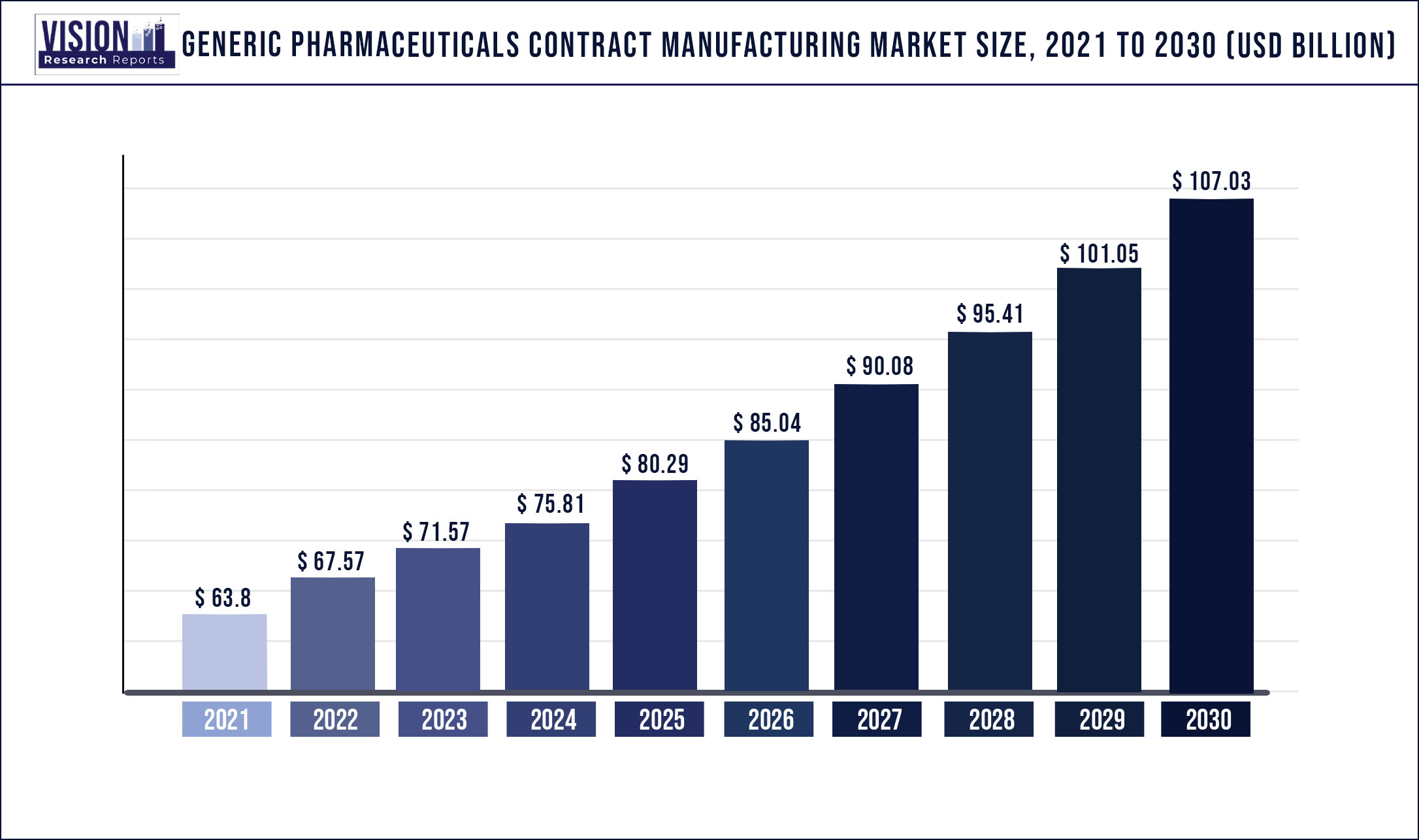

The global generic pharmaceuticals contract manufacturing market was valued at USD 63.8 billion in 2021 and it is predicted to surpass around USD 107.03 billion by 2030 with a CAGR of 5.92% from 2022 to 2030.

Report Highlights

Cost-saving and time-saving benefits associated with the implementation of outsourcing is responsible for driving the industry. A significant number of people globally suffer from chronic diseases. For instance, the CDC states that 6 in 10 adults in the U.S. suffer from at least one chronic disease and 4 in 10 adults suffer from two or more chronic diseases. Chronic diseases are required to be treated for a long time. The high cost of medicines is increasing the demand for cost-effective generic drugs for the treatment of chronic diseases.

This is expected to support the industry's growth post-pandemic. There is an improvement in the regulatory approval of generic drugs. For instance, in 2021, the FDA approved 93 generic drugs, and by October 2022, the regulatory authority approved over 95 generic drugs. Such improvements are expected to have a positive impact on the manufacturing of generic drugs and; thus, support the industry growth. The Japanese government is constantly trying to improve the generic pharmaceuticals market in the country. The government is also taking measures to improve the supply of generics in the country and is also encouraging medical institutes to promote the use of generic drugs.

