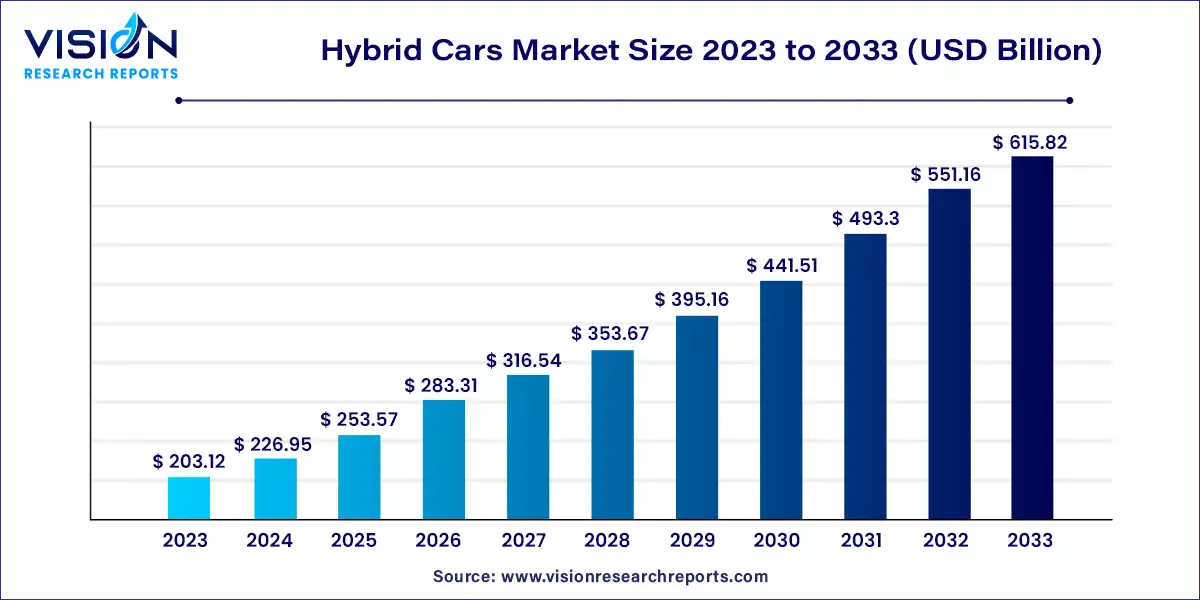

The global hybrid cars market size was estimated at around USD 203.12 billion in 2023 and it is projected to hit around USD 615.82 billion by 2033, growing at a CAGR of 11.73% from 2024 to 2033.

Hybrid cars combine the benefits of traditional internal combustion engines with electric propulsion systems, offering improved fuel efficiency and reduced emissions compared to conventional vehicles. This innovative technology has garnered widespread attention from both consumers and manufacturers seeking to mitigate environmental impact while enhancing driving performance.

The growth of the hybrid cars market is propelled by an increasing environmental awareness among consumers has led to a heightened demand for eco-friendly transportation options. As concerns over air pollution and climate change continue to rise, hybrid vehicles offer a compelling solution by reducing emissions and promoting sustainable driving practices. Additionally, government incentives and regulations play a significant role in driving market growth. Many governments worldwide provide incentives such as tax credits and subsidies to encourage the purchase of hybrid cars, while stringent fuel efficiency standards and emission regulations compel automakers to invest in hybrid technology. Moreover, ongoing technological innovations in hybrid technology have resulted in more efficient and affordable hybrid vehicles, further stimulating market expansion.

