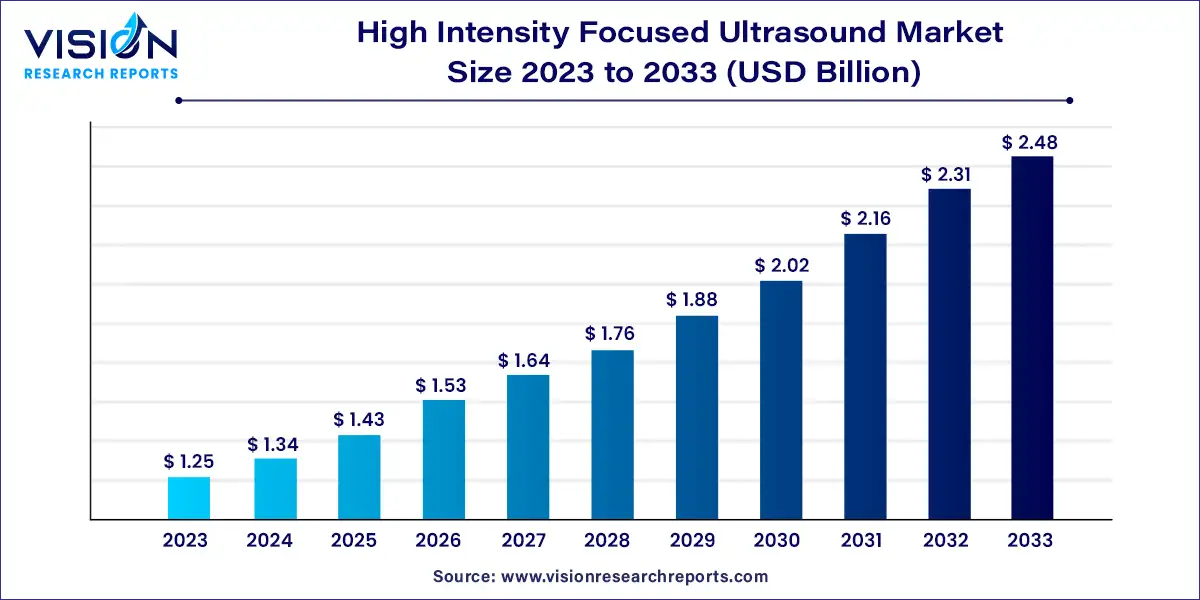

The global high intensity focused ultrasound market size was estimated at around USD 1.25 billion in 2023 and it is projected to hit around USD 2.48 billion by 2033, growing at a CAGR of 7.08% from 2024 to 2033.

High intensity focused ultrasound (HIFU) is an innovative medical technology that utilizes focused ultrasound waves to treat various medical conditions. This non-invasive technique is primarily used for tumor ablation, targeted drug delivery, and cosmetic procedures. The HIFU market has been witnessing significant growth due to its advantages over traditional surgical methods, including reduced recovery times, minimal invasiveness, and precise targeting of affected areas.

The growth of the High intensity focused ultrasound (HIFU) market is primarily driven by the rising prevalence of chronic diseases, particularly cancer, which necessitates advanced and effective treatment options. HIFU's non-invasive nature and precision in targeting diseased tissues without affecting surrounding healthy structures make it a preferred choice among both patients and healthcare providers. Additionally, continuous advancements in imaging technologies, such as MRI and ultrasound, have significantly improved the accuracy and outcomes of HIFU treatments, further boosting its adoption. The increasing demand for minimally invasive procedures, coupled with the expanding geriatric population prone to chronic ailments, also contributes to the market's robust growth. Furthermore, heightened awareness about the benefits of HIFU and supportive government initiatives aimed at modernizing healthcare systems are expected to propel market expansion in the coming years.

