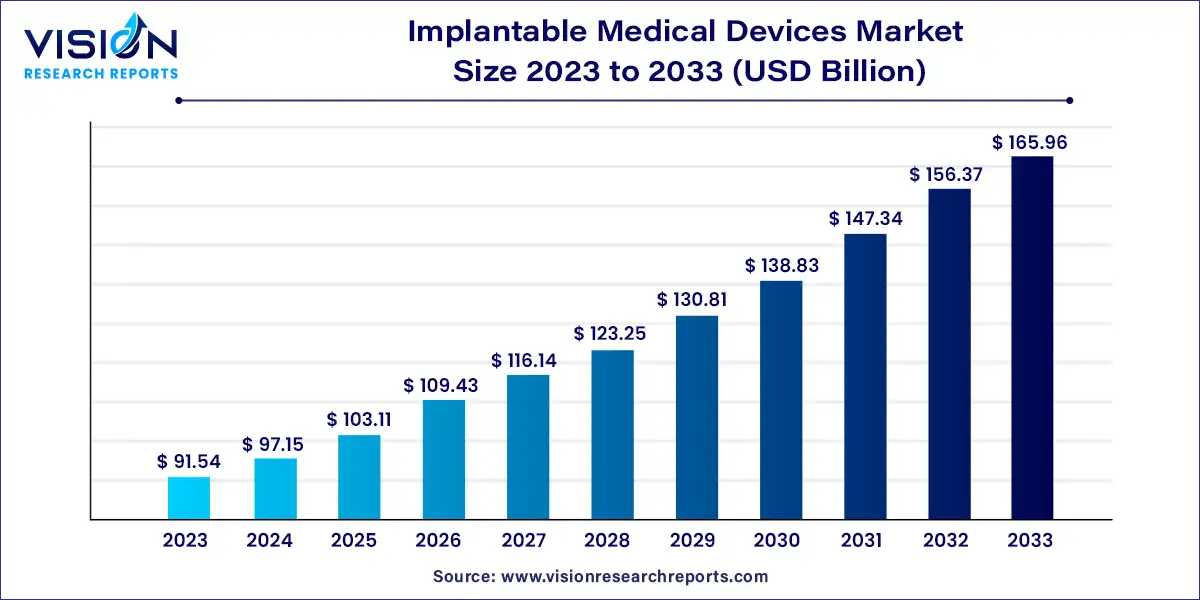

The global implantable medical devices market size was estimated at USD 91.54 billion in 2023 and it is expected to surpass around USD 165.96 billion by 2033, poised to grow at a CAGR of 6.13% from 2024 to 2033. The implantable medical devices market is a rapidly evolving sector of the healthcare industry, driven by technological advancements, the growing prevalence of chronic diseases, and increasing demand for improved patient care. These devices are designed to be placed inside the human body, either permanently or temporarily, to replace, support, or enhance the function of specific body parts. They are critical in diagnosing, monitoring, and treating various medical conditions, ranging from cardiovascular diseases to neurological disorders.

The implantable medical devices market is experiencing robust growth driven by the rising prevalence of chronic diseases such as cardiovascular disorders, diabetes, and orthopedic conditions, which necessitate the use of implantable devices for effective management and treatment. Additionally, the global aging population is increasing, with older adults being more susceptible to health conditions that require implantable solutions, such as pacemakers, joint replacements, and neurostimulators. Technological advancements have also significantly boosted market growth by enabling the development of more advanced, reliable, and biocompatible devices that enhance patient outcomes. Innovations like wireless connectivity and remote monitoring capabilities have improved the functionality and convenience of implantable devices, making them more appealing to both healthcare providers and patients. Furthermore, increasing healthcare expenditure, coupled with expanding access to healthcare services in emerging economies, is creating new opportunities for market expansion.