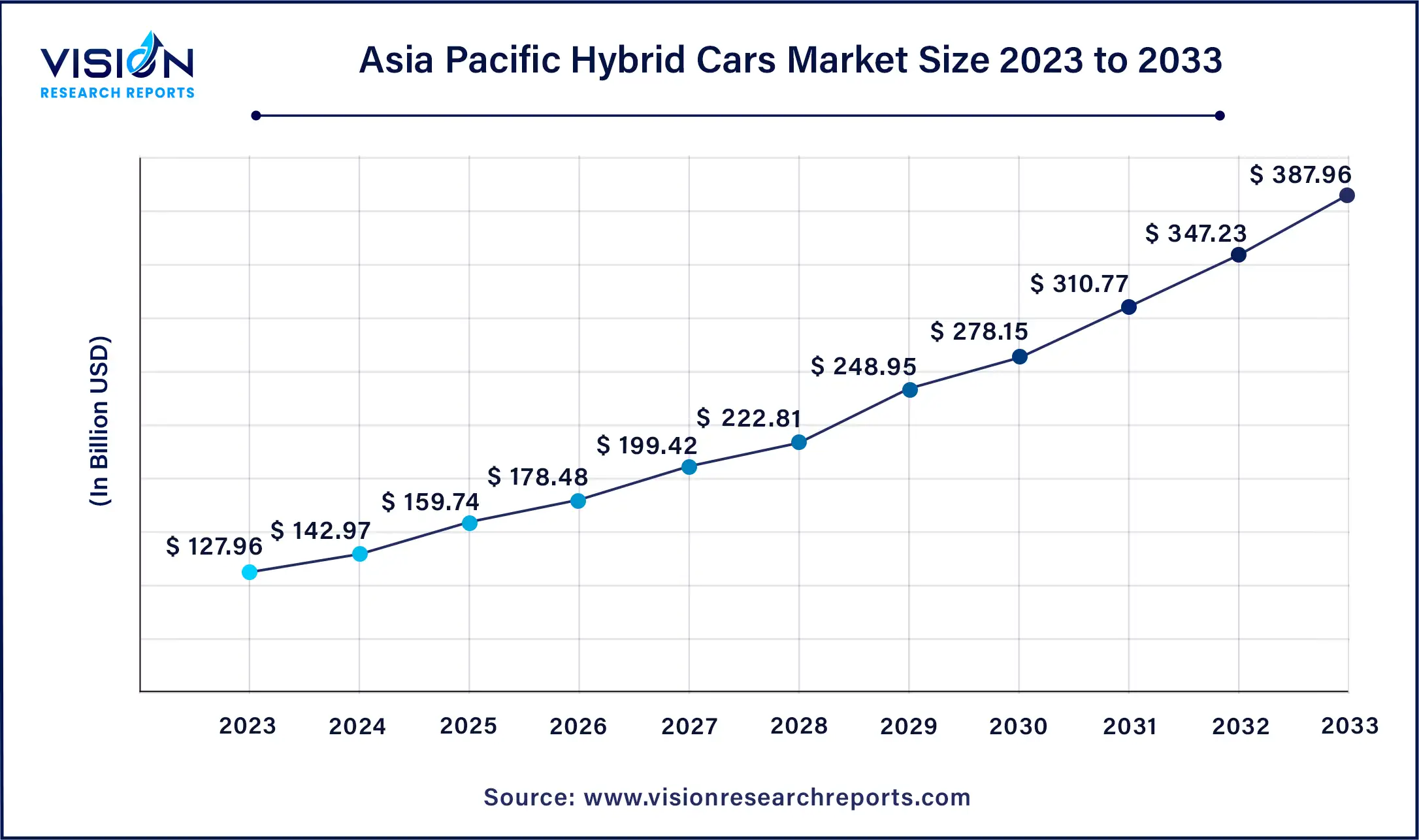

The Asia Pacific hybrid cars market size was valued at USD 127.96 billion in 2023 and is anticipated to reach around USD 387.96 billion by 2033, growing at a CAGR of 11.73% from 2024 to 2033.

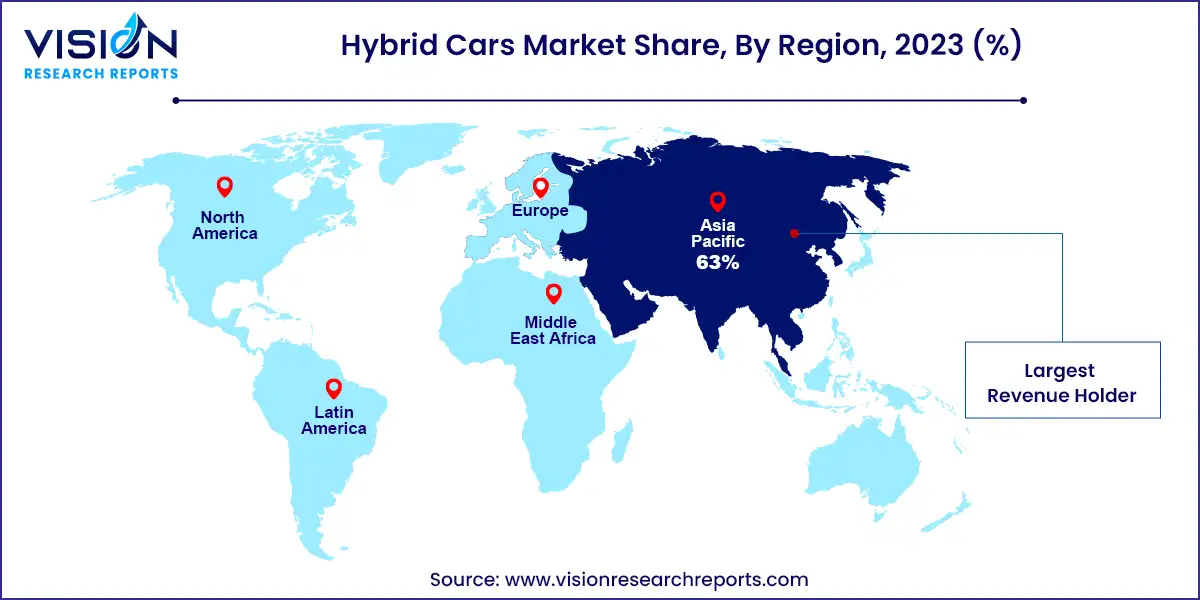

The hybrid cars market in Asia Pacific dominated the global industry, with the largest revenue share of 63% in 2023. Rising concerns about air quality and environmental sustainability have prompted governments in countries such as India and China to implement supportive policies and incentives for hybrid vehicles, driving their adoption. According to IQAIR, in 2023, 96% of India's 1.3 billion people live in areas where air quality exceeds WHO guidelines by seven times. Central and South Asia were identified as the worst-performing regions globally, with Bangladesh, Pakistan, India, and Tajikistan being the four most polluted countries.

The North America hybrid cars market is anticipated to grow at a lucrative CAGR over the forecast period. With growing concerns about climate change and air pollution, consumers in North America are increasingly seeking greener transportation alternatives. Hybrid cars, which combine traditional gasoline engines with electric motors, offer lower emissions and improved fuel efficiency compared to conventional gasoline-powered vehicles. This environmental consciousness drives consumer interest and incentivizes the adoption of hybrid cars as an eco-friendlier transportation option

Based on the degree of hybridization, the market is further bifurcated into mild-hybrid, full-hybrid, and plug-in-hybrid. The full-hybrid segment held the largest revenue share of 48% in 2023. The full-hybrid vehicles are equipped with a gasoline engine and an electric motor, allowing them to operate using either power sources independently or in combination. These vehicles utilize advanced hybrid drivetrain technology to optimize fuel efficiency, reduce emissions, and enhance performance. Full hybrids differ from mild hybrids in that they can run solely on electric power for short distances, making them more environmentally friendly and suitable for urban driving conditions. The full hybrid cars have gained traction in the automotive market due to increasing environmental concerns, government regulations promoting cleaner transportation, and consumer demand for fuel-efficient vehicles.

The plug-in-hybrid segment is anticipated to witness the fastest CAGR over the forecast period. Plug-in-hybrid cars offer the flexibility of running on electric power for shorter commutes while having an internal combustion engine for longer distances, alleviating concerns about range limitations. The expanding charging infrastructure and advancements in battery technology are making plug-in hybrids more appealing, addressing one of the critical concerns of potential buyers. As environmental awareness continues to rise, consumers are increasingly seeking vehicles that offer fuel efficiency and reduced emissions, further driving the growth of plug-in hybrid cars in the automotive market.

Based on vehicle type, the market is segmented into sedan, hatchback, and SUV. The SUV segment held the largest revenue share in 2023. Hybrid and battery technology advancements have contributed to the increasing popularity of hybrid SUVs. Hybrid SUVs offer improved fuel efficiency, enhanced performance, and extended electric-only driving ranges compared to earlier generations of hybrid vehicles. These technological advancements have helped overcome some limitations and concerns associated with hybrid vehicles, such as range issues and higher upfront costs. The hybrid SUV market is expected to grow, driving further innovation and adoption in the automotive industry. For instance, in December 2023, Renault announced plans for a new venture in Brazil, earmarking an investment of 350 billion euros (equivalent to USD 379.12 billion) to manufacture a hybrid engine C-SUV tailored for distribution across Latin America. The new vehicle will be produced at Renault's Curitiba Veiculos de Passeio facility in Sao Jose dos Pinhais, Parana. This region is Renault's second-largest market after France.

The hatchback segment is anticipated to register the fastest CAGR over the forecast period. Changing mobility trends and urbanization have influenced consumer preferences toward smaller, more agile vehicles like hatchbacks. With their small footprint and agile handling, hatchback models are utilized for navigating crowded city streets and tight parking spaces. Similarly, the shift towards shared mobility services and ride-hailing platforms has increased demand for fuel-efficient vehicles like hybrid hatchbacks among fleet operators and transportation providers seeking to reduce operating costs and environmental impact.

By Degree of Hybridization

By Vehicle Type

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others