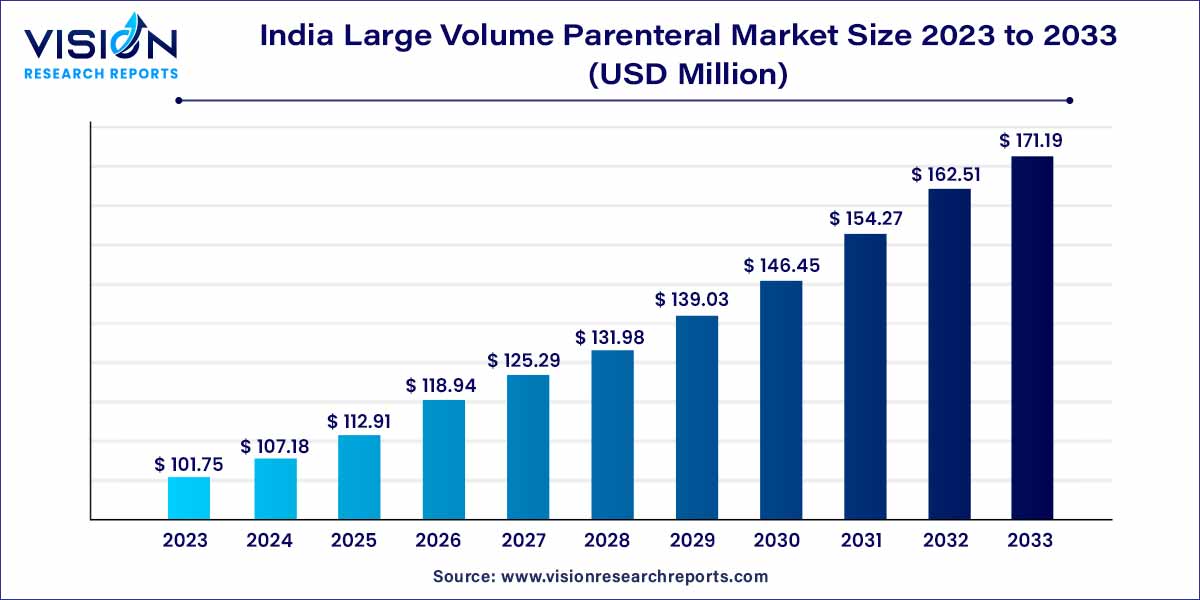

The India large volume parenteral market size was estimated at around USD 101.75 million in 2023 and it is projected to hit around USD 171.19 million by 2033, growing at a CAGR of 5.34% from 2024 to 2033.

The Indian large volume parenteral (LVP) market has emerged as a significant player in the pharmaceutical landscape, reflecting a dynamic intersection of healthcare demands, technological advancements, and strategic investments. LVPs, commonly known as injectables, form a critical segment within the pharmaceutical industry, providing sterile solutions for intravenous administration.

The growth of the large volume parenteral (LVP) market in India is propelled by several key factors. Firstly, the escalating demand for LVPs stems from the increasing prevalence of chronic diseases and a burgeoning elderly population, driving the need for advanced therapeutic solutions. Secondly, significant technological advancements in pharmaceutical manufacturing have elevated production standards, ensuring the delivery of high-quality and sterile injectables. Government initiatives aimed at fortifying healthcare infrastructure and regulatory frameworks contribute to a conducive environment for market expansion. Moreover, the influx of strategic investments, both domestic and international, underscores the industry's potential, leading to collaborations, mergers, and acquisitions to broaden product portfolios. While the market presents significant growth opportunities, challenges include navigating stringent regulatory compliance and maintaining stringent quality control measures, emphasizing the need for continuous investment in research, development, and manufacturing capabilities. Overall, these factors collectively shape the dynamic landscape of India's LVP market, positioning it as a pivotal player in the global pharmaceutical sector.

| Report Coverage | Details |

| Growth rate from 2024 to 2033 | CAGR of 5.34% |

| Market Size in 2023 | USD 101.75 million |

| Revenue Forecast by 2033 | USD 171.19 million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The nutritious injections segment dominated the market with the largest revenue share of 46% in 2023. Its growth is attributed to increased demand for these formulations to fulfill adequate nutrition requirements and improve drug absorption for faster and more effective results. Different combinations of nutrients are available at different concentrations for different requirements. Parenteral nutrition is selected when a patient experiences short bowel syndrome, extensive Crohn’s disease, high-output gastrointestinal fistula, intractable vomiting, radiation enteritis, and mucositis after chemotherapy. Nutritious injections also reduce risks associated with the treatment of chronic diseases and ensure smoother therapy.

The therapeutic injections application segment is anticipated to grow at the fastest CAGR of 5.75% over the forecast period owing to the increasing prevalence of life-threatening diseases and growing demand for safer, faster, and more effective methods of drug administration in patients undergoing surgical procedures. The COVID-19 pandemic and the surging demand for these formulations owing to the rising patient population suffering from low immunity levels and prone to the incidence of neurological diseases, cardiac problems, cancers, and spinal injuries, to meet adequate nutritional requirements when enteral nutrition mode is insufficient, not possible, or contraindicated, has positively impacted the company sales and overall market growth.

The 500 ml segment had a significant share in India large volume parenteral market in 2023. Growing awareness among healthcare professionals about hospital-associated malnutrition, rising number of surgeries, increasing preference for single-dose administration of vaccines and drugs, growing need for a faster route of drug administration to avoid complications, and an increase in local manufacturing are factors expected to drive the demand for LVP, which, in turn, can boost this segment. Moreover, rising demand for LVP formulations among critically ill patients, an increasing number of ICU admissions, and growing prevalence of various chronic disorders such as cancer and diabetes, are additional factors expected to propel market growth.

