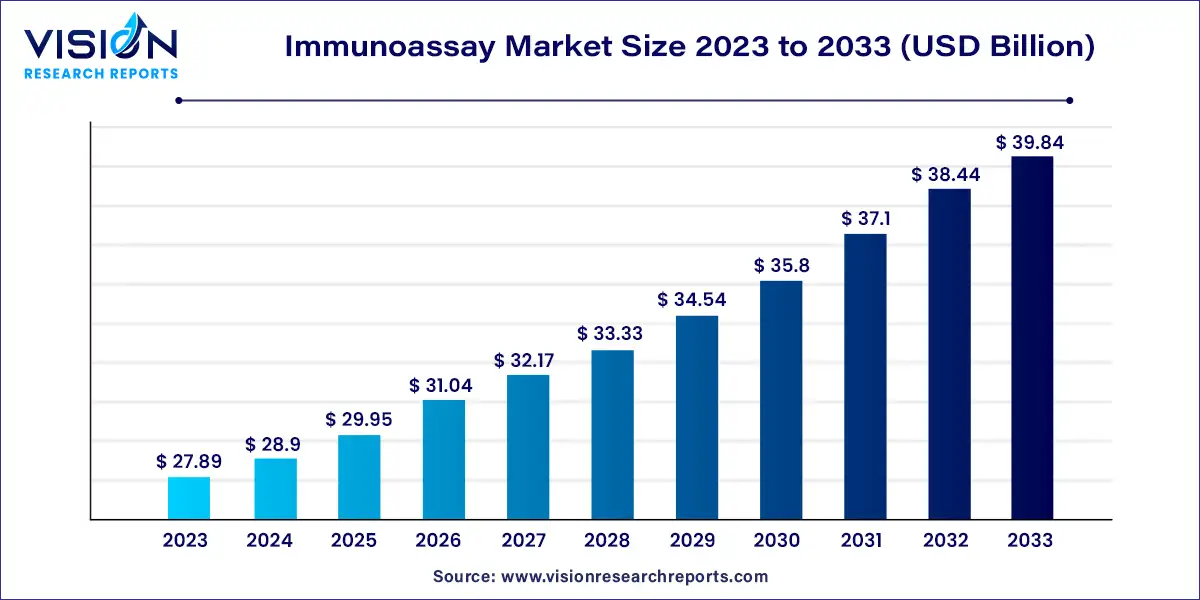

The global immunoassay market size was estimated at around USD 27.89 billion in 2023 and it is projected to hit around USD 39.84 billion by 2033, growing at a CAGR of 3.63%from 2024 to 2033. Immunoassays are biochemical tests that measure the presence or concentration of a substance using the reaction of an antibody or antibodies to its antigen. These assays play a crucial role in the diagnosis and management of various diseases, drug testing, and research applications. They are widely used in clinical laboratories, hospitals, research institutes, and pharmaceutical and biotechnology companies.

The growth of the immunoassay market is driven by an increasing prevalence of chronic and infectious diseases, such as cancer, cardiovascular diseases, and COVID-19, which necessitate early diagnosis and ongoing monitoring. This demand has led to the widespread adoption of immunoassays in clinical diagnostics due to their high specificity, sensitivity, and ability to detect even low levels of biomarkers. Additionally, technological advancements in immunoassay platforms, including the development of automated and multiplexed systems, have enhanced the efficiency and accuracy of these tests, making them more appealing to healthcare providers. The expanding applications of immunoassays in drug development, therapeutic drug monitoring, and veterinary diagnostics further contribute to market growth. Moreover, increasing investment in healthcare infrastructure and rising awareness about preventive healthcare are boosting the demand for immunoassay testing globally.

