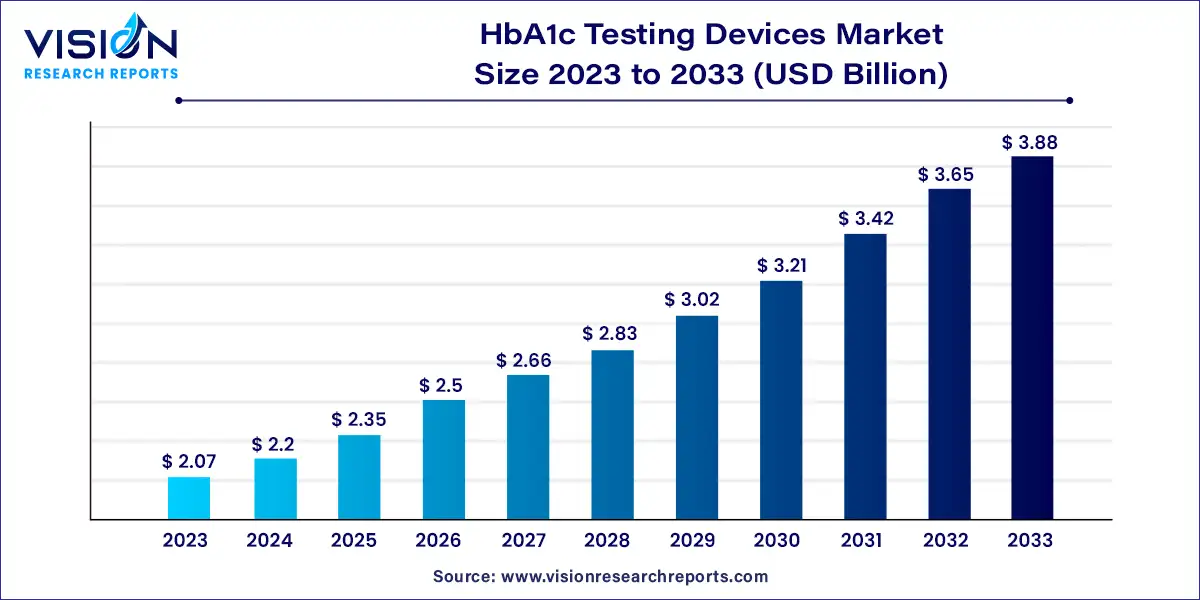

The global HbA1c testing devices market size was surpassed at USD 2.07 billion in 2023 and is expected to hit around USD 3.88 billion by 2033, growing at a CAGR of 6.49% from 2024 to 2033.

The HbA1c testing devices market is witnessing significant growth due to the rising prevalence of diabetes worldwide. HbA1c, or glycated hemoglobin, is a crucial marker for monitoring long-term blood glucose levels in individuals with diabetes. As the demand for efficient and reliable diabetes management tools increases, the market for HbA1c testing devices is expanding rapidly.

The growth of the HbA1c testing devices market is primarily propelled by several key factors. Firstly, the escalating prevalence of diabetes worldwide, particularly type 2 diabetes, necessitates regular monitoring of blood glucose levels, driving the demand for HbA1c testing devices. Additionally, heightened awareness among both healthcare professionals and patients regarding the importance of glycemic control further fuels market growth. Moreover, continuous advancements in technology, such as the development of point-of-care testing systems and continuous glucose monitoring devices, enhance the accuracy, efficiency, and convenience of diabetes management, thus driving the adoption of HbA1c testing devices. These factors collectively contribute to the expansion of the HbA1c testing devices market, positioning it for sustained growth in the foreseeable future.