The 100 ml injectable segment is anticipated to register a significant growth rate during the forecast period. The increasing prevalence of chronic diseases and growing demand for LVP formulations for fulfilling adequate nutrition requirements, correcting electrolyte and fluid balance disturbances, and as a vehicle for administration of other drugs are key factors expected to drive this segment. For instance, patients weighing more than 50 kg and with no additional risk factors for hepatotoxicity, paracetamol infusion in 100 mL quantity is suggested for treating fever or pain, especially in post-surgery, when other means of administering medicine are not feasible or when the IV method is clinically suggested to urgently treat hyperthermia or pain. This, in turn, is anticipated to positively impact the growth of the segment.

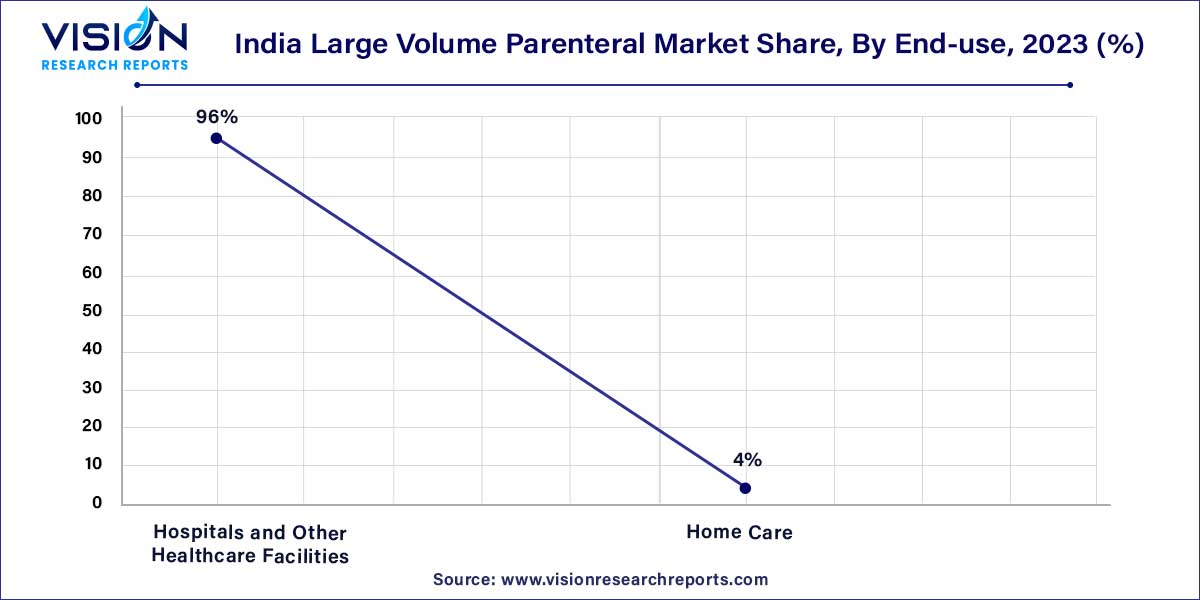

The hospitals and other healthcare facilities segment led the market with the largest revenue share of over 96% in 2023 and it is expected to grow at the fastest CAGR of 5.3% over the forecast period. The growth can be attributed to the increase in demand for these formulations among patients during surgery or while recovering in the hospital, as well as growing physician preferences for single-dose administration. In India, the prevalence of malnutrition has increased over the past few years. According to the 2018 State of Food Security and Nutrition in the World report, 195.9 million people are undernourished in India. Total Parenteral Nutrition (TPN) is an essential preparation for malnutrition, used in hospitalized patients where enteral feeding is not feasible or for critical care patients with compromised gastrointestinal tract function.

The homecare facilities segment is expected to register significant growth during the forecast period owing to the growing geriatric population and increasing consumer interests in the adoption of at-home care. According to a report, Elderly in India 2021, published by the National Statistical Office (NSO), the elderly population of India aged 60 years or above is estimated to increase by 56 million and reach 194 million by the year 2031 from 138 million in the year 2021. Similarly, according to an article published by Economic Times in April 2019, the share of the older population-those aged 60 years or above-in India is projected to increase to around 20% in 2050. This has resulted in an increased number of home care services that can manage dose administration in the geriatric population. Moreover, benefits offered by formulations such as high bioavailability and delivery of safer and faster drug absorption, are likely to boost segment growth.

By Application

By Volume

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Application Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on India Large Volume Parenteral Market

5.1. COVID-19 Landscape: India Large Volume Parenteral Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. India Large Volume Parenteral Market, By Application

8.1. India Large Volume Parenteral Market, by Application, 2024-2033

8.1.1 Therapeutic Injections

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Fluid Balance Injections

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Nutritious Injections

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. India Large Volume Parenteral Market, By Volume

9.1. India Large Volume Parenteral Market, by Volume, 2024-2033

9.1.1. 100 ml

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. 250 ml

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. 500 ml

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. 1,000 ml

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. 2,000 ml

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. India Large Volume Parenteral Market, By End-use

10.1. India Large Volume Parenteral Market, by End-use, 2024-2033

10.1.1. Hospitals and Other Healthcare Facilities

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Home Care

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. India Large Volume Parenteral Market, Regional Estimates and Trend Forecast

11.1. India

11.1.1. Market Revenue and Forecast, by Application (2021-2033)

11.1.2. Market Revenue and Forecast, by Volume (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. B. Braun SE.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Fresenius Kabi AG.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Baxter.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Otsuka Pharmaceutical Co., Ltd.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Sichuan Kelun.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Albert David Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. BML Parenteral Drugs.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others