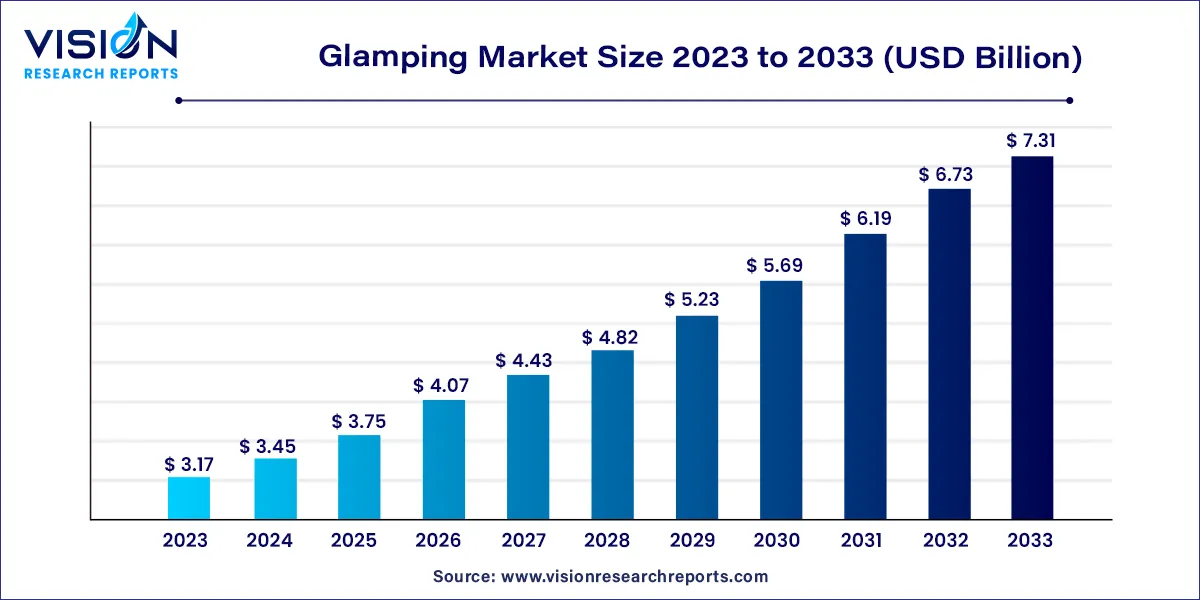

The global glamping market size was estimated at USD 3.17 billion in 2023 and it is expected to hit around USD 7.31 billion by 2033, poised to grow at a CAGR of 8.72% from 2024 to 2033. Glamping, a blend of "glamorous" and "camping," has transformed the outdoor hospitality industry by offering a luxurious alternative to traditional camping. This market caters to travelers seeking the adventure of the great outdoors without sacrificing comfort or style. Over the past decade, the glamping industry has seen significant growth, driven by changing consumer preferences, advancements in outdoor accommodations, and an increasing focus on sustainable tourism.

The growth of the glamping market is driven by an increasing demand for unique and immersive travel experiences has led many travelers, particularly millennials and Gen Z, to seek alternatives to traditional accommodations. Glamping offers a blend of luxury and nature, catering to this demand. Additionally, the rising awareness of sustainable and eco-friendly travel options has further fueled market growth, as glamping aligns with environmentally conscious practices. The influence of social media, showcasing picturesque and unique glamping sites, has also significantly contributed to the market's expansion by attracting a broader audience.