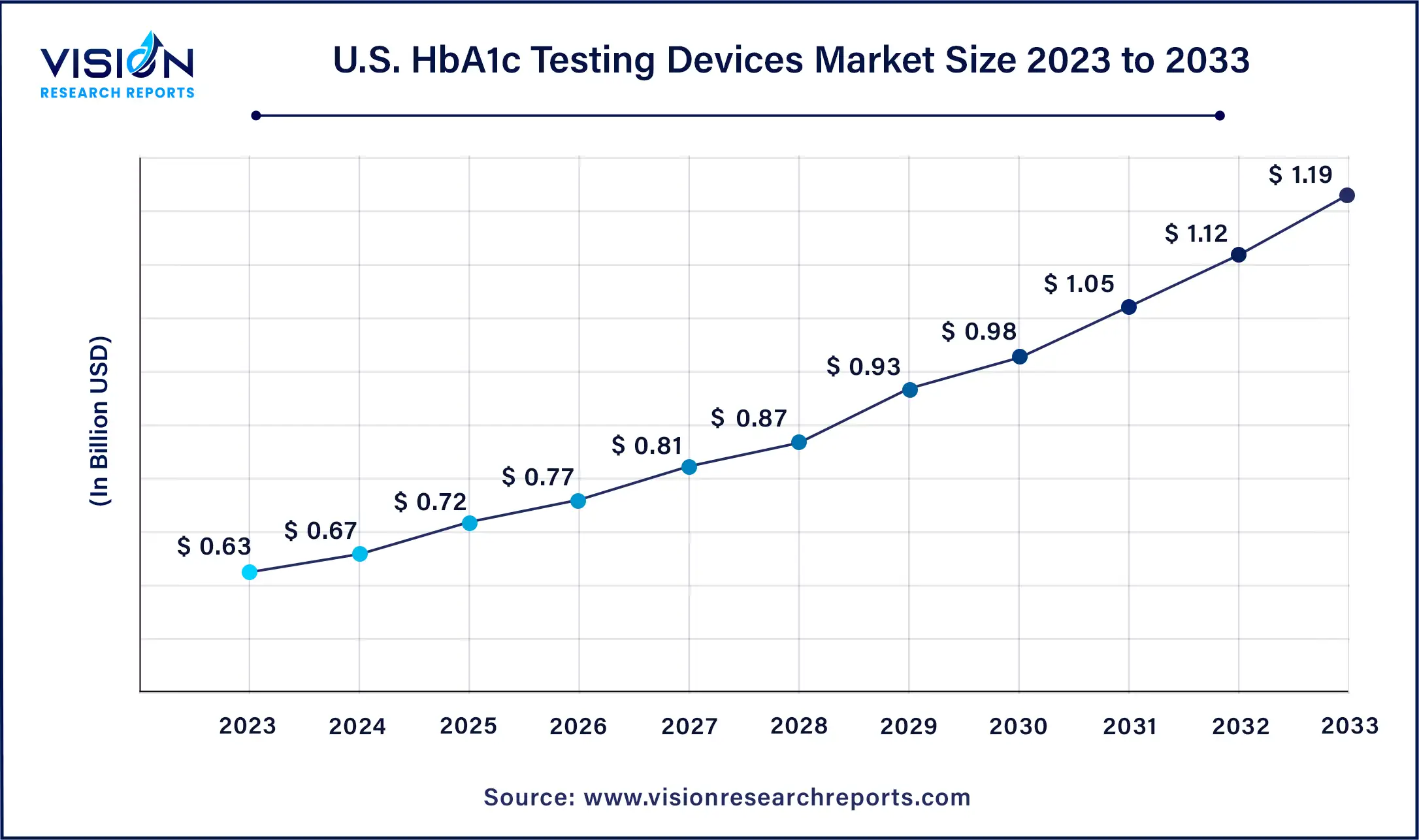

The U.S. HbA1c testing devices market size was estimated at around USD 10 billion in 2023 and it is projected to hit around USD 10 billion by 2033, growing at a CAGR of 10% from 2024 to 2033.

