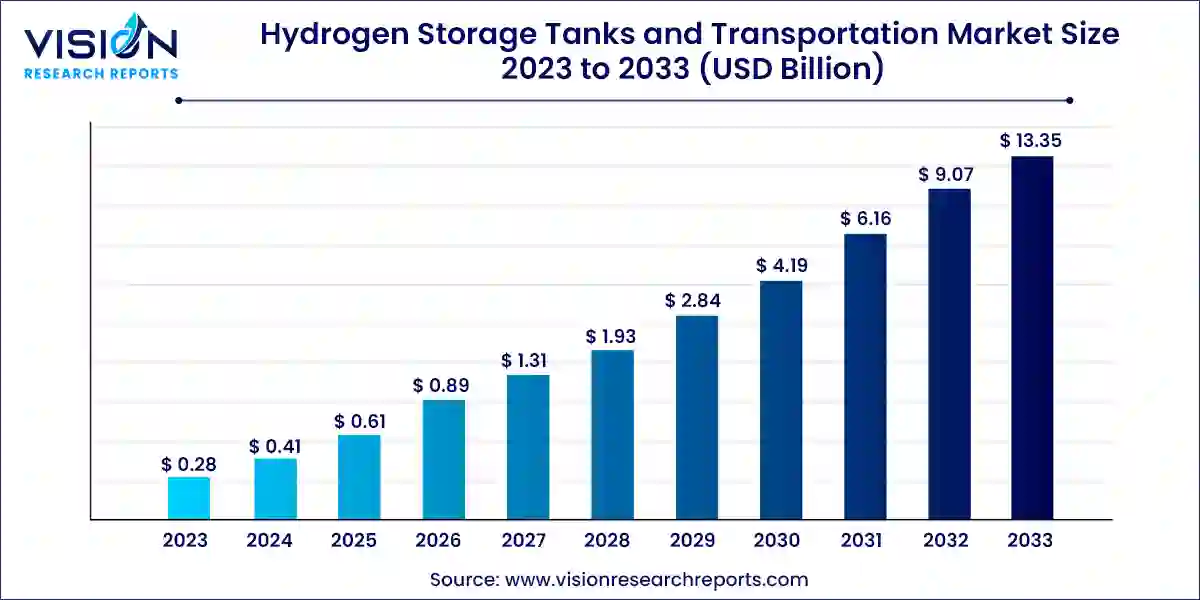

The global hydrogen storage tanks and transportation market size was estimated at around USD 0.28 billion in 2023 and it is projected to hit around USD 13.35 billion by 2033, growing at a CAGR of 47.17% from 2024 to 2033.

The hydrogen storage tanks and transportation market is experiencing significant growth, fueled by the rising demand for clean energy solutions and the increasing adoption of hydrogen as a key alternative fuel source. With advancements in technology and infrastructure, coupled with supportive government policies and investments, the market is witnessing a surge in innovation and development of efficient storage and transportation solutions. As industries and economies worldwide transition towards decarbonization, hydrogen emerges as a promising solution for achieving sustainability goals, driving the expansion of the storage tanks and transportation market.

The growth of the hydrogen storage tanks and transportation market is propelled by an increasing efforts to transition towards clean and sustainable energy sources drive the demand for hydrogen as an alternative fuel. Additionally, supportive government policies and initiatives, along with investments in hydrogen infrastructure, further stimulate market growth. Technological advancements in storage tank design and transportation systems enhance efficiency and safety, fostering market expansion. Moreover, growing collaborations between industry players and research institutions facilitate innovation and the development of advanced hydrogen storage and transportation solutions.

