lithium-ion battery segment is anticipated to record the highest growth rate over the forecast period. Rising environmental concerns are driving businesses towards eco-friendly solutions to reduce carbon footprints. Lithium-ion batteries offer a cleaner alternative to traditional lead-acid batteries, which contain toxic components like lead and sulfuric acid. Adoption of lithium-ion technology in electric forklifts aligns with stringent environmental regulations, underscoring vendor commitments to sustainability and bolstering growth in this segment.

The industrial segment held the largest revenue share of 25% in 2023. Forklifts are integral to material handling and warehousing operations in industrial settings. In manufacturing plants, they play a critical role in transporting raw materials, intermediate products, and finished goods along production lines. Their ability to manage heavy loads and maneuver through tight spaces enhances material flow efficiency, reduces production bottlenecks, and optimizes operational workflows.

The retail and e-commerce industry has undergone a profound transformation in recent years, driven by evolving consumer preferences and the surge in online shopping. Forklifts have become indispensable in this dynamic landscape, offering specialized applications that support efficient material handling and logistics operations. They play a crucial role in optimizing warehouse operations, facilitating seamless movement of goods from order processing through storage to order fulfillment. Their compact designs and precise controls enable agile maneuvering within limited spaces, maximizing storage efficiency and accelerating inventory management processes.

By Class

By Power Source

By Load Capacity

By Electric Battery Type

By End Use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others