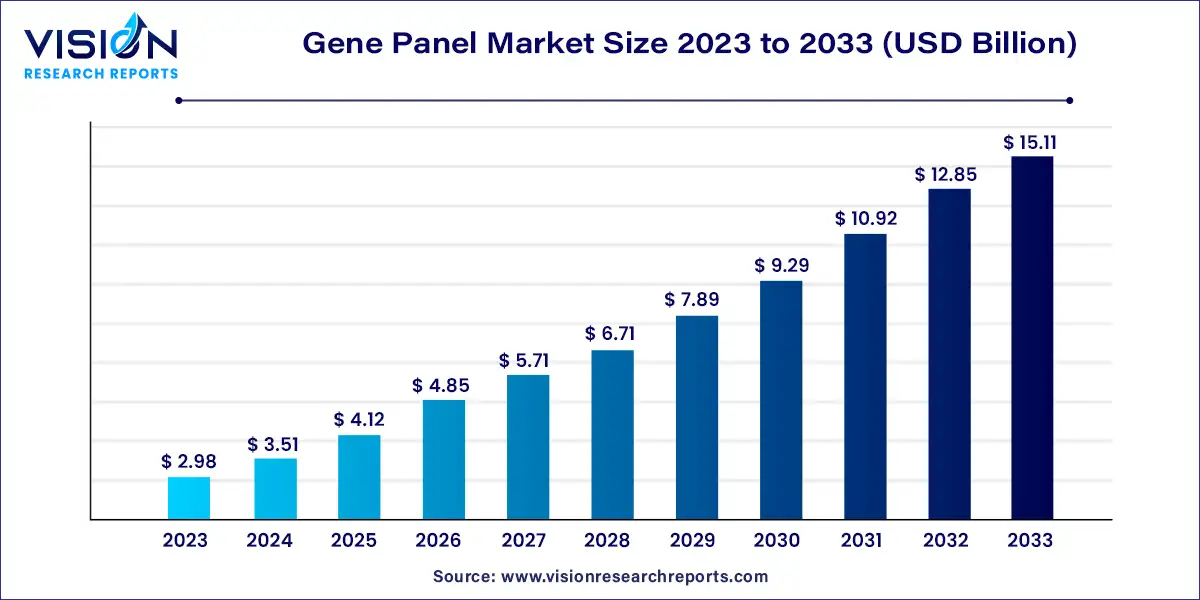

The global gene panel market size was valued at USD 2.98 billion in 2023 and it is predicted to surpass around USD 15.11 billion by 2033 with a CAGR of 17.63% from 2024 to 2033. The Gene Panel Market is experiencing robust growth, driven by advancements in genomics, personalized medicine, and rising prevalence of genetic disorders. Gene panels, which are comprehensive collections of genetic tests targeting multiple genes associated with specific conditions, are becoming increasingly pivotal in diagnosing and managing genetic diseases.

The growth of the gene panel market is significantly influenced by the rising prevalence of genetic disorders and chronic diseases, which drives the demand for accurate and comprehensive diagnostic tools. As genetic conditions such as cancer, cardiovascular diseases, and rare genetic disorders become more prevalent, the need for gene panels that can identify mutations across multiple genes becomes increasingly critical. Additionally, advancements in genomic technologies, particularly next-generation sequencing (NGS), have greatly enhanced the efficiency and accuracy of gene panel testing. These technological improvements have made gene panels more accessible and cost-effective, further boosting their adoption. Moreover, the growing emphasis on personalized medicine is a major growth driver, as gene panels enable tailored treatment plans based on individual genetic profiles.