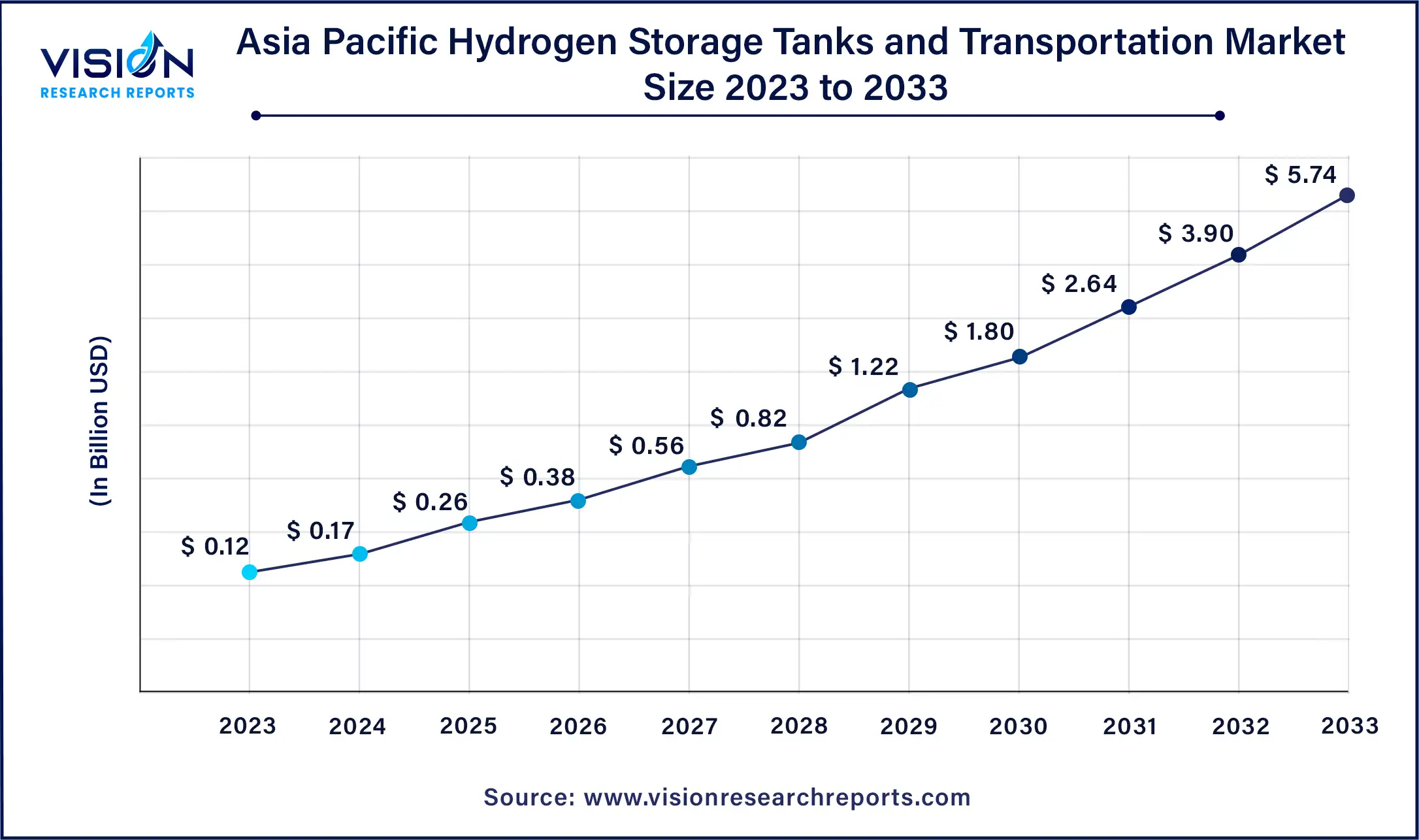

The Asia-Pacific hydrogen storage tanks and transportation market was estimated at USD 0.12 billion in 2023 and it is expected to surpass around USD 5.74 billion by 2033, at a CAGR of 47.22% from 2024 to 2033.

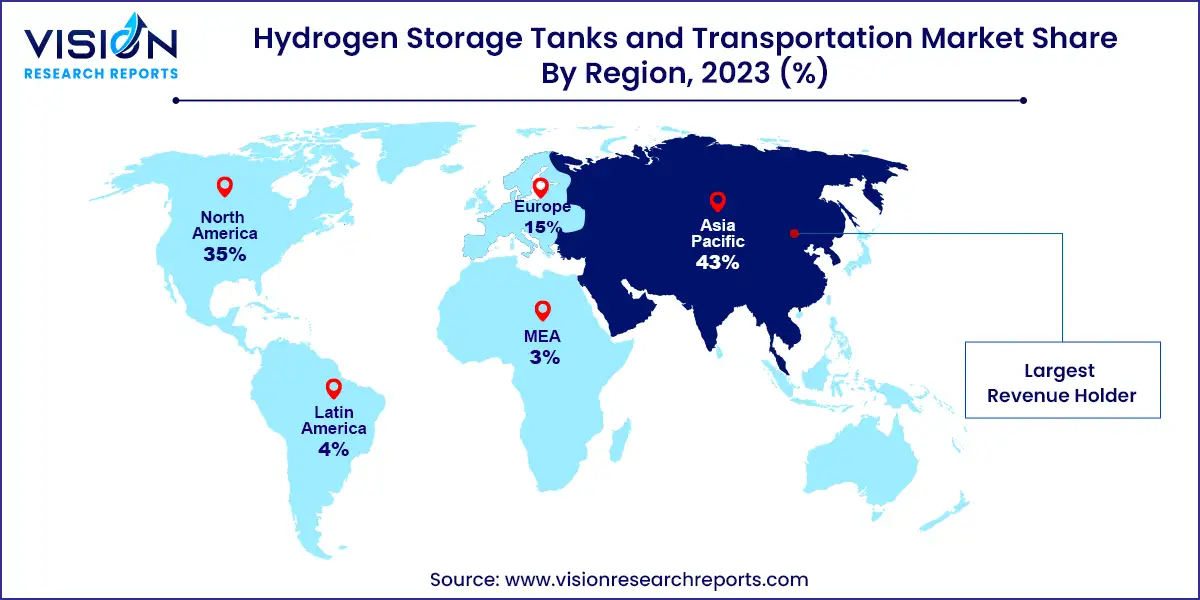

In 2023, Asia-Pacific dominated the market with a substantial 43% share, attributed to robust industrialization, government backing for hydrogen initiatives, and a heightened focus on clean energy. Leading countries like Japan and South Korea spearhead the adoption of hydrogen technologies across various applications. The region's dedication to curbing carbon emissions and advocating sustainable energy solutions has spurred significant investments in hydrogen infrastructure. Furthermore, the burgeoning automotive and industrial sectors in Asia-Pacific contribute significantly to its market share, cementing its pivotal role in the global shift towards hydrogen as a clean energy alternative.

