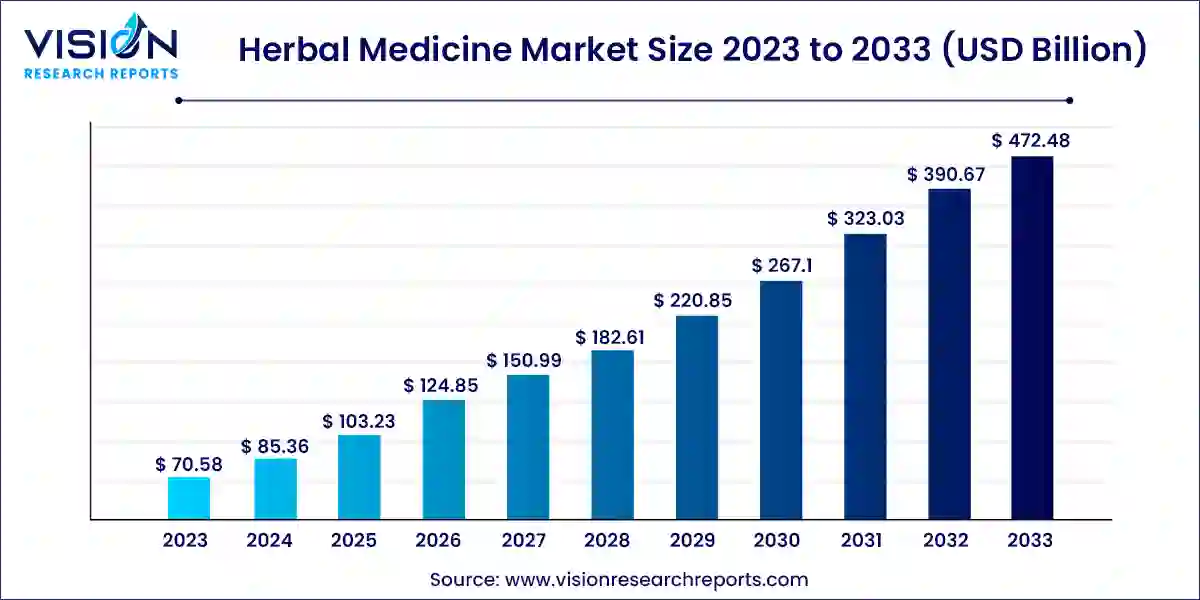

The global herbal medicine market size was estimated at around USD 70.58 billion in 2023 and it is projected to hit around USD 472.48 billion by 2033, growing at a CAGR of 20.94% from 2024 to 2033.

The global herbal medicine market has witnessed remarkable growth in recent years, driven by increasing consumer awareness regarding the benefits of natural and holistic healthcare solutions. This overview delves into the key trends shaping the herbal medicine market, explores the factors driving its growth, and provides insights into future prospects.

The growth of the herbal medicine market is propelled by an increasing health consciousness among consumers is driving the demand for natural and holistic healthcare solutions. Additionally, the aging population and rising prevalence of chronic diseases are fueling the adoption of herbal medicines as complementary or alternative therapies. Furthermore, supportive regulatory frameworks and initiatives promoting the integration of traditional and complementary medicine are creating opportunities for market expansion. The digitalization of healthcare through e-commerce platforms and digital marketing channels is also facilitating greater accessibility and visibility of herbal medicines. These factors collectively contribute to the sustained growth of the herbal medicine market, promising continued opportunities for innovation and market development.

The U.S. herbal medicine market size was estimated at around USD 23.99 billion in 2023 and it is projected to hit around USD 160.64 billion by 2033, growing at a CAGR of 20.94% from 2024 to 2033.

Europe dominated the herbal medicine market with the largest revenue share of 34% in 2023. This growth is influenced by rising geriatric population, increasing prevalence of chronic diseases, and a growing preference for plant-based therapies. The adoption of traditional remedies, integration of herbs into mainstream healthcare, and emphasis on quality assurance and safety standards with a long history of herbal traditions, Europe represents a mature yet evolving market, characterized by moderate growth and a diverse array of products. In Europe, herbal remedies fall into three categories. The most rigorously controlled are prescription drugs, which include injectable forms of phytomedicines and those used to treat life-threatening diseases. The second category is OTC phytomedicines, similar to American OTC drugs.

