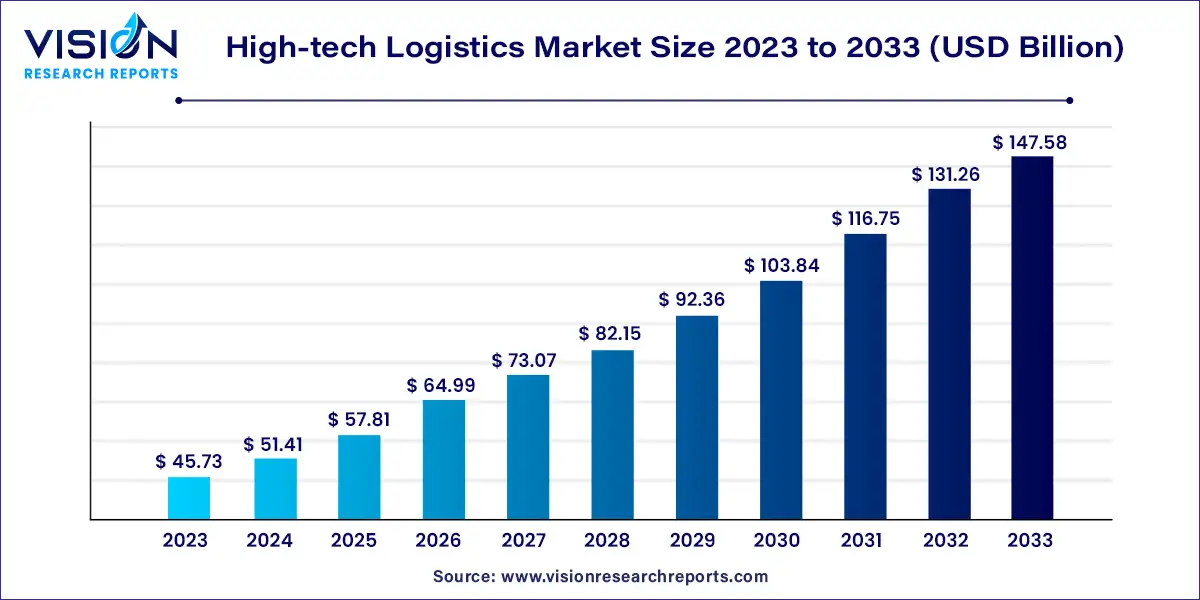

The global high-tech logistics market size was estimated at around USD 45.73 billion in 2023 and it is projected to hit around USD 147.58 billion by 2033, growing at a CAGR of 12.43% from 2024 to 2033. The high-tech logistics market refers to the transportation, warehousing, and distribution services designed to handle high-value, technologically advanced products. These include electronics, semiconductors, telecommunications equipment, medical devices, and other precision instruments. Due to the sensitive nature of these products, the industry emphasizes precision, security, and efficiency, relying on cutting-edge technologies such as automation, IoT, and artificial intelligence to enhance supply chain management.

The growth of the high-tech logistics market is primarily driven by an increasing demand for efficient and secure transportation of high-value goods, such as electronics and medical devices. The rapid expansion of e-commerce, coupled with the globalization of supply chains, has created a need for more advanced logistics solutions that ensure real-time tracking and faster delivery. Additionally, the adoption of automation, artificial intelligence, and IoT in logistics operations has significantly improved efficiency and reduced human error, further accelerating market growth. Increasing investments in infrastructure development, along with the rising trend of outsourcing logistics services to third-party providers, are also contributing to the market’s expansion.