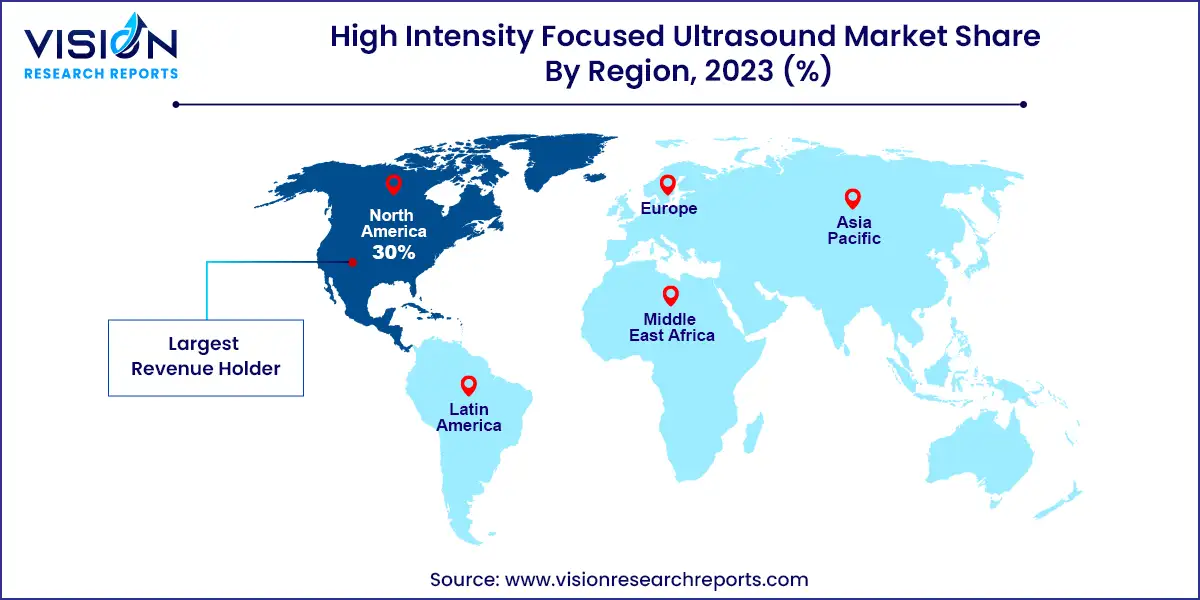

The North America High Intensity Focused Ultrasound (HIFU) market accounted for the largest global revenue share of 30% in 2023. This is due to the presence of key market players and ongoing research and development activities in the region. Additionally, the high prevalence of chronic diseases, including cancer, increases demand for effective and less invasive treatments like HIFU.

