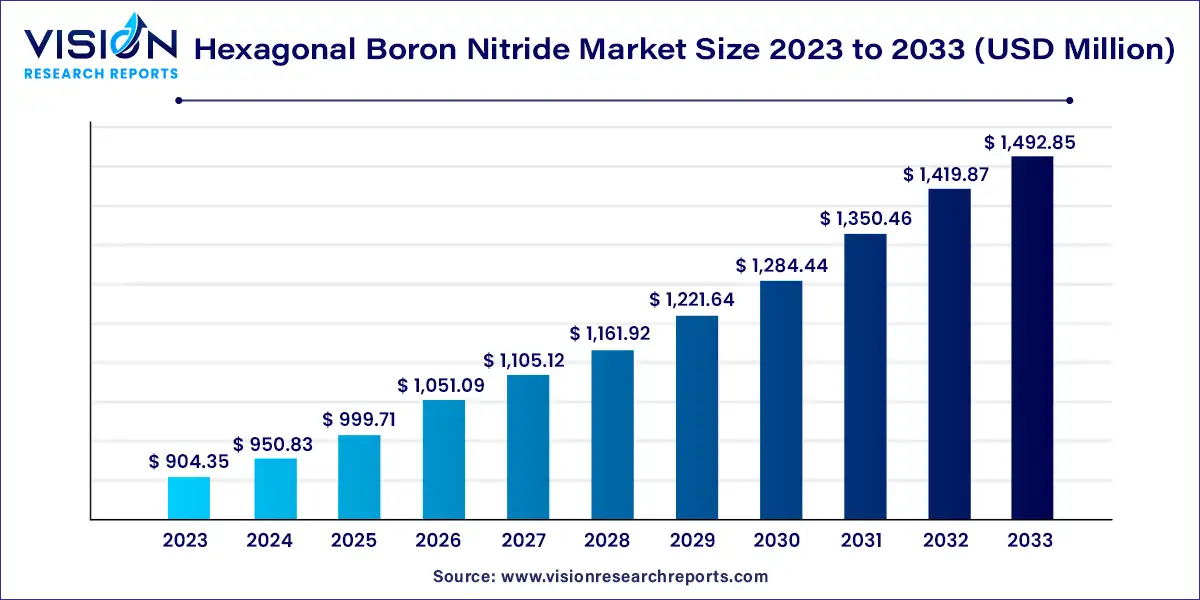

The global hexagonal boron nitride market size was estimated at around USD 904.35 million in 2023 and it is projected to hit around USD 1,492.85 million by 2033, growing at a CAGR of 5.14% from 2024 to 2033.

Hexagonal Boron Nitride (h-BN) is a unique material known for its outstanding thermal stability, high electrical insulation, and excellent lubricating properties. Often referred to as "white graphite" due to its structure and properties similar to graphite, h-BN is finding increasing applications across various industries, including electronics, aerospace, and personal care.

The growth of the hexagonal boron nitride (h-BN) market is primarily fueled by its expanding applications across multiple industries, particularly in electronics, aerospace, and cosmetics. In the electronics sector, h-BN's exceptional thermal conductivity and electrical insulation make it indispensable for managing heat in semiconductor devices and LEDs. The aerospace industry benefits from h-BN's high-temperature stability and lubrication properties, essential for advanced coatings and composites. Additionally, the cosmetic industry is increasingly incorporating h-BN in makeup formulations due to its smooth texture and ability to enhance product performance. These diverse applications, coupled with ongoing advancements in material science, are driving significant growth in the h-BN market.

