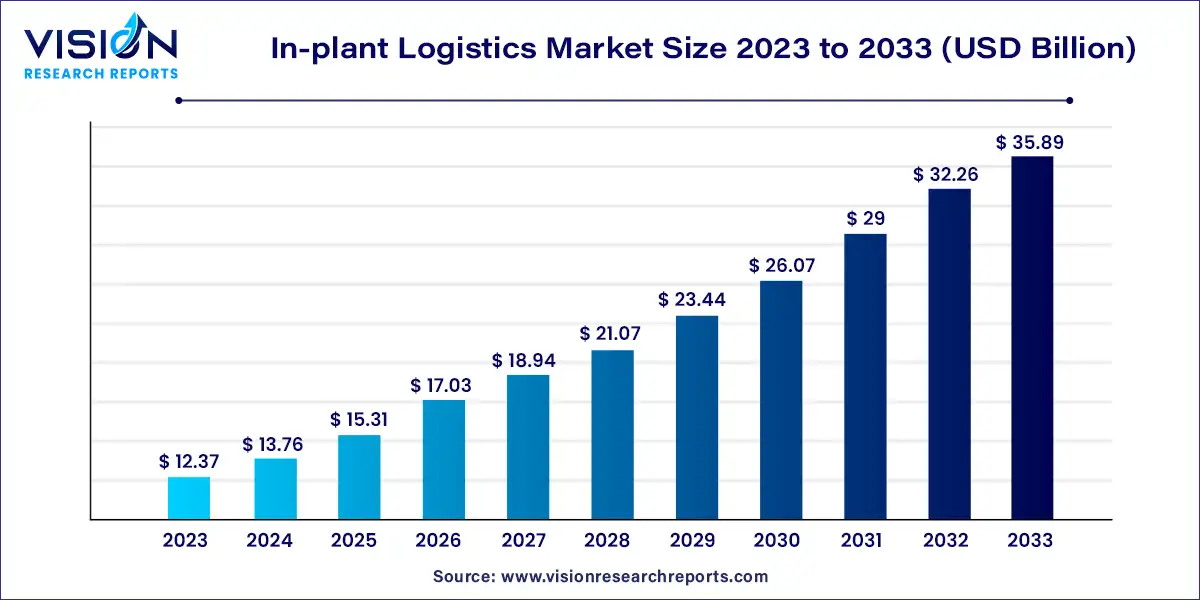

The global in-plant logistics market size was valued at USD 12.37 billion in 2023 and is predicted to surpass around USD 35.89 billion by 2033 with a CAGR of 11.24% from 2024 to 2033. The in-plant logistics market is a critical component of modern supply chain management, facilitating the seamless movement of materials, components, and finished products within manufacturing facilities.

The growth of the in-plant logistics market is propelled by the relentless pursuit of operational excellence and cost optimization within manufacturing facilities is driving significant investments in advanced intralogistics solutions. Additionally, the increasing complexity of supply chains necessitates agile and scalable logistics systems to meet the demand for faster turnaround times. Furthermore, stringent regulatory requirements pertaining to safety, quality, and traceability are compelling companies to upgrade their in-plant logistics infrastructure. Moreover, the rising adoption of digitalization and automation technologies such as RFID, IoT, and robotics is enhancing efficiency, accuracy, and real-time visibility in intralogistics operations.

