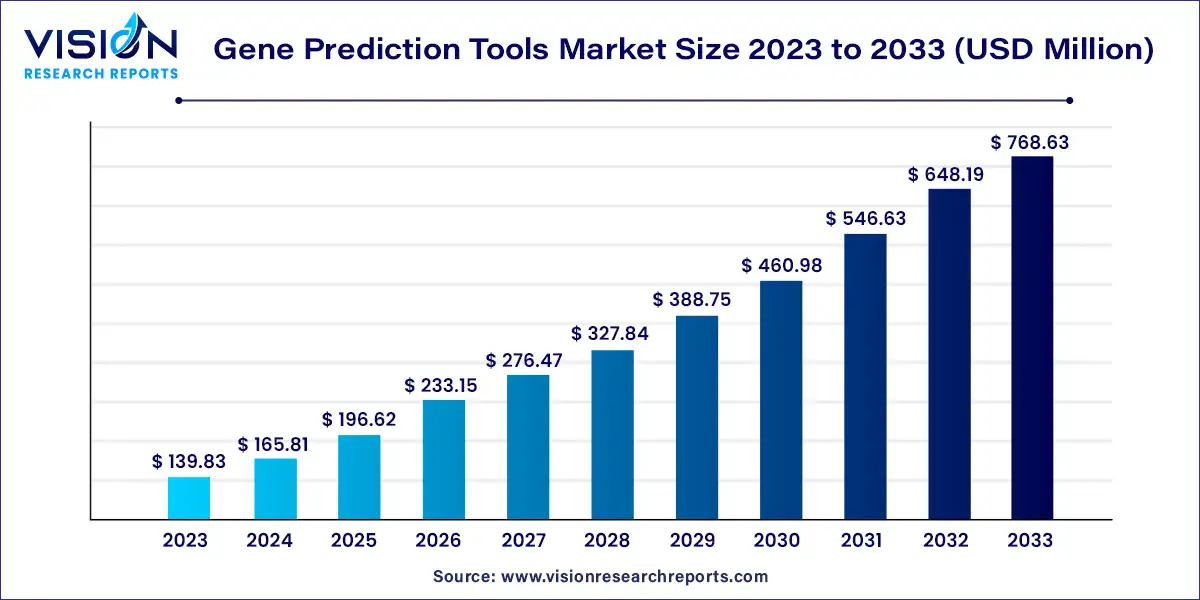

The global gene prediction tools market size was estimated at USD 139.83 million in 2023 and it is expected to surpass around USD 768.63 million by 2033, poised to grow at a CAGR of 18.58% from 2024 to 2033.

The gene prediction tools market is a dynamic and rapidly evolving segment within the biotechnology and bioinformatics industries. This market encompasses a variety of software and hardware solutions designed to predict the structure and function of genes from genomic sequences. These tools are essential for understanding the genetic makeup of organisms, aiding in research, clinical diagnostics, and therapeutic development.

The growth of the gene prediction tools market is significantly driven by the rapid advancements in genomic sequencing technologies have led to an exponential increase in the volume of genetic data, necessitating sophisticated tools to analyze and interpret this information. This surge in data drives the demand for accurate and efficient gene prediction tools. Secondly, the burgeoning field of personalized medicine, which relies heavily on genetic insights for customized treatment plans, is fueling market growth. Personalized medicine’s focus on tailored healthcare solutions has amplified the need for precise gene prediction to guide therapeutic decisions. Additionally, the integration of artificial intelligence and machine learning into gene prediction tools has markedly enhanced their analytical capabilities, making them more attractive to researchers and clinicians.