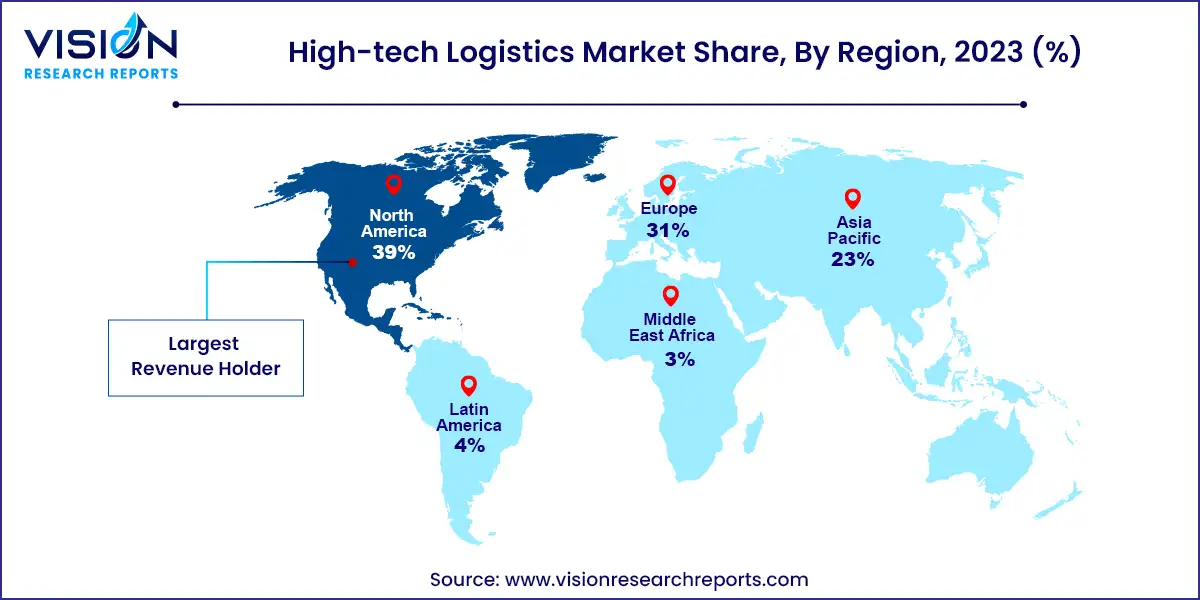

North America led the global high-tech logistics market with a 39% revenue share in 2023. The region’s strong technology sector drives demand for specialized logistics services for sensitive electronics and high-value components. The robust growth of e-commerce and consumer expectations for rapid delivery of tech products have increased the need for advanced supply chain solutions. Furthermore, the presence of major tech companies with complex global supply networks contributes to the region's leadership in the high-tech logistics market.

| Attribute | North America |

| Market Value | USD 17.83 Billion |

| Growth Rate | 12.45% CAGR |

| Projected Value | USD 57.55 Billion |

The Asia Pacific high-tech logistics market is projected to grow rapidly, with a CAGR of 13.03% from 2024 to 2033. The region’s growth is driven by its expanding technology manufacturing sector, especially in countries like China, Taiwan, and South Korea. The rising adoption of consumer electronics across emerging economies is boosting the demand for efficient distribution networks. Additionally, investments in digital infrastructure and e-commerce platforms, along with government initiatives promoting technology industries, are contributing to the region’s market expansion.

Europe’s high-tech logistics market growth is primarily driven by its emphasis on Industry 4.0 and digital transformation. The expansion of e-commerce platforms for consumer electronics is increasing the need for efficient supply chain management. Furthermore, European countries’ focus on sustainability is pushing for greener logistics practices, particularly in the high-tech sector. The rise of smart cities and IoT applications is also opening new opportunities for specialized logistics services. Strict regulations on data protection and product safety in Europe are driving the need for more secure and traceable supply chain solutions for high-value tech goods.

In 2023, the transportation segment accounted for the largest revenue share of 39% in the high-tech logistics market. This dominance is expected to continue from 2024 to 2033, driven by the need for efficient and secure transportation of high-value, sensitive technology products like semiconductors and medical devices. Advances in transportation technologies, including real-time tracking, temperature control, and specialized handling, are expected to further enhance the segment's growth, ensuring safe and timely deliveries.

The inventory management segment is projected to record the fastest compound annual growth rate (CAGR) of 13.54% between 2024 and 2033. This growth is due to the increasing complexity of high-tech product supply chains, which require advanced inventory solutions for real-time visibility, accurate stock levels, and efficient order fulfillment. The rise of automation, AI-driven analytics, and smart warehousing technologies is significantly enhancing inventory management, supporting its expansion in the high-tech logistics sector.

The semiconductor industry held the largest revenue share of 33% in the global high-tech logistics market in 2023. The complexity and global nature of the semiconductor supply chain, which spans multiple countries, drive the demand for specialized logistics solutions. This industry’s high-value products require secure, temperature-controlled, and time-sensitive transportation. The global chip shortage has also increased the emphasis on efficient logistics to meet the rising demand across various technology sectors.

The consumer electronics segment is expected to register the fastest CAGR of 12.94% from 2024 to 2033. This growth is primarily driven by the increasing global demand for smartphones, smart home devices, and wearables, which is creating a need for efficient distribution networks. The frequent launches of new products and shorter product lifecycles require agile supply chains for rapid market deployment. Additionally, the growth of e-commerce and direct-to-consumer sales models is boosting demand for streamlined last-mile delivery solutions.

By Service

By Industry

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on High-tech Logistics Market

5.1. COVID-19 Landscape: High-tech Logistics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global High-tech Logistics Market, By Service

8.1. High-tech Logistics Market, by Service, 2024-2033

8.1.1. Transportation

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Warehousing and Storage

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Inventory Management

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Distribution and Fulfillment

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global High-tech Logistics Market, By Industry

9.1. High-tech Logistics Market, by Industry, 2024-2033

9.1.1. Semiconductor Industry

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Consumer Electronics

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Medical Devices

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Telecommunications Equipment

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Aerospace and Defense Technologies

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global High-tech Logistics Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Service (2021-2033)

10.1.2. Market Revenue and Forecast, by Industry (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Service (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Industry (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Service (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Industry (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Service (2021-2033)

10.2.2. Market Revenue and Forecast, by Industry (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Service (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Industry (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Service (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Industry (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Service (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Industry (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Service (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Industry (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Service (2021-2033)

10.3.2. Market Revenue and Forecast, by Industry (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Service (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Industry (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Service (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Industry (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Service (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Industry (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Service (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Industry (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Service (2021-2033)

10.4.2. Market Revenue and Forecast, by Industry (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Service (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Industry (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Service (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Industry (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Service (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Industry (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Service (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Industry (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Service (2021-2033)

10.5.2. Market Revenue and Forecast, by Industry (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Service (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Industry (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Service (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Industry (2021-2033)

Chapter 11. Company Profiles

11.1. C.H. Robinson Worldwide, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. FedEx

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Agility

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. DHL Group

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. DB Schenker

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. A.P. Moller - Maersk

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Ceva Logistics

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Kerry Logistics Network Limited

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Rhenus Group

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Aramex

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others