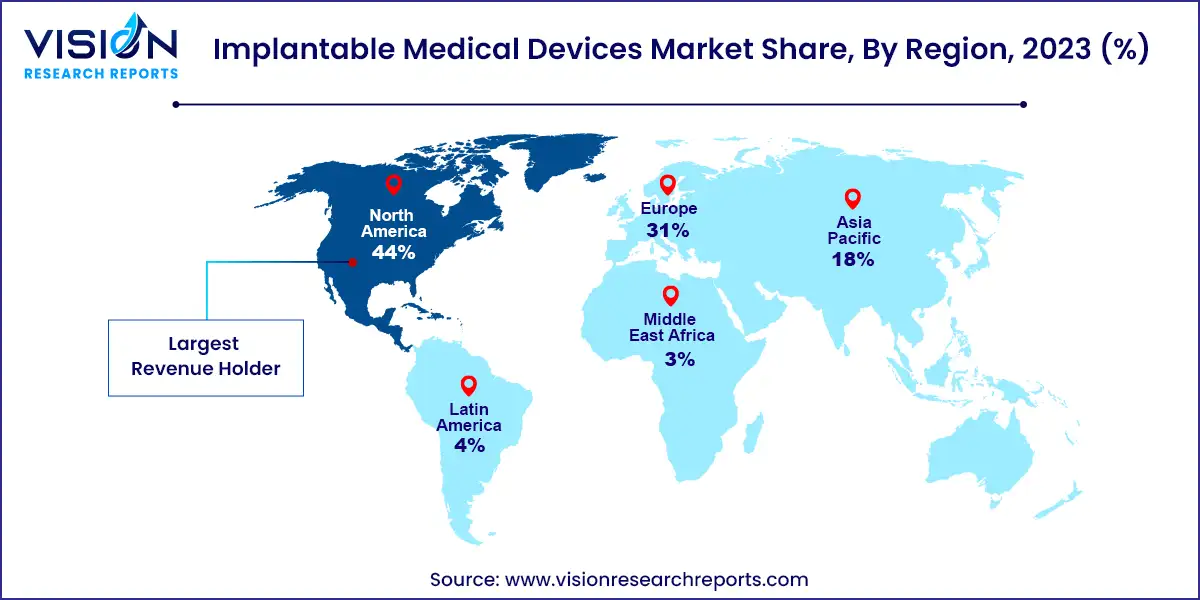

North America dominated the implantable medical devices market in 2023, holding a revenue share of 44%. The region benefits from advanced healthcare infrastructure, high healthcare expenditure, and a strong focus on technological innovation. A large patient population with high chronic disease prevalence drives demand for cardiac, orthopedic, and neurostimulator implants. Collaborations among healthcare providers, research institutions, and industry players further fuel advancements in biomaterials and surgical techniques. The shift towards outpatient settings for minimally invasive procedures also supports market expansion by offering cost-effective and patient-centric care options.

| Attribute | North America |

| Market Value | USD 40.27 Billion |

| Growth Rate | 6.15% CAGR |

| Projected Value | USD 73.02 Billion |

Europe’s implantable medical devices market is characterized by a robust regulatory environment, technological innovation, and rising healthcare expenditures. Universal healthcare systems in many European countries ensure broad access to advanced treatments, including implantable devices. A notable development is the February 2024 inauguration of MAISI at King's College London, a facility dedicated to advancing the production of active implants and surgical instruments. MAISI aims to transition healthcare engineering research into clinical applications and address the need for compliant manufacturing facilities.

Asia Pacific is expected to witness a significant CAGR of 7.23% over the forecast period. This growth is driven by expanding healthcare infrastructure, increasing healthcare expenditure, and a rising prevalence of chronic diseases. Countries like China, Japan, and India are major contributors to market growth due to large patient populations and improving access to advanced medical technologies. Factors such as aging populations, urbanization, and lifestyle changes further increase demand for cardiac and orthopedic implants, with Japan having over 29.1% of its population aged 65 and older.

In 2023, the cardiovascular implants segment led the market with the largest revenue share of 31%, owing to its crucial role in treating and managing cardiovascular diseases globally. This segment encompasses a range of devices, including pacemakers, implantable cardioverter defibrillators (ICDs), cardiac stents, and cardiac monitors. Cardiovascular diseases such as coronary artery disease, heart failure, and arrhythmias are major causes of morbidity and mortality worldwide. Heart failure alone affects over 84 million people globally, as reported by secondary sources and GVR analysis. The increasing prevalence of these conditions drives the demand for implantable devices. For example, in July 2023, Abbott received FDA approval for its AVEIR dual-chamber leadless pacemaker system, marking a significant advancement in treating abnormal or slow heart rhythms.

The dental implants segment is projected to grow at the fastest CAGR of 9.83% during the forecast period, driven by a global trend towards cosmetic enhancements. This segment is expected to see substantial growth due to its expanding applications and the rising demand for prosthetics. Dental implants not only offer functional benefits but also improve appearance and overall quality of life. Developed countries, particularly the United States, are leading this growth, with millions of dental implant procedures performed annually, as indicated by data from the American Dental Association.

In 2023, the metallic biomaterials segment led the market with a 49% revenue share. Metals like titanium alloys, stainless steel, and cobalt-chromium alloys are favored for their mechanical strength, biocompatibility, and durability, making them ideal for long-term use within the human body. These metals can be shaped into complex forms, allowing for customization to meet specific anatomical requirements, and are crucial in orthopedics, cardiovascular interventions, and other medical specialties. Their properties drive innovation and enhance patient outcomes worldwide.

The natural biomaterials segment is expected to grow at the fastest CAGR of 6.63% during the forecast period. There is a rising preference for natural or biocompatible materials due to their perceived safety and lower risk of adverse reactions. Advances in biomaterials and manufacturing techniques have led to the development of sophisticated natural implants that offer better integration with the body and improved long-term outcomes. Favorable regulatory policies and approvals for natural implants support their adoption among healthcare providers and patients.

In 2023, hospitals led the market with a revenue share of 44%. Hospitals are primary centers for complex medical procedures, including surgeries involving implantable devices. They provide specialized departments such as cardiology, orthopedics, neurology, and oncology, where these devices are routinely used. Hospitals offer comprehensive healthcare services, advanced technologies, and multidisciplinary care teams, contributing to high-quality care and advancements in medical knowledge.

The outpatient facilities segment is anticipated to grow at the fastest CAGR of 6.23% during the forecast period. This growth is driven by increasing demand for outpatient procedures and patient preference for less invasive treatments. Outpatient facilities align with the trend towards patient-centric care models that prioritize convenience and minimize disruptions to daily life. With shorter wait times, reduced hospital stays, and lower costs, outpatient procedures are becoming increasingly popular. For example, over 23 million procedures are performed annually in ambulatory surgery centers (ASCs) in the U.S., with the number of ASCs increasing to 6,223 in 2024 from 6,109 in 2023.

By Product

By Biomaterial

By End Use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others