Meanwhile, North America is poised for rapid expansion in the hydrogen storage tanks and transportation market, driven by escalating efforts towards a clean energy transition. Governments and industries alike are channeling investments into hydrogen infrastructure to combat carbon emissions. Supportive policies, coupled with technological advancements and increasing recognition of hydrogen's potential, are propelling the demand for storage and transportation solutions in the region. North America's steadfast commitment to sustainability positions it as a key player in nurturing the growth of the hydrogen economy, thus presenting promising opportunities for further market development.

The carbon fibers segment accounted for the largest market share, with 53% based on material. Within the hydrogen storage tanks and transportation market, the carbon fibers segment utilizes carbon fiber-reinforced materials for constructing storage tanks that are lightweight yet highly durable. Carbon fibers possess an exceptional strength-to-weight ratio, making them an ideal choice for reinforcing the structural integrity of hydrogen storage systems. The growing preference for carbon fibers in hydrogen storage tanks is driven by the demand for lighter solutions, which not only enhances energy efficiency but also raises safety standards in the transportation and storage of hydrogen, thus supporting market growth overall.

The metals segment is projected to experience rapid growth at a significant compound annual growth rate (CAGR) of 34.73% during the forecast period. In the hydrogen storage tanks and transportation market, the metals segment primarily involves the use of metal materials in constructing storage tanks and transportation infrastructure for hydrogen. Metals such as steel and aluminum are commonly chosen for their durability and strength, ensuring the safety and reliability of hydrogen containment. Recent trends in the metals segment include advancements in alloy compositions aimed at improving corrosion resistance and reducing weight, thereby contributing to more efficient and sustainable hydrogen storage and transportation solutions. These trends aim to address safety concerns and optimize the performance of metal-based hydrogen storage technologies.

The 200 - 500 bar segment held a 47% market share in 2023. Within the hydrogen storage tanks and transportation market, the 200-500 bar segment pertains to storage and transportation systems designed to handle hydrogen at pressures ranging from 200 to 500 bar. This segment plays a crucial role in applications requiring high-pressure storage, such as fueling stations and industrial processes. The trend within this segment involves advancements in materials and technologies aimed at enhancing safety, efficiency, and capacity, thereby meeting the growing demand for high-pressure hydrogen storage solutions across various sectors as hydrogen emerges as a prominent clean energy source.

The above 500 bar segment is expected to witness rapid growth over the forecast period. Within the hydrogen storage tanks and transportation market, this segment refers to storage systems capable of withstanding pressures exceeding 500 bar. These high-pressure tanks are essential for efficiently storing hydrogen gas. Recent trends in this segment emphasize the development of advanced materials and engineering techniques to improve the safety and efficiency of above 500 bar storage solutions. This segment caters to applications requiring high-pressure hydrogen, such as specific industrial processes and certain types of hydrogen-powered vehicles.

By Material

By Pressure

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Hydrogen Storage Tanks and Transportation Market

5.1. COVID-19 Landscape: Hydrogen Storage Tanks and Transportation Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Hydrogen Storage Tanks and Transportation Market, By Material

8.1. Hydrogen Storage Tanks and Transportation Market, by Material, 2024-2033

8.1.1. Metals

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Glass Fibers

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Carbon Fibers

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Hydrogen Storage Tanks and Transportation Market, By Pressure

9.1. Hydrogen Storage Tanks and Transportation Market, by Pressure, 2024-2033

9.1.1. Below 200 bar

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. 200 - 500 bar

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Above 500 bar

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Hydrogen Storage Tanks and Transportation Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Material (2021-2033)

10.1.2. Market Revenue and Forecast, by Pressure (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Material (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Pressure (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Material (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Pressure (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Material (2021-2033)

10.2.2. Market Revenue and Forecast, by Pressure (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Material (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Pressure (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Material (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Pressure (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Material (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Pressure (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Material (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Pressure (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Material (2021-2033)

10.3.2. Market Revenue and Forecast, by Pressure (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Material (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Pressure (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Material (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Pressure (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Material (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Pressure (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Material (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Pressure (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Material (2021-2033)

10.4.2. Market Revenue and Forecast, by Pressure (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Material (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Pressure (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Material (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Pressure (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Material (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Pressure (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Material (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Pressure (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Material (2021-2033)

10.5.2. Market Revenue and Forecast, by Pressure (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Material (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Pressure (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Material (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Pressure (2021-2033)

Chapter 11. Company Profiles

11.1. Linde plc

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Air Products and Chemicals, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. NPROXX

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Hexagon Purus

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Worthington Industries

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Luxfer Holdings PLC

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. McPhy Energy S.A.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Chart Industries, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Plug Power Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Praxair, Inc. (now part of Linde plc)

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others