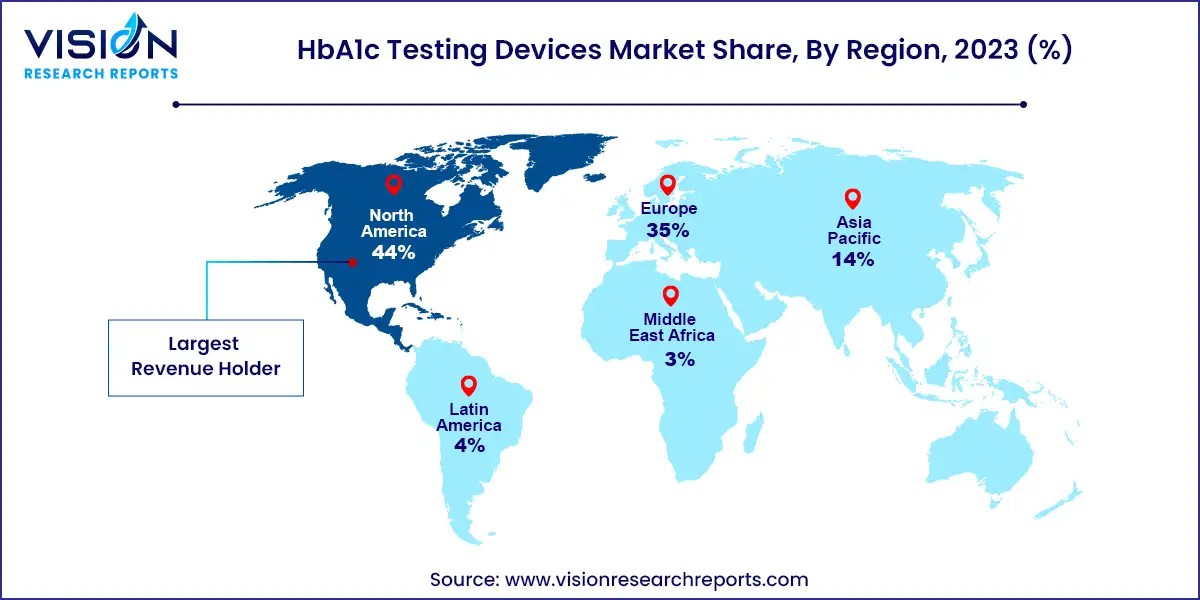

In 2023, the North America HbA1c testing devices industry held a substantial 44% share of the global market, driven by various factors. These include the escalating incidence and prevalence of diabetes, the presence of established market players, and the availability of reimbursements for specific diabetes care products, including HbA1c testing devices. Notably, the announcement made by the US Centers for Medicare and Medicaid Services in December 2021, extending coverage to all continuous glucose monitoring systems (CGMs) under Medicare, has positively impacted the US market, leading to increased utilization of HbA1c testing devices.

Meanwhile, the HbA1c testing devices market in Asia Pacific is poised to witness the swiftest compound annual growth rate (CAGR) over the forecast period. The region boasts a large target population, significant unmet clinical needs, and a developing healthcare infrastructure, offering substantial growth opportunities for the market. Major players in the region are actively focusing on developing innovative point-of-care solutions, driven by the increasing prevalence of diabetes and the aging population. Additionally, there is a notable emphasis on geographic expansion, demonstrated by the launch of new manufacturing facilities in the region. For instance, in October 2023, Japan-based company Tosoh Bioscience Inc. partnered with Sysmex America to integrate HLC723G8 analyzers with Sysmex XN-9000 and XN-9100 hematology systems, aiming to enhance A1c testing automation in the US, Latin America, and Canada.

In 2023, the Point-of-care (POC) testing devices segment emerged as the market leader, capturing a substantial 77% market share and is expected to maintain its position with the fastest Compound Annual Growth Rate (CAGR) throughout the forecast period. The surge in demand for POC testing devices, including those for HbA1c testing, stems from various factors. These include the increasing necessity for swift diagnostic outcomes in clinical environments, the trend towards decentralizing healthcare services, and the rising prevalence of diabetes, all of which contribute to the heightened adoption of these devices. Notably, the advancement of rapid microfluidic assay technology, exemplified by LumiraDx's HbA1c test, fulfills the growing clinical requirement for accessible and dependable diagnostic instruments capable of delivering immediate feedback. This facilitates expedited decision-making in patient care.

