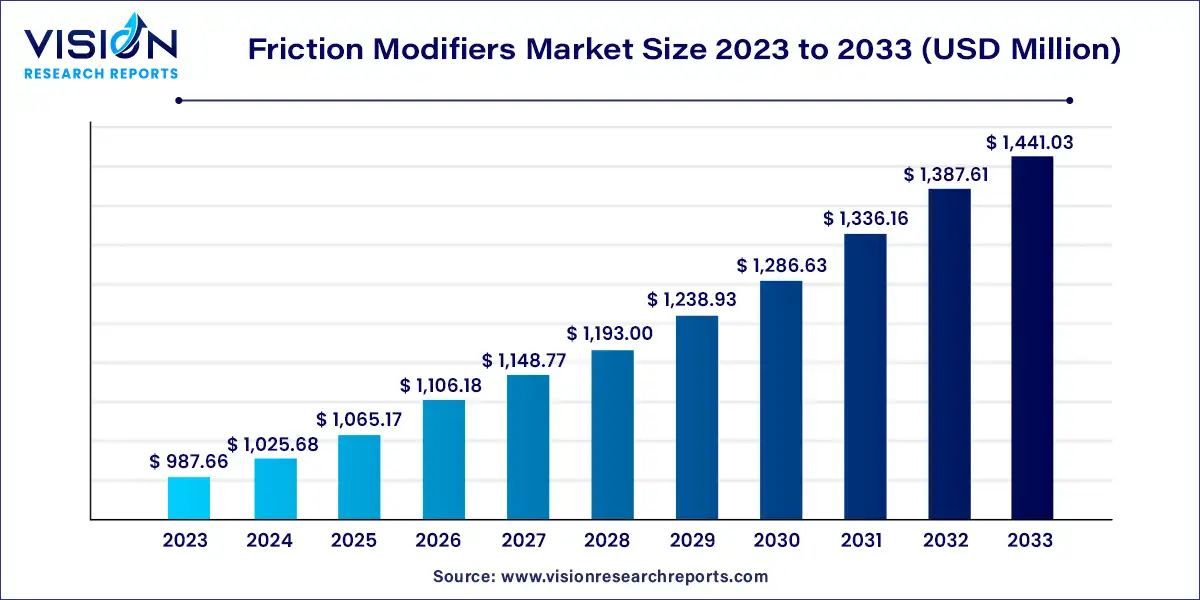

The global friction modifiers market size was valued at USD 987.66 million in 2023 and it is predicted to surpass around USD 1,441.03 million by 2033 with a CAGR of 3.85% from 2024 to 2033. The global market for friction modifiers is experiencing robust growth, driven by increasing demand across diverse end-user industries such as automotive, aerospace, and industrial manufacturing. Friction modifiers play a critical role in enhancing the efficiency and longevity of machinery by reducing frictional resistance between surfaces in contact.

The friction modifiers market is experiencing robust growth driven by an increasing demand across automotive, aerospace, and industrial sectors is bolstering market expansion. These additives play a crucial role in enhancing efficiency and longevity by reducing frictional resistance between surfaces, thereby improving fuel efficiency and lowering maintenance costs. Technological advancements in lubrication systems and a shift towards eco-friendly additives due to stringent environmental regulations are also contributing to market growth. Moreover, innovations in synthetic and bio-based friction modifiers are catering to sustainability trends, further fueling market expansion.

