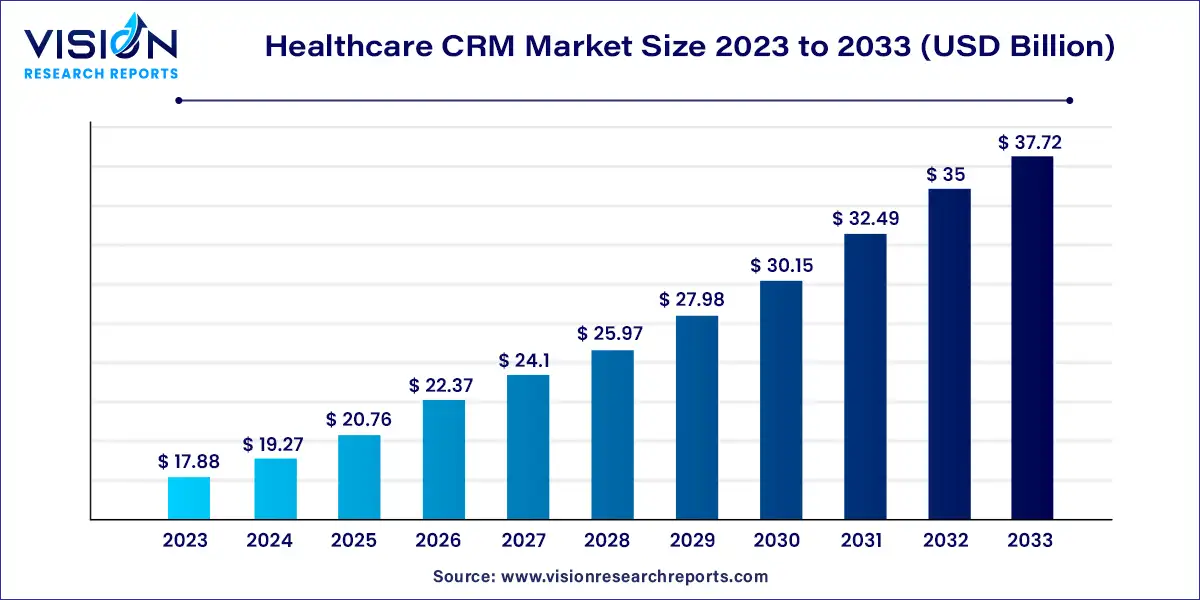

The global healthcare CRM market size was estimated at around USD 17.88 billion in 2023 and it is projected to hit around USD 37.72 billion by 2033, growing at a CAGR of 7.75% from 2024 to 2033. The healthcare customer relationship management (CRM) market has experienced substantial growth over recent years, driven by the increasing need for personalized patient care and efficient management of healthcare services. A healthcare CRM system helps organizations streamline operations, enhance patient engagement, and improve overall service delivery by integrating various functions such as appointment scheduling, patient communication, and data management.

The growth of the healthcare CRM market is significantly driven by the increasing demand for personalized patient care and improved operational efficiencies. As healthcare providers strive to enhance patient engagement and satisfaction, CRM systems offer advanced tools for managing patient interactions and data. The rise of digital health technologies, including telemedicine and mobile health apps, has further accelerated the need for integrated CRM solutions that can handle complex patient data and communication channels effectively. Additionally, stringent regulatory requirements around data privacy and security are prompting healthcare organizations to adopt CRM systems that ensure compliance and protect sensitive information. The push for operational efficiency, through automation and streamlined workflows, also contributes to the market's expansion as organizations seek to reduce administrative burdens and optimize resource management.

