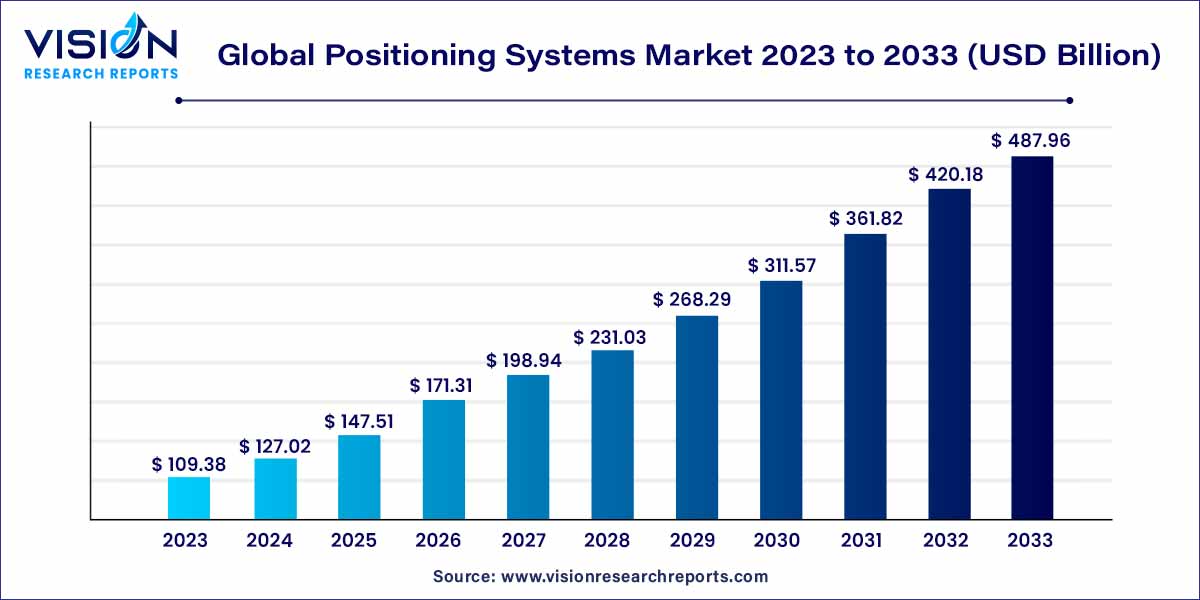

The global positioning systems market size was estimated at around USD 109.38 billion in 2023 and it is projected to hit around USD 487.96 billion by 2033, growing at a CAGR of 16.13% from 2024 to 2033. During the forecast period, the market's growth is expected to be supported by the increasing prevalence of smartphones and the proliferation of GPS-enabled automobiles.

The global positioning systems (GPS) market has become a linchpin in modern navigation and spatial data applications. A technological marvel initially designed for military precision, GPS has evolved into an omnipresent force, influencing various sectors and daily life. This overview delves into the key aspects that define the GPS market, shedding light on its growth drivers, market segments, and the competitive landscape.

The growth of the global positioning systems (GPS) market is propelled by a confluence of factors contributing to its expanding influence across diverse industries. One primary growth driver is the escalating demand for location-based services, with GPS technology becoming integral to smartphones, wearables, and the Internet of Things (IoT). The advent of autonomous vehicles is another pivotal factor, as GPS plays a critical role in ensuring precise navigation and coordination for these innovative modes of transportation. Additionally, the agricultural sector has witnessed a surge in the adoption of GPS for precision farming practices, facilitating accurate mapping and targeted resource management. This widespread integration of GPS into various applications underscores its versatility and underscores its role as a linchpin technology in the modern era. As industries continue to harness the potential of GPS, the market is poised for sustained growth, with innovations in technology further amplifying its impact across global landscapes.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 16.13% |

| Market Revenue by 2033 | USD 109.38 billion |

| Revenue Share of Asia Pacific in 2023 | 37% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The consumer devices segment accounted for the highest revenue share of 46% in 2023, owing to the proliferation of smartphones, tablets, and PCs worldwide. GPS technology is increasingly deployed in consumer devices such as smartphones and tablets. It is also used in other devices, such as automotive telematics, portable navigation, and standalone trackers.

Moreover, GPS technology is used to transmit fleet positioning information through onboard units (OBUs) to assist transport operators in monitoring logistics performance activities. An increasing number of connected vehicles and growing driving safety concerns are estimated to lead to significant growth in the automotive telematics systems segment during the forecast period.

Automotive telematics systems segment is anticipated to witness significant growth during the forecast period. It is attributed to increasing usage and dependence on GPS systems for real-time and accurate navigation. The growing usage of GPS among industries to track vehicles and manage fleets is also fueling the growth of this segment.

GPS technology can be used in various applications, including road, aviation, marine, location-based services, surveying and mapping. The location-based services segment held the largest revenue share of 43% in 2023. The growth can be attributed to a shift in consumer trends towards e-commerce and e-hailing services.

Mobile manufacturers and application developers are showing an increased interest in using location-based information as an enabler for several enterprises, customers, and public safety services. For instance, several enterprises also leverage location-based data for analytics and advertising applications that help enterprises understand consumer behavior and reach the target customers, thus aiding them in expanding their business. Location-based information can be useful for secure authentication of users and fraud management services while enabling mobile services.

Location technology plays a vital role in road applications, owing to which the road applications segment is anticipated to command a sizeable share of the overall value in 2023. In addition, with rising demand for inbuilt GPS modules in automobiles and surging demand for autonomous vehicles, key vehicle manufacturers are focusing on undertaking partnerships and agreements with component manufacturers.

The road application segment is witnessing growth in the global positioning market at the highest CAGR of 16.62% during the forecast period. The growth is attributed to increasing demand for accurate navigation, real-time traffic updates, and efficient routing services. Integration of GPS technology in road applications has improved transportation efficiency, enhanced safety, and enabled features like fleet management and smart city initiatives. The rise of connected vehicles, mobile mapping apps, and government support for road infrastructure further contribute to this growth.

North America, Europe, Asia Pacific, South America, and MEA (Middle East and Africa) are the key regions reviewed in the report. North America is one of the regions witnessing significant growth in the market. The growth is due to high military expenditure by governments (approximately 4.0% of the country’s GDP each year) and the high penetration of smartphones in the region. The penetration of smartphones in the region has been increasing, resulting in increased demand for location-based services. Thus, the regional market is expected to register a healthy growth rate during the forecast period.

Asia Pacific region dominated the market with the largest market share of 37% in 2023. The growth is attributed to rising smartphone users, growing broadband adoption, and high network infrastructure investments. Moreover, the widening base of social media users and an increasing number of GPS-enabled applications to share their real-time locations are likely to stimulate the growth of the regional market during the forecast period.

By Deployment

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Positioning Systems Market

5.1. COVID-19 Landscape: Positioning Systems Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Positioning Systems Market, By Deployment

8.1. Positioning Systems Market, by Deployment, 2024-2033

8.1.1. Standalone tracker

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Portable Navigation Devices

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Automotive Telematics Systems

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Consumer Devices

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Positioning Systems Market, By Application

9.1. Positioning Systems Market, by Application, 2024-2033

9.1.1. Road

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Aviation

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Marine

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Location Based Services

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Surveying & Mapping

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Positioning Systems Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Deployment (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Hexagon AB

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Qualcomm Technologies, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Broadcom

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Trimble Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. MiTAC Holdings Corp

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. TomTom International BV

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Collins Aerospace

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Texas Instruments Incorporated

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Garmin Ltd.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others