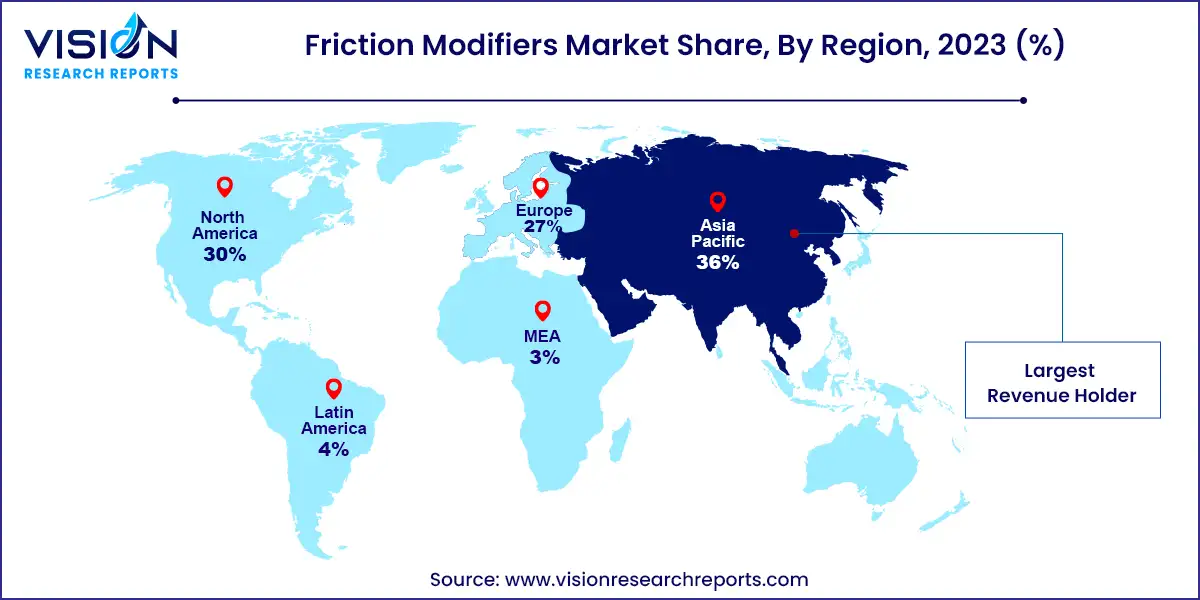

Asia Pacific held a dominant revenue share of 36% in 2023, leading the global market. This region continues to drive global growth, fueled by robust automotive production, particularly in China, the world's largest automobile producer.

| Attribute | Asia Pacific |

| Market Value | USD 355.55 Million |

| Growth Rate | 3.85% CAGR |

| Projected Value | USD 518.77 Million |

China's friction modifiers market is experiencing significant expansion, driven by its leadership in automotive manufacturing, which has a profound impact on lubricant consumption and, consequently, the demand for friction modifier additives.

North America boasts a strong industrial presence in automotive, aerospace, and manufacturing sectors, all substantial consumers of friction modifiers. Technological advancements in the automotive industry have propelled market growth in this region, with increased vehicle production directly influencing global demand.

Europe anticipates increased demand for friction modifiers due to rising automotive production driven by consumer demand for fuel-efficient vehicles. Moreover, the shift toward electrification in road passenger transport, supported by national policies aimed at reducing carbon and particulate emissions, is expected to become increasingly significant in the coming years.

The commercial vehicle segment led the market with a substantial revenue share of 65% in 2023. The growing sales of commercial vehicles have driven up the consumption of lubricants, thereby increasing the demand for friction modifiers. Particularly in transportation lubricants, which are crucial for commercial vehicles, friction modifiers are expected to see significant growth.

In passenger vehicles, the application of friction modifiers plays a crucial role in enhancing fuel efficiency, reducing friction, and addressing environmental concerns. This aligns well with industry trends focused on sustainability and performance improvement, underscoring the importance of friction modifiers in this segment. With the rising production volumes of passenger cars and the booming automotive industry, the demand for friction modifiers in the global market is further amplified, emphasizing the critical role of the passenger vehicles segment.

Organic friction modifiers dominated the market with a significant revenue share of 58% in 2023. These modifiers, derived from naturally occurring or synthetic organic compounds, have gained considerable traction due to their ability to form a protective boundary film on metal surfaces, effectively reducing friction and wear.

Organic friction modifiers such as fatty acids, esters, and amides offer superior lubrication properties and find extensive use in automotive and industrial applications. Their environmentally friendly nature and compatibility with a wide range of base oils make them the preferred choice for lubricant formulations aimed at reducing energy consumption and enhancing equipment durability.

In contrast, inorganic friction modifiers are derived from mineral-based compounds and metallic salts. These additives alter the surface properties of metal components, thereby reducing friction and wear. Inorganic options like molybdenum disulfide and graphite provide excellent stability at high temperatures and exceptional load-carrying capacity, making them ideal for heavy-duty applications such as industrial gear oils and metalworking fluids. Their ability to withstand extreme operating conditions and provide long-lasting lubrication solutions positions them as essential components in high-performance lubricants across various industrial sectors.

By Type

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Friction Modifiers Market

5.1. COVID-19 Landscape: Friction Modifiers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Friction Modifiers Market, By Type

8.1. Friction Modifiers Market, by Type, 2024-2033

8.1.1. Organic

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Inorganic

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Friction Modifiers Market, By Application

9.1. Friction Modifiers Market, by Application, 2024-2033

9.1.1. Commercial Vehicles

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Passenger Vehicles

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Friction Modifiers Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. INX International Ink Co.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Kornit DigitalMarabu GmbH & Co. KG

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Nazdar

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Nutec digital Ink

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Sensient Imaging Technologies

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Siegwerk Druckfarben AG & Co. KgaA

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Sun Chemical

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Toyo Ink Co., Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Wikoff Color Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Whitmore Manufacturing, LLC.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others