This is expected to improve CMO activities for generics in the coming years. Global spending on medicines is also on the rise. According to the data provided in a report published by IQVIA in April 2021, global spending on medicine is expected to increase in the next 4-5 years. The report states that global spending on medicine accounted for USD 1, 265 billion in 2020 and is going to reach USD 1,580-1,610 billion by 2025. This is also expected to improve the demand for generic drugs owing to their cost efficiency, thereby supporting the industry in growth.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 63.8 billion |

| Revenue Forecast by 2030 | USD 107.03 billion |

| Growth rate from 2022 to 2030 | CAGR of 5.92% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Drug type, product, route of administration, application, region |

| Companies Covered |

Jubilant Generics Ltd.; Recipharm AB; Siegfried Holding AG; Aurobindo Pharma; Cambrex Corp.; Alcami Corp., Inc.; Catalent, Inc; Acme Generics Pvt. Ltd.; Syngene International Limited; Pfizer CentreOne; Curia Global, Inc.; Metric Contract Services |

Drug Type Insights

On the basis of drug types, the global industry has been further categorized into branded generics and non-branded generics. The branded generics segment dominated the global industry in 2021 and accounted for the largest share of more than 61.6% of the overall revenue. The segment is anticipated to expand further at the fastest growth rate maintaining its dominant industry position throughout the forecast period. Branded generics are known for their superior quality and doctors usually use branded generics over unbranded, based on past experiences.

The unbranded generics segment is also expected to register a significant growth rate during the forecast period. Unbranded generics are generally cheaper than branded ones. Research published by the NCBI states that branded generics are over 13 times more expensive than unbranded generics, which is one of the key factors supporting the demand for unbranded generics. Unbranded generic drugs are equally safe and effective as branded generics. This is expected to boost their demand over the forecast period.

Product Insights

The API product segment dominated the industry in 2021 and accounted for the highest share of more than 55.74% of the overall revenue. Based on products, the industry has been divided into API and drug products. Growing demand for new geriatric drugs and patent expiry of exclusive small-molecule drugs are two of the key reasons boosting segment growth. Increased interest of public organizations in improving the production of API is further supporting segment growth. For instance, in March 2020, the Indian government set up a multiyear plan, in which, it invested USD 1.3 billion to boost the production of API in the country.

Such initiatives are expected to improve generic API contract manufacturing activities and hence contribute to segment growth. The drug product segment is expected to grow at a steady CAGR over the forecast period. Small molecule drug substances have become more complex, with manufacturing methods becoming more specialized. This supports the demand for a CMO for manufacturing drug products. The adoption of the expansion agreements by the CMO for drug product manufacturing is expected to further support segment growth in the coming years. For instance, in January 2022, Piramal Pharma Solutions added a development/commercial-scale roller compaction technology in its facility in Pennsylvania to expand its capabilities in manufacturing solid dosage forms.

Route Of Administration Insights

On the basis of routes of administration, the global industry has been further categorized into oral, topical, parenteral, and others. The oral route of administration segment dominated the industry in 2021 and accounted for the highest share of more than 59.36% of the overall revenue. The oral route is a self-administering route of administration and does not require a trained physician for drug administration, which is one of the major reasons for the high acceptance of oral formulations. Oral formulations are also considered more flexible in design and are majorly used in treating some common diseases, such as migraine, fever, infectious diseases, and diabetes.

These factors are supporting the demand for the oral route of administration. On the other hand, the parenteral segment is expected to register the fastest growth rate during the forecast period. The high bioavailability of injectable formulations leading to the immediate onset of action is the prime factor for its fastest growth. Apart from this, injectable formulations are preferred if the drugs are poorly absorbed. Moreover, the parenteral formulation is also primarily preferred in cases of medical emergencies, which is further driving the segment growth.

Application Insights

The oncology segment accounted for the highest share of more than 20.61% in 2021. Based on application, the industry is segmented into oncology, immunology, antidiabetic, neurology, anticoagulants, cardiovascular, respiratory, pain, HIV antivirals, and others. Cancer is one of the major causes of death worldwide. According to the World Cancer Research Fund International, over 18.1 million cases of cancer were reported in 2020. The American Cancer Society states that National Cancer Costs are expected to increase in the coming years. It states that spending on cancer care accounted for USD 200.7 billion in 2020 and is expected to rise to USD 245.6 billion by 2030 in America.

This increases the demand for cheaper alternatives like generic drugs for cancer treatment. The immunology segment is expected to grow at a significant CAGR over the forecast period. Immunological disorders include rheumatoid arthritis, Addison disease, psoriasis, Alzheimer's disease, and others. One of the major causes of these diseases is the growing geriatric population. Furthermore, immunological diseases require treatment for a long period. This increases the cost of medications and thus supports the demand for generic medications for treating immunological disorders. These factors are supporting the segment growth.