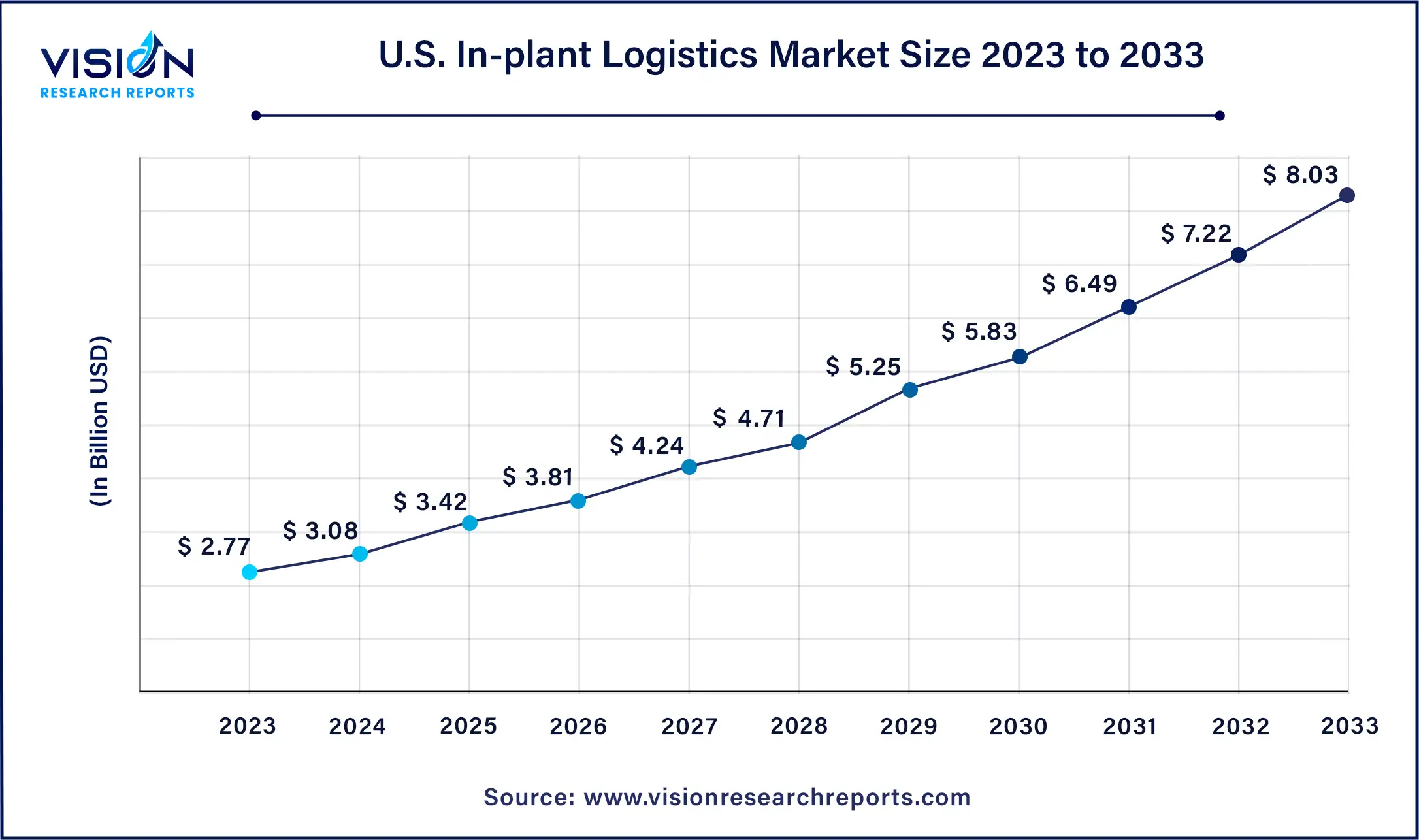

The U.S. in-plant logistics market size was estimated at around USD 2.77 billion in 2023 and it is projected to hit around USD 8.03 billion by 2033, growing at a CAGR of 11.24% from 2024 to 2033.

In 2023, North America emerged as the dominant force in the market, capturing the largest revenue share at 32%. This growth is driven by several key factors. The robust manufacturing sectors in the U.S. and Canada, particularly in industries like automotive, fuel the demand for efficient in-plant logistics solutions. Moreover, the increasing adoption of automation technologies such as robots, AGVs, and ASRS enhances processes and boosts productivity.