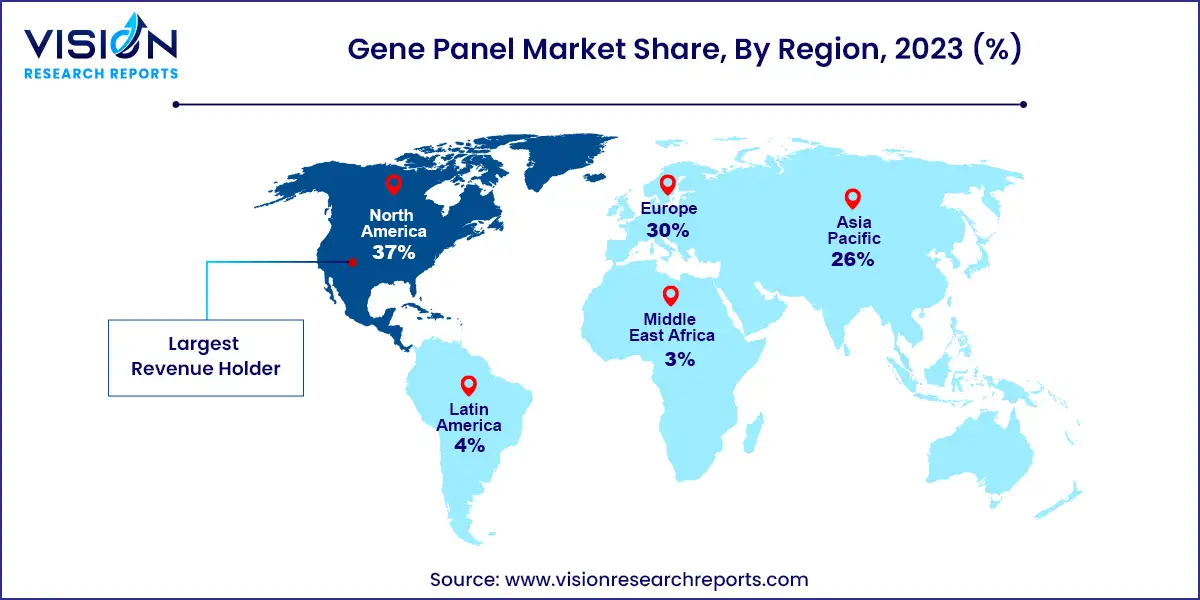

North America led the global gene panel market with a 37% share in 2023. The region has seen a surge in cancer research and inherited rare diseases, with significant increases in NGS-based and clinical applications. Government support, such as the CDC's $90 million funding for the Pathogen Genomics Centers of Excellence, is driving advancements in genomics technologies and public health applications.

| Attribute | North America |

| Market Value | USD 1.10 Billion |

| Growth Rate | 17.65% CAGR |

| Projected Value | USD 5.59 Billion |

Europe is expected to grow, supported by government policies and the development of new products. Germany’s genomeDE strategy and the UK's NHS commitment to whole genome sequencing are anticipated to drive market growth in the region.

Asia Pacific is projected to grow at the fastest CAGR. Increasing research on chronic diseases and the presence of key players in the region are significant drivers. The collaboration between Avesthagen Limited and Wipro L, announced in June 2022, aims to develop genetic testing solutions for various diseases, highlighting the region’s growth potential.

Test kits led the market with a substantial revenue share of 61% in 2023. The global trend towards self-utilization has increased demand for advanced diagnostic solutions for chronic diseases. For instance, in October 2023, China's National Medical Products Administration (NMPA) approved Geneseeq’s NSCLC tumor mutational burden test kit, which features a comprehensive gene panel covering 425 cancer-associated genes.

The testing services segment is projected to grow at the fastest rate from 2024 to 2033. Genetic testing services offer a wide range of tests that are crucial for making informed health decisions. These services include disease diagnosis, gene mutation identification, disease risk prediction, and guidance on treatment strategies. By integrating genetic testing into routine healthcare, these services provide convenient ordering options, flexible pricing, and professional genetic counseling for interpreting results.

Cancer risk assessment represented the largest segment, with a share of 55% in 2023. Gene panels provide a comprehensive alternative to multiple individual tests for identifying genetic risk factors associated with various cancers. For example, in October 2023, Invitae received FDA authorization for its Common Hereditary Cancers Panel, designed to detect germline variants related to hereditary cancer. The development of such panels is expected to further boost market growth.

The segment for diagnosing congenital diseases is anticipated to experience significant growth. Congenital diseases, which develop during fetal development, can be detected before birth or in early childhood. New tests, such as those introduced by CooperSurgical and Fulgent Genetics in February 2024, including the CBR Snapshot, CBR Portrait, and CBR Landscape tests, are enhancing the ability to screen for a variety of conditions like cardiovascular issues, cancer, and neonatal diabetes.

The amplicon-based approach dominated the market, holding 80% share in 2023. This technique, a target-based next-generation sequencing method, is widely used for examining genetic variations in specific genomic regions. It supports various applications, including genotyping, CRISP validation, SNP identification, and detection of indels. New products utilizing amplicon sequencing, such as PacBio's Onso platform introduced in October 2022, are expected to drive further market growth.

The hybridization-based approach is forecasted to grow at a significant CAGR. Known for its reproducibility and reliability, this method is often used for multigene panels. Integrated DNA Technologies, Inc.'s xGen Custom Hybridization Capture Panels, featuring high-fidelity oligos for targeted NGS research, exemplify this approach's effectiveness in sequencing a large number of genes, which will likely support segment growth.

Predesigned gene panels led the market with a revenue share of 67% in 2023. Increased investment in genomics and the development of new technologies for understanding biological systems are driving the growth of this segment. For instance, Vizgen's launch of predesigned MERFISH Gene Panels at the AACR Annual Meeting 2023 is expected to advance research in oncology and neuroscience.

Customized gene panels are anticipated to register significant growth. These panels allow for precise identification of nucleotide and copy number variations and are used for profiling various cell types and signaling pathways. In March 2024, 10x Genomics introduced a 5,000-Plex Gene Panel for Xenium, offering high customization for specific research needs. The development of such panels is expected to enhance market growth.

The academic and research institutes segment held the largest revenue share of over 43% in 2023 and is expected to see substantial growth. Increasing incidences of cancer and genetic disorders drive research activities, promoting the use of gene panels for pre-gestational, prenatal, neonatal screenings, and cancer diagnostics. In the U.S., genetic testing costs vary widely, influencing the accessibility and adoption of these tests.

