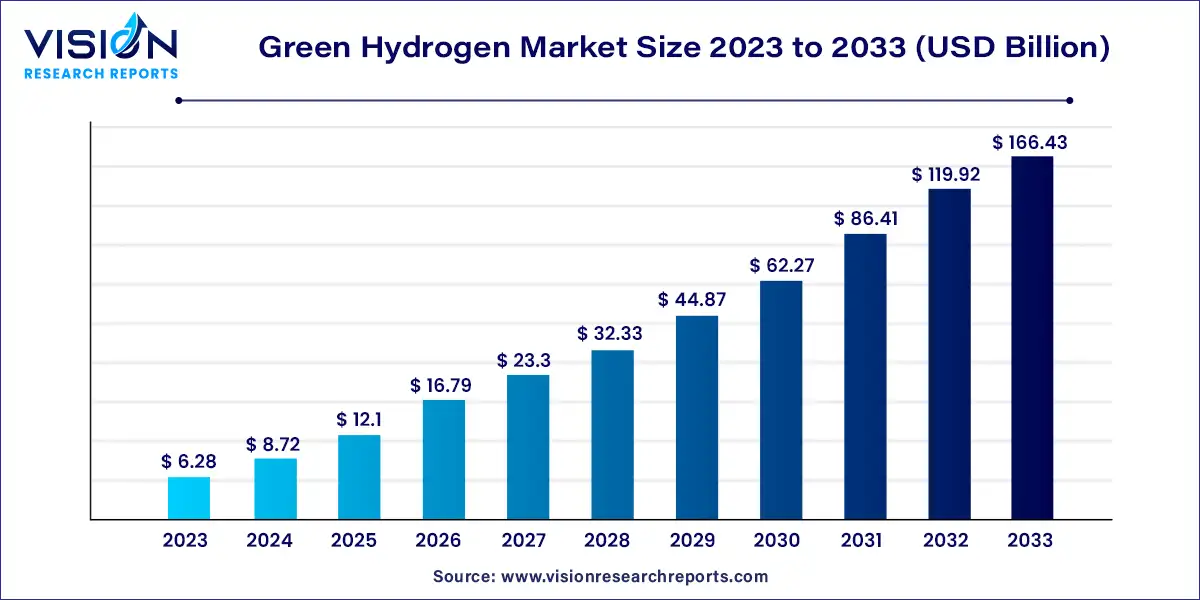

The global green hydrogen market size was estimated at around USD 6.28 billion in 2023 and it is projected to hit around USD 166.43 billion by 2033, growing at a CAGR of 38.78% from 2024 to 2033.

Green hydrogen, produced using renewable energy sources through the electrolysis of water, is emerging as a critical component in the global transition to sustainable energy. Unlike traditional hydrogen production methods, which rely on fossil fuels and emit significant amounts of carbon dioxide, green hydrogen is generated with minimal environmental impact. This makes it a vital player in achieving net-zero emissions and fostering a cleaner energy ecosystem.

The growth of the green hydrogen market is driven by the stringent government policies and regulations supporting the transition to clean energy are crucial. Initiatives such as subsidies, tax incentives, and research grants are designed to make green hydrogen more competitive compared to traditional energy sources. Technological advancements also play a significant role; innovations in electrolyzer technologies and renewable energy integration are enhancing efficiency and reducing costs. Additionally, the increasing global focus on sustainability and carbon reduction is fueling demand across various sectors, including transportation, industrial processes, and power generation. Corporate sustainability commitments are further accelerating the adoption of green hydrogen, as companies seek to meet their environmental goals and improve their market positions.

In 2023, the alkaline electrolyzer segment led the market with a 26% revenue share. This dominance is largely attributed to the advantages of alkaline electrolysis technology, such as the use of readily available and inexpensive electrolytes. The broad availability of these materials contributes to the rapid expansion and market leadership of alkaline electrolyzers.

Conversely, the solid oxide electrolyzer segment is projected to experience significant growth during the forecast period. Solid oxide electrolysis benefits from electrolytes that are easy to replicate or replace and exhibit minimal corrosive effects on electrodes, which extends the electrolyzer's lifespan. The challenges associated with hydrogen ions diffusing into the electrolyte solution contribute to the efficiency of alkaline electrolysis in producing green hydrogen.

