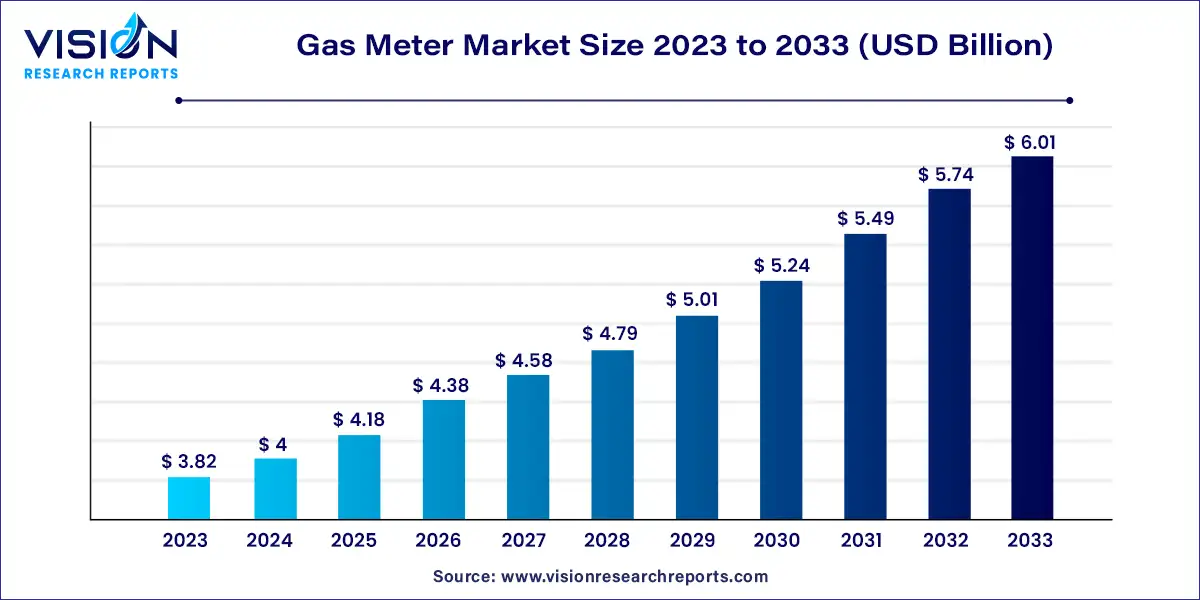

The global gas meter market size was valued at USD 3.82 billion in 2023 and is anticipated to reach around USD 6.01 billion by 2033, growing at a CAGR of 4.63% from 2024 to 2033. The gas meter market is a critical sector within the energy industry, responsible for measuring natural gas consumption in residential, commercial, and industrial settings. With the ongoing emphasis on energy efficiency and smart technologies, the gas meter market is undergoing significant transformation.

The gas meter market is experiencing robust growth due to the global push towards energy efficiency and sustainability is driving the adoption of advanced metering technologies. Smart meters, equipped with IoT and data analytics capabilities, offer real-time consumption tracking and enhanced accuracy, which help in optimizing energy usage and reducing waste. Additionally, regulatory frameworks and government incentives are accelerating the replacement of outdated infrastructure with modern, smart metering solutions. The increasing need for accurate billing and fraud prevention is also fueling market expansion, as businesses and utilities seek technologies that offer greater reliability and transparency. Furthermore, the rise in urbanization and industrial activities, especially in emerging economies, is contributing to higher demand for gas meters to support growing energy needs. These factors collectively underpin the dynamic growth trajectory of the gas meter market.

