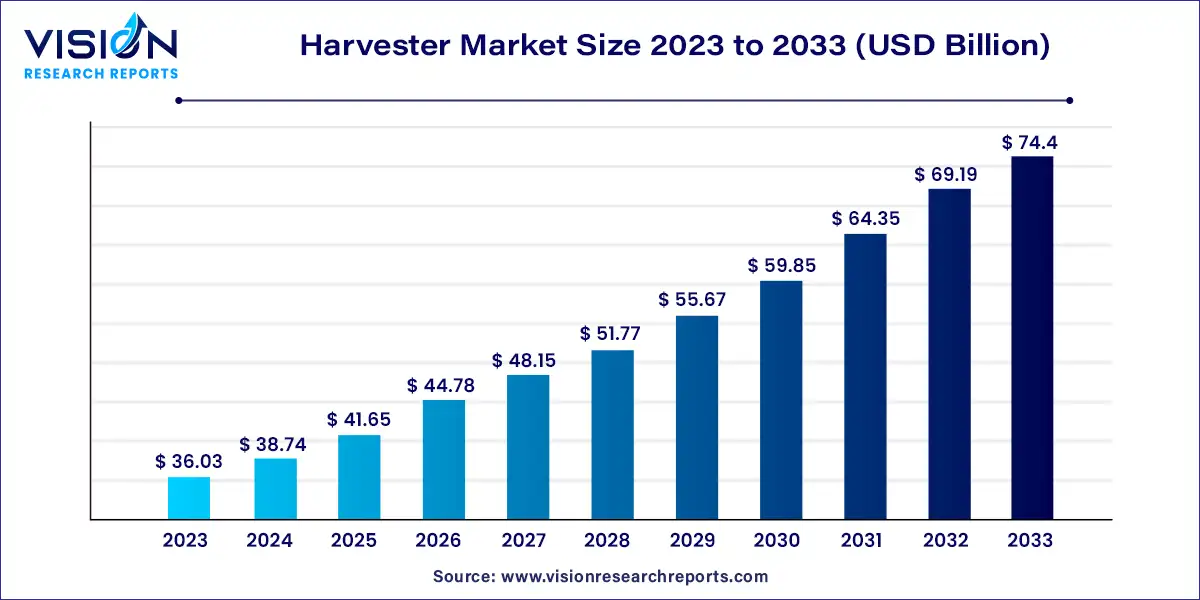

The global harvester market size was estimated at USD 36.03 billion in 2023 and it is expected to surpass around USD 74.4 billion by 2033, poised to grow at a CAGR of 7.52% from 2024 to 2033. The harvester market is a pivotal segment within the agricultural machinery industry, driven by the increasing need for efficient and cost-effective farming practices. Harvesters, crucial for the collection of crops, range from combines and forage harvesters to specialized equipment tailored for specific crops. As agriculture evolves with technological advancements, the harvester market reflects these changes through innovation and diversification.

The harvester market is experiencing robust growth due to the continuous advancement in agricultural technology, including automation and precision farming, is significantly enhancing the efficiency of harvesting processes. Modern harvesters equipped with cutting-edge features such as GPS navigation and real-time data analysis are streamlining operations and reducing labor costs. Additionally, the escalating demand for higher agricultural productivity to feed a growing global population is driving the adoption of sophisticated harvesting equipment. Government incentives and subsidies aimed at modernizing agricultural practices further bolster market expansion. Moreover, increasing investments in research and development are fostering innovations that cater to diverse crop needs, thereby expanding the applicability of harvesters across various agricultural sectors.

The Asia Pacific harvester market led globally, accounting for over 40% of revenue in 2023. Growth in the region is driven by increasing agricultural mechanization in emerging economies like India and China. The shift from manual labor to mechanized farming is fueling demand for multi-crop harvesters, especially in countries with diverse cropping patterns such as India.

| Attribute | Asia Pacific |

| Market Value | USD 14.41 Billion |

| Growth Rate | 7.54% CAGR |

| Projected Value | USD 29.76 Billion |

The harvester market in North America is expected to grow at a notable CAGR of 8.03% from 2024 to 2033. Technological advancements and a focus on large-scale farming operations are key drivers. The adoption of high-capacity harvesters for extensive farmland is particularly prominent in the U.S. and Canada.

