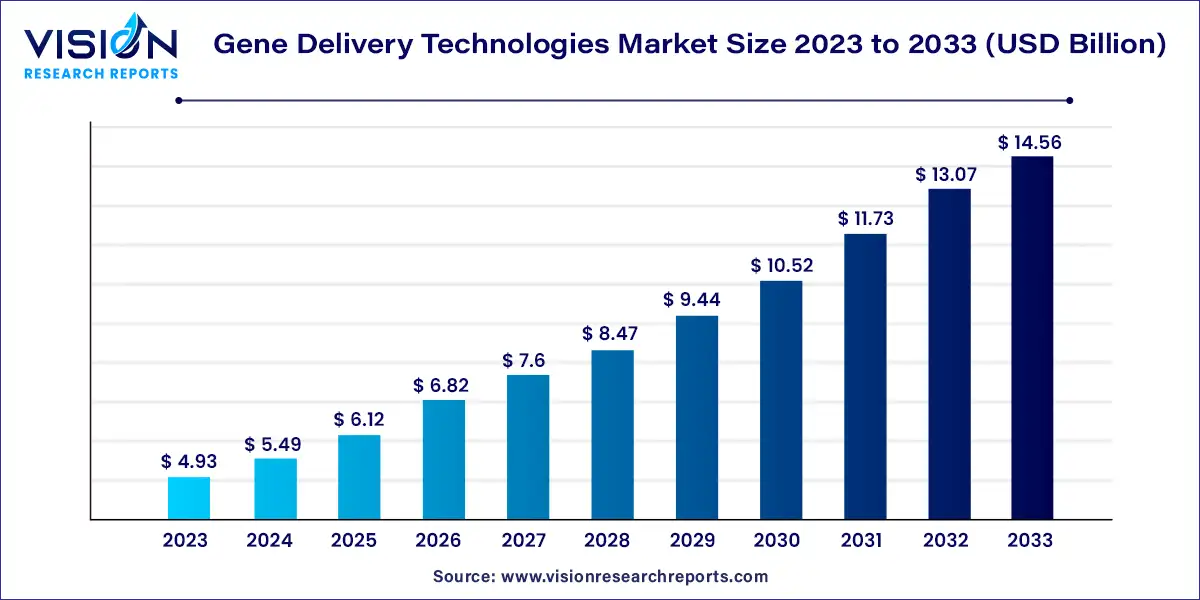

The global gene delivery technologies market size was valued at USD 4.93 billion in 2023 and it is predicted to surpass around USD 14.56 billion by 2033 with a CAGR of 11.44% from 2024 to 2033. The gene delivery technologies market is an innovative and rapidly evolving sector within the biotechnology and pharmaceutical industries. This market focuses on the development and application of techniques to introduce genetic material into cells, which can be used for therapeutic purposes, genetic modification, and various research applications. With significant advancements and increasing investments in this field, gene delivery technologies are playing a pivotal role in revolutionizing healthcare and biotechnology.

The growth of the gene delivery technologies market is driven by an advances in genetic research and biotechnology have significantly improved the efficiency and precision of gene delivery systems, enhancing their potential for therapeutic applications. The rising prevalence of genetic disorders and chronic diseases, coupled with a growing demand for personalized medicine, has accelerated the need for effective gene therapies. Additionally, increasing investment from both public and private sectors into research and development has spurred innovation and expanded the market's capabilities. Strategic partnerships between biotech firms, academic institutions, and healthcare providers are also fostering advancements and accelerating the commercialization of new technologies. Furthermore, supportive regulatory frameworks and a heightened focus on targeted and precision medicine are contributing to the market's robust growth trajectory.

