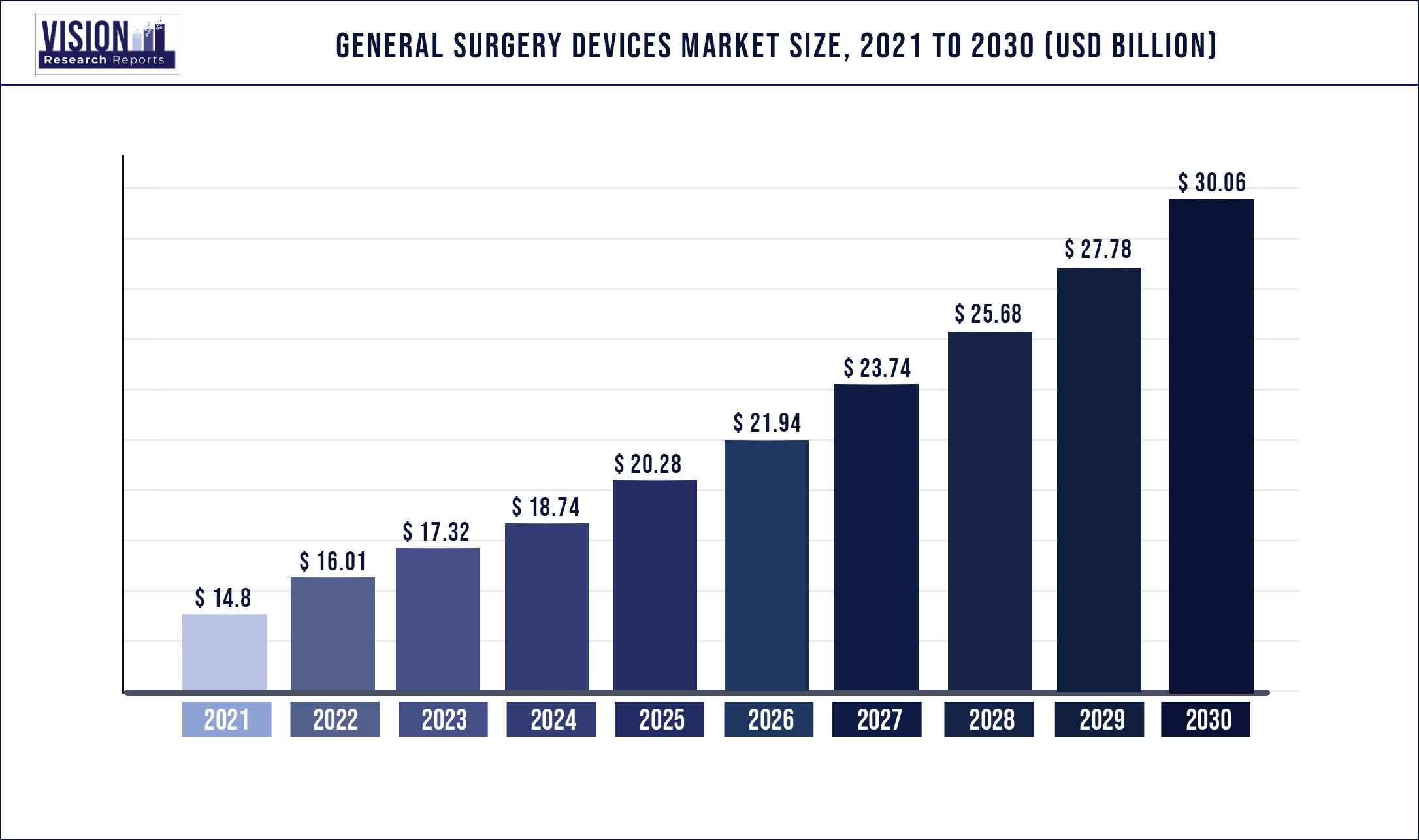

The global general surgery devices market size was estimated at around USD 14.8 billion in 2021 and it is projected to hit around USD 30.06 billion by 2030, growing at a CAGR of 8.19% from 2022 to 2030.