The harvester market in Europe is expected to grow significantly from 2024 to 2033. Strict environmental regulations are pushing farmers towards low-emission harvesting equipment. The EU's Common Agricultural Policy (CAP) supports this transition by encouraging the adoption of sustainable farming machinery.

In 2023, the forage harvester segment led the market, capturing over 27% of global revenue. The growing preference for self-propelled forage harvesters is attributed to their high efficiency and adaptability to various field conditions. Additionally, the shift towards sustainable farming practices is influencing this segment, with manufacturers focusing on reducing environmental impacts through innovative designs.

The combine harvester segment is anticipated to experience the highest growth rate, with a projected CAGR of 8.53% from 2024 to 2033. This growth is driven by the rising global population and the corresponding increase in food demand. Government initiatives promoting agricultural mechanization, particularly in developing nations, are also boosting the adoption of combine harvesters. For example, India's Sub-Mission on Agricultural Mechanization (SMAM) offers subsidies for modern machinery, including combine harvesters.

In 2023, the semi-automatic segment dominated the market, accounting for over 55% of global revenue. The adoption of semi-automatic harvesters is driven by rising labor costs and a shortage of skilled farm labor. These machines strike a balance between cost and efficiency, making them popular among mid-sized farms. Countries such as China, India, and Brazil are increasingly adopting semi-automatic harvesters as part of their agricultural modernization efforts. These harvesters are becoming more advanced, incorporating features like GPS tracking, yield mapping, and real-time data analytics that were previously exclusive to fully automated systems.

The automatic segment is expected to see substantial growth from 2024 to 2033. The need for increased efficiency and productivity in large-scale farming is a primary driver for this segment. Automatic harvesters reduce reliance on costly manual labor and benefit from AI and machine learning integration, which helps optimize harvesting processes, reduce waste, and enhance yield quality.

In 2023, internal combustion engine (ICE) harvesters dominated the market, representing over 88% of global revenue. The well-established infrastructure for diesel fuel, particularly in rural farming areas, makes ICE harvesters a practical choice. Manufacturers are investing in advanced engine technologies to improve fuel efficiency and reduce emissions. For example, Tier 4 engines, which comply with stringent U.S. Environmental Protection Agency (EPA) emissions standards, are increasingly used. These engines incorporate advanced after-treatment systems like selective catalytic reduction (SCR) and exhaust gas recirculation (EGR) to lower nitrogen oxide (NOx) emissions.

The electric segment is projected to grow at the highest CAGR from 2024 to 2033. This segment is marked by rapid technological advancements and increasing interest from both manufacturers and farmers. Significant developments include high-capacity batteries with extended operational times, such as lithium-ion batteries known for their energy density and quick charging. Additionally, some manufacturers are exploring solid-state batteries for even greater energy storage and safety.

By Type

By Automation Level

By Propulsion Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Harvester Market

5.1. COVID-19 Landscape: Harvester Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Harvester Market, By Type

8.1. Harvester Market, by Type, 2024-2033

8.1.1 Forage Harvester

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Combine Harvester

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Sugarcane Harvester

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Potato Harvester

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Harvester Market, By Automation Level

9.1. Harvester Market, by Automation Level, 2024-2033

9.1.1. Manual

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Semi-Automatic

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Automatic

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Harvester Market, By Propulsion Type

10.1. Harvester Market, by Propulsion Type, 2024-2033

10.1.1. ICE

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Electric

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Harvester Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.1.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.2.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.3.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.4.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.5.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Automation Level (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Propulsion Type (2021-2033)

Chapter 12. Company Profiles

12.1. AGCO Corporation.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. CLAAS KGaA mbH.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. CNH Industrial N.V.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Dasmesh Group.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Deere & Company.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. KUBOTA Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Linttas Electric Company.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Mahindra&Mahindra Ltd.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. SDF.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Caterpillar Inc

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others