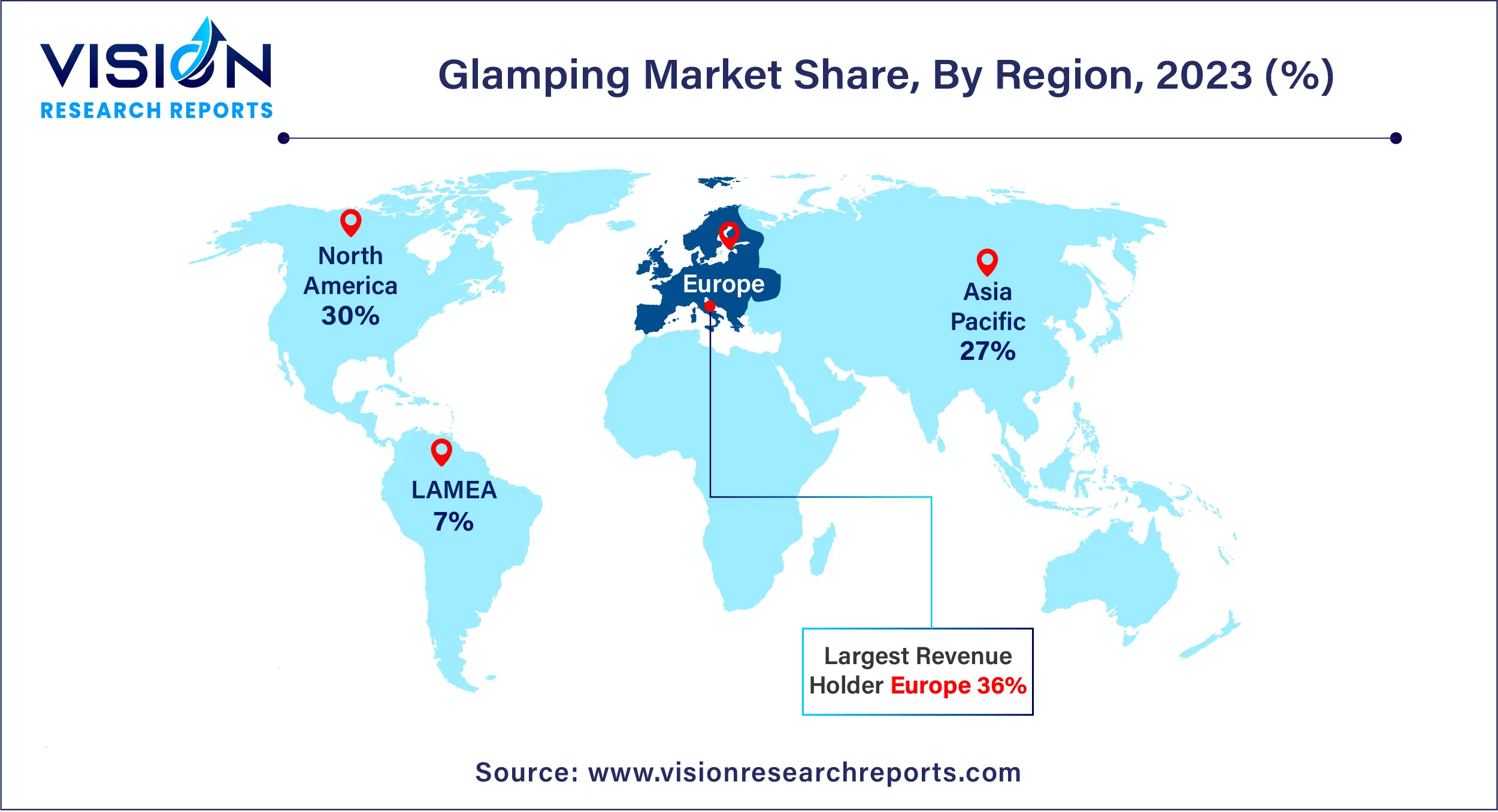

In 2023, the European glamping market captured over 36% of global revenue. The appeal of glamping has surged among European customers, who seek distinctive and authentic travel experiences. This interest is fueling travel to new, exotic destinations across the region, which is expected to boost the luxury travel industry over the forecast period.

| Attribute | Europe |

| Market Value | USD 1.14 Billion |

| Growth Rate | 8.74% CAGR |

| Projected Value | USD 2.63 Billion |

Glamping in Europe provides visitors with the unique experience of staying in luxurious accommodations surrounded by nature. Tourists in the region are increasingly seeking such experiences, and France, with its 8,000 campsites, stands out as a leading nation promoting glamping, second only to the U.S.