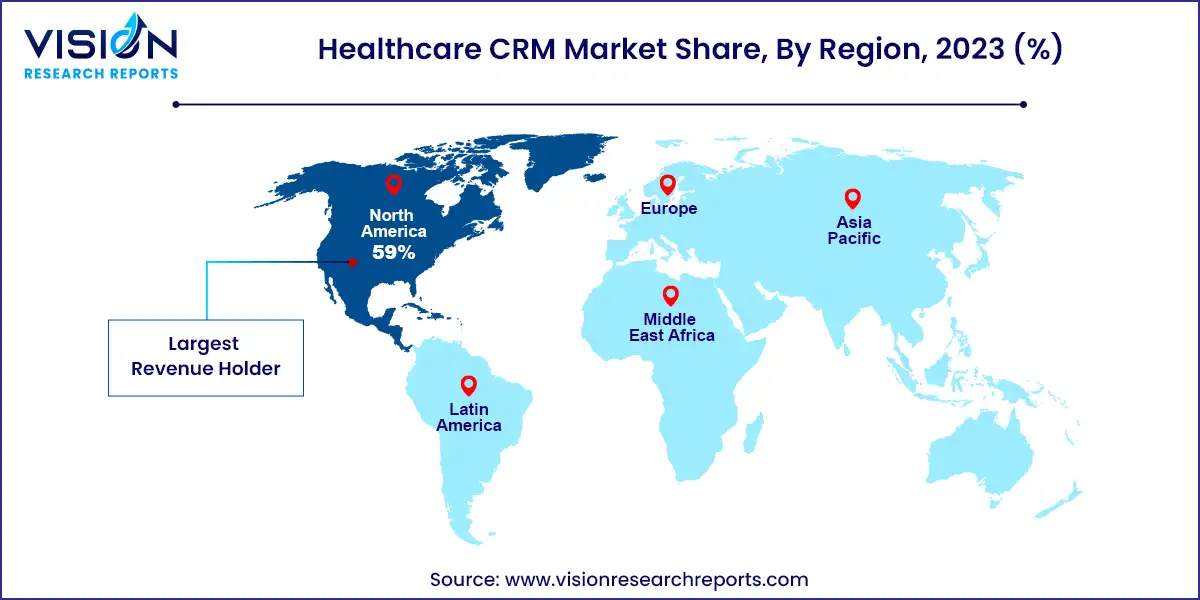

The North American healthcare CRM market led with a 59% share of total revenue in 2023, attributed to advanced healthcare infrastructure and supportive government initiatives in the region.

Europe holds the second-largest revenue share, with significant growth driven by the strong presence of healthcare providers and institutions. The region is also advancing in AI and machine learning, increasing demand for AI-integrated healthcare CRM solutions.

The Asia Pacific healthcare CRM market is anticipated to register the highest CAGR of 10.73% from 2024 to 2033, propelled by government-led healthcare schemes. The region’s focus on improving healthcare infrastructure and medical tourism, coupled with rising healthcare spending and demand for advanced services, supports market expansion. Factors such as the growing aging population, increased incidence of chronic diseases, and a burgeoning private health management and insurance sector are also contributing to market growth.

The healthcare CRM market is primarily divided into two segments: software and services, with software leading the market. The surge in demand for cloud-based healthcare CRM solutions, celebrated for their flexibility, scalability, and ease of implementation, is a key driver of this segment’s growth. These software solutions are increasingly integrated with other healthcare IT systems, such as Electronic Health Records (EHR), practice management systems, and telehealth platforms. Such integration ensures seamless data exchange, enhances care coordination, and elevates the patient experience. Additionally, advancements in analytics and artificial intelligence (AI) are enriching these software solutions, enabling personalized communication, targeted marketing campaigns, and proactive patient engagement, thus further driving the segment’s expansion.

The services segment is projected to experience significant growth from 2024 to 2033, as healthcare organizations seek consulting and implementation support from CRM vendors and third-party providers. These services include software selection, customization, deployment, and training. Comprehensive training and support services are vital for the effective adoption and use of healthcare CRM software. Providers offer extensive training programs, user manuals, online resources, and technical support to help organizations maximize their CRM investments, thereby fueling the segment’s growth.

The market is segmented by functionality into customer service & support, digital commerce, marketing, sales, and cross-CRM. In 2023, the sales segment led with a revenue share of 31% and is expected to grow at the fastest CAGR of 8.03% from 2024 to 2033. Healthcare CRM solutions optimize marketing and sales processes while ensuring compliance with healthcare security regulations.

For instance, Pegasystems' Pega for Healthcare & Life Sciences is a low-code platform that enhances engagement and efficiency. Another example is HealtheCRM, developed in collaboration by Cerner (now Oracle) and Salesforce, designed to improve consumer-provider collaboration, customer service, and clinical outcomes. This integrated solution combines HealtheIntent with Salesforce Health Cloud and Marketing Cloud, offering stakeholders a comprehensive view of consumers and ensuring a consistent experience throughout the consumer journey.

The market is categorized by deployment mode into on-premise and cloud/web-based options. In 2023, the cloud/web-based deployment segment dominated, holding an 82% share. Cloud-based solutions improve customer satisfaction by offering rapid data access and enabling simultaneous access from any device. The growing preference for cloud-based CRM among small and medium-sized businesses is driving market expansion. Cloud solutions are also cost-effective, accessible, and reduce hardware expenses, further contributing to the segment’s growth.

The market is segmented by end-use into healthcare providers, healthcare payers, and life sciences. In 2023, healthcare providers held the largest market share at 41%. They are increasingly adopting CRM systems to enhance patient engagement, streamline workflows, and improve communication and outcomes. Conversely, the healthcare payer segment is expected to experience the fastest CAGR from 2024 to 2033.

CRM systems facilitate claims and billing processes by automating workflows, tracking claims status, and resolving payment issues. This enhances operational efficiency, reduces administrative costs, and optimizes revenue cycle management. Additionally, CRM systems provide analytics and reporting tools that offer insights into member behavior, utilization patterns, and cost drivers, helping payers identify opportunities for cost savings, care improvement, and strategic decision-making.

By Component

By Functionality

By Deployment Mode

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others