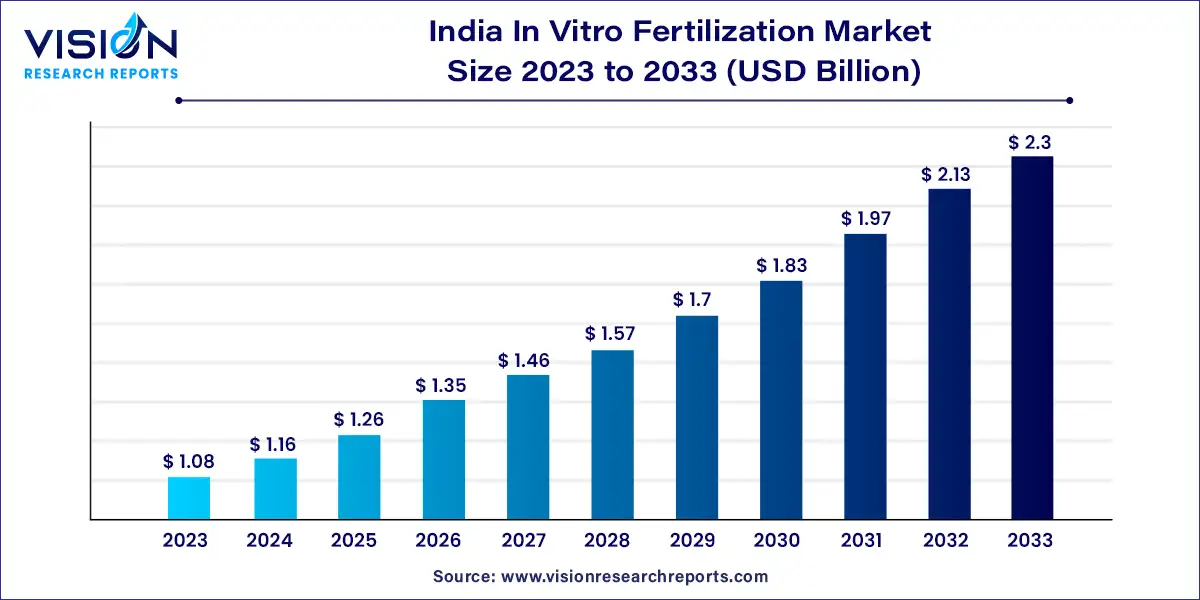

The India In vitro fertilization market size was estimated at around USD 1.08 billion in 2023 and it is projected to hit around USD 2.3 billion by 2033, growing at a CAGR of 7.9% from 2024 to 2033. The India In vitro fertilization (IVF) market has witnessed significant growth in recent years, driven by a combination of factors such as rising infertility rates, technological advancements in reproductive healthcare, increasing awareness, and a shift towards delayed parenthood. With a growing number of fertility clinics across the country and improved accessibility to advanced fertility treatments, India has become a key player in the global IVF industry.

The growth of the India In Vitro Fertilization (IVF) market is driven by the rising infertility rates across the country, attributed to lifestyle changes, increasing stress levels, and late marriages. Additionally, advancements in reproductive technology, such as embryo cryopreservation and pre-implantation genetic diagnosis (PGD), have enhanced IVF success rates, encouraging more couples to seek fertility treatments. Growing awareness and social acceptance of IVF procedures, coupled with the increasing number of fertility clinics offering affordable treatment options, have further propelled market growth. Additionally, government initiatives and policies aimed at improving healthcare infrastructure and accessibility have played a significant role in expanding the IVF market in India.

In 2023, the culture media segment led the market, accounting for around 41% of the total share. This growth is driven by increased research and development efforts to enhance culture media, coupled with the availability of funding. For example, in June 2023, Gold Standard Diagnostics introduced the BACGro Culture Media for detecting pathogenic microorganisms across the food, environmental, and pharmaceutical sectors. The BACGro product line offers both dehydrated and liquid media that adhere to global standards and reference methods.

The disposable devices segment is projected to experience the fastest compound annual growth rate (CAGR) during the forecast period. This rise is attributed to the introduction of disposable devices such as slides, needles, and chambers by industry players to meet sterility and regulatory standards. These innovations are expected to drive greater adoption of disposable IVF devices. Recent advancements include disposable slides for sperm counting, imaging-based tracking systems to identify optimal motile sperm, and disposable microchips. For instance, in May 2022, DPU IVF and Endoscopy Center in Pune introduced the Time-Lapse Imaging Embryoscope, an advanced technology that enhances live birth rates while significantly reducing early pregnancy losses.

The frozen non-donor segment held the largest market share in 2023, driven by factors such as cost-effectiveness compared to fresh embryo transfers or donor eggs, increased IVF success rates, and the availability of genetic testing. Advances in genetic testing now allow embryos to be screened for genetic disorders before implantation, leading more couples to opt for frozen embryos for testing, ensuring the healthiest embryo is selected for implantation. In December 2023, Progenesis, a prominent genetic testing company, expanded its presence in India by opening its first genetic laboratory in New Delhi.

The fresh donor segment is expected to grow at the fastest CAGR during the forecast period. The rising demand for donor eggs and sperm, fueled by increasing infertility rates, is a major factor contributing to the growth of this segment in India’s IVF market. India's large population and socio-cultural factors provide a vast pool of potential egg donors, offering clinics a wide variety of options for couples seeking fresh donors. Additionally, many clinics offer anonymous donation services, further expanding the donor pool. In June 2023, LifeCell International Pvt. Ltd. launched home-based self-collection and preservation kits, including OvaScore, SpermScore, and InferGenes, allowing convenient and private sample collection for sexual, reproductive, women's, and baby health services.

In 2023, the fertility clinics segment dominated the market and is expected to grow at the highest CAGR during the forecast period. The increasing demand for assisted reproductive technology (ART) treatments, coupled with a rise in the number of ART centers and fertility clinics, has propelled the growth of this segment. Moreover, the availability of fertility specialists, cost-effective treatment options, and lower risks of hospital-acquired infections (HAIs) are anticipated to further boost this growth. For instance, in January 2024, CK Birla Healthcare Pvt. Ltd. opened a new fertility clinic in Meerut, Uttar Pradesh, expanding access to specialized fertility care.

By Instrument

By Procedure Type

By Providers

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others