Furthermore, this growth is fueled by strategic acquisitions and product launches, which have enriched the market's competitive landscape. For instance, in January 2024, Roche revealed a deal to acquire LumiraDx's point-of-care testing technology for USD 295 million, with an additional allocation of up to USD 55 million to bolster Lumira's point-of-care technology platform until the acquisition's finalization. Additionally, in May 2022, LumiraDx obtained CE Marking for its HbA1c test, thereby enhancing diabetes screening and monitoring capabilities on its point-of-care LumiraDx Platform. The rapid microfluidic assay delivers results in under seven minutes, aiding in the identification of patient risks.

In 2023, Immunoassays emerged as the leading technology segment, commanding a share of 36%. Immunoassay technology utilizes antibodies to bind specifically to HbA1c, enabling precise quantification. Its popularity in point-of-care testing is attributed to its efficiency and straightforward results interpretation. In diabetology, immunoassays are instrumental in evaluating critical biomarkers such as HbA1c, C-peptide, insulin, and beta cell protein autoantibodies. These biomarkers are essential for accurate diagnosis and classification of diabetes mellitus. For example, the LumiraDx HbA1c test is a user-friendly microfluidic immunoassay designed for rapid HbA1c quantification in both fingerstick and venous whole blood samples. Paired with the LumiraDx Platform, this test ensures swift and reliable results, delivered directly at the point of care in under 7 minutes.

High-Performance Liquid Chromatography (HPLC) is expected to exhibit significant growth over the forecast period, owing to its accuracy, sensitivity, wide detection range, reproducibility, consistency, efficiency, and compliance with clinical standards. HPLC detects even trace amounts of HbA1c, enabling early diagnosis and precise diabetes monitoring. Its expansive detection range assesses diabetes severity, facilitating personalized treatment strategies. Known for its reproducibility and consistency, HPLC yields reliable results across various laboratories and instruments, essential for clinical decision-making. It efficiently analyzes multiple samples simultaneously, enhancing workflow efficiency. Advancements in particle technology have further improved the speed and efficiency of HPLC systems for HbA1c testing, resulting in faster and more accurate analysis of HbA1c levels, thus aiding in diabetes management.

In 2023, Hospitals emerged as the dominant end-use segment, commanding a market share of 42%. With their advanced technology and infrastructure, hospitals and clinics are well-equipped to effectively utilize HbA1c testing devices. These facilities require efficient methods for monitoring glycemic control in diabetic patients, making HbA1c testing devices indispensable. The point-of-care testing capabilities enable immediate access to patient data, facilitating timely interventions. Despite initial investment costs, the cost-effectiveness of these devices, driven by their ability to conduct multiple tests and reduce testing time, is appealing to healthcare facilities. Additionally, the high accuracy and reliability of advanced testing methods, such as ion-exchange HPLC and TINIA, meet the stringent quality standards and regulatory requirements of hospitals and clinics.

The homecare settings segment is anticipated to experience the fastest compound annual growth rate (CAGR) over the forecast period. With the global rise in diabetes cases, continuous monitoring becomes imperative, making homecare settings conducive to convenient and personalized care delivery. The increasing preference for home-based diagnostic testing, driven by factors such as convenience and cost-effectiveness, amplifies the demand for HbA1c testing devices in these settings. Furthermore, advancements in diagnostic technology ensure accuracy, reliability, and user-friendliness, enhancing patient safety and comfort. This transition towards home care is propelled by a desire for convenience and comfort, bolstered by technological innovations that streamline testing processes. The cost-effectiveness and remote monitoring capabilities of home testing devices further drive demand.

By Type of Device

By Technology

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others