Pharmaceutical and biotechnology companies experienced a rapid growth rate of 22.8%. This growth is attributed to rising demand for gene panels in research, increased government funding, and the focus on advanced drug development. For instance, in November 2023, Natera, Inc. and MSD formed an agreement allowing MSD to utilize Natera's real-world database of cancer patients, advancing oncology research.

By Product & Services

By Techniques

By Design

By End-use

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Gene Panel Market

5.1. COVID-19 Landscape: Gene Panel Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Gene Panel Market, By Product & Services

8.1. Gene Panel Market, by Product & Services, 2024-2033

8.1.1. Test Kits

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Testing Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Gene Panel Market, By Technique

9.1. Gene Panel Market, by Technique, 2024-2033

9.1.1. Amplicon Based Approach

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Hybridization Based Approach

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Gene Panel Market, By Design

10.1. Gene Panel Market, by Design, 2024-2033

10.1.1. Predesigned Gene Panel

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Customized Gene Panel

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Gene Panel Market, By Application

11.1. Gene Panel Market, by Application, 2024-2033

11.1.1. Cancer Risk Assessment

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Diagnosis of Congenital Diseases

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Pharmacogenetics

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Other Applications

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Gene Panel Market, By End-use

12.1. Gene Panel Market, by End-use, 2024-2033

12.1.1. Academic & Research Institutes

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Hospital & Diagnostic Laboratories

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Pharmaceutical & Biotechnology Companies

12.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Gene Panel Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.1.2. Market Revenue and Forecast, by Technique (2021-2033)

13.1.3. Market Revenue and Forecast, by Design (2021-2033)

13.1.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.5. Market Revenue and Forecast, by End-use (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Technique (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Design (2021-2033)

13.1.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.7. Market Revenue and Forecast, by End-use (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Technique (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Design (2021-2033)

13.1.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.8.5. Market Revenue and Forecast, by End-use (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.2.2. Market Revenue and Forecast, by Technique (2021-2033)

13.2.3. Market Revenue and Forecast, by Design (2021-2033)

13.2.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.5. Market Revenue and Forecast, by End-use (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Technique (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Design (2021-2033)

13.2.7. Market Revenue and Forecast, by Application (2021-2033)

13.2.8. Market Revenue and Forecast, by End-use (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Technique (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Design (2021-2033)

13.2.10. Market Revenue and Forecast, by Application (2021-2033)

13.2.11. Market Revenue and Forecast, by End-use (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Technique (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Design (2021-2033)

13.2.12.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.13. Market Revenue and Forecast, by End-use (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Technique (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Design (2021-2033)

13.2.14.4. Market Revenue and Forecast, by Application (2021-2033)

13.2.15. Market Revenue and Forecast, by End-use (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.3.2. Market Revenue and Forecast, by Technique (2021-2033)

13.3.3. Market Revenue and Forecast, by Design (2021-2033)

13.3.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.5. Market Revenue and Forecast, by End-use (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Technique (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Design (2021-2033)

13.3.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.7. Market Revenue and Forecast, by End-use (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Technique (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Design (2021-2033)

13.3.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.9. Market Revenue and Forecast, by End-use (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Technique (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Design (2021-2033)

13.3.10.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.10.5. Market Revenue and Forecast, by End-use (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Technique (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Design (2021-2033)

13.3.11.4. Market Revenue and Forecast, by Application (2021-2033)

13.3.11.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.4.2. Market Revenue and Forecast, by Technique (2021-2033)

13.4.3. Market Revenue and Forecast, by Design (2021-2033)

13.4.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Technique (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Design (2021-2033)

13.4.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.7. Market Revenue and Forecast, by End-use (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Technique (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Design (2021-2033)

13.4.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.9. Market Revenue and Forecast, by End-use (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Technique (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Design (2021-2033)

13.4.10.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.10.5. Market Revenue and Forecast, by End-use (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Technique (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Design (2021-2033)

13.4.11.4. Market Revenue and Forecast, by Application (2021-2033)

13.4.11.5. Market Revenue and Forecast, by End-use (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.5.2. Market Revenue and Forecast, by Technique (2021-2033)

13.5.3. Market Revenue and Forecast, by Design (2021-2033)

13.5.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.5. Market Revenue and Forecast, by End-use (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Technique (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Design (2021-2033)

13.5.6.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.7. Market Revenue and Forecast, by End-use (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Product & Services (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Technique (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Design (2021-2033)

13.5.8.4. Market Revenue and Forecast, by Application (2021-2033)

13.5.8.5. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 14. Company Profiles

14.1. Agilent Technologies

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Illumina Inc.

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Qiagen Inc.

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Eurofins Genomics

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Thermo Fisher Scientific

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Foundation Medicine Inc.

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Guardant Health, Inc.

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Myriad Genetic Laboratories Inc.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Cepheid

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Bio-Rad Laboratories, Inc.

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others