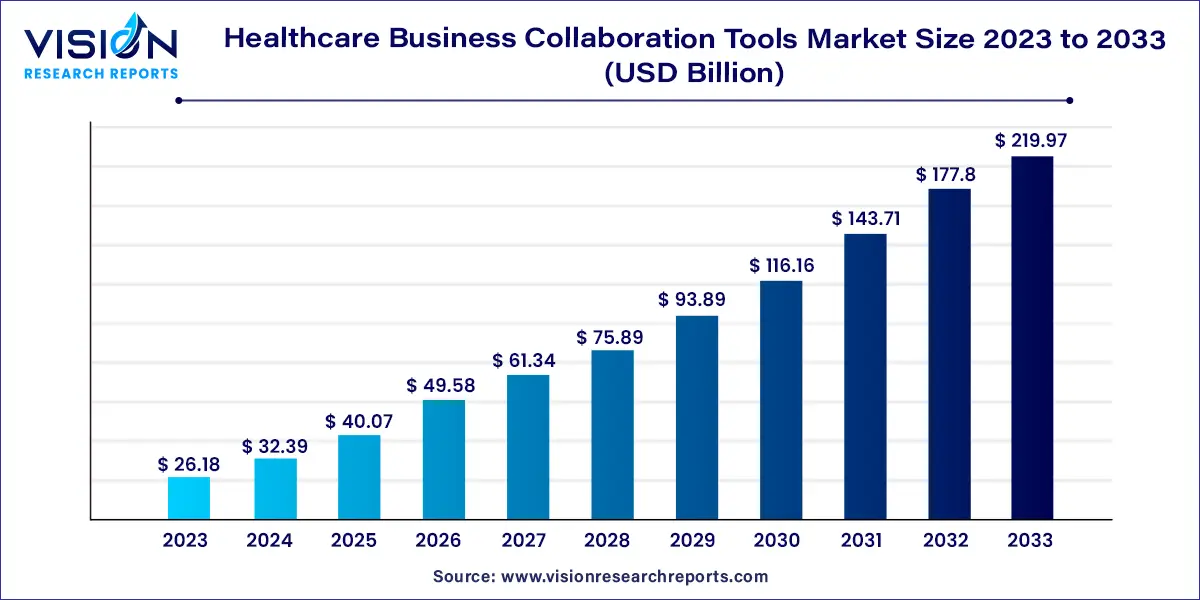

The global healthcare business collaboration tools market size was valued at USD 26.18 billion in 2023 and it is predicted to surpass around USD 219.97 billion by 2033 with a CAGR of 23.72 from 2024 to 2033.

In the dynamic landscape of healthcare, efficient communication and collaboration are pivotal to delivering superior patient care. Healthcare business collaboration tools have emerged as a transformative force, revolutionizing how healthcare professionals interact, share information, and coordinate efforts. This overview provides a comprehensive glimpse into the Healthcare Business Collaboration Tools market, elucidating its critical role in enhancing healthcare workflows, optimizing operations, and ultimately, improving patient outcomes.

In the rapidly evolving landscape of healthcare, the expansion of the Healthcare Business Collaboration Tools market is propelled by several pivotal growth factors. One of the primary drivers is the increasing need for seamless communication and collaboration within healthcare organizations. With the rising adoption of telemedicine and remote healthcare services, the demand for efficient virtual communication platforms has soared. Moreover, the stringent data security regulations and the necessity for compliance with healthcare standards have led to the development of collaboration tools equipped with advanced encryption and privacy features, ensuring the secure exchange of sensitive patient information. Additionally, the market is bolstered by the focus on user-friendly interfaces, enabling easy navigation and enhancing user experience, which, in turn, accelerates the adoption rate among healthcare professionals. The integration of Artificial Intelligence (AI) and machine learning technologies into these tools further augments their functionalities, enabling predictive analytics for resource optimization and enhancing patient engagement through AI-driven solutions. These combined factors drive the continual growth of the Healthcare Business Collaboration Tools market, reshaping healthcare communication, collaboration, and overall efficiency.

