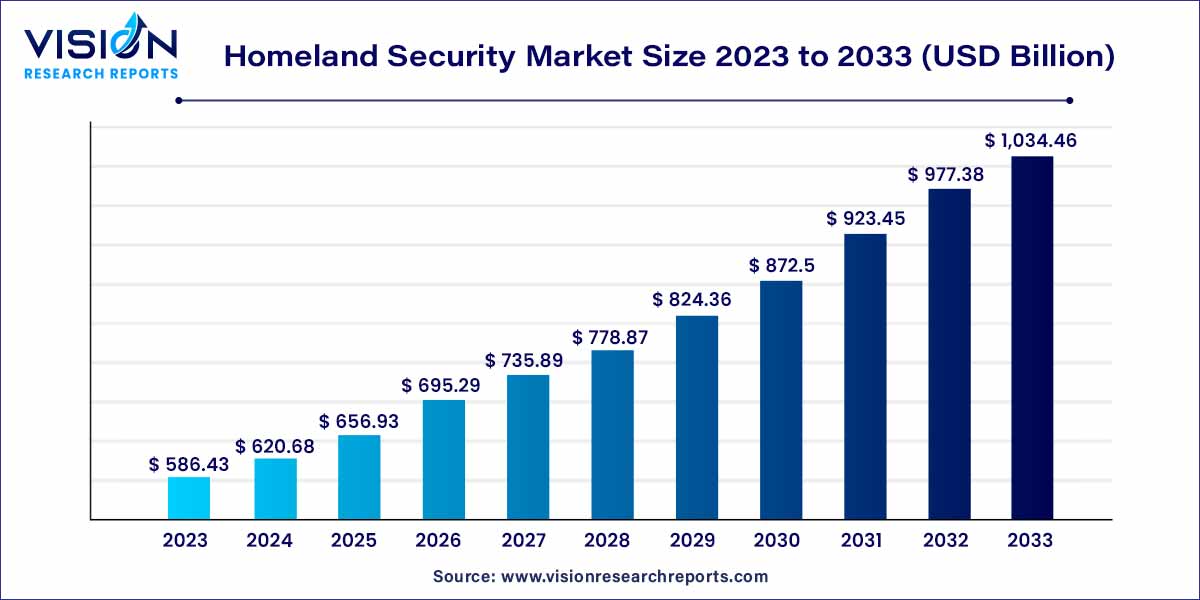

The global homeland security market size was estimated at around USD 586.43 billion in 2023 and it is projected to hit around USD 1,034.46 billion by 2033, growing at a CAGR of 5.84% from 2024 to 2033.

The global homeland security market is a dynamic and evolving sector that plays a crucial role in safeguarding nations and their citizens from a diverse range of threats. This overview delves into the key aspects of the homeland security market, examining its current landscape, major players, emerging trends, and the driving factors behind its growth.

The growth of the homeland security market is propelled by various factors contributing to its dynamic expansion. One key driver is the persistent and evolving threat landscape, encompassing terrorism, cyber attacks, and natural disasters. As these threats become increasingly sophisticated, there is a growing demand for advanced security solutions and technologies. Government initiatives and stringent regulations aimed at fortifying national security further stimulate market growth. Additionally, the globalization of security risks and the need to protect critical infrastructure amplify the market's significance. The integration of cutting-edge technologies such as artificial intelligence and biometrics, coupled with collaborative efforts between public and private sectors, plays a pivotal role in shaping the market's trajectory. Despite facing challenges related to privacy concerns and regulatory complexities, the homeland security market remains resilient, driven by a proactive approach to risk management and a continuous commitment to innovation.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 1,034.46 billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.84% |

| Revenue Share of North America in 2023 | 31% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The critical infrastructure security segment accounted for the largest revenue share of 26% in 2023. In the U.S., the Department of Homeland Security (DHS) has identified 16 sectors involving critical infrastructure, including energy, communications, transportation, financial services, food and agriculture. The significant cyber protection risks occur from the widespread and increasing dependence on information and communication technology infrastructure and e-services, which has led the key focus on ensuring safety by combating cybercrime more efficiently and advancing national defense capabilities.

The maritime security segment is expected to grow at the fastest CAGR of 7.05% during the forecast period. The growth of the maritime security segment is attributed to the increasing use of maritime transport which has led to an increase in illegal immigration, smuggling of prohibited substances, and terrorist attacks on ports and coastal regions

North America dominated the market with the largest revenue share of 31% in 2023. The growth is attributed to rise in adoption of homeland security products and services which led to modernization of military through improvement programs.

With advancements in technology, cyber threats, terrorism, and border security concerns, governments and organizations in North America have recognized the need to invest in advanced security solutions. This has led to increased spending on surveillance systems, communication networks, biometric identification, and cybersecurity measures. The goal is to enhance the protection of critical infrastructure, public safety, and national security.

Rest of the world segment is expected to grow at the fastest CAGR of 7.68% during the forecast period. The region has witnessed significant improvement in economy leading to increased investment in infrastructure, which fuels security risks. In addition, increase in illegal and terrorist activities and growing threat of cybercrime boosted the market growth.

By Types

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Homeland Security Market

5.1. COVID-19 Landscape: Homeland Security Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Homeland Security Market, By Types

8.1. Homeland Security Market, by Types Type, 2024-2033

8.1.1. Aviation Security

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Maritime Security

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Border Security

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Critical Infrastructure Security

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Cyber Security

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. CBRN Security

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Mass Transit Security

8.1.7.1. Market Revenue and Forecast (2021-2033)

8.1.8. Others

8.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Homeland Security Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Types (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Types (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Types (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Types (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Types (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Types (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Types (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Types (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Types (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Types (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Types (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Types (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Types (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Types (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Types (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Types (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Types (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Types (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Types (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Types (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Types (2021-2033)

Chapter 10. Company Profiles

10.1. Elbit Systems Ltd.

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Teledyne FLIR LLC

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. General Dynamics Corporation

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. L3Harris Technologies, Inc.

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. L-3 Communications Holding, Inc.

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Magal Security Systems Ltd.

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Raytheon Technologies Corporation

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Safran

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. ThalesUnisy

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others