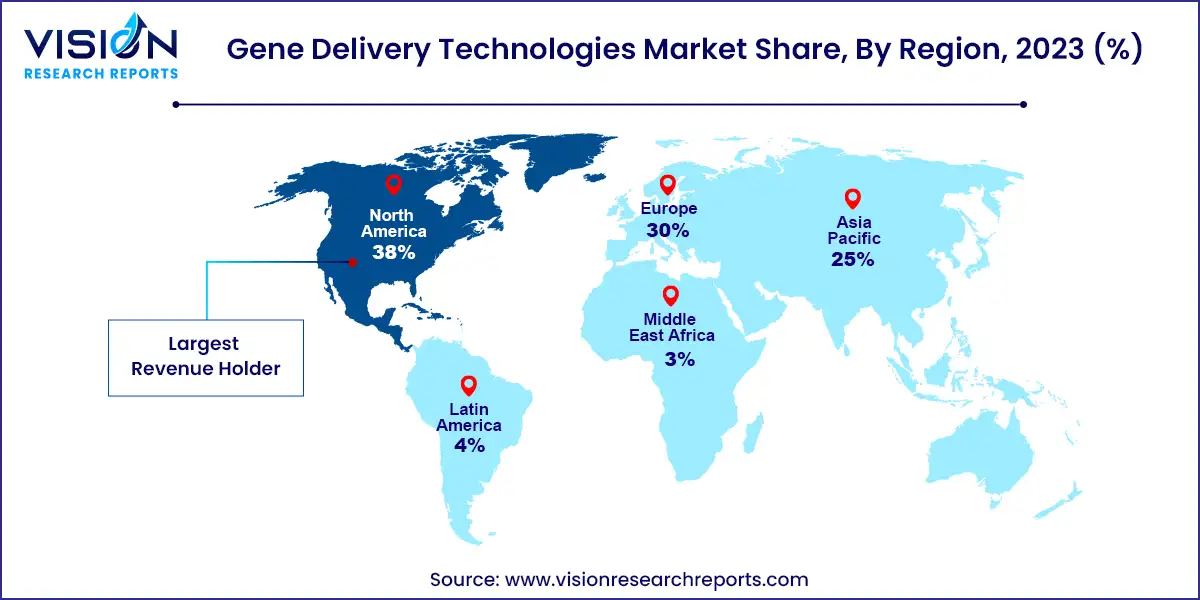

In 2023, North America led the global market with the largest market share of 38%, driven by its strong research infrastructure, well-established pharmaceutical and biotechnological sectors, and significant investments in gene therapy and genetic medicine.

Europe was recognized as a promising region in 2023. The market is being fueled by improved regulatory standards and the development of advanced therapeutic products. The UK, in particular, is expected to see rapid growth due to supportive regulatory frameworks, an expanding therapeutic pipeline, and ongoing technological advancements.

The gene delivery technology market in Asia-Pacific is projected to experience substantial growth over the forecast period. This growth is attributed to increasing investments in biotechnology research, a rising prevalence of genetic disorders, and the swift adoption of advanced medical technologies. China, in particular, held a significant market share in 2023, driven by its expanding therapeutic areas, including ophthalmology, neurology, and oncology.

In 2023, the biological segment commanded a significant 60% share of the market revenue, driven by the notable advantages of biological methods. These methods, which encompass viral and non-viral vectors, are often more effective in delivering genes to targeted cells. Viral vectors, despite some safety concerns, are particularly efficient due to their natural ability to penetrate cells and integrate genetic material. Conversely, non-viral vectors, though less efficient, are deemed safer and easier to produce, making them a viable alternative for specific uses. The strong performance of this segment highlights ongoing research and development efforts and the growing commercialization of gene therapies leveraging these technologies.

Meanwhile, the chemical segment is expected to experience a robust growth rate, with a projected CAGR of 11.93% from 2024 to 2033. Chemical gene delivery methods, such as liposomes and nanoparticles, offer distinct advantages over biological methods. They generally provoke fewer immune responses and can be produced more cost-effectively. The significant growth anticipated in this segment reflects a broader recognition of these advantages and suggests that advancements in chemical delivery technologies will continue to progress, potentially leading to more efficient and safer gene delivery solutions. This trend is supported by increasing investments from both public and private sectors, driven by the transformative potential of these technologies in healthcare.

The gene therapy segment led the market with a 37% revenue share in 2023. This dominance is fueled by a surge in demand for gene-based treatments, growing research efforts, and the approval of new gene therapy products. The increase in clinical trials and advancements in the field have further propelled this segment's growth.

The cell therapy segment is anticipated to grow at the highest CAGR of 12.43% from 2024 to 2033. This rapid expansion is driven by advancements in stem cell therapy and immunotherapy, such as CAR-T cell therapies, which have made significant impacts in cancer treatment. Additionally, stem cell therapies are being explored for a range of conditions, including neurological and cardiovascular diseases.

The ex vivo method led the gene delivery technologies market in 2023 with a 42% revenue share. This method's advantages include its ability to assess the effectiveness of gene transduction before reinjection into patients and its lower immunogenicity. Its high transduction efficiency also contributes to its prevalent use in research applications.

The in vitro method is projected to grow at a CAGR of 11.83% from 2024 to 2033. This method is favored in research and development due to its ease of use and cost-effectiveness. The anticipated growth in this segment is driven by increased utilization in developing new gene therapies and rising investments in research and development. Advancements in in vitro techniques and enhanced understanding of human genetics are expected to support this growth.

By Mode

By Application

By Method

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others