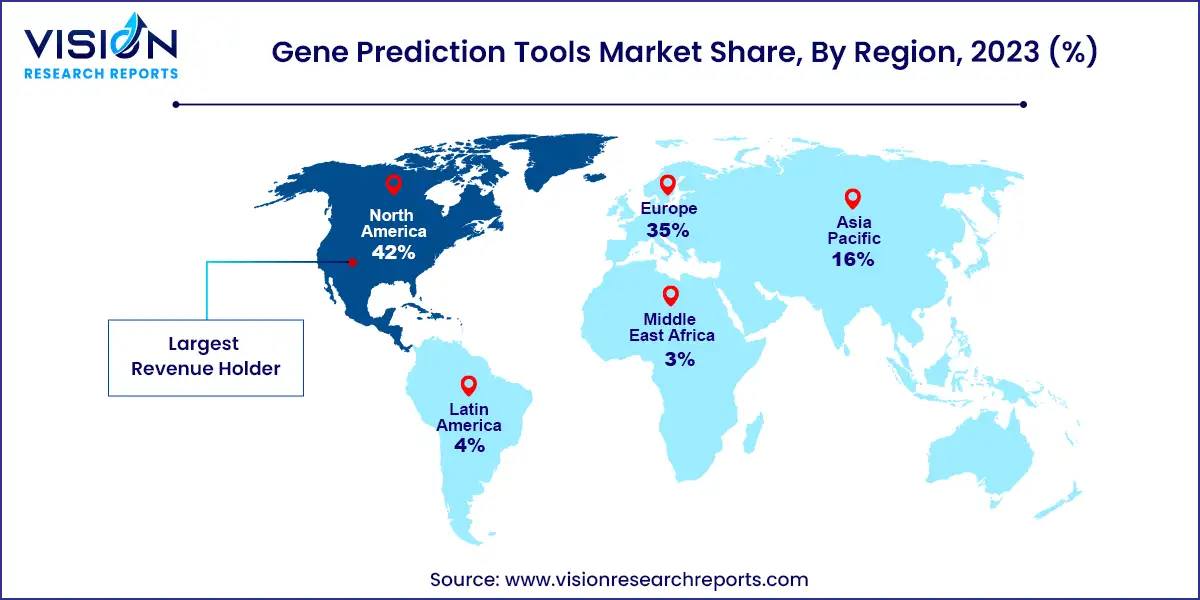

North America held the largest market share of 42% in 2023, supported by a strong regulatory framework, government initiatives like the Precision Medicine Initiative, and significant funding from organizations such as the National Institutes of Health (NIH). The presence of comprehensive genomic databases and biobanks accelerates research and application of gene prediction tools. The high prevalence of chronic diseases and emphasis on personalized medicine further drive the demand for advanced genomic tools.