Regional Insights

The Asia Pacific region dominated the global industry in 2021 and accounted for the maximum share of more than 37.02% of the overall revenue. The region is estimated to expand further at the fastest growth rate maintaining its dominant position in the global industry throughout the forecast period as countries in the region have a GMP-regulated infrastructure for manufacturing drugs. Furthermore, the low costs of manufacturing eventually encourage various pharmaceutical companies in developed economies, such as the U.S., to outsource their manufacturing activities in this region.

This factor also helps boost the market growth in the Asia Pacific region. The North America region also accounted for a considerable share in 2021 and will grow further at a steady CAGR from 2022 to 2030. This can be attributed to the growth of the pharmaceutical industries in the U.S. and Canada. The presence of a large number of major players in this region is expected to contribute significantly to its growth. The growing focus of pharmaceutical companies in the region to outsource non-core operations, such as manufacturing, is further supporting the region’s growth.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Generic Pharmaceuticals Contract Manufacturing Market

5.1. COVID-19 Landscape: Generic Pharmaceuticals Contract Manufacturing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Generic Pharmaceuticals Contract Manufacturing Market, By Drug Type

8.1. Generic Pharmaceuticals Contract Manufacturing Market, by Drug Type, 2022-2030

8.1.1. Branded Generics

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Unbranded Generics

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Generic Pharmaceuticals Contract Manufacturing Market, By Product

9.1. Generic Pharmaceuticals Contract Manufacturing Market, by Product, 2022-2030

9.1.1. API

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Drug Product

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Generic Pharmaceuticals Contract Manufacturing Market, By Route of Administration

10.1. Generic Pharmaceuticals Contract Manufacturing Market, by Route of Administration, 2022-2030

10.1.1. Oral

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Parenteral

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Topical

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Generic Pharmaceuticals Contract Manufacturing Market, By Application

11.1. Generic Pharmaceuticals Contract Manufacturing Market, by Application, 2022-2030

11.1.1. Oncology

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Immunology

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Antidiabetic

11.1.3.1. Market Revenue and Forecast (2017-2030)

11.1.4. Neurology

11.1.4.1. Market Revenue and Forecast (2017-2030)

11.1.5. Anticoagulants

11.1.5.1. Market Revenue and Forecast (2017-2030)

11.1.6. Cardiovascular

11.1.6.1. Market Revenue and Forecast (2017-2030)

11.1.7. Respiratory

11.1.7.1. Market Revenue and Forecast (2017-2030)

11.1.8. Pain

11.1.8.1. Market Revenue and Forecast (2017-2030)

11.1.9. HIV antivirals

11.1.9.1. Market Revenue and Forecast (2017-2030)

11.1.10. Others

11.1.10.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Generic Pharmaceuticals Contract Manufacturing Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.1.2. Market Revenue and Forecast, by Product (2017-2030)

12.1.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.1.4. Market Revenue and Forecast, by Application (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Product (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.1.5.4. Market Revenue and Forecast, by Application (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Product (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.1.6.4. Market Revenue and Forecast, by Application (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.2.2. Market Revenue and Forecast, by Product (2017-2030)

12.2.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.2.4. Market Revenue and Forecast, by Application (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Product (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.2.5.4. Market Revenue and Forecast, by Application (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Product (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.2.6.4. Market Revenue and Forecast, by Application (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Product (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.2.7.4. Market Revenue and Forecast, by Application (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Product (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.2.8.4. Market Revenue and Forecast, by Application (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.3.2. Market Revenue and Forecast, by Product (2017-2030)

12.3.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.3.4. Market Revenue and Forecast, by Application (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Product (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.3.5.4. Market Revenue and Forecast, by Application (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Product (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.3.6.4. Market Revenue and Forecast, by Application (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Product (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.3.7.4. Market Revenue and Forecast, by Application (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Product (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.3.8.4. Market Revenue and Forecast, by Application (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.4.2. Market Revenue and Forecast, by Product (2017-2030)

12.4.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.4.4. Market Revenue and Forecast, by Application (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Product (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.4.5.4. Market Revenue and Forecast, by Application (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Product (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.4.6.4. Market Revenue and Forecast, by Application (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Product (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.4.7.4. Market Revenue and Forecast, by Application (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Product (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.4.8.4. Market Revenue and Forecast, by Application (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.5.2. Market Revenue and Forecast, by Product (2017-2030)

12.5.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.5.4. Market Revenue and Forecast, by Application (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Product (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.5.5.4. Market Revenue and Forecast, by Application (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Drug Type (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Product (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Route of Administration (2017-2030)

12.5.6.4. Market Revenue and Forecast, by Application (2017-2030)

Chapter 13. Company Profiles

13.1. Jubilant Generics Ltd.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Recipharm AB

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Siegfried Holding AG

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Aurobindo Pharma

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Cambrex Corp.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Alcami Corp., Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Catalent, Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Acme Generics Pvt Ltd.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Syngene International Ltd.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Pfizer CentreOne

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others