Meanwhile, the Asia Pacific in-plant logistics market recorded the fastest CAGR of 12.53% during the forecast period from 2024 to 2033. The region's expanding manufacturing sector, notably in China and India, generates significant demand for efficient in-plant logistics solutions. Additionally, rising labor costs and a growing focus on automation propel companies to embrace technologies like robots, AGVs, and ASRS. The surge in e-commerce and the adoption of omnichannel fulfillment strategies necessitate manufacturing plants to improve their order fulfillment processes for faster and more accurate results, driving demand for innovative solutions

The robots segment emerged as the dominant force in the target market, capturing the largest share of revenue at over 21% in 2023. Robots have become indispensable assets, particularly in tasks characterized by repetition and precision. Their proficiency in material handling, sorting, and order fulfillment significantly boosts operational efficiency while minimizing errors. The realm of robotics has evolved significantly beyond its traditional role in heavy-lifting tasks. Recent advancements have rendered robots highly adaptable and agile assets, seamlessly integrating with and enhancing existing workflows within businesses.

Despite the initial investment required, the long-term benefits of deploying robots in facilities are considerable, especially in reducing labor costs, particularly for tasks involving hazardous materials or physically demanding environments. Furthermore, robots excel in assuming risky responsibilities, thus mitigating workplace accidents and injuries. Unlike human workers, robots operate tirelessly, ensuring uninterrupted operations and faster turnaround times, thereby optimizing productivity in the in-plant logistics market.

The automated storage and retrieval systems (ASRS) segment is poised to register the highest CAGR of 11.33% over the forecast period. ASRS is rapidly reshaping the market landscape by maximizing space utilization and streamlining inventory management. These intelligent systems employ computer-controlled mechanisms to store and retrieve goods on demand, optimizing picking times and enhancing order fulfillment accuracy.

The receiving and delivery docks segment asserted its dominance in the market, claiming the largest market share of 27% in 2023. Receiving and delivery docks play a crucial role in market efficiency, serving as critical entry and exit points for materials and finished goods. While traditional docks rely on manual processes, the market is witnessing a surge in automation solutions. This includes dock scheduling software, automated guided vehicles (AGVs), and automated loading and unloading systems.

These advancements streamline dock operations, reduce congestion, and expedite turnaround times for incoming and outgoing shipments. Furthermore, integrating real-time tracking systems with receiving and delivery docks enhances visibility and control over the flow of goods, enabling better inventory management and improved planning throughout the in-plant logistics chain. As the focus on speed and efficiency intensifies, receiving and delivery docks are poised to transform from passive zones to intelligent hubs within the ecosystem.

The storage facilities segment is expected to register the highest CAGR of 11.23% over the forecast period. Storage facilities are the backbone of the market, serving as physical spaces for housing raw materials, work-in-progress inventory, and finished goods. However, the concept of storage facilities is evolving beyond basic warehousing. Modern facilities are adopting smarter storage solutions to optimize space utilization and inventory management. This includes the use of vertical storage solutions like mezzanines and high-bay racking, which maximize vertical space and improve accessibility.

The automobiles segment asserted its dominance in the target market, capturing a revenue share of 23% in 2023. Given the intricate and just-in-time nature of car manufacturing, efficient in-plant logistics are paramount. This translates to a high demand for advanced solutions such as automated guided vehicles (AGVs) for seamless transportation of parts and materials across the assembly line. Additionally, the rising trend of electric vehicle (EV) production calls for specialized in-plant logistics solutions to handle bulky batteries and other EV components.

Moreover, the industry's emphasis on lean manufacturing principles necessitates real-time inventory tracking and optimized storage solutions to minimize waste and production delays. The continuous advancements in automation and the transition towards alternative fuel vehicles within the automotive sector are reshaping the landscape of in-plant logistics. This presents significant opportunities for broader supply chains, driving demand for innovative and adaptable solutions to meet the evolving needs of auto manufacturers.

The food and beverages segment is poised to witness the fastest CAGR of 11.23% over the forecast period. Stringent food safety regulations and the perishable nature of many products require meticulous handling and temperature control throughout the production process. Automated storage and retrieval systems (ASRS) offer a solution by optimizing space utilization and ensuring proper cold chain management for temperature-sensitive items. Additionally, the integration of IoT sensors with equipment and packaging enables real-time monitoring of product quality and expiration dates, minimizing waste and ensuring food safety.

By Product

By Location

By Industry Vertical

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others