Report Highlights

Increasing number of surgical procedures coupled with technological advancements is anticipated to drive the market. Moreover, increasing awareness and patient affordability for plastic or reconstructive surgeries would propel the number of procedures conducted. Technological advancements in the field of general surgery are considered key drivers of this industry. Several key players are investing in R&D for the launch of innovative products. For instance, the development of medical robots to assist surgeons is a key advancement in the field.

Medical robots offer several advantages, such as a 3D view of the operating field, reduced blood loss & transfusions, early discharge from the hospital, lower risk of infection, faster recovery time, minimal scarring, less trauma to the body & less postoperative pain, more precision in surgery due to the elimination of a surgeon’s tremor. Furthermore, an increase in the number of road accidents, an aging population, and rising healthcare expenditure in emerging economies are also among the key factors expected to boost industry growth. The geriatric population is more susceptible to a vast number of diseases, which is likely to increase the need to treat the diseases effectively, thereby boosting industry growth. According to the U.S. Census Bureau, healthcare spending worldwide is anticipated to increase to USD 18.28 trillion by 2040, growing at a CAGR of 2.6%.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 14.8 billion |

| Revenue Forecast by 2030 | USD 30.06 billion |

| Growth rate from 2022 to 2030 | CAGR of 8.19% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Type, application, end-use, region |

| Companies Covered |

Medtronic Plc; Johnson & Johnson Service, Inc.; Conmed Corp.; Integra LifeSciences; Smith & Nephew; Becton, Dickinson and Company (Bd); B. Braun Melsungen Ag; Cadence Inc.; Integer Holdings Corp.; Olympus Corp.; Stryker; Boston Scientific Corp.; Erbe Elektromedizin GmbH; 3M Healthcare |

Type Insights

On the basis of types, the global industry has been further segmented into disposable surgical supplies, open surgery instruments, energy-based & powered instruments, minimally invasive surgery instruments, adhesion prevention products, and medical robotics & computer-assisted surgery devices. The disposable surgical supplies segment dominated the global industry in 2021 and accounted for the largest share of more than 51.8% of the overall revenue. The growth of the segment can be attributed to the high demand for disposable supplies, such as needles, syringes, and catheters. Furthermore, increasing awareness levels about diseases transmitted through surgical devices coupled with government regulations ensuring safety in surgical procedures are likely to augment demand for disposable products.

Furthermore, minimally invasive surgery instruments are expected to grow at a significant CAGR during the forecast period. Minimally invasive procedures are gaining surgical demand due to their shorter hospital stays, increased accuracy, reduced scarring and pain, and smaller incisions. Medical displays guarantee improved visibility of diagnostic images, showing even the smallest variation in tissues and cells, ensuring accurate and speedier procedures. Higher-quality tools are made available by the field's ongoing technical improvements, enabling surgeons to carry out surgical procedures quickly without compromising patient safety.

Application Insights

On the basis of applications, the global industry has been further segmented into orthopedic surgery, cardiology, ophthalmology, wound care, audiology, thoracic surgery, urology and gynecology surgery, plastic surgery, neurosurgery, and others. The orthopedic surgery segment dominated the market in 2021 and accounted for the maximum share of more than 17.53% of the overall revenue. The segment will maintain its dominance throughout the forecast period due to the rising cases of bone diseases and the growing geriatric population across the globe. Product innovations, favorable reimbursement, and improving diagnosis methods & imaging technology in orthopedic surgery are also likely to drive the segment.

The cardiology segment is estimated to account for the second-largest share by 2030 owing to the rising cases of cardiovascular disorders. According to the WHO, 17.9 million deaths worldwide in 2019 were attributable to CVDs, or 32% of all fatalities. Heart attack and stroke deaths accounted for 85% of these fatalities. Furthermore, instances of heart attacks were high in 2021 due to genetics and lifestyle changes contributing to a variety of issues, including hypertension, cholesterol, diabetes, and obesity, which can result in fatal heart attacks, cardiac arrests, and strokes. During these uncertain times, people have also faced a great deal of stress. Excessive stress, insufficient sleep, excessive alcohol, and drug intake, smoking, consumption of cheap supplements, and over-exercising are some of the factors that lead to fatal diseases.