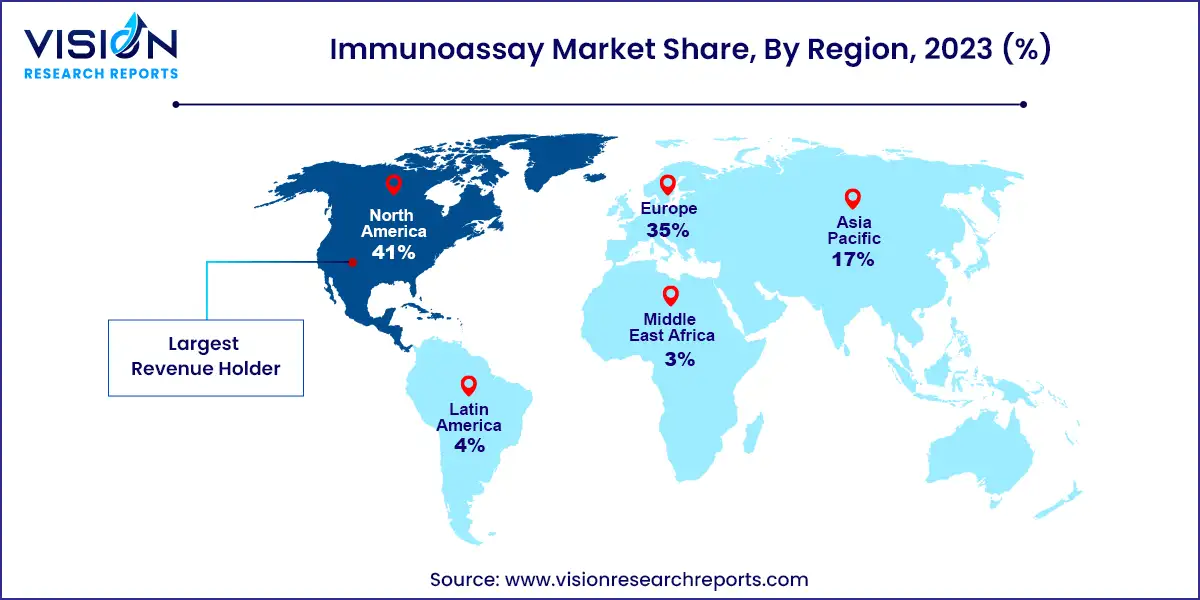

North America led the market in 2023 with a 41% revenue share. The increasing demand for diagnostics related to chronic diseases and the availability of advanced diagnostic technologies are expected to drive market growth over the forecast period. In the United States, there were 55.7 million individuals aged over 65 in 2022, accounting for approximately 17% of the population. Nearly 25% of this elderly population suffers from cancer, with 30% being obese, creating an opportunity for local market players to enhance their sales of diagnostic products for cancer, cardiology, endocrinology, infectious diseases, and other conditions.

The Asia Pacific region is expected to exhibit the fastest CAGR over the forecast period. Key factors driving market growth include unmet medical needs, positive economic development, and increased scientific research initiatives. Additionally, an improved healthcare regulatory environment in high-growth countries is expected to attract more foreign investors and encourage them to seize opportunities. Favorable developments, such as government healthcare benefits, increased public awareness, and a willingness to invest in advanced medical care, are further anticipated to fuel market growth.

In 2023, the hospitals segment led the market with a revenue share of 33%. Hospitals and clinics serve as the primary care facilities for diagnosing and treating various medical conditions. A significant portion of the population relies on these established institutions for disease diagnosis, treatment, and management. Additionally, ongoing changes in the healthcare industry have increased the demand for hospitals equipped with advanced diagnostic services. The rise in global healthcare spending has also significantly fueled the growth of this segment.

The clinical laboratories segment is projected to grow at the fastest compound annual growth rate (CAGR) over the forecast period. This growth can be mainly attributed to the benefits of diagnostic laboratories, such as faster results (typically within 3-4 hours), high sensitivity and specificity, scalability, cost-effectiveness, and the ability to test a wide range of samples. The increasing preference for diagnostic laboratories due to their rapid and cost-effective testing capabilities is expected to drive the demand for immunoassay solutions, thereby boosting the segment's growth.

The reagents and kits segment held the largest market share in 2023, accounting for 67% of the market. This dominance can be linked to the growing demand for immunoassay reagents and diagnostic kits, driven by the rising prevalence of infectious and autoimmune diseases. The introduction and approval of new immunoassay kits are expected to further support the growth of this segment. For example, in February 2022, Agilent Technologies, Inc. launched the Dako SARS-CoV-2 IgG linked immunosorbent assay in the U.S., with plans to expand to other regions, including Canada, Europe, Latin America, and parts of Asia Pacific.

The software and services segment is expected to exhibit a notable CAGR from 2024 to 2033. This growth can be attributed to the increased availability and demand for cost-effective automated immunoassay systems in developing markets. For instance, in July 2023, Sysmex Corporation launched a new fully automated, high-speed chemiluminescence immunoassay system at the 2023 AACC exhibition. Additionally, security software and Laboratory Information Systems (LIS) integrated with immunoassay analyzers enable administrators to manage user access and seamlessly transfer data to other devices and healthcare cloud computing systems, which are expected to drive segment growth during the forecast period.

In 2023, the enzyme immunoassays (EIA) segment held the largest market share at 64%, primarily due to its widespread use in detecting infectious diseases, chronic illnesses, food allergies, and drug abuse, among other applications. EIA offers several advantages over traditional methods like immunoelectrophoresis and immunodiffusion, including shorter assay times, quantitative results, and lower antisera requirements. Ongoing research initiatives are anticipated to present lucrative opportunities during the forecast period. For instance, researchers at the University of Central Florida are developing a screening method that is 300 times more effective at detecting a cancer biomarker than existing methods, utilizing nanoparticles with platinum-rich shells and nickel-rich cores to enhance ELISA sensitivity.