The glamping market in India is flourishing, driven by the changing preferences of discerning travelers. As the tourism sector in India undergoes a transformation, glamping has emerged as a significant trend, offering a combination of luxury and immersive natural experiences.

Many glamping sites in India integrate wellness and Ayurveda into their services, with serene natural environments serving as the perfect backdrop for wellness activities, yoga retreats, and Ayurvedic treatments. This aligns with the global trend toward wellness tourism, attracting travelers in search of relaxation, rejuvenation, and holistic experiences.

The North American glamping market is projected to grow at a CAGR of 12.63% from 2024 to 2033. Rising income levels among tourists and a growing interest in diverse vacation experiences are expected to positively impact the market during this period. The expansion of glamping resorts is also contributing to this growth, with companies like Under Canvas, Terra Glamping, Collective Retreats, Getaway, and AutoCamp recently entering the market, further driving the industry’s

In 2023, the cabins and pods segment led the market, accounting for 47% of the share. The growing demand for immersive experiences that do not sacrifice luxury has driven travelers toward premium accommodations like cabins and pods. Additionally, the increasing popularity of eco-pods, which utilize local, natural, and recycled materials, has made them a top choice for eco-conscious campers. These pods not only offer protection from the elements but also maintain the cozy ambiance of a home, making them ideal for sustainable tourism.

The tents segment is projected to grow at a CAGR of 8.73% from 2024 to 2033. Leading outdoor tourism providers now offer rugged camping experiences complemented by luxurious amenities within tents, such as kitchen appliances, indoor bathrooms, air conditioning, luxury beds, TV, and Wi-Fi. The presence of national parks and abundant wildlife has further bolstered the popularity of tents among travelers. Moreover, advancements in travel agents and booking systems have simplified the process of selecting tents that meet consumers’ needs. Unlike traditional camping, glamping tents provide a high level of comfort and luxury, often featuring plush bedding, stylish decor, and even en-suite bathrooms, driving their demand in the coming years.

In 2023, travelers aged 18-32 years held the largest market share, contributing 46% of the revenue. This younger demographic is increasingly drawn to destination weddings, with many finding the idea of wedding glamping particularly appealing. As a result, event organizers are expanding their offerings to include glamping options for such events. For instance, Buffalo, a startup based in New York, provides luxury rentals for weddings, private events, and festivals. These trends are helping to popularize glamping among younger travelers.

The 32-50 years age group is expected to grow at a CAGR of 8.73% from 2024 to 2033. The primary factors driving this segment's growth are the desire to escape busy lifestyles and the availability of high disposable incomes. This age group typically consists of married individuals, who often choose glamping trips as a way to spend quality time with their spouses or families.

By Accommodation

By Age Group

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Glamping Market

5.1. COVID-19 Landscape: Glamping Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Glamping Market, By Accommodation

8.1. Glamping Market, by Accommodation, 2024-2033

8.1.1. Cabins & Pods

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Tents

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Treehouses

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Yurts

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Glamping Market, By Age Group

9.1. Glamping Market, by Age Group, 2024-2033

9.1.1. 18-32 years

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. 33-50 years

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. 51-65 years

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Above 65 years

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Glamping Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.1.2. Market Revenue and Forecast, by Age Group (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Age Group (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Age Group (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.2.2. Market Revenue and Forecast, by Age Group (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Age Group (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Age Group (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Age Group (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Age Group (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.3.2. Market Revenue and Forecast, by Age Group (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Age Group (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Age Group (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Age Group (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Age Group (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.4.2. Market Revenue and Forecast, by Age Group (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Age Group (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Age Group (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Age Group (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Age Group (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.5.2. Market Revenue and Forecast, by Age Group (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Age Group (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Accommodation (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Age Group (2021-2033)

Chapter 11. Company Profiles

11.1. Under Canvas

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Collective Retreats

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Tentrr

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Eco Retreats

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Baillie Lodges

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Nightfall Camp Pty Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Tanja Lagoon Camp

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Wildman Wilderness Lodge

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Paperbark Camp

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others