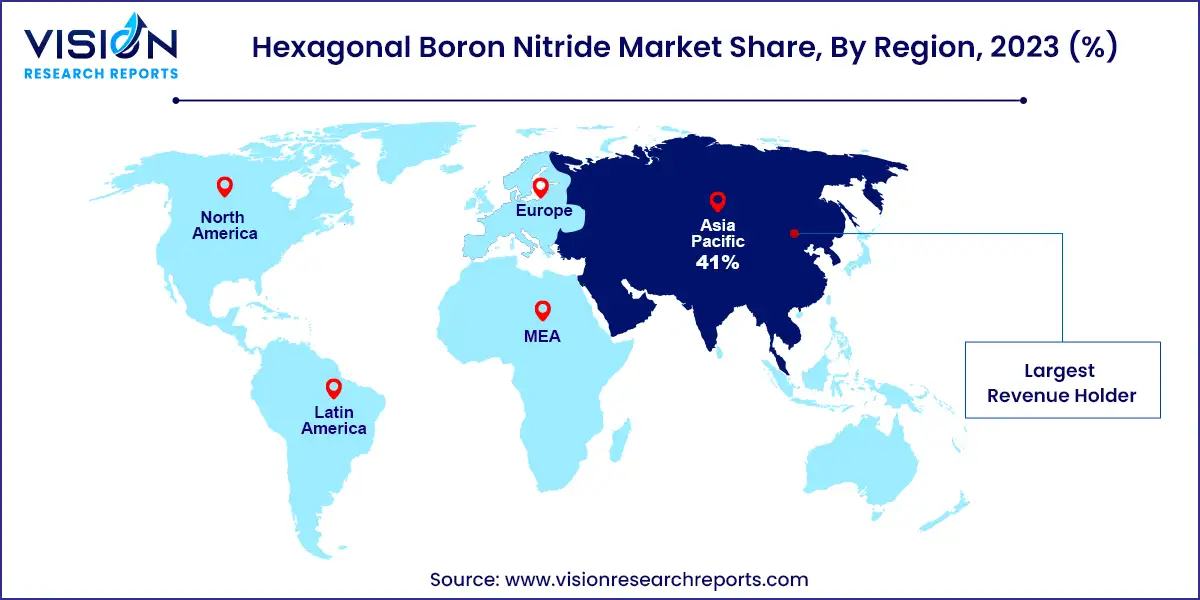

The Asia Pacific region dominated the market in 2023, accounting for a 41% share. This region is a major consumer of hexagonal boron nitride, driven by rapid industrialization and technological advancements in countries like Japan, South Korea, and India. The strong growth in the electronics, automotive, and aerospace industries in these countries is propelling the demand for advanced materials like h-BN. Recent developments include the growing use of h-BN in high-performance electronic devices and thermal management solutions within the semiconductor industry. For example, in Japan, leading semiconductor manufacturers are incorporating h-BN into thermal interface materials to enhance the efficiency of high-power electronic devices. Additionally, South Korea’s advancements in electric vehicles (EVs) are boosting the demand for h-BN-based lubricants and coatings, which improve the performance and lifespan of EV components. Significant investments in research and development across the region further support the increased use of h-BN in various high-tech applications.

| Attribute | Asia Pacific |

| Market Value | USD 370.78 Million |

| Growth Rate | 5.16% CAGR |

| Projected Value | USD 612.06 Million |

In North America, hexagonal boron nitride is increasingly applied across several high-tech industries, including aerospace, electronics, and automotive. The United States and Canada are key consumers of h-BN, utilizing its unique properties for advanced technological applications. For instance, the aerospace sector is adopting h-BN-based materials for protective coatings and thermal management systems, ensuring components withstand extreme temperatures and perform optimally. Additionally, North American manufacturers are integrating h-BN into high-performance lubricants used in precision engineering and automotive applications. The region's emphasis on innovation and high-performance materials drives h-BN demand, with ongoing investments in new technologies and applications further fueling consumption.

In Europe, the consumption of hexagonal boron nitride is characterized by its integration into cutting-edge technologies and advanced manufacturing processes. Countries like Germany, France, and the United Kingdom are at the forefront of adopting h-BN for various applications, particularly in the electronics and automotive sectors. For example, German automotive manufacturers are utilizing h-BN in advanced thermal management systems to enhance the efficiency of electric vehicles and high-performance engines. Moreover, European research institutions are exploring new applications for h-BN in quantum computing and energy storage systems. The region’s strong focus on sustainability and technological innovation is driving the demand for h-BN, particularly in high-performance coatings and lubricants that meet stringent environmental and performance standards

The paints & coatings segment led the market, capturing approximately 33% of the revenue share in 2023. Hexagonal boron nitride (h-BN) has carved out a specialized niche in this sector due to its exceptional thermal conductivity and chemical resistance. In recent years, h-BN has been integrated into protective coatings for various industrial applications, notably in the aerospace and automotive industries, where effective thermal management is critical.

For example, h-BN-based coatings are employed to shield components from extreme temperatures and oxidative environments, thereby enhancing their durability and performance. A notable application is in high-temperature protective coatings for aerospace components, where h-BN's heat dissipation capabilities and resistance to harsh conditions ensure the longevity and reliability of vital parts. Additionally, h-BN is used in anti-corrosive coatings to safeguard against environmental damage, making it an essential component in maintaining the longevity and efficiency of industrial equipment.

In the personal care and cosmetics industry, hexagonal boron nitride is gaining traction due to its unique texture and functional properties. Its smooth, silky feel improves the application and sensory experience of cosmetic products. Recent innovations have incorporated h-BN into high-end skincare products and makeup formulations. For instance, h-BN is now used in foundations and powders to enhance their spreadability and adherence to the skin, delivering a smoother and more polished finish.

Furthermore, h-BN's chemical stability and inertness make it suitable for products designed for sensitive skin, minimizing the risk of irritation. Its ability to provide a soft-focus effect is particularly valued in high-performance cosmetics, contributing to a more refined and flawless appearance.

In the lubricants industry, hexagonal boron nitride is becoming increasingly important due to its ability to significantly enhance lubrication systems' performance. h-BN is utilized as an additive in both industrial and automotive lubricants, improving thermal stability and reducing friction. Recent advancements include the development of h-BN-enhanced lubricants for high-performance engines and machinery, where its high thermal conductivity aids in effective heat dissipation and reduces wear and tear.

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others