| Attribute | North America |

| Market Value | USD 58.72 Million |

| Growth Rate | 14.68% CAGR |

| Projected Value | USD 322.82 Million |

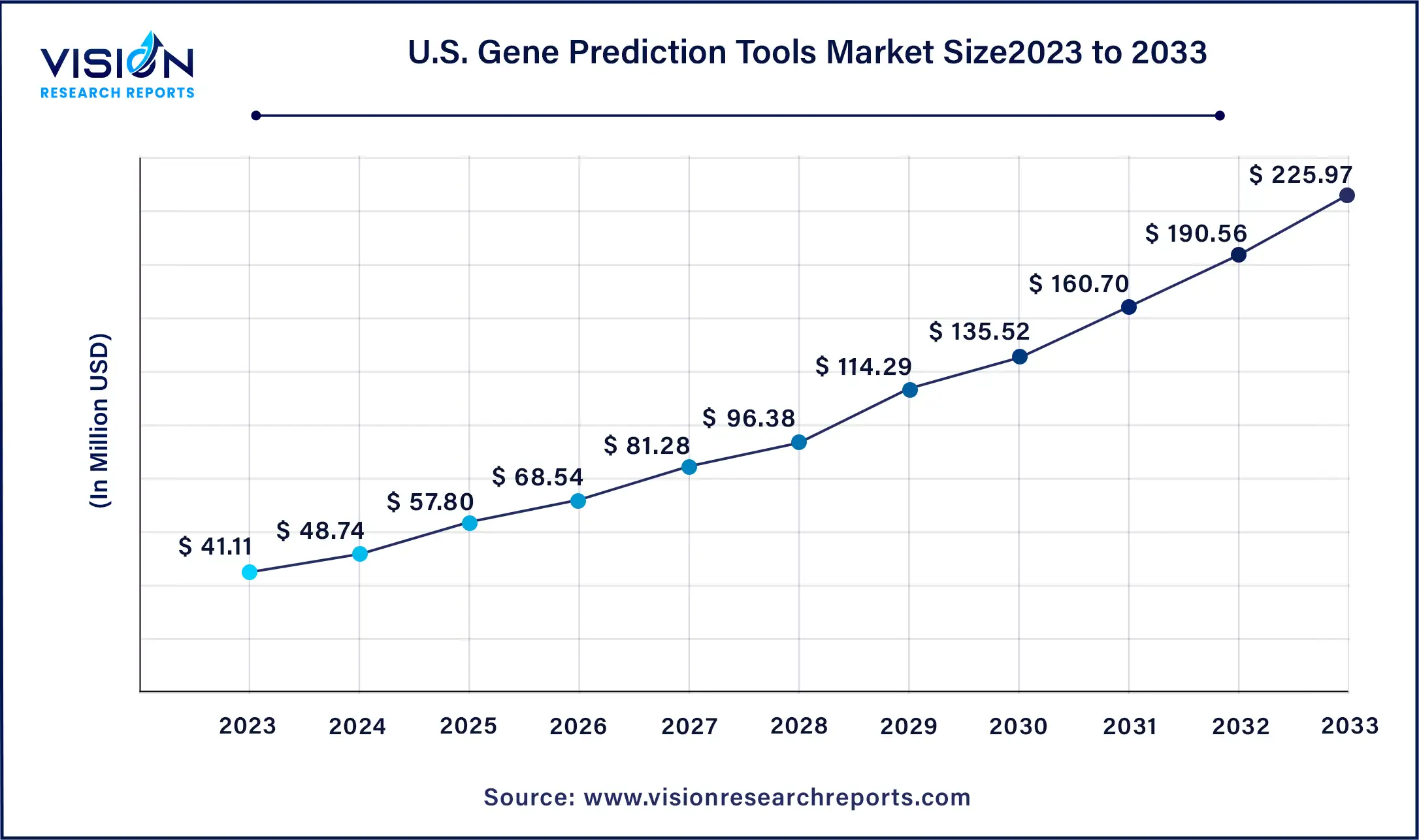

The U.S. gene prediction tools market size was estimated at around USD 41.11 million in 2023 and it is projected to hit around USD 225.97 million by 2033, growing at a CAGR of 18.58% from 2024 to 2033.

The U.S. market is expected to grow due to its robust R&D infrastructure, substantial funding, and collaborative ecosystem. The increasing prevalence of genetic disorders and chronic diseases drives the need for advanced genomic tools for early diagnosis, treatment planning, and monitoring.

Europe Gene Prediction Tools Market Trends

The European market is anticipated to grow, supported by a strong network of universities, research institutions, and biotechnology firms. European investments in genomics research, such as the Horizon Europe program, drive the development and adoption of advanced gene prediction tools. The UK's focus on genomic research and projects like the 100,000 Genomes Project further contributes to market growth.

Asia Pacific Gene Prediction Tools Market Trends

The Asia Pacific market is expected to grow at a CAGR of 19.83% from 2024 to 2033, driven by favorable demographics, technological advancements, supportive government policies, and increased investments in healthcare and biotechnology. Countries like China, India, Japan, and South Korea are implementing policies that promote genomic research and healthcare innovation. China’s significant investments in biotechnology and the "Made in China 2025" strategy are fostering innovation in gene prediction technologies.

In 2023, the software segment led the market due to its advanced computational capabilities, integration with genomic technologies, and user-friendly interfaces. The sophisticated software solutions utilize algorithms, artificial intelligence (AI), and machine learning (ML) to precisely predict gene functions, interactions, and regulatory mechanisms. For example, IBM Watson for Genomics employs AI to analyze extensive genomic datasets, offering insights that manual analysis cannot achieve. Launched in June 2022, IBM’s Watson for Genomics aids European doctors in selecting cancer treatments by analyzing patient DNA, showcasing software’s efficiency in processing large-scale data.

The trend towards user-friendly interfaces in gene prediction software has broadened access to complex genomic analyses. Tools like QIAGEN's CLC Genomics Workbench feature intuitive interfaces and customizable workflows, making it easier for users to conduct diverse genomic analyses.