| Report Coverage | Details |

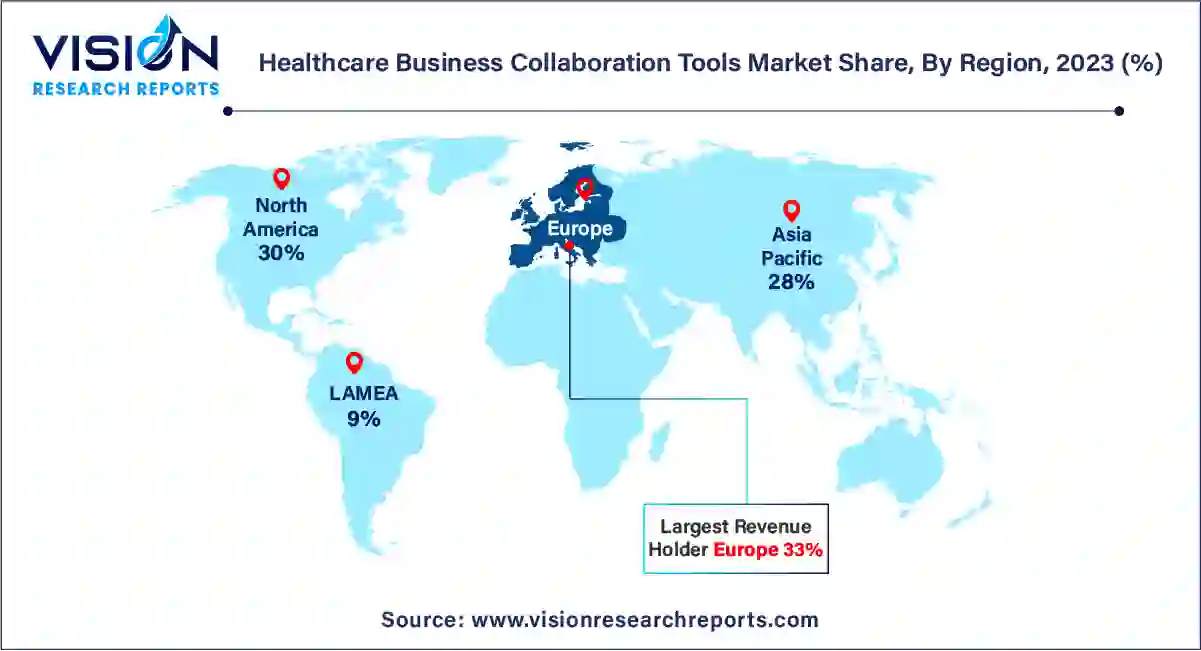

| Revenue Share of Europe in 2023 | 33% |

| CAGR of Asia Pacific from 2024 to 2033 | 6.26% |

| Revenue Forecast by 2033 | USD 219.97 billion |

| Growth Rate from 2024 to 2033 | CAGR of 23.72% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Communication & coordination held the largest revenue share of 60% in 2023. Communication & Coordination Software, healthcare organizations are embracing innovative solutions that facilitate real-time messaging and task management. These software platforms provide secure channels for healthcare professionals to exchange vital patient information swiftly. Moreover, they offer functionalities such as task assignment, progress tracking, and deadline management. Such tools streamline internal communication, ensuring that the healthcare teams remain well-coordinated, leading to enhanced operational efficiency. Additionally, these software solutions often integrate seamlessly with Electronic Health Records (EHR) systems and other healthcare applications, minimizing data silos and promoting the flow of accurate and updated patient information across various platforms. As the healthcare industry continues to evolve, these sophisticated Conferencing and Communication & Coordination Software play a pivotal role in shaping the future of collaborative healthcare, offering efficient, secure, and integrated solutions for medical professionals worldwide.

The conferencing software is expected to grow at the fastest CAGR of 25.06% over the forecast period. Within the Conferencing Software category, healthcare professionals are benefiting from high-quality video and audio solutions. These conferencing tools enable seamless virtual consultations, fostering doctor-patient interactions irrespective of geographical distances. The integration of features like screen sharing and real-time document collaboration enhances the efficiency of medical discussions and decision-making processes among healthcare teams. This robust conferencing software is pivotal in the telemedicine sector, enabling remote diagnostics, consultation services, and medical education programs.

The on-premises segment contributed more than 57% of revenue share in 2023. On-premises deployment, traditionally favored for its localized control and customization options, allows healthcare institutions to host collaboration tools within their own physical infrastructure. This method grants them complete autonomy over data management, ensuring compliance with specific regulatory requirements and internal security protocols. However, it demands substantial initial investments in hardware, software, and dedicated IT staff, making it a choice often favored by larger healthcare facilities with significant resources.