| Attribute | North America |

| Market Value | USD 0.37 Billion |

| Growth Rate | 7.17% CAGR |

| Projected Value | USD 0.74 Billion |

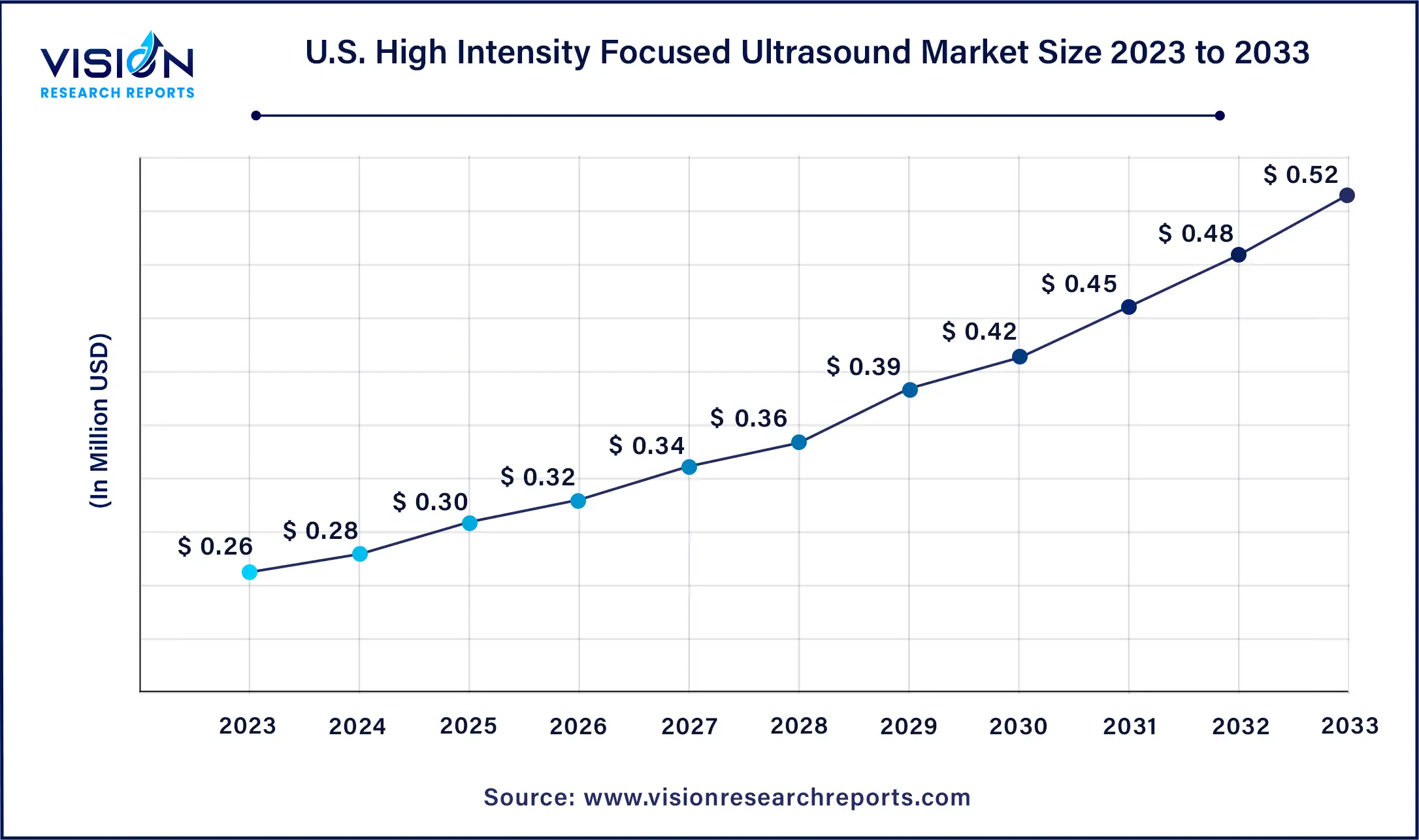

The U.S. high intensity focused ultrasound market was estimated at USD 0.26 billion in 2023 and it is expected to surpass around USD 0.52 billion by 2033, poised to grow at a CAGR of 7.17% from 2024 to 2033.

In the U.S., the HIFU market held the largest share in the North America region in 2023. The rising prevalence of various cancers, such as prostate and breast cancer, is expected to boost the adoption of HIFU as a less-invasive alternative to surgery. According to the International Agency for Research on Cancer, there were approximately 230,125 prostate cancer cases in the U.S. in 2022, with 33,746 reported deaths.

The Asia Pacific High Intensity Focused Ultrasound (HIFU) market is projected to experience the fastest CAGR of 7.76% during the forecast period. Advancements in healthcare infrastructure and increasing healthcare expenditures in countries like China, Japan, and South Korea are driving the adoption of innovative medical technologies, including HIFU. Additionally, the region's growing aging population, alongside evolving healthcare policies and favorable regulatory frameworks, is supporting the expansion of HIFU applications in both therapeutic and cosmetic fields.

The dermatology segment led the market with a 21% share in 2023, largely due to the increasing use of HIFU technology in aesthetic and therapeutic applications. HIFU is popular in dermatology for non-invasive skin tightening, wrinkle reduction, and facial rejuvenation treatments. This minimally invasive cosmetic solution is favored for its ability to stimulate collagen production and tighten skin without surgery. The American Board of Cosmetic Surgery notes that HIFU treatments for skin tightening yield favorable results within 2–3 months, with proper skin care practices extending these results up to a year.

The uterine fibroid segment is projected to grow at the fastest CAGR of 7.75% over the forecast period. Uterine fibroids, common among women, cause symptoms like heavy menstrual bleeding, pelvic pain, and reproductive issues. HIFU offers a less-invasive alternative to traditional surgeries like hysterectomy or myomectomy, appealing to patients seeking shorter recovery times and fewer complications. Advances in HIFU devices have improved their precision and effectiveness, enhancing safety and efficacy in targeting fibroids while minimizing damage to surrounding tissues. Increased awareness and adoption of non-surgical treatment options, such as HIFU for uterine fibroids, are driving market growth. For example, in June 2024, Nordica Fibroid Care Centre plans to introduce the first HIFU machine for treating uterine fibroids in the nation, following their initial introduction of the HIFU treatment method in Lagos in 2021.

The hospital segment dominated the market with over 40% share in 2023 and is expected to grow at the fastest CAGR over the forecast period. This is due to hospitals adopting technologically advanced medical devices. For instance, in February 2022, Children’s National Hospital in Washington, D.C., performed the first HIFU surgery on a pediatric patient with neurofibromatosis (NF). Hospitals often have specialized departments and trained medical personnel for effective HIFU treatment administration. Additionally, hospitals treat a wide range of medical conditions, including cancer, where HIFU is beneficial.

The imaging centers segment also held a significant market share in 2023. Equipped with advanced diagnostic technologies essential for guiding and monitoring HIFU procedures, imaging centers are crucial for providing comprehensive diagnostic services. They are increasingly integrating HIFU for minimally invasive treatments and often collaborate with hospitals and healthcare providers to enhance their capacity to deliver specialized care.

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on High Intensity Focused Ultrasound Market

5.1. COVID-19 Landscape: High Intensity Focused Ultrasound Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global High Intensity Focused Ultrasound Market, By Application

8.1. High Intensity Focused Ultrasound Market, by Application, 2024-2033

8.1.1. Uterine Fibroids

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Prostate Cancer

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Essential Tremor

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Dermatology

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Breast Cancer

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Glaucoma

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Backpain, Facetogenic

8.1.7.1. Market Revenue and Forecast (2021-2033)

8.1.8. Other Applications

8.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global High Intensity Focused Ultrasound Market, By End-use

9.1. High Intensity Focused Ultrasound Market, by End-use, 2024-2033

9.1.1. Hospitals

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Imaging Centers

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Other End Users

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global High Intensity Focused Ultrasound Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Application (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.1.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.1.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Application (2021-2033)

10.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.5.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.5.4.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. Focal One

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Sonablate Corp.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Verasonics, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. ALPINION MEDICAL SYSTEMS Co., Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Theraclion

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Chongqing Haifu Medical Technology Co., Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Lynton Lasers Ltd

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. ULTRAISER

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Profound Medical Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others