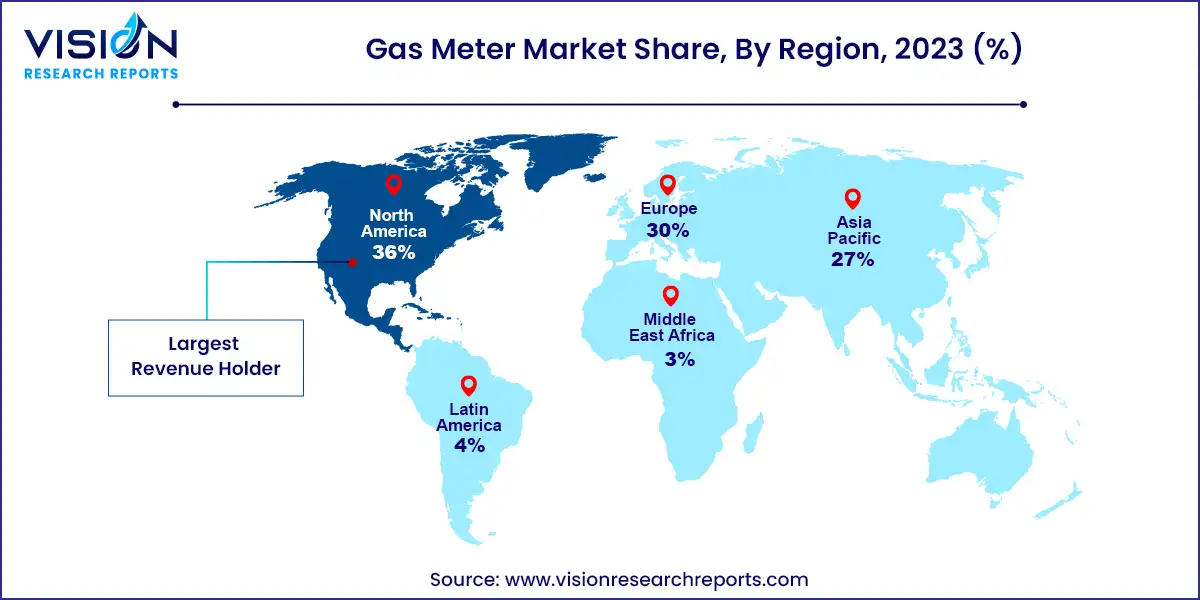

North America led the global gas meter market with a substantial revenue share of over 36% in 2023. The region's dominance is supported by active government policies and programs that promote the deployment of smart gas meters. Initiatives such as subsidies, mandates, and national energy efficiency targets are pushing for widespread adoption. In the U.S., large-scale smart meter rollouts are part of efforts to meet ambitious environmental goals and improve grid management.

| Attribute | North America |

| Market Value | USD 1.37 Billion |

| Growth Rate | 4.65% CAGR |

| Projected Value | USD 2.16 Billion |

Europe is a leader in smart metering deployment, driven by EU directives and national regulations aimed at enhancing energy efficiency and reducing carbon emissions. The EU's Third Energy Package mandates the installation of smart meters for both electricity and gas, leading to broad adoption across member states. This regulatory framework is a key driver for utilities to invest in Advanced Metering Infrastructure (AMI) and smart grid technologies.

In the Asia-Pacific region, particularly in countries like China and India, rapid urbanization and infrastructure development are fueling the demand for advanced gas metering solutions. Gas meters are essential for modernizing energy infrastructure, improving efficiency, and supporting sustainable urban growth. The integration of advanced technologies such as Low Power Wide Area Network (LPWAN), Internet of Things (IoT), and cloud-based analytics into gas meters is becoming more prevalent. These technologies facilitate real-time data monitoring, remote meter reading, and predictive maintenance, enhancing operational efficiency for utilities and improving service delivery to consumers.

In 2023, the basic gas meter segment captured the largest revenue share, accounting for 68%. The global gas meter market is on a strong growth trajectory, driven by multiple factors. The rising demand for natural gas, particularly in emerging economies, is a significant driver. As energy consumption increases and the shift towards cleaner fuels accelerates, the need for precise gas measurement and monitoring becomes more critical.

Technological advancements are playing a pivotal role, with innovations such as smart meters, IoT integration, and data analytics enhancing gas metering solutions. These technologies contribute to more efficient grid operations and improved energy efficiency. Additionally, government initiatives and regulations that promote energy conservation and sustainability are further accelerating the adoption of advanced gas meters across residential, commercial, and industrial sectors.

In 2023, the residential sector led the market with a notable revenue share of 42%. The growth in residential gas meters is largely attributed to the rising adoption of smart gas meters, which offer benefits like real-time monitoring, remote reading, and improved accuracy. These features appeal to both consumers and utility companies, enhancing energy efficiency and generating cost savings.

The commercial gas meter sector is also experiencing substantial growth. The increased adoption of smart meters in this segment allows for precise billing, real-time consumption monitoring, and enhanced operational efficiency for utilities, driving its expansion.

By Type

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others