End-use Insights

Based on end-uses, the global industry has been further classified into hospitals, Ambulatory Surgical Centers (ASCs), and specialty clinics. In 2021, the hospitals segment dominated the global industry and accounted for the maximum share of more than 58.9% of the overall revenue. A report indicates that the majority of hospitals and healthcare facilities are in Asia Pacific, which is fueling industry expansion. In addition, rising healthcare costs in developed and developing nations may lead to an increase in the number of hospitals, which is predicted to boost the demand for general surgical instruments and fuel segment growth.

The ASCs segment is expected to register the fastest growth rate during the forecast period. Growing public awareness about one-day procedures is a key driver of the segment’s expansion. People in many regions are preferring ASCs as they are less expensive than hospitals for treatment due to the rising expense of medical operations. People are being driven to seek medical care at ASCs due to the growing usage of cutting-edge surgical equipment in ASCs. The segment will also be driven by an increasing number of types of procedures with the potential for reimbursement. These factors are anticipated to encourage the use of general surgical devices in ASCs, accelerating the segment's growth over the forecast period.

Regional Insights

North America dominated the global industry in 2021 and accounted for the largest share of more than 39.96% of the overall revenue. The region is expected to maintain its leading position throughout the forecast period. Major factors contributing to the region’s growth include favorable reimbursement policies, the presence of key market players, and government initiatives that provide access to advanced devices for general surgery & training sessions for physicians. In 2015, Global Surgery Initiative (GSI) was launched by the Department of Surgery at Massachusetts General Hospital to help establish international partnerships and enhance medical technology for conducting surgeries efficiently.

The Asia Pacific region, on the other hand, is anticipated to register the fastest growth rate during the forecast period. The rapid growth can be attributed to the rising investments in the region. Japan, China, India, Australia, and Singapore are the major countries contributing to the market growth in the Asia Pacific region. In addition, various initiatives by the regional governments to incorporate improvements in reimbursement policies and growing awareness about reconstructive or plastic surgeries are anticipated to support the region’s growth during the forecast period.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on General Surgery Devices Market

5.1. COVID-19 Landscape: General Surgery Devices Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global General Surgery Devices Market, By Type

8.1. General Surgery Devices Market, by Type, 2022-2030

8.1.1 Disposable Surgical Supplies

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Open Surgery Instrument

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Energy-based & Powered Instrument

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Minimally Invasive Surgery Instruments

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Medical Robotics & Computer Assisted Surgery Devices

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Adhesion Prevention Products

8.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global General Surgery Devices Market, By Application

9.1. General Surgery Devices Market, by Application, 2022-2030

9.1.1. Orthopedic Surgery

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Cardiology

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Ophthalmology

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Wound Care

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Audiology

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Thoracic Surgery

9.1.6.1. Market Revenue and Forecast (2017-2030)

9.1.7. Urology and Gynecology Surgery

9.1.7.1. Market Revenue and Forecast (2017-2030)

9.1.8. Plastic Surgery

9.1.8.1. Market Revenue and Forecast (2017-2030)

9.1.9. Neurosurgery

9.1.9.1. Market Revenue and Forecast (2017-2030)

9.1.10. Others

9.1.10.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global General Surgery Devices Market, By End Use

10.1. General Surgery Devices Market, by End Use, 2022-2030

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Ambulatory Surgical Centers

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Specialty Clinics

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global General Surgery Devices Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.3. Market Revenue and Forecast, by End Use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End Use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End Use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.3. Market Revenue and Forecast, by End Use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End Use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End Use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End Use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End Use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.3. Market Revenue and Forecast, by End Use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End Use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End Use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End Use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End Use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.3. Market Revenue and Forecast, by End Use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End Use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End Use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End Use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End Use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.3. Market Revenue and Forecast, by End Use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End Use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End Use (2017-2030)

Chapter 12. Company Profiles

12.1. Medtronic Plc

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Johnson & Johnson Service, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Conmed Corp.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Integra LifeSciences

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Smith & Nephew

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Becton, Dickinson, and Company (Bd)

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. B. Braun Melsungen AG

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Cadence Inc

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Integer Holdings Corp.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Olympus Corp.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others