The services segment is projected to grow at the highest CAGR of 19.13% from 2024 to 2033, driven by increasing demand for outsourcing and specialized expertise for clinical and pharmaceutical applications. Gene prediction services support drug discovery, development, and personalized treatment strategies by offering insights into genetic variations. Pharmaceutical companies, for example, collaborate with genomic service providers to identify novel drug targets and understand genetic influences on drug responses, enhancing their R&D efficiency.

Empirical methods dominated the market with a 64% share in 2023 and are expected to grow at the highest CAGR from 2024 to 2033. These methods, which use statistical models and observed data to predict gene functions and interactions, are valued for their accuracy and reliability. They leverage extensive datasets of known gene sequences to create precise predictive models.

Ab initio methods are anticipated to see significant growth due to recent advances in computational power and data analytics. These methods benefit from powerful computing platforms and sophisticated data analysis tools, enhancing their ability to deliver accurate gene predictions. Cloud computing services from providers like Amazon Web Services (AWS) and Google Cloud Platform (GCP) support large-scale analyses, making ab initio methods more accessible and scalable.

In 2023, the drug discovery and development segment led with a 67% market share, owing to its critical role in identifying drug targets, refining drug development, and accelerating discovery timelines. Gene prediction tools improve drug development precision by offering detailed insights into genetic variations affecting drug responses. For instance, targeted cancer therapies from companies like Genentech and AstraZeneca use gene prediction tools to identify genetic mutations driving tumors, enabling the creation of targeted treatments. In November 2023, AstraZeneca's collaboration with Cellectis exemplified efforts to advance cell therapy and genomic medicines.

The diagnostics development segment is expected to grow at a CAGR of 19.75% from 2024 to 2033. This growth is fueled by the demand for precision medicine, advancements in genomic technologies, rising prevalence of genetic disorders, and expansion of personalized diagnostics. Gene prediction tools aid in developing diagnostics for specific genetic mutations and biomarkers, crucial for early disease detection. For example, these tools are used to create diagnostic tests for cancer by identifying genetic mutations specific to different cancer types.

In 2023, the industrial segment led the market due to its extensive applications across biotechnological processes, synthetic biology, agricultural biotechnology, and pharmaceutical manufacturing. Gene prediction tools are vital for understanding genetic variations and customizing treatments, which enhances therapeutic outcomes. The collaboration between industries and research institutions leads to the development of advanced gene prediction technologies, driving market growth in the industrial sector.

The academic and research segment is projected to experience the highest CAGR of 19.05% over the forecast period, driven by academic institutions' leadership in research, education, and ethical considerations. These institutions contribute to developing gene prediction tools that meet ethical guidelines and regulatory standards. Their high-impact publications increase the visibility and credibility of these tools, fostering their adoption in academic research.

By Type

By Method

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Gene Prediction Tools Market

5.1. COVID-19 Landscape: Gene Prediction Tools Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Gene Prediction Tools Market, By Type

8.1. Gene Prediction Tools Market, by Type, 2024-2033

8.1.1. Software

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Gene Prediction Tools Market, By Method

9.1. Gene Prediction Tools Market, by Method, 2024-2033

9.1.1. Empirical Methods

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Ab Initio Methods

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Gene Prediction Tools Market, By Application

10.1. Gene Prediction Tools Market, by Application, 2024-2033

10.1.1. Drug Discovery & Development

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Diagnostics Development

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Gene Prediction Tools Market, By End-use

11.1. Gene Prediction Tools Market, by End-use, 2024-2033

11.1.1. Academic & Research

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Industrial

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Gene Prediction Tools Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Method (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Method (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Method (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Method (2021-2033)

12.2.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Method (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Method (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Method (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Method (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Method (2021-2033)

12.3.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Method (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Method (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Method (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Method (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Method (2021-2033)

12.4.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Method (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Method (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Method (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Method (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Method (2021-2033)

12.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Method (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Method (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 13. Company Profiles

13.1. Thermo Fisher Scientific

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Bio-Techne

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Charles River Laboratories

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Eurofins

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. GenScript

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Danaher

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. MedGenome

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Sino Biological

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Syngene

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Twist Bioscience

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others