The herbal medicine market in Asia Pacific is characterized by rapid growth and is expected to grow at the fastest CAGR during the forecast period, driven by factors such as a long history of traditional medicine, increasing consumer awareness of natural remedies, and rising healthcare costs. Traditional herbal practices deeply rooted in countries like India, China, and Japan contribute to the market's growth. The growing acceptance of supplements, expansion of distribution channels, and government initiatives promoting traditional medicine is driving the market growth. With a diverse range of botanical remedies and a large consumer base, the Asia Pacific region is a significant contributor to the global market.

Based on intervention, the ayurveda segment led the market with the largest revenue share of 28% in 2023. This growth is driven by increased awareness and adoption of Ayurveda and growing consumer demand for natural and holistic healthcare solutions. The market is leveraging technology to improve product quality, increase efficiency, and enhance the consumer experience. For instance, the Indian government launched a digital platform called the Ayurveda Health and Wellness Centre to provide telemedicine and e-consultation services to patients.

The apitherapy segment is anticipated to grow at the fastest CAGR over the forecast period, due to the broader acceptance among the medical community owing to the growing scientific evidence supporting the therapeutic benefits of honeybee products. Apitherapy uses products derived from honeybees, such as honey, bee venom, and beeswax, for medical purposes and has been growing in popularity as people seek natural and alternative therapies for various health concerns. The apitherapy market is leveraging technology to improve product quality, safety, and efficacy. For instance, a Canadian company called Apiterra uses artificial intelligence and machine learning to identify the most effective strains of honeybees for producing high-quality honey and other bee products.

Based on product form, the tablet/capsules segment led the market with the largest revenue share of 47% in 2023. The increasing preference for convenient dosage forms among consumers played a pivotal role in driving the demand for tablets and capsules. These forms offer ease of consumption, precise dosing, and portability, catering to the busy lifestyles of modern consumers. In addition, advancements in formulation technologies have enhanced the efficacy, stability, and bioavailability of herbal ingredients in tablet and capsule formulations, bolstering their acceptance among health-conscious individuals.

The powder form segment is expected to grow with the fastest CAGR during the forecast period, due to its versatility and ease of consumption. Powdered forms offer flexibility in dosage, allowing consumers to customize their intake based on individual needs and preferences. Moreover, powdered products often boast higher bioavailability than other dosage forms, leading to faster absorption and potentially enhanced efficacy. This factor has attracted health-conscious consumers seeking efficient and potent natural remedies. In addition, the growing trend towards DIY healthcare and home remedies has spurred the demand for powdered herbs, empowering individuals to create personalized formulations for various health concerns.

Based on source, the roots segment led the market with the largest revenue share of 39% in 2023, owing to their traditional use in herbal remedies and various formulations. In addition, the increasing scientific validation of the pharmacological benefits of multiple root extracts has bolstered their appeal among modern consumers seeking evidence-based natural remedies. Research studies highlighting the anti-inflammatory, antioxidant, immune-modulating, and adaptogenic properties of root-derived compounds have further propelled their utilization in herbal medicine formulations, catering to various health concerns. The growing trend towards sustainable and ethically sourced ingredients has heightened interest in wildcrafted and organically cultivated roots, ensuring quality, purity, and environmental responsibility throughout the supply chain.

The leaves segment is expected to grow at the fastest CAGR during the forecast period. The widespread recognition of leaves' therapeutic properties, including antioxidant, anti-inflammatory, and detoxifying effects, has fueled their increasing utilization in herbal remedies. Leaves offer a rich source of bioactive compounds such as polyphenols, flavonoids, and essential oils, contributing to their appeal among health-conscious consumers seeking natural alternatives. The versatility of leaves allows for diverse applications in herbal formulations, including teas, extracts, tinctures, and topical preparations, catering to a broad spectrum of health needs. Furthermore, growing consumer awareness of the benefits of plant-based diets and holistic wellness practices has spurred demand for leaves-based herbal products, driving market expansion.

Based on distribution channel, the direct sales channels segment held the market with the largest revenue share of 68% in 2023. The increased awareness about the benefits of herbal medicines has led to a surge in demand, effectively catered by companies using direct sales channels. Direct sales channels enable companies to offer personalized recommendations and customized products based on individual consumer needs. This level of customization enhances the overall consumer experience and drives higher sales through direct channels.

The e-sales segment is expected to grow at the fastest CAGR during the forecast period. The integration of technology in the herbal medicine sector has made it easier for consumers to access information about the herb and product, contributing to the market growth of the e-sales segment in the global market. This is strongly supported by many factors, such as increasing investments in the improvement of internet connectivity, rising adoption of mobile devices, and awareness created through social media. E-commerce platforms have played a significant role in expanding their reach globally.

By Intervention

By Product Form

By Source

By Distribution Channel

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others