Rapid tests are also expected to experience significant growth throughout the study period. These tests, often referred to as lateral flow immunoassays, can detect target analytes without the need for specialized equipment. Rapid tests are widely used for detecting infections such as dengue, Legionella, Salmonella, Campylobacter, Zika, and Listeria. The increased availability of advanced sandwich assays and the approval of various home-based immunoassays are anticipated to further propel market growth. For example, in July 2023, SEKISUI Diagnostics introduced the OSOM COVID-19 Antigen Home Test, a lateral flow immunoassay for SARS-CoV-2 detection.

The infectious diseases testing segment dominated the market in 2023, accounting for 37% of the share, and is expected to grow at the fastest CAGR over the forecast period. The rising prevalence of infectious diseases globally is expected to drive market growth. According to the World Health Organization (WHO), there were 241 million malaria cases reported across 85 malaria-endemic countries in 2020. The increasing incidence of infectious diseases is expected to boost the demand for immunoassays. Moreover, the approval and launch of new products in the infectious disease testing field are further driving market expansion. For example, in March 2021, Abbott received FDA Emergency Use Authorization (EUA) for its new BinaxNOW COVID-19 Ag Card rapid test, a lateral flow immunoassay designed for COVID-19 detection.

The oncology segment is expected to experience rapid growth over the forecast period. The high prevalence of cancer worldwide is a major factor driving market expansion. According to the American Cancer Society, approximately 1.96 million new cancer cases were reported in 2023, with around 609,820 cancer-related deaths. As a result, effective diagnostic tests for early cancer detection and treatment are essential. Due to these factors, immunoassays and analyzers are becoming increasingly popular among market players, with a growing focus on developing and launching cost-effective products in developing countries.

In 2023, the blood specimen segment held the largest market share, accounting for 44%. The increase in disease occurrence has driven the demand for various blood testing procedures, supporting the segment's growth. Additionally, ongoing technological advancements are expected to boost market expansion. For example, in March 2022, CSL received clearance from the U.S. FDA for the Rika Plasma Donation System, developed by Cell Technologies and Terumo Blood. This clearance accelerates plasma collection, promoting the research and development of new plasma-based medicines.

The urine specimen segment is anticipated to grow at the fastest CAGR over the forecast period. Urinalysis is a quick and simple method for analyzing urine samples to detect infections and chronic disorders, such as urinary tract infections, diabetes, and kidney disease. Products like the BinaxNOW S. pneumoniae Antigen Card, a lateral flow immunochromatographic assay, can detect C polysaccharide cell wall antigens, including all pneumococcal variants, in urine samples from patients with pneumonia. Such tests are gaining popularity due to their advantages. Additionally, Rapid Influenza Diagnostic Tests (RIDTs) are widely used for identifying influenza due to their ease of use, rapid results, and suitability for point-of-care testing.

By Product

By Specimen

By Technology

By Application

By End-use

By Region

13.4.10.1. Market Revenue and Forecast, by Product

13.4.10.2. Market Revenue and Forecast, by Specimen

13.4.10.3. Market Revenue and Forecast, by Technology

13.4.10.4. Market Revenue and Forecast, by Application

13.4.10.5. Market Revenue and Forecast, by End-use

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Product

13.4.11.2. Market Revenue and Forecast, by Specimen

13.4.11.3. Market Revenue and Forecast, by Technology

13.4.11.4. Market Revenue and Forecast, by Application

13.4.11.5. Market Revenue and Forecast, by End-use

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Product

13.5.2. Market Revenue and Forecast, by Specimen

13.5.3. Market Revenue and Forecast, by Technology

13.5.4. Market Revenue and Forecast, by Application

13.5.5. Market Revenue and Forecast, by End-use

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Product

13.5.6.2. Market Revenue and Forecast, by Specimen

13.5.6.3. Market Revenue and Forecast, by Technology

13.5.6.4. Market Revenue and Forecast, by Application

13.5.7. Market Revenue and Forecast, by End-use

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Product

13.5.8.2. Market Revenue and Forecast, by Specimen

13.5.8.3. Market Revenue and Forecast, by Technology

13.5.8.4. Market Revenue and Forecast, by Application

13.5.8.5. Market Revenue and Forecast, by End-use

Chapter 14. Company Profiles

14.1. Abbott

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Siemens Healthineers

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Danaher Corporation (Beckman Coulter)

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. bioMérieux SA

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Quidel Corporation

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Sysmex Corporation

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Ortho Clinical Diagnostics

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Bio-Rad Laboratories, Inc.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. F. Hoffmann-La Roche AG

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Becton, Dickinson, and Company

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others