The cloud deployment is anticipated to grow at the noteworthy CAGR of 28.57% during the forecast period. Cloud deployment has emerged as a transformative force in the healthcare sector. Cloud-based Healthcare Business Collaboration Tools are hosted on remote servers, accessible through the internet. This approach offers unparalleled flexibility and scalability, enabling healthcare organizations to swiftly adapt to changing demands. Cloud solutions eliminate the need for extensive on-site infrastructure, reducing upfront costs significantly. Moreover, they facilitate seamless remote access, allowing healthcare professionals to collaborate from diverse locations, enhancing teamwork and enabling timely decision-making, especially in critical situations.

The large facilities accounted for the largest revenue share of 56% in 2023. Large Facilities, often comprising extensive medical centers, hospitals, and research institutions, possess distinct requirements. They demand robust, scalable collaboration solutions capable of managing a vast array of healthcare tasks seamlessly. These large-scale facilities benefit significantly from advanced collaboration tools that support multifaceted communication needs, ensuring efficient coordination among diverse medical professionals. The complexity of patient cases and the volume of data in these settings necessitate sophisticated Collaboration Tools that can handle extensive information exchange, real-time updates, and intricate task management, all within a secure and compliant framework. These tools empower large facilities to streamline workflows, optimize resource allocation, and enhance patient care through seamless collaboration and communication channels.

The small & medium segment is expected to grow at the fastest CAGR of 23.84% over the forecast period. Small & Medium Facilities, including clinics, physician offices, and outpatient centers, have their unique set of challenges and requirements in the healthcare collaboration. For these facilities, agility, affordability, and simplicity are paramount. Collaboration tools tailored for small and medium-sized setups are designed for ease of use, rapid deployment, and cost-effectiveness. They prioritize intuitive interfaces, enabling healthcare professionals to communicate swiftly, manage appointments efficiently, and share essential patient data seamlessly. The emphasis here is on enhancing the overall efficiency of day-to-day operations. These facilities often rely on collaboration tools that integrate with existing systems, such as Electronic Health Records (EHR), ensuring the continuity of patient information while adhering to budget constraints.

Europe held the largest revenue share of 33% in 2023. Europe exhibits a similar trend, with countries like Germany, France, and the United Kingdom leading in the adoption of advanced collaboration tools. The European healthcare landscape benefits from significant investments in digital healthcare infrastructure, emphasizing the need for seamless communication and efficient coordination among healthcare professionals.

Asia Pacific is predicted to grow at the remarkable CAGR of 28.18% over the forecast period. In the Asia-Pacific region, rapid economic growth and an increasing focus on healthcare infrastructure development are driving the adoption of Healthcare Business Collaboration Tools. Countries like China and India are witnessing a surge in telemedicine services, spurring the demand for secure and user-friendly collaboration platforms to support remote consultations and patient care.

By Type

By Deployment

By Facility Size

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Healthcare Business Collaboration Tools Market

5.1. COVID-19 Landscape: Healthcare Business Collaboration Tools Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Healthcare Business Collaboration Tools Market, By Type

8.1. Healthcare Business Collaboration Tools Market, by Type, 2024-2033

8.1.1 Conferencing Software

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Communication & Coordination Software

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Healthcare Business Collaboration Tools Market, By Deployment

9.1. Healthcare Business Collaboration Tools Market, by Deployment, 2024-2033

9.1.1. Cloud

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. On-premises

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Healthcare Business Collaboration Tools Market, By Facility Size

10.1. Healthcare Business Collaboration Tools Market, by Facility Size, 2024-2033

10.1.1. Small & Medium Facilities

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Large Facilities

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Healthcare Business Collaboration Tools Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.3. Market Revenue and Forecast, by Facility Size (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Facility Size (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Facility Size (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.3. Market Revenue and Forecast, by Facility Size (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Facility Size (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Facility Size (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Facility Size (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Facility Size (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.3. Market Revenue and Forecast, by Facility Size (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Facility Size (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Facility Size (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Facility Size (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Facility Size (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.3. Market Revenue and Forecast, by Facility Size (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Facility Size (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Facility Size (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Facility Size (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Facility Size (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.3. Market Revenue and Forecast, by Facility Size (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Facility Size (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Facility Size (2021-2033)

Chapter 12. Company Profiles

12.1. Microsoft.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Google.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. IBM.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. FreshBooks.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. CONTUS TECH.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Tvisha Technologies Pvt Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Zoho Corporation Pvt. Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Wrike, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. 500apps.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. BrainCert

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others