Wind energy held the largest share of the green hydrogen market in 2023, accounting for 48% of the market. Wind energy is a prevalent and renewable resource with substantial potential for generating clean electricity. Wind turbines, whether installed onshore or offshore, harness air movement to produce electricity without emitting greenhouse gases or pollutants. As wind energy becomes more cost-competitive compared to fossil fuels, the decreasing costs of wind turbines, installation, and maintenance make it a viable and economical source for green hydrogen production. This enables cost-effective hydrogen production through electrolysis powered by wind-generated electricity.

The refining sector commanded a significant share of 42% of the green hydrogen market in 2023. Refineries, with their established infrastructure and expertise in handling large volumes of gases and liquids, can adapt their existing facilities for hydrogen production. This capability allows refineries to enter the green hydrogen market efficiently and economically. Many refineries are investing in research and development to advance green hydrogen production technologies, including improvements in electrolysis, catalysts, and renewable energy integration, which enhance the efficiency and cost-effectiveness of hydrogen production in the refining industry.

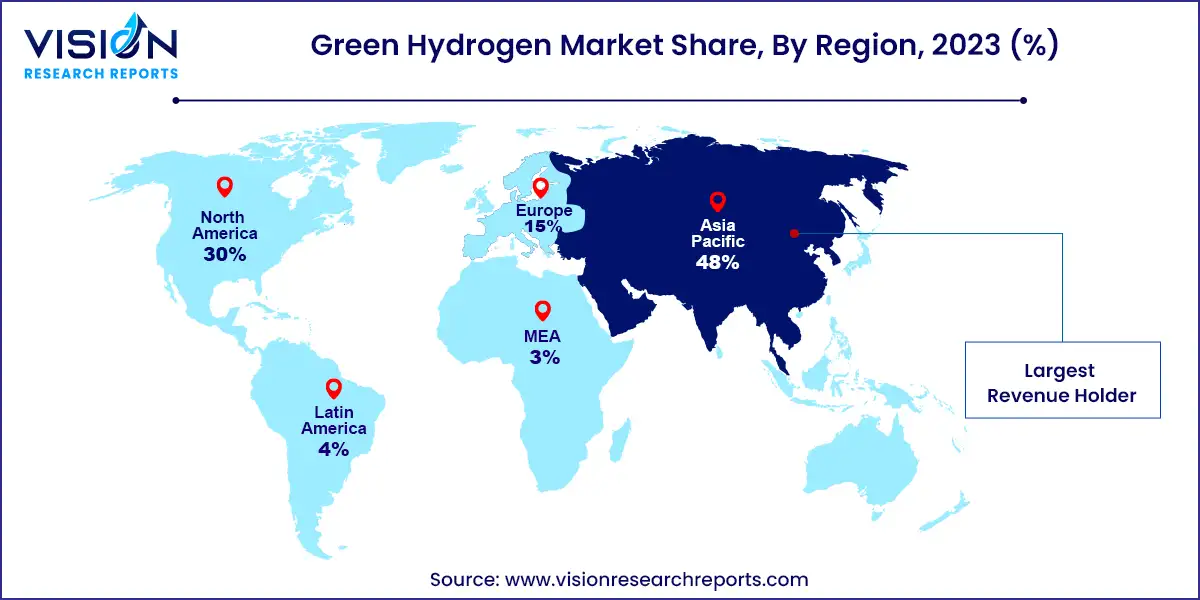

In 2023, the Asia-Pacific region led the global green hydrogen market in revenue and is expected to maintain this leadership throughout the forecast period. China, in particular, holds the largest market share within Asia-Pacific, contributing significantly to global green hydrogen production. With an output of 20 million tons, China commands approximately one-third of the world's total green hydrogen production.

Meanwhile, Europe also captured a substantial share of the market. Hydrogen plays a critical role in Europe’s energy landscape, supported by the European Green Deal. This initiative aims to cut greenhouse gas emissions and transition Europe’s economy towards a climate-neutral future